You purchase an electronic gadget from Amazon or Flipkart. On the payment page, you can pay upfront or you can opt for No-cost EMI from your bank.

What is a No-cost EMI?

Instead of paying Rs 30,000 upfront, you pay Rs 5,000 per month for the next 6 months. You still pay Rs 30,000 but you get to pay the amount over 6 months (instead of upfront). No cost for you. Hence, the name No-cost EMI.

What a good deal, isn’t it?

But do you know RBI prohibits banks from offering zero interest EMI schemes?

If the banks can’t offer loans at 0% percent, how do retailers offer such schemes then?

Do you know the interesting math behind the No-cost EMI schemes?

Additionally, you will find No-cost EMIs for only 3, 6 or 9 months loan tenure? Usually 3 or 6 months. Why not for 12, 18 or 24 months?

Once you understand the math, you will have all the answers.

Let’s find out.

Note: I also wrote a Twitter thread on how No-cost EMIs. If you use Twitter, you can check out the Twitter thread here. If you like the content, do like/retweet/share.

How do No-cost EMIs work?

Let’s quickly check how Amazon and Flipkart explain this.

Here is an excerpt from Amazon website with respect to No-cost EMI schemes.

Amazon

The bank will continue to charge interest on EMI as per existing rates. However, the interest to be charged by the bank will be passed on to you as an upfront discount at the time of your purchase, effectively giving you the benefit of a No Cost EMI. This discount excludes GST on interest amount that will be charged by your bank.

Flipkart also explains in a similar way through an example.

Let’s see what this means.

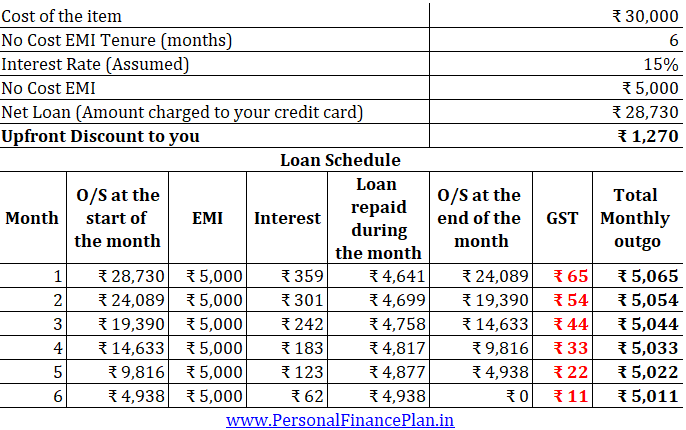

- Let’s assume the item costs Rs 30,000.

- If you opt for 6-month No-cost EMI, you will have to pay an EMI of Rs 30,000/6 = Rs 5,000 per month

- The bank charges interest rate of 15% p.a. for a 6 month loan.

- Now, find X such that a loan of X at 15% p.a. for 6 months results in an EMI of Rs 5,000 per month. Use PV formula in excel to find X.

- X = Rs 28,730

- Offer upfront discount of Rs 30,000 – Rs 28, 730 = Rs 1,270. The merchant bears the discount.

- Your Credit card is charged Rs X or Rs 28,730. That’s lower than the listed price of Rs 30,000.

- If you work the numbers, a loan of Rs 28,730 at 15% p.a. for 6 months will have an EMI of Rs 5,000 per month.

- A few days later, the bank will convert purchase amount (X) into EMIs. 5,000 per month for 6 months.

- You will have to pay GST on the interest amount. Now, the GST paid is an extra cost to you.

Let’s try to understand with the help of another example .

The cost of the product is Rs 1,01,999.

You can see No-cost EMI options for 3-month and 6 month EMI. For longer tenure repayment, the no-cost EMI option is not available. We will see later why that’s the case.

The rate of interest can’t be zero because that’s not acceptable to the RBI. As you can see, for the other EMI schemes, the rate of interest is 15% p.a. It is fair to assume R=15% p.a.

For the 3 months No-cost EMI, you pay Rs 34,000 per month. That makes it 1,02,000. You don’t pay anything extra. The difference of Rs 1 is to rounding off.

Ditto for 6-month No-cost EMI. 17,000 X 6 = 1,02,000.

So, if you purchase the item for 1,02,000, you will have to pay Rs 17,000 per month for 6 months.

Where is the upfront discount?

As we have discussed before, banks can’t offer any loan without interest.

It is another matter if you do not return the principal.

Coming back to the topic, we need to figure out the amount X, that would result in EMI of Rs 17,000 per month for 6 months at an interest rate of 15% p.a.

You can simply use PV function on excel to find that out. You can also try out Loan calculator to figure out the same.

Y = PV(15%/12,6,17000,0,0) = Rs 97,682

Your credit card will be charged Rs 97,682.

Therefore, the discount (D) becomes 1,01,999 – 97, 682 = Rs 4,318

This discount is borne by the merchant/retailer/brand/seller.

