It’s time to talk mortgage rate shopping, which has become an absolute must in 2023.

Simply put, you’ve got to be more proactive to get your hands on a low rate today than you did a year ago.

Aside from rates doubling from around 3% last year to 6%+ today, there’s a lot of rate dispersion right now.

Because of all the interest rate volatility, you could see rates 1% apart for the same exact product.

Fortunately, there are a number of ways to score a better deal on your home loan, though a little bit of legwork on your behalf is definitely required. After all, you’re not buying a TV.

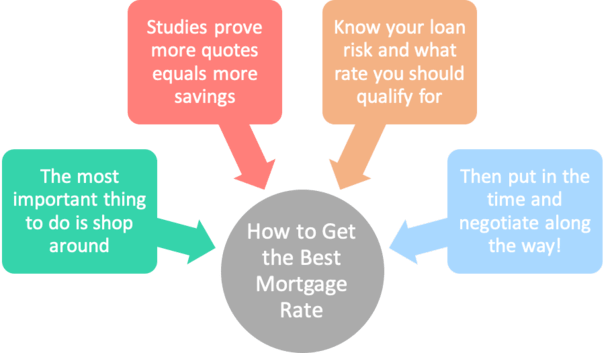

How to Get the Best Mortgage Rate

If you’re not willing to put in the work, you might be disappointed with the mortgage rate you receive.

But if you are up for the challenge, the savings can make the relatively little time you put in well worth it.

The biggest takeaway is to shop around, since you can’t really determine if a mortgage rate is any good without comparing it to other quotes.

Many prospective and existing homeowners simply gather one quote, typically from a friend or real estate agent’s reference, and then kick themselves later for not seeing what else is out there.

At the moment, there’s a wide range of rates on offer for the same exact loan programs. This means one bank might advertise a rate of 6.5% on a 30-year fixed, while another pitches 5.875%.

Of course, you won’t know that unless you take the time to see what’s out there.

Below are 10 tips aimed at helping you better navigate the home loan shopping experience and ideally save some money.

1. Advertised mortgage rates generally include points and are best-case scenario

You know those mortgage rates you see on TV, hear about on the radio, or see online. Well, most of the time they require you to pay mortgage points.

So if your loan amount is $200,000, and the rate is 5.5% with 1 point, you have to pay $2,000 to get that rate.

And there may also be additional lender fees on top of that for things like underwriting, processing, commission, and so on.

It’s important to understand that you’re not always comparing apples to apples if you look at interest rate alone.

For example, lenders don’t charge the same amount of fees, so the rate isn’t the only thing you should look at when shopping.

Additionally, these advertised mortgage rates are typically best-case scenario, meaning they expect you to have a 780+ credit score and a minimum 20% down payment.

They also assume the property is a single-family home that will be your primary residence.

If any of the above are not true, you can expect a much higher mortgage rate than advertised.

Those who actually present the least amount of risk to lenders are the ones with the best chance of securing a great rate.

Tip: Why mortgage lenders are requiring upfront points right now.

2. The lowest mortgage rate may not be the best option

Most home loan shoppers are probably looking for the lowest interest rate possible, but at what cost?

As noted above, the lowest interest rate may have steep fees and/or require discount points, which will push the APR higher and make the effective rate less desirable.

Be sure you know exactly what is being charged for the rate provided to accurately determine if it’s a good deal. And consider the APR vs. interest rate to accurately gauge the cost of the loan over the full loan term.

Lenders are required to display the APR next to the interest rate so you know how much the rate actually costs. Of course, APR has its limitations, but it’s yet another tool at your disposal to take note of.

For example, you might be better off going with a rate of 6.75% instead of 6.5% if the former has zero fees, while the latter costs say $5,000.

If you pay for a lower rate, it takes time to recoup the cost, and you could sell or refinance before those saving are actually realized.

And if the loan amount were $500,000, we’re only talking $83 in monthly savings at the lower rate of 6.5%.

