How many times have you approached the Union Budget with immense expectations and come back empty handed? The action lay elsewhere. There were important announcements but not directly related to putting more money in your pockets.

Not this time.

The Union Budget 2023 was action-packed. So many announcements that directly impact the middle-class taxpayer. I list some of the budget proposals directly impacting the taxpayers.

- Lower tax rates under the new tax regime.

- Traditional plans with annual premiums over Rs 5 lacs brought under the tax net.

- Taxpayers set off long term capital gains by purchasing a residential property. Set-off limits under Section 54 and Section 54F are now capped.

- Increase in investment cap under Senior Citizens savings scheme (SCSS) from Rs 15 lacs to Rs 30 lacs.

- Increase in Tax collection at Source (TCS) for remittance under LRS for travel and investments abroad.

- Adverse tax changes for REITs and Market-linked debentures

All of the above changes are not favourable but the unfavourable ones mostly affect the HNIs.

Not possible to cover this wide range of topics in a single post. Hence, will cover some of these over the next few weeks. In this post, I focus on the most important one, the changes to the tax structure in the new tax regime.

Now that the new tax regime has been made more attractive, does it make sense for you to switch from the old tax regime to the new regime?

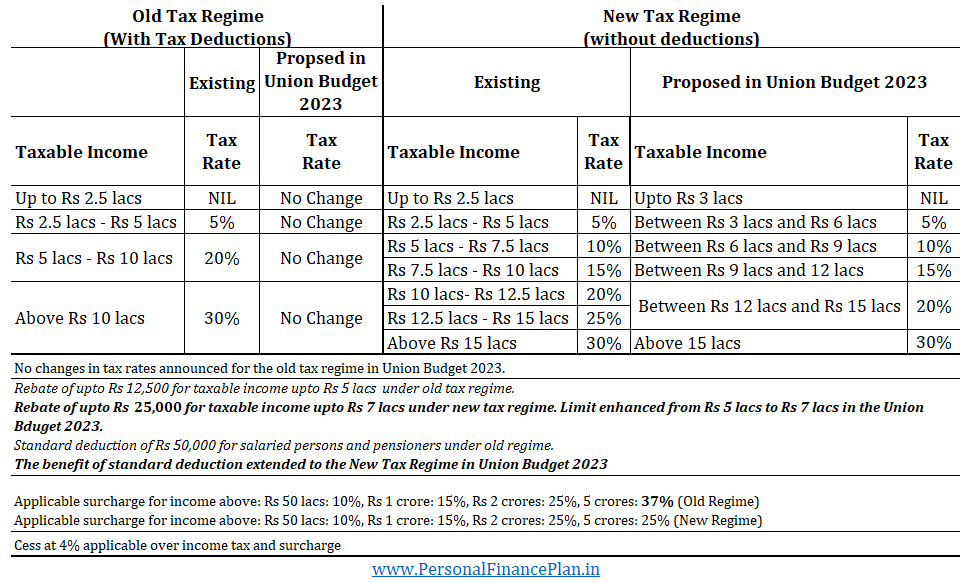

What are the new tax slabs?

The tax rates have not been changed under the old tax regime (Higher tax rate but deductions).

The changes are only for the new tax regime (lower tax rates without deductions).

Incentives for the New Tax Regime

- Enhancement of minimum exemption limit from Rs 2.5 lacs to Rs 3 lacs

- The eligibility of rebate under Section 87A enhanced from Rs 5 lacs to Rs 7 lacs if opting for the new tax regime. This ensures no taxes if your income does not exceed Rs 7 lacs.

- Lower tax rates

- Standard deduction of Rs 50,000 is now allowed for Salaried persons and pensioners. Was not permitted earlier.

- Surcharge for income over Rs 5 crores reduced from 37% to 25%, if opting for the new tax regime.

- New tax regime shall be the default option.

No taxes if the income is up to Rs 7 lacs

If you opt for the new tax regime and if your income is up to Rs 7 lacs, you do not have to pay any tax.

How does this happen?

Through a provision under Section 87A.

Under Section 87A, you are eligible for a rebate of up to Rs 25,000 (earlier Rs 12,500) if the total income does not exceed Rs 7 lacs (earlier Rs 5 lacs). This change is only for the New tax regime.

