What is the debt mutual fund taxation from 1st April 2023? Whether they be taxed as per tax slab or indexation benefit available? Should you invest in Debt Funds?

In a surprising move, the government amended certain taxation rules in its Finance Bill 2023. In this, the biggest news which was creating a kind of NOISE from so-called financial experts is debt mutual fund taxation.

Debt Mutual Funds Taxation from 1st April 2023

The new debt mutual fund taxation is effective from 1st April 2023. Hence, no need to press the PANIC BUTTON!!

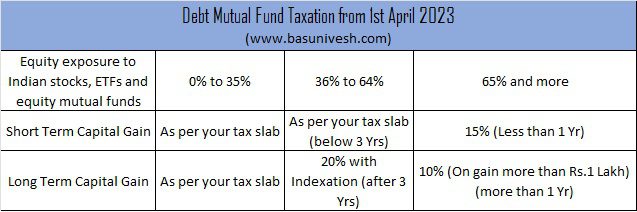

This amendment to finance bill 2023 created three categories of mutual funds for TAXATION.

# Mutual Funds holding more than 65% or more in Indian equity, Indian equity ETFs, or equity funds

In this category, there is no change in taxation. They are taxed like equity funds. If your holding period is less than a year, then STCG is applicable and taxed at 15%. However, if your holding period is more than 1 year, then LTCG is applicable and taxed at 10% (over and above the aggregated long-term capital gain of Rs.1 Lakh). As there is no change in this category, I hope it is clear for you.

# Mutual Funds holding less than 65% or more than 35% in Indian equity, Indian equity ETFs, or equity funds

Here also there is no change. They are taxed like debt funds (as per the old rule). If your holding period is less than three years, then the gain is taxed as STCG and the rate is as per your tax slab. However, if the holding period is more than three years, then taxed at 20% with an indexation benefit.

# Mutual Funds holding less than or equal to 35% of Indian equity, Indian equity ETFs, or equity funds

Here is a big change (if the amendment passed in parliament). The taxation is as per your tax slab. No question of LTCG or STCG. This taxation rule will be applicable from 1st April 2023.

Investments done before 31st March 2013 are eligible as per the old tax rules (with indexation for long-term capital gain).

Because of this, many are very angry with the government (I can understand investors’ anger but I hate the anger of the finance industry. Because it is mainly because they lose the business).

The same can be tabulated as below.

Debt Mutual Funds Taxation from 1st April 2023 – Should you invest in Debt Mutual Funds?

Considering all these changes, it is still worth considering debt mutual funds for our investments? Few funds may change the mandate by increasing the exposure of arbitrage opportunity for more than 35% to be eligible for debt mutual fund indexation. To what extent such a change in mandate will impact fund performance is unknown to us. However, if one is looking for a long-term tax advantage, then one can opt for this.

Let us now discuss some positives and negatives of both Bank FDs (RDs) and Debt Mutual Funds based on this new change.

# Safety

As I have explained in my previous post “Safest Short Term Investment Plans 2023“, bank FDs offer you a guarantee of up to Rs.5 lakh only. If you are looking for complete safety, then you have to look for Post Office Term Deposits.

However, in the case of debt mutual funds, they are market-linked, and the returns are not guaranteed and are based on certain risks like interest rate risk, default risk, or credit downgrade risk. Those who are ready to take the risk for the sake of returns can explore as now both FDs and Debt Funds have a level play in terms of taxation. But be sure that you may be successful or unsuccess also.

# Taxation

Even though after this sudden change in rules taxation of debt funds, FDs seem to be better. But one thing you have to notice is that in the case of bank FDs, you have to pay the tax on an accrual basis (TDS is also one more negative). However, in the case of debt funds, the taxation will be at the time of withdrawal. With this logic, debt funds have an advantage over FDs.

# Comfort

Just because taxation is the same for both FDs and Debt Funds does not mean in practice you invest in FDs. As many of us are monthly investors, creating a monthly FD may be cumbersome. However, in the case of mutual funds, a SIP is the best choice. One may argue of RD. But many banks have limited periods of RD. Hence, in practice, I think, MFs are better for many of us.

# Liquidity

Flexi FDs offer you the liquidity option. However, if you book the normal FDs, then you have to pay a certain early withdrawal penalty (no matter whatever may be the period). However, in the case of debt funds, after a certain period, there will not be any exit load. Hence, liquidity is more and less cost-effective than Bank FDs.

# Set off and carry forward capital gains and losses

In the case of debt mutual funds, as the gain is considered capital gains (in FDs it is income from other sources), you can set off and carry forward the capital gain and losses. However, this feature is not available with FDs.

Considering all these features, hoping mutual fund companies change the mandate to align this taxation. Until that period, better to wait and watch. No need to panic about the existing investments. I am still tilted toward the debt funds for our long-term goals. Mainly because of deferred taxation, liquidity, and set-off and carry-forward capital gain features of mutual funds.