Company Overview:

Mankind Pharma Ltd is a 33-year-old pharmaceutical company incorporated in the year 1991. The company develops and manufactures a complete of range of pharmaceutical formulations to treat acute and chronic therapeutic areas. In addition, it is also extremely popular in India for its consumer healthcare products, especially those sold under the Manforce brand and the Prega News brand. Its formulations brand include anti-infectives, cardiovascular, gastrointestinal, anti-diabetic and respiratory issues; among others. Mankind Pharma has over 600 scientists manning its R&D centre, and has already applied 55 ANDAs. The company also has one of the largest distribution networks of medical representatives in the Indian pharmaceutical market.

Objects of the Offer:

- To carry out the Offer for Sale of 4,00,58,844 Equity Shares by the Selling Shareholders.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Investment Rationale:

- Unique Position: Mankind pharma is the India’s fourth largest pharmaceutical company in terms of Domestic Sales and third largest in terms of sales volume for MAT (Monthly Annual Total) December 2022. The company is predominantly an India driven business with 97% of its revenues coming from the domestic market. They operate at the intersection of the Indian pharmaceutical formulations and consumer healthcare sectors with the aim of providing quality products at affordable prices, and have an established track record of building and scaling brands in-house. They have created 36 brands in the pharmaceutical business that have achieved over Rs.50 crs each in Domestic Sales for MAT December 2022. Their Formulations manufacturing facilities have a total installed capacity of 42.05 billion units per annum across a wide range of dosage forms including tablets, capsules, syrups, vials, ampoules, blow fill seal, soft and hard gels, eye drops, creams, contraceptives, and other over-the-counter products, as of December 31, 2022. The company have outperformed the IPM (Indian pharmaceutical market) in 5 out of 10 key therapeutic areas.

- Consumer Healthcare brands: The company have established several consumer healthcare brands in the condoms, pregnancy detection, emergency contraceptives, antacid powders, vitamin and mineral supplements and anti-acne preparations categories, among others. The company holds the category leadership positions in (i) the male condom category, where its Manforce brand had Domestic Sales of approximately Rs.451 crs (representing a market share of approximately 30.2%), (ii) the pregnancy detection kit category, where its Prega News brand had Domestic Sales of approximately Rs.153 crs (representing a market share of approximately 80.1%), and (iii) the emergency contraceptives category, where its Unwanted-72 brand had Domestic Sales of approximately Rs.90 crs (representing a market share of approximately 59.2%), for FY22.

- Financial Track Record: The consolidated revenue from operations have increased at a CAGR of 15% between FY20-FY22 from Rs.5865 crs in FY20 to Rs.7782 crs in FY22. The EBITDA for the company has increased at a CAGR of 18% from Rs.1438 crs in FY20 to Rs.1991 crs in FY22. The EBITDA margin has been standing between 25-27% for the past 3 years. The Profit after Tax of the company has increased at a CAGR of 17% between FY20-FY22 from Rs.1056 crs in FY20 to Rs.1453 crs in FY22. The PAT margin of the company was 18%, 21% and 19% in FY20, FY21 and FY22. The company’s consistent growth has been backed by its capital efficiency which led to strong ROCE of 36%, 30% and 26% for FY20, FY21 and FY22.

Key Risks:

- OFS – The IPO is a complete Offer for Sale (OFS) by the Selling Shareholders. The Selling Shareholders will receive the entire proceeds from the OFS and the Company will not receive any part of the proceeds of the Offer. Promoter & Promoter group selling shareholders will offload 1,00,14,711 shares and other selling shareholders will offload 3,00,44,133 shares.

- Legal Proceedings – The company’s Promoters, Subsidiaries, and Directors are currently involved in certain legal proceedings. These legal proceedings are pending at different levels of adjudication before various courts.

Outlook:

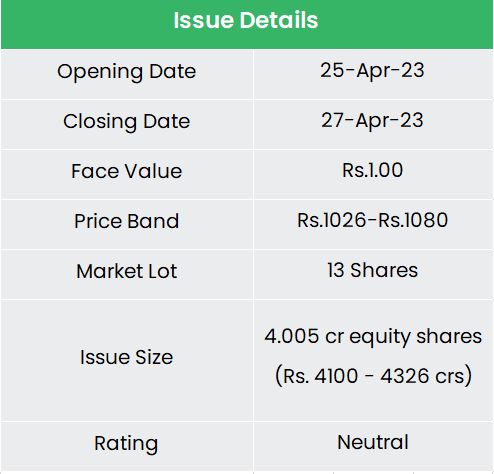

Mankind pharma, one of the largest domestic pharma players, going public by selling around 10% of its overall stake. The company’s financial performance is very strong except a small setback due to a one-off transaction in 9MFY23. The company’s listed peers according to the RHP are Sun Pharma, Cipla, Zydus Life sciences, Torrent Pharma, Alkem labs, JB chemicals, etc. However, not all the above companies will be an Apple-to-Apple comparison. At higher price band, the listing market cap will be around ~Rs.43264 crs and Mankind Pharma is demanding a P/E multiple of 30x based on FY22EPS. While comparing with the industry average P/E of 40x, the company seems to be fully priced. Based on the above views, we provide a ‘Neutral’ rating for this IPO.

If you are new to FundsIndia, open your FREE investment account with us and enjoy lifelong research-backed investment guidance.

Other articles you may like