Bank failures have hit the news in 2023, with a series of high-profile collapses raising fears of a 2008-style meltdown. But what is a bank failure? Why do banks collapse, and what does a collapse mean for the economy?

Let’s find out.

How Banks Fail

First, let’s look at what banks do. A bank’s business involves three main activities.

- Taking deposits and paying interest on those deposits.

- Making loans and charging interest on the loans.

- Facilitating transactions through payment solutions, money transfers, letters of credit, and similar activities.

A bank’s assets come from deposits. The bank then lends assets at an interest rate higher than the rate it pays to its depositors. That’s how the bank makes money.

Fractional Reserve Banking

A bank has to hold some of its assets in reserve to meet the demand for withdrawals. In a fractional reserve system, a bank holds a fraction of its reserves to meet the demand for cash, with the rest available for lending.

These reserves fall into two categories.

- Required reserves are the minimum reserves necessary for day-to-day operations.

- Excess reserves are reserves that the bank holds for unusual or unexpected withdrawals.

Reserves that a bank holds in cash do not earn anything for the bank. The bank still has to pay interest to the depositors, so it is losing money on its cash reserve.

The Risk

If a bank holds too much of its money in reserve, it won’t earn money. Reserves are not being lent out, so the bank’s earnings from that money are small or nonexistent.

If the bank doesn’t have enough in reserve, it risks becoming insolvent if a large number of clients need to withdraw their money. Every depositor has the right to withdraw at any time, so the bank always faces potential claims that are larger than its reserves.

In most cases, depositors don’t withdraw their money all at once. Most individual and corporate clients have fairly predictable cash needs, so the bank has a way to judge whether its reserves are adequate.

When withdrawals exceed the reserves available to meet them, the bank becomes insolvent, which is a banker’s way of saying it runs out of money.

How Banks Manage Risk

Risk is built into the banking industry: no bank would remain solvent if all of its depositors removed all their money at the same time. Banks use multiple methods to control risk.

- Reserves. Maintaining enough reserves is at the core of any risk management strategy.

- Managing short-term investments. Banks invest their short-term reserves, often in bonds. They have to mix the maturities of these bonds, just as an investor might use a bond ladder, to ensure that they will always have reserves nearing maturity.

- Diversification. If a bank’s client base is focused on one industry or a few large depositors, the bank is vulnerable. Banks can reduce the risk of mass withdrawals by catering to a wide variety of clients.

- Underwriting standards. Bad loans represent a risk. Banks have to evaluate credit risk carefully and diversify their lending to make sure they can collect the money they have lent out.

- Management. New risks emerge, and old ones change, so bank managers have to continuously assess the risk landscape and adjust their risk management policies.

These methods don’t always succeed. When they don’t, banks can fail.

A Brief History of Bank Failures

Bank failures are as old as banks. In the 1800s and early 1900s, banks failed on a regular basis. There was little or no regulation, and if the bank failed, the depositors lost everything. Depositors rushed to get their money out at the first sign of trouble, causing frequent bank runs.

Sometimes these runs came in batches, like the Panic of 1837, the Panic of 1873, and the Panic of 1907, but in between, there was a steady stream of failures. This culminated in the Great Depression, which caused over 9000 bank failures.

Enter the FDIC

The Federal Deposit Insurance Corporation (FDIC) was formed in 1933 to address the problem of bank runs. The FDIC insures bank deposits and claims that since it was founded, no depositor has lost even a dollar of insured deposits.

Because depositors are protected, there’s less incentive to panic and pull your money out of the bank at the first sign of trouble. This dramatically reduced the problem of bank runs.