So, let’s say your income is Rs 6.5 lacs. As per the revised tax slabs/rates, your tax liability will be Rs 20,000. However, since the income is below Rs 7 lacs, you will be eligible for a rebate of Rs 20,000. Lower of (Rs 20000, 25000). Hence, zero tax liability.

If you are a salaried employee or a pensioner, you can also take standard deduction. This will push the tax-free limit to Rs 7.5 lacs.

Note: The rules have not been changed for the old tax regime. Under the old tax regime, the rebate is still capped at Rs 12,500 if the income does not exceed Rs 5 lacs.

For determination of total taxable income, it is not just your salary that is counted. The capital gains or interest income or any other taxable income must also be added to calculate the total income. Even the LTCG on equity/equity funds of up to Rs 1 lac must be added since it is not exempt income but taxable income on which no tax must be paid.

Relief for High Income Earners

If you earn really well, the Government asks you to pay more taxes. The tax slabs don’t change but the surcharge kicks in.

Above 50 lacs: 10%

Above Rs 1 crores: 20%

Above Rs 2 crores: 25%

Above Rs 5 crores: 37%

Thus, if your taxable income is more than Rs 5 crores, your tax rate for your entire income above Rs 10 lacs is 30% * (1+37% surcharge) * (1 + 4% cess) = 42.77%

The Government proposes a change here.

For income above Rs 5 crores, the surcharge shall be reduced from 37% to 25%, but only if you opt for the new regime. This reduces marginal tax rate = 30% * (1+25% surcharge) * (1+4% cess) = 39%

No change in surcharge rate for the old tax regime. And the rate of surcharge remains 37% if the total income is more than 5 crores.

Clearly, for such taxpayers with annual income above Rs 5 crores, new tax regime is an easy choice irrespective of the tax deductions taken.

How better is the Proposed New Tax Regime compared to the Existing New Regime?

The following illustration demonstrates the impact for salaried taxpayers.

Since the benefit of standard deduction is available only to salaried employees and pensioners, the difference will reduce for professionals.

What should you pick: New Tax Regime or the Old Tax Regime?

Now to the real question.

Between the old and the new tax regime, which one should you pick?

The new Tax regime has lower tax rates but does not allow deductions.

Old tax regime has higher taxes but allows to reduce income through tax deductions.

Therefore, if you can avail enough tax deductions, you might still be better off in the old regime.

But what is the tipping point? What is “enough”?

What should be the amount of tax deductions to make the old regime more attractive?

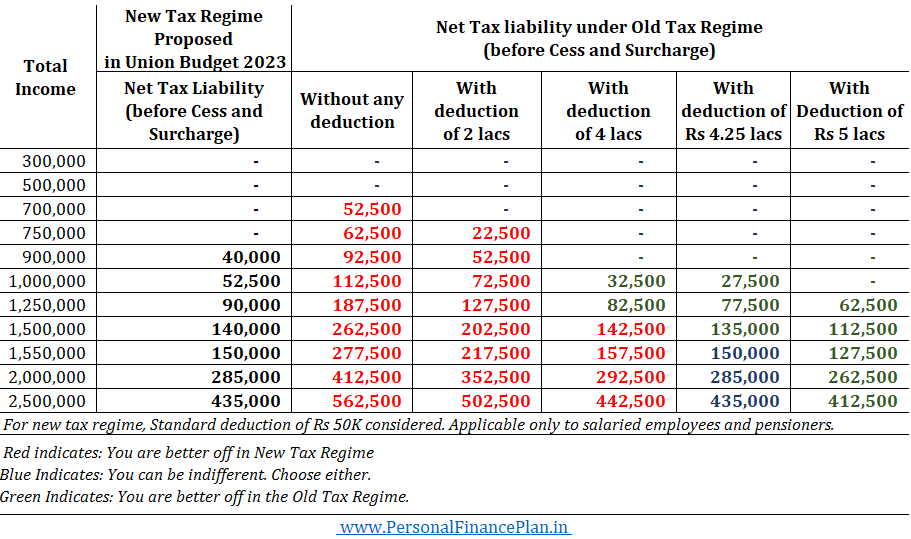

I compared the tax liabilities for various levels of income and tax deductions for salaried employees (who will get the benefit of standard deduction under both old and new regime).