Had you opted for 3 month No-cost EMI, your credit card would have been charged Rs 99,502. The upfront discount would have been Rs 2,497.

If you had an option of going for 9 month No-cost EMI, the upfront discount would have been Rs 6,093. For a 12 month No-cost EMI, the upfront discount will be Rs 7,825.

The upfront goes up with the loan tenure.

Let’s consider this with another example.

Listed price (cost) =Rs 30,000, Interest Rate = 15% p.a.

- 3 months No-cost EMI. X = Rs 29,265. Discount = Rs 735

- 6 months No-cost EMI. X = Rs 28,730. Discount = Rs 1,270

- 9 months No-cost EMI. X = Rs 28,208. Discount = Rs 1,792

- 12 months No-cost EMI. X = Rs 27,698. Discount = Rs 2,302

- 18 months No-cost EMI. X = Rs 26,716. Discount = Rs 3,284

- 24 months No-cost EMI. X = Rs 25,780. Discount = Rs 4,220

The discount to provide you the experience of No-cost EMI increases as you increase the loan tenure.

Since the discount is borne by the seller/retailer/brand, the cost (discount amount) to the merchant goes up if the repayment tenure is longer. And the merchant can bear only so much discount.

That is why No-cost EMI schemes are limited to shorter repayment tenures. Usually 3 to 6 months.

The scheme is No cost for you. However, it is not Zero interest for the bank (which RBI wouldn’t be happy with).

Everyone wins.

The customer gets the product in easy zero-cost installments.

The bank gets the loan and avoids regulatory glare. The scheme is No cost for you. However, it is not zero interest rate for the bank.

The merchant, despite the discount hit, gets business.

Is the No cost EMI scheme really No-cost?

Not really. GST plays spoilsport.

GST is charged on the interest portion of the EMI.

Let’s see how it affects your payment.

As you can see, you are paying something extra every month due to GST on the interest cost.

In the first month, you pay Rs 5,065 (instead of Rs 5,000). This is because of 18% GST on interest amount of Rs 359.

359*18% = Rs 65

The total extra payment due to GST over the loan tenure will be Rs 229 i.e. you will pay Rs 30,229 (instead of Rs 30,000).

This pushes the cost of loan from 0% to 2.6% p.a.

In absence of GST, the effective cost of the loan would have been 0%.

Therefore, not really a Zero cost EMI for you.

Don’t forget the processing fee

A few banks charge a processing fee on EMI transactions, including No-cost EMI transactions.

Such processing fee could be a % of your purchase amount or a fixed fee (irrespective of loan amount).

For instance, ICICI and HDFC Bank charge Rs 199 + GST.

Your bank may have a different policy. Please check with your bank.

Processing fee adds to the cost of borrowing. Additionally, a fixed fee can also sharply increase the cost for smaller loans.

As we have seen above, No-cost EMIs are short term loans. Therefore, the impact of processing fee is spread over a very short period.

Let’s go back to the example discussed (Cost =30,000, Interest rate = 15% p.a., Loan Tenure = 6 months).

GST increased the cost of loan from 0% to 2.6% p.a.

Processing fee of Rs 199 + GST increases the cost from 2.6% to 5.3% p.a.

Now, the impact will be higher for shorter duration loans.

If the loan tenure is 3 months, the effective cost is 7.3% p.a.

Moreover, the impact will be higher for smaller loans.

For instance, the effective cost of No-cost EMI for Rs 10,000 loan (Cost =10,000, Interest rate =15%, Tenure = 6 months, Processing fee = 199 + GST) will be 16.8% p.a. That’s the kind of impact processing fee can have on short term loans. This is worse than a 12% loan available at 0% processing fee.

Note: The processing fee is not always disclosed on the platform (Amazon/Flipkart). The onus is on you to check with the bank.

Don’t ignore Lost cashbacks and rewards

ICICI AmazonPay Credit Card offers 5% cashback to Prime users (3% to Non-prime users) on every purchase on Amazon. However, if you buy on EMIs, including No-cost EMIs, you do not get any cashback.

The same happens if you buy on EMIs using Flipkart Axis Bank credit card.

Now, these lost cashbacks are an opportunity cost if you opt for no-cost EMIs.

Do consider these costs before purchasing on No-cost EMIs.

Are No-cost EMI schemes good?

No-cost EMI schemes allow you to purchase items on EMIs without any additional cost. Or a very small cost.

Difficult to find flaws with loans with effective cost of 0% or say less than 5% p.a.

Good deal.

However, do consider the impact of processing fee and the potential lost cashbacks/rewards before you opt.

A caveat: While No-cost EMIs increase your affordability, every loan must be repaid. No-cost EMIs are not a license to overspend. Do not overborrow. Overborrowing or reckless credit behaviour can get you into serious trouble.

Image Credit: Pixabay.com

The post was first published in August 2018 and has been updated since.