Banks Still Fail

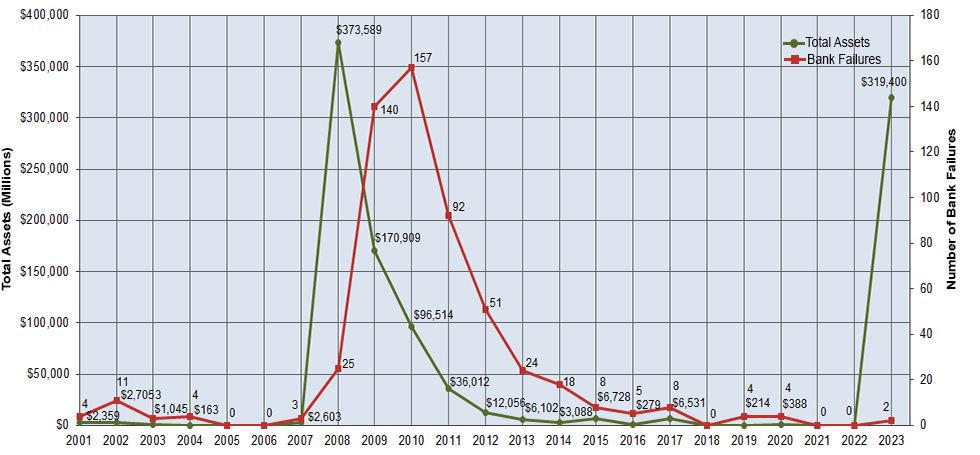

The FDIC reduced both the number and the impact of bank failures, but banks still go insolvent on a regular basis. There were 563 bank failures between 2001 and 2023, with 465 of them coming from 2008 to 2012, in what is now called “The Great Recession”.

Source: FDIC

The explosion in bank failures during the 2008 recession, along with a dramatic reduction after the crisis, is clearly visible on the chart.

Bank Failures in 2023: Why the Panic?

The 2020s so far have not exactly been a hotspot for bank failures. There were four in 2020, none in 2021, none in 2022, and three in 2023 so far. That, in itself, is hardly a reason to be concerned.

With a closer look at the chart, you’ll see that the green line indicating the total assets of the failed banks spiked dramatically in 2023, indicating that while the number of failed banks was small, the banks that failed were fairly large.

The last time we saw such a large disparity between failures and assets was in 2008, which saw the largest bank failure in US history, the $188 billion collapse of Washington Mutual Bank.

The second and third largest US bank failures in US history were in 2023: the $175 billion failure of Silicon Valley Bank and the $89 billion failure of Signature Bank. The contagion also spread to Europe, sinking banking giant Credit Suisse, with $1.4 trillion in assets under management.

It’s not the number of bank failures that has people worried, it’s the size and high profile of the banks that have failed.

Silicon Valley Bank: What Happened?

Silicon Valley Bank (SVB) made its name providing banking services to startup companies. At one point, SVB’s website claimed:

We bank nearly half of all US venture-backed startups, and 44% of the US venture-backed technology and healthcare companies that went public in 2022 are SVB clients.

That specialty allowed SVB to provide services specifically tailored to its client base and led to rapid expansion as more startups flocked to SVB. It also left the bank with a dangerously concentrated client base.

In some ways, SVB became the victim of its own success. 2021 was a huge year for IPOs and venture capital investment. Money flowed into the coffers of SVB clients, and the clients took the money to the bank. Deposits tripled from 2020 to 2022.

SVB prudently held a large portion of that money in reserves, mainly US government bonds. Less prudently, they concentrated their bond holdings on relatively long-term bonds, seeking higher returns but mismatching the maturities of their assets with the maturities of their deposits, which could be withdrawn at any time.

Things Fall Apart

In 2022 the pendulum swung in the other direction. The IPO market came to a dead stop. VC capital stopped flowing. Many of the companies that banked with SVB were not generating operating profits. They needed the money they had on deposit, and the withdrawals piled up.

SVB needed cash to meet the withdrawals. They had their bond portfolio, and government bonds could be sold in the secondary market at any time.

The problem was that the bonds they held were bought when interest rates were very low, under 2%. With new bonds available at rates approaching 4%, the old bonds could only be sold at a massive discount. On March 8, 2023, SVB sold a bond package with a face value of $23.97 billion to Goldman Sachs for $21.45 billion, a $1.8 billion loss.