As you can see above, the threshold of tax deduction where old regime becomes more attractive than the new regime is Rs 4.25 lacs (including standard deduction).

Therefore, if you can manage tax deduction of Rs 4.25 or more (Rs 3.75 lacs excluding standard deduction), you will be better off in the old regime.

For non-salaried (who don’t get benefit of standard deduction), the tipping point shall be Rs 3.75 lacs.

Now, you must see if you can take tax deductions to that extent.

Section 80C: Up to Rs 1.5 lacs (life insurance premium, ELSS, PPF, EPF, etc.)

Section 80D: Up to Rs 25,000. For health insurance premium. If you (or your spouse) are a senior citizen, the benefit goes up to Rs 50,000. In addition, if you are paying the premium for your parents, you get an additional 25,000 tax benefit. If either parent is a senior citizen, the additional benefit goes to 50,000.

Section 80CCD(1B): Up to 50,000 for own contribution to NPS.

Standard deduction of Rs 50,000.

These numbers add up to about 2.75 lacs.

The other prominent ones are up to Rs 2 lacs for Home Loan Interest (Section 24) and house rent allowance (HRA) adjustment . If you have taken an education loan, you get tax benefit for interest payment on education loan (no cap on the tax benefit) under Section 80E.

So, if you are staying in a house you own (self-occupied) and you have repaid the home loan in full, you can’t take benefit under Section 24 (home loan interest) and house rent (HRA).

In such a case, it is difficult to touch that magical mark of Rs 4.25 lacs (for salaried/pensioners) and Rs 3.75 lacs (for self-employed).

And if you can’t hit the mark, you are better off in the new tax regime.

Tax Benefits that are still permitted under the New Tax Regime

Standard deduction of Rs 50,000. Allowed only for salaried employees and pensioners.

Employer contribution to NPS, EPF, and superannuation fund. Section 80CCD (2). Note only employer contributions are allowed as deduction. Not own contribution. Hence, if you have been investing in NPS and taking benefit of up to 50K under Section 80CCD(1B), you won’t be able to get that benefit if you switch to the new tax regime.

In addition, for a let-out property, you might still be able to take benefit for home loan interest.

The Verdict

It is evident that the Government is trying to increase acceptance of the New Tax regime through incentives.

By reducing tax rates for the middle-income earners.

And reducing surcharge for very high-income earners.

And possibly gradually phase out the old regime. Or if very few people opt for the old regime, it will automatically become irrelevant.

And I think the Government is doing it the right way. Rather than abolishing the old regime or withdrawing tax benefits under the old regime, they have just made the New Tax Regime more attractive.

The Government did the same with crypto investments. It could have banned crypto investments. Instead, it discouraged the investment in cryptos through higher taxes, TCS, disallowing setoffs, or carry forward of loss. So, not an outright ban but a nudge to not invest.

Going forward, if the Government wants to put more money in the pockets of the investors, it will simply tweak the tax rates or tax slabs under the new regime. And not touch the old tax regime.

With this, it is fair to NOT expect an enhancement in the Section 80C limit. Not now and not in the future. Or any other special tax benefits. I do not expect any fresh tax benefit exclusively for the old tax regime in the future. If a new tax benefit (deduction) is announced, it would be for both the old and the new regime.

By the way, if we keep adding tax deductions to the new regime, we will beat the ultimate purpose of the New Tax Regime. A simpler tax structure. And the new regime becomes the New “Old Regime”.

The new tax regime is simple.

Gets you out of that tax-saving mindset.

Entire industries have mushroomed around the concept of tax-saving. Taxpayers buy insipid investment products just to save taxes. Under pressure to make that tax-saving investment before the end of March, they buy anything with little regard to their needs and utility in their portfolios. Sales agents build their entire sales pitch around tax-saving. Not anymore.

I do not deny that taxation is an important decision variable when selecting an investment, but it should not be the only decision variable.

And yes, it is fine to get out of the tax-saving mindset. However, do not let go of the investment-making mindset. You must still invest for your financial goals.

Featured Image Credit: Unsplash