3. Compare the costs of the mortgage rate being offered

Along those same lines, you need to compare the costs of securing the loan at the par rate, versus paying to buy down the rate.

For example, it may be in your best interest to take a slightly higher rate to cover all your closing costs, especially if you’re cash-poor or simply don’t plan on staying in the home very long.

If you won’t be keeping the mortgage for more than a year or two, why pay points and a bunch of closing costs out of pocket?

Might as well take a slightly higher rate and pay a tiny bit more each month, then you can get rid of the loan. [See: No cost refinance]

Conversely, if you plan to hunker down in your forever home and can obtain a really low rate, it might make sense to pay the fees out-of-pocket and pay points to lower your rate even more.

After all, you’ll enjoy a lower monthly payment as a result for many years to come, and save a ton on interest.

Tip: Most economists expect mortgage rates to improve in the near future, so paying a lot upfront might not be a smart move if a refinance opportunity comes along soon.

4. Consider different loan types beyond the 30-year fixed based on your goals

When comparing pricing, you should also look at different loan types, such as a 30-year fixed vs. 15-year fixed.

If it’s a small loan amount, you might be able to snag a lower interest rate on a 15-year loan term and still manage the higher monthly payment. This can greatly reduce your interest expense.

You’ll also own the home much sooner, assuming that’s your goal.

On the other end of the spectrum, if you only plan to stay in the home for a few years, you can look at lower-rate options, such as the 5/1 ARM.

They come with rates that can be much lower than the 30-year fixed, boosting affordability and lowering monthly payments. And more of each payment will go toward the principal balance.

If you’ll be out of there before the loan ever adjusts, why pay the premium for a 30-year fixed?

Tons of homeowners pay extra for a 30-year fixed mortgage, then refinance a year or two later. You don’t want to leave money on the table, or overpay interest.

A 3-2-1 buydown (or 2-1 buydown) could also work if the seller/lender/builder offers to pay for it.

These temporary rate reductions can bridge the gap to a lower rate in the future (assuming they do come down!).

5. Watch out for bad recommendations that don’t fit your plan

Don’t overextend yourself just because the bank or broker (or Dave Ramsey) says you’ll be able to pay off your mortgage in no time at all. A 15-year fixed can be pricey.

Sure, paying off your mortgage early has its advantages, but you might have better places to put your money.

This is especially true with savings rates now in the 4-5% range, which can rival the interest rate on a mortgage.

They may recommend something that isn’t really ideal for your situation, so do your research before shopping, and make a plan.

You should have a good idea as to what loan program will work best for you, instead of blindly following the loan officer’s opinion.

It’s not uncommon to be pitched an adjustable-rate mortgage when you’re looking for a fixed loan, simply because the lower rate and payment will sound enticing.

Or be told the 30-year fixed is a no-brainer, even though you plan to move in just a few years.

Know what you want/need loan-wise before you speak to a lender.

6. Consider banks, online lenders, credit unions, and mortgage brokers

I always recommend you shop around and compare lenders as much as possible.

This means comparing mortgage rates online, calling your local bank, a credit union, and contacting a handful of mortgage brokers.

Heck, you can even compare mortgage brokers while you’re at it.

If you stop at just one or two quotes, you may miss out on a much better opportunity. Simply put, don’t spend more time shopping for your new couch or stainless-steel refrigerator.

This is a way bigger deal and deserves a lot more time and energy on your part.

Your mortgage term is probably going to be 30 years, so the decision you make today can affect your wallet for the next 360 months, assuming you hold your loan to term.

Even if you don’t keep it that long, it can affect you for years to come! Put in the time to do it right.

7. Research the mortgage companies before you apply

Shopping around will require doing some homework about the mortgage companies in question.

When comparing their interest rates, also do research about the companies to ensure you’re dealing with a legitimate, reliable lender that can actually get your loan closed.

A low rate is great, but only if it actually funds! There are lenders that consistently get it done, and others that will give you the runaround or bait and switch you.

