Do your clients dictate what kind of business you have, or does your business dictate the types of clients you serve?

Early in your career as an advisor, you may have had relatively few criteria for accepting new clients. The more assets you could gather, the better! But as your firm and service offering have matured, you and your team may need help managing the book you’ve built. Have you ever gone back to assess whom you’re working with and the resources and time they require of you?

One method that could help you redirect your energy toward the right people and activities—and create more room for growth—is building a client segmentation and service model. Here’s how.

What’s the Makeup of Your Book?

The first step in building a client segmentation and service model is to understand the people in your current client base. Think in terms of both quantitative criteria (e.g., assets under management and revenue generated) and qualitative factors (e.g., level of trust, coachability, and referral history).

Also, consider what you do for them. Does everyone currently receive the same services, such as a financial plan, an annual review meeting, regular outreach, and invitations to client events? (Hint: If the answer is yes, prepare for a change!)

Separating your clients into segments based on clearly defined criteria and determining the services you’ll deliver to each one can help increase capacity and build scale.

A Strategy for Client Segmentation

Once you have a better understanding of your current clients, it’s time to start categorizing them. There are many ways advisors can approach client segmentation. The key is to find the one that works best for you and your business, which means having a vision for your firm and the ideal clients you want to work with.

You may be familiar with the segmentation approach that places clients into categories labeled “A,” “B,” “C,” or “D” based on either revenue or AUM. While this quantitative approach helps to identify your most profitable clients, chances are you already know those clients well. So, what about the rest of your book?

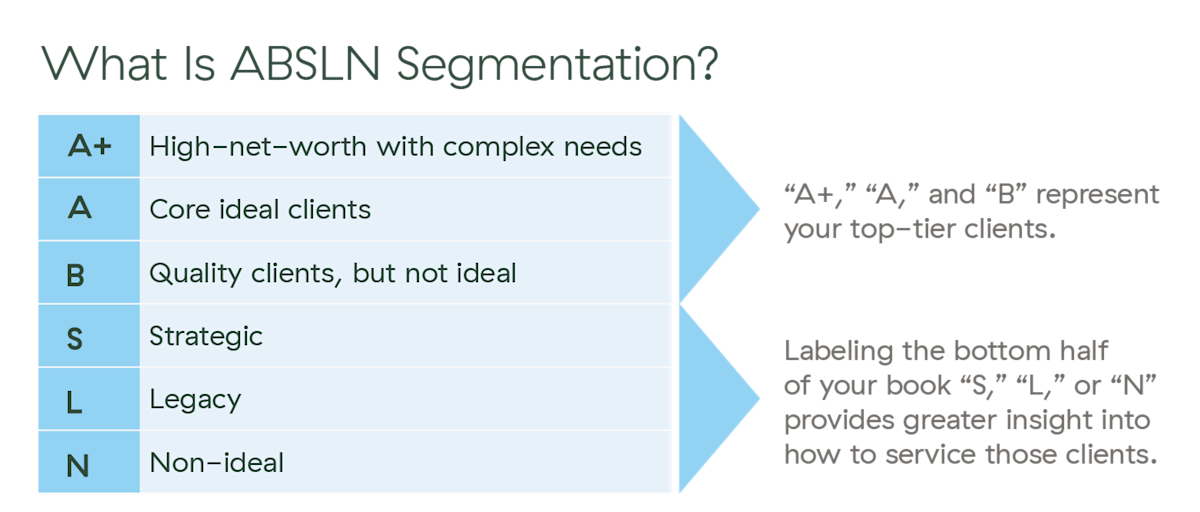

Commonwealth’s Business Consulting team often recommends our advisors use a more holistic segmentation method called the “ABSLN” method.

With the ABSLN segmentation method, you still identify your top clients as “A+,” “A,” or “B” based on the revenue they generate for your firm. For the bottom tiers, though, you’ll use qualitative criteria to place clients into segments labeled “S,” “L,” or “N.”

-

S/Strategic: Individuals in this tier have the potential to become ideal clients. Consider young, high earners with strong savings, business owners with illiquid wealth, or HENRYs (high earners, not rich yet).

-

L/Legacy: These clients may have a legacy relationship that justifies providing continued service—for example, “A” clients’ children, widows, or personal friends.

-

N/Non-ideal: These clients don’t fit into any other segments. For them, you could continue offering service, transfer them to a junior advisor, or discontinue your relationship.

This approach offers deeper insight into the kinds of clients currently in your book, which you can then use to identify the types of services you’ll deliver to them.

From strategy to action. Recently, I worked with a Commonwealth-affiliated advisor on some capacity issues. They were wondering whether to hire a service advisor to manage the bottom half of their book. Together, we used the ABSLN method to segment their clients and analyze how much revenue each tier brought it. It quickly became clear that hiring a new advisor would cost them far more than the assets being managed. So, the advisor decided it wouldn’t make financial sense to hire help in that area.

By using this analysis, though, the advisor realized that many of their existing clients fell into the “non-ideal” category. They decided to scale back the services they provided to that group and were able to free up some time, which was their original goal.

Pairing Segmentation with Services

Once you’ve finished the client segmentation exercise, you can move on to building your client service model, where you’ll identify which services you’ll deliver to each segment—and how often.

If you’re like many advisors I work with, you may have your services mapped out in your head. But trust me, it’s worth documenting them. Like with other processes, clear documentation will help ensure that you consistently offer high-quality service.

To help with decisions about service offerings, reflect on these questions:

Your results might start looking something like the below grids, with all services—including investment management, financial planning, marketing initiatives, and client events—at the left and the tiers that may be eligible for each service at the right.

If the total number of hours you’ll spend to deliver service across each client category doesn’t align with the average revenue earned from that category, you may need to adjust.

Of course, there’s no magic number for how many client meetings to hold each year, and the number of offerings will vary by advisor. Decide what you can provide your clients while also being mindful of your capacity.

Now What? From Strategy to Action

You’ve segmented your clients and created a service model. Now, it’s time to implement your strategy in your practice. This means systematically evaluating every aspect of your business to decide where to make adjustments.

Here are some questions to consider:

By aligning each area of the business with your new service model, you’ll be better positioned to attract more ideal clients and scale your business.

Ready for a Change?

When you don’t have a deliberate client segmentation and service model, your clients can end up dictating how your business runs. Why not try a different approach? After all, offering your clients a great service experience shouldn’t come at the expense of your own business’s growth.

Taking time to complete these exercises allows you to focus your energy where you need it most. The benefit is more time to manage more relationships—primarily with ideal clients. Plus, you’ll be able to support increased revenue with fewer resources, which means more income heading directly to your firm’s bottom line. And that’s a win-win.