Why PPF interest rate not increased from 1st April 2020 onwards? Even though from 1st April 2023, all the small savings schemes’ interest rates were increased, why did PPF interest remain unchanged?

The PPF rate is the same at 7.1% from 1st April 2020 to 1st April 2023. It is almost 3 years!! What may be the reasons?

When yesterday government announced the interest rates for all small savings interest rates applicable from 1st April 2023 to 30th June 2023, the majority of PPF investors are angry. Because the PPF interest rate was not changed for almost 3 years.

Why it is so? Why government not acting to change the PPF interest rate?

Why PPF interest rate not increased?

You may be aware that before 2016, the PPF rate used to be changed quarterly. However, effective from 1st April 2016, the change in interest rate will be once a quarter. I have written a detailed post on this “Post Office Savings Schemes -Changes effective from 1st, April 2016“. According to this, the timetable as below was set to announce the interest rates.

You noticed that it was mentioned in the notification that the Govt agreed and decided to recalibrate the interest rates of all small savings schemes “every quarter to align the small saving interest rates with the market rates of the relevant Government securities.”

But what is this FIMMDA month-end G-Sec rate?

FIMMDA (Fixed Income Money Market and Derivatives Association of India) is a voluntary market body for the bond, money, and derivatives markets. They publish the Government Security rate. Based on these rates, the next quarter’s interest rate on various Post Office Savings Schemes is considered.

The 10-year G-Sec bond is considered the benchmark for PPF and the Sukanya Samriddhi Yojana (SSY). Sukanya Samriddhi Yojana (SSY) is to have a rate of 0.75% more than over “prevailing 10Y bond market rates” and PPF a 0.25% higher return.

These are the rules set in 2016. However, when it comes to government schemes like PPF, SSY, SCSS, or EPF, there is a lot of pressure from the public to have a higher rate always. We as investors feel a breach of trust if the interest rate starts to fall. However, if any government starts to increase it (even though because of inflation and the falling bond market), we feel it is the BEST strategy.

All these socially related schemes’ interest rates are sometimes retained as usual or increased considering the public anger, political benefits, or some other situations which are beyond economic implications.

This is what happened with PPF also. When the new process was introduced on 1st April 2016, the average yield of 10 Years G-Sec was 7.7%. As per the above rule, it should be 7.95%. However, the rate was set at 8.1%. Mainly because the previous PPF rate for FY2015-16 was 8.7%. If someone reduced it to 7.95%, then the government has to face the anger as it is almost around 0.75% rate drop!!

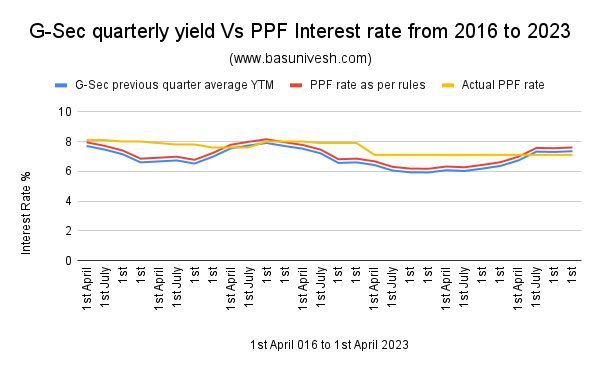

The trend of having a higher rate than the actual previous quarter’s G-Sec average YTM continued from that period onwards. You can refer to the below chart for that purpose.

In the above chart, I have taken the previous quarter’s average G-Sec yield and what should be the PPF rate Vs the actual rate.

You noticed that from 1st April 2016 itself, the actual PPF rate was higher than the average G-Sec yield, and also the PPF rate should be as per the rules the government set.

We enjoyed the higher PPF rate during the lower interest rate regime. Now you noticed that a year due to an increase in inflation and interest rate, the bond markets have fallen drastically. Because of this, the yield of the bonds also increased.

The yield on bonds is inversely proportional to their price. Raise in interest rates will result in a fall in bond prices. This will raise the yield. The reverse will happen when the interest rate starts to fall.

Let us say you have a bond with a face value of Rs.1, 000 and the interest (coupon) on this bond will be 10%. Therefore, if you bought it at face value and the return from this bond is 10%, then the yield on the such bond will be 10% (100/1000).

Now let us say RBI increased the rate of interest to 11%, then whether anyone tries to buy such bonds, which offer less than the current market interest rate? Obviously, no, in that case, the price of such a bond, which bears a face value of Rs.1,000, and coupon or yearly interest of 10% will have to fall. Let us say it fell to Rs.900. Then the yield will be 11.1% (100/900).

Why yield raised? Because the person who buys the bond which bears the face value of Rs.1,000, but is currently priced at Rs.900, and the interest rate (coupon) on such bond is fixed i.e. 10%. Therefore, by investing Rs.900 one can get a 10% return. Earlier you have to buy this bond at Rs.1,000 (face value) and the return is 10%. Now, due to an increase in the interest rate and a fall in bond price, the yield on such investment will increase. Hence, the fall in price resulted in a higher yield.

We are currently facing the above situation for around a year. We as investors think that as bank FD rates and other debt instruments are offering the higher rate then why is PPF interest not increased?

In my view, the reason is that as PPF has a huge AUM, I think the government is compensating for what loss they made earlier due to offering higher rates during the lower interest rate regime. How long they will continue we don’t know.

Today morning when I tweeted about the same as below.

Someone replied saying “No, the real reason is not compensating but the finance secretary says since the tax-free yield is higher (more than 10% for the one falling in the highest tax bracket) therefore there is no need of increasing the rate”.

I will not accept this reason. If that is the case, then the same rule must also apply to SSY. However, in this quarter (1st April 2023 onwards), they increased the SSY rate but retained the PPF rate unchanged.

Considering all these scenarios, what I assume is that asking why the PPF interest rate has not increased is not under our control. Even though Government and politicians with bureaucrats float the rules, they hardly followed them. Mainly because such schemes involve a lot of political repercussions rather than economic ones.

Hence, rather than discussing or showing anger on why the government not changing the interest rate of PPF, let us concentrate on what we can control (i.e investing).

You may add one more risk to your investment journey i.e POLITICAL POLICIES PARALYSIS RISK!!