Or just fail to make it to the closing table because they don’t know what they’re doing.

Fortunately, there are plenty of readily accessible mortgage reviews online that should make this process pretty simple.

Just note that results will vary from loan to loan, as no two mortgage loans or borrowers (or employees) are the same.

You can probably take more chances with a refinance, but if it’s a home purchase, you’ll want to ensure you’re working with someone who can close your loan in a timely manner.

Otherwise a seemingly good deal could turn bad instantly.

8. Mind your credit scores and stop spending now

Understand that shopping around may require multiple credit pulls.

This shouldn’t hurt your credit as long as you shop within a certain period of time. In other words, it’s okay to apply more than once, especially if it leads to a lower mortgage rate.

More importantly, do not apply for any other types of loans before or while shopping for a mortgage.

The last thing you’d want is for a meaningless credit card application to take you out of the running completely. Or inadvertently bump up your mortgage rate.

Additionally, don’t go swiping your credit card and racking up lots of debt, as that too can sink your credit score in a hurry.

It’s best to just pay cash for things and/or keep your credit cards untouched before, during, and up until the loan funds.

Without question, your credit score can move your mortgage rate significantly (in both directions), and it’s one of the few things you can actually fully control.

Keep a close eye on it. I’d say it’s the most important factor with regard to mortgage rate pricing and shouldn’t be taken lightly.

If your credit scores aren’t very good, you might want to work on them for a bit before you apply for a mortgage.

It could mean the difference between a bad rate and a good rate, and hundreds or even thousands of dollars.

Tip: 10 Things You Should Do Before Applying for a Mortgage

9. Lock your rate early on so it doesn’t go up

This is a biggie. Just because you found a good mortgage rate, or were quoted a great rate, doesn’t mean it’s yours yet.

You still need to lock the rate (if you’re happy with it) and get the confirmation in writing. Without the lock, it’s merely a quote and nothing more. That means it’s subject to change.

Each day, rates can go up or down, just like a stock can change in price. Timing can be crucial here. If you don’t want to leave it to chance, lock it in.

The loan also needs to fund. So if you’re dealing with an unreliable lender who promises a low rate, but can’t actually deliver and close the loan in time, the low rate means absolutely nothing.

Again, watch out for the bait and switch where you’re told one thing and offered something entirely different when it comes time to lock.

Either way, know that you can negotiate during the process. Don’t be afraid to ask for a lower rate if you think you can do better; there’s always room to negotiate mortgage rates!

10. Be patient, take your time, and don’t panic

Lastly, take your time. This isn’t a decision that should be taken lightly, so do your homework and consult with family, friends, co-workers, and whoever else may have your best interests in mind.

If a company is aggressively asking for your sensitive information, or trying to run your credit report right out of the gate, tell them you’re just looking for a ballpark quote.

Don’t ever feel obligated to work with someone, especially if they’re pushy.

You should feel comfortable with the bank or broker in question, and if you don’t, feel free to move on until you find the right fit. Trust your gut.

Also keep an eye on mortgage rates over time so you have a better idea of when to lock. No one knows what the future holds, but if you’re actively engaged, you’ll have a leg up on the competition.

One thing I can say is, on average, mortgage rates tend to be lowest in December, all else being equal.

And they tend to be highest in spring. Yes, during the housing market’s busiest period.

Either way, don’t panic. Sure, rates have gone up a lot recently, but that doesn’t mean you need to lock in a high rate now. They could easily “correct” and drift lower over the next month or two.

This is similar to freaking out and selling your stocks because they’re down, only to see them bounce higher after you sell.

In summary, be sure to look beyond the mortgage rate itself – while your goal will be to secure the lowest rate possible, you have to factor in the closing costs, your plans with the property/mortgage, and the lender’s ability to close your loan successfully.

Tip: Even if you get it wrong the first time around, you can always look into refinancing your mortgage to lower your current interest rate. You aren’t stuck if you can qualify for another mortgage down the road!