That loss alone should not have left the bank insolvent. When the news went public, though, depositors concluded that the bank was desperate for cash. The bank complicated the problem with a poorly written press release that only stoked fears about its solvency. The simultaneous collapse of crypto-focused Silvergate Bank whipped those fears up even more.

FDIC insurance deters bank runs by individual investors, but SVB had a large concentration of business accounts, many with balances much higher than the $250,000 FDIC limit. Over 93% of SVB deposits were uninsured. Faced with the possibility that their bank was approaching insolvency, they rushed to withdraw their deposits.

The result was an old-fashioned bank run, with customers withdrawing $42 billion in a single day. SVB was seized by the California Department of Financial Protection and Innovation and placed into FDIC receivership on March 10, 2023.

The Aftermath

The collapse of Silicon Valley Bank raised immediate fears for companies caught with large deposits, including Vox, Roblox, Unity, and others. There were fears that these companies would be unable to pay workers or suppliers, leading to a chain of business collapses.

Those fears were immediately alleviated when the FDIC committed to reimbursing all deposits, even those above the $250,000 insurance limit.

On March 27, the FDIC announced that SVB would be sold to North Carolina lender First Citizens Bank.

Signature Bank: What Happened

Signature Bank was a New York-chartered commercial bank catering mainly to cryptocurrency companies, real estate buyers, and law offices. It was the 19th-largest bank in the US, with $88.59 billion in deposits and $110.36 billion in total assets, and had offices in New York, Connecticut, North Carolina, Nevada, and California.

Signature was known for its Signet program, a blockchain-based digital payments platform with a $250,000 minimum account balance. The bank saw rapid growth in net income, from $732 million in 2020 to $1.25 billion in 2021 and $1.75 billion in 2022.

What Went Wrong

The collapse of Signature Bank was directly caused by the insolvency of Silicon Valley Bank. Like SVB, Signature was heavily concentrated in a few industries that were coming under pressure as crypto prices tumbled and real estate deals dried up as interest rates soared.

Like SVB, Signature had a high level of uninsured deposits, with almost 90% of the bank’s deposits not covered by insurance and thus vulnerable to complete loss in a collapse. Signature held only about 5% of its assets as cash reserves, vs. an average of 13% across the industry.

When SVB collapsed, Signature depositors started a bank run of their own, pulling out deposits they were afraid to lose. After $10 billion in withdrawals in a single day threatened to sink the bank, regulators stepped in and took over.

The Aftermath

As with SVB, the FDIC immediately promised that all deposits would be covered, preventing a chain reaction of business collapses. Flagstar Bank, a subsidiary of New York Community Bancorp, will acquire most of Signature Bank’s business.

Credit Suisse: What Happened

Credit Suisse was a completely different sort of bank. Founded in 1856, it was a pillar of Switzerland’s famed banking industry, the second-largest bank in Switzerland and one of the largest in Europe.

Credit Suisse was a global, highly diversified institution offering private banking, investment banking, asset management, and other services to a highly diversified worldwide client base. It was considered less sensitive to rate movements, had large reserves, and had access to central bank lending.

So what could throw such a large, established, diversified institution into disarray?

What Went Wrong

Credit Suisse did not have a highly concentrated client base focused on high-risk industries. Its reserves were not low or committed to long-term low-interest bonds. What it did have was a recent record of bad decisions and scandals:

- In 2020 the CEO was forced to resign after hiring private detectives to spy on a former executive.

- In March 2021, Greenshill Capital, which handled around $10 billion of Credit Suisse capital, collapsed amid accusations of supervisory failure by the bank.

- Only weeks later, Credit Suisse booked a $5.5 billion loss when Archegos Capital, a family management firm focused on high-risk investments, defaulted.

- In October 2021, Credit Suisse faced $475 million in fines from US and British authorities after a bribery scandal involving operations in Mozambique.

- In January 2022, CEO Antonio Horta-Osorio, who was hired to clean up the mess, resigned after only nine months in the office and stated that the situation at Credit Suisse was the worst he’d ever seen.

