In the first quarter of 2023, economic growth slowed to an annual rate of 1.1%, amid rising interest rates and an ongoing banking crisis. This quarter’s growth was dragged down by decreases in private inventory investment and residential fixed investment. Private inventory investment subtracted 2.26 percentage points off the headline growth rate for overall GDP, while residential fixed investment took 0.17 percentage points off the headline number.

Meanwhile, the GDP price index rose 4.0% for the first quarter, up from a 3.9% increase in the fourth quarter. The Personal Consumption Expenditures (PCE) price Index, capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior, rose 4.2% in the first quarter, compared with a 3.7% increase in the fourth quarter of 2022. Looking forward, only a mild recession is expected for this cycle due to the Federal Reserve tightening financial conditions.

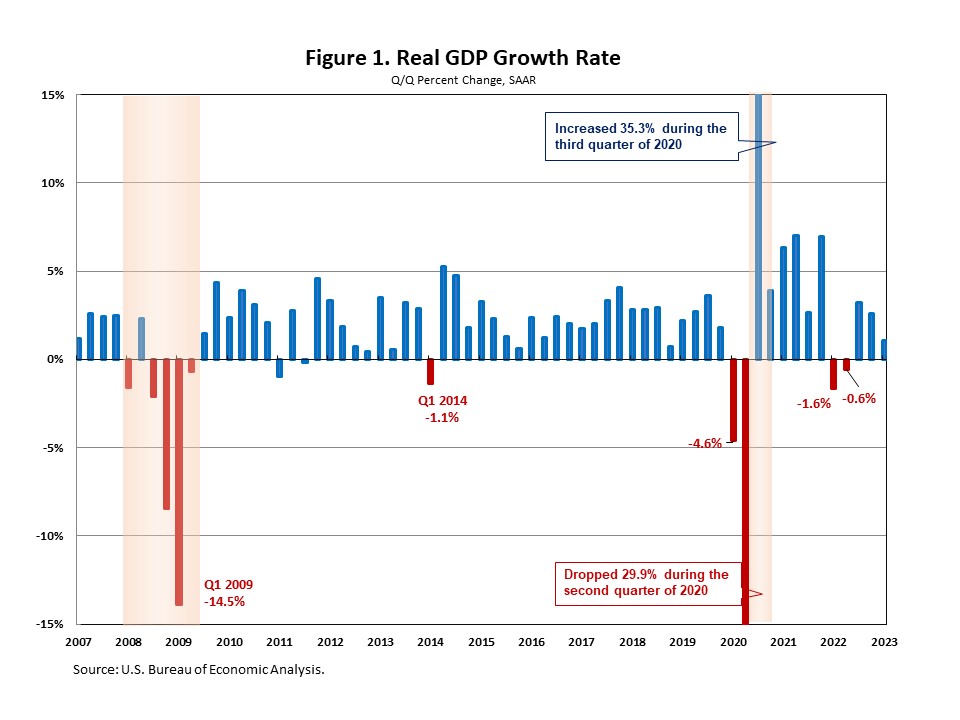

According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) increased at an annual rate of 1.1% in the first quarter of 2023. It was down from a 2.6% increase in the fourth quarter of 2022 and marks the lowest growth rate in the past three quarters. This quarter’s growth was close to NAHB’s forecast of a 1.0% increase.

This quarter’s increase reflected increases in consumer spending, exports, government spending, and nonresidential fixed investment, partially offset by decreases in private inventory investment and residential fixed investment.

Consumer spending rose at an annual rate of 3.7% in the first quarter, reflecting increases in both services and goods. While expenditures on services increased 2.3% at an annual rate, goods spending increased 6.5% at an annual rate, led by motor vehicles and parts (+45.3%).

This quarter’s increase in exports reflected an increase in goods that was partly offset by a decrease in services.

Meanwhile, federal government spending increased 4.7% in the first quarter, led by an increase in nondefense spending, while state and local government spending rose 2.3%, led by an increase in compensation of state and local government employees.

Nonresidential fixed investment increased 0.7% in the first quarter, down from a 4.0% increase in the fourth quarter. Additionally, residential fixed investment (RFI) decreased 4.2% in the first quarter. This was the eighth consecutive quarter for which RFI subtracted from the headline growth rate for overall GDP. Within residential fixed investment, single-family structures declined 20.7% at an annual rate, multifamily structures rose 10.1% and other structures (specifically brokers’ commissions) increased 6.3%.

Related