- In February 2022, a massive data leak revealed that Credit Suisse was handling funds for dozens of sanctioned individuals, including drug traffickers, heads of state, intelligence officials, and human rights abusers.

- In March 2022, a Bermuda judge issues a $553 million decision against Credit Suisse after a fraudulent scheme by a local branch executive.

- In June 2022, a Swiss court found Credit Suisse guilty of failing to prevent a money-laundering scheme by a Bulgarian drug trafficking operation.

Depositors were pulling money out of Credit Suisse before the 2023 banking crisis. For the fourth quarter of 2022, Credit Suisse reported outflows of $119 billion, the largest since the 2008 financial crisis.

In March 2023, the US Securities and Exchang Commission (SEC) requested revisions to the 2022 annual report, forcing its delay. Credit Suisse admitted “material weaknesses” in its financial controls.

When SVB and Signature Bank failed, the withdrawals went into overdrive. When the Chairman of Saudi National Bank, a major shareholder, refused support, outflows escalated to $10 billion a day, threatening the bank with insolvency.

The Aftermath

The Swiss National Bank extended a credit facility to help stabilize the short-term situation on March 16. Swiss regulators are brokering a takeover by UBS, Switzerland’s largest bank. Credit Suisse will default on low-ranking bonds, and shareholders will face significant losses.

What Do They All Have in Common?

Banking relies on trust, probably more than any other industry. The whole point of putting money in a bank is that it’s safe. You have to be absolutely sure that the bank will be there and that your money will be accessible in the future.

FDIC insurance largely resolves the trust issue for individual depositors. Very few individuals keep over $250,000 in a bank account.

For businesses, though, the situation is totally different. Even a small to medium-sized company may need far more than $250,000 in ready cash to cover payroll, utility bills, rent, payments to contractors and suppliers, maintenance, and a huge list of other expenses.

That leaves business and corporate depositors highly exposed in the event of a bank failure. Their deposits are largely not insured. If they lose trust in the bank, they will race to pull their money out, just like individual depositors used to do in the bank panics of the 19th and early 20th centuries.

When enough depositors run for the exits at the same time, the bank fails.

Where Do We Go From Here?

The rapid-fire string of bank collapses in March 2023 raised fears of a “Lehman Brothers moment”, after the 2008 failure that marked the first sign of a global economic crisis.

The immediate fear was that companies with deposits at the failed banks would miss payrolls and default on loans, triggering a chain reaction of failure. That was alleviated by rapid action from the FDIC.

The second reaction was a wave of withdrawals at smaller regional banks that were perceived to be at risk. First Republic Bank, another institution with many startups and tech companies among its depositors, had to be rescued by a package of private lenders. Bank stocks plunged across the board.

Goldman Sachs predicts that small and medium-sized banks will tighten lending standards and cut back on lending, potentially constricting the flow of capital into the economy. JP Morgan expects a major negative impact on the crypto industry.

Treasury Secretary Janet Yellen has stated that the US banking system is safe, well-capitalized, and resilient. That may be predictable, but it is true that a large majority of US banks are not facing the problems that brought down the failed banks.

There are still plenty of skeptics. Former FDIC chair William Isaac has stated that “there will be more” bank failures. JP Morgan CEO Jaime Dimon has warned that the repercussions of the bank failures will be felt “for years to come”. Bloomgerd worries that bank-held portfolios of low-interest bonds represent $260 billion in unrealized losses (which are only meaningful if the banks are forced to sell those portfolios before they mature.

University of Chicago economist Doug Diamond, who won a Noble Prize for research on bank regulation, says that the combination of lax regulation of regional and local banks, combined with the Fed’s aggressive rate tightening, could bring more failures.

Nobody really knows what the impact of this string of bank failures will be. In an economy already beset by inflation, high interest rates, falling stock markets, and dangerously high levels of debt, there are any number of potential negative scenarios, but no assurance that any of them will happen.

All we can do is pay attention and be ready for anything!