Welcome to the May 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g., ‘only’ checking client portfolios for tax-loss harvesting every other day, after having advertised daily checks) – a first for the SEC in scrutinizing an RIA not for failing to execute its investment promises to clients, but for failing to execute tax-loss harvesting promises instead. Which may raise questions for other RIAs (including smaller firms) who promote their tax-loss harvesting practices as part of a ‘tax-efficient’ investing strategy about whether their own practices (and the technology they use to implement it) really align with what they claim to provide.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Altruist has announced a $112 million Series D fundraising round to expand its capabilities to meet the needs of larger advisory firms, the latest in a series of high-profile moves (including becoming a fully self-clearing broker-dealer and acquiring its rival custodian SSG) positioning Altruist to compete directly with the likes of Schwab and Fidelity for established RIAs.

- GeoWealth has acquired its fellow TAMP First Ascent Asset Management, marrying GeoWealth’s tech-forward, open-architecture investment management platform with First Ascent’s ‘concierge’-style investment and service-oriented solution (and its flat-fee TAMP business model).

- T. Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- Business support software provider Benjamin shuts down its operations, which may say less about the demand for workflow support tools (which appears to remain strong) and more about Benjamin’s positioning itself as an “AI-driven digital assistant” in an environment where advisors may not trust AI technology enough to pay for it as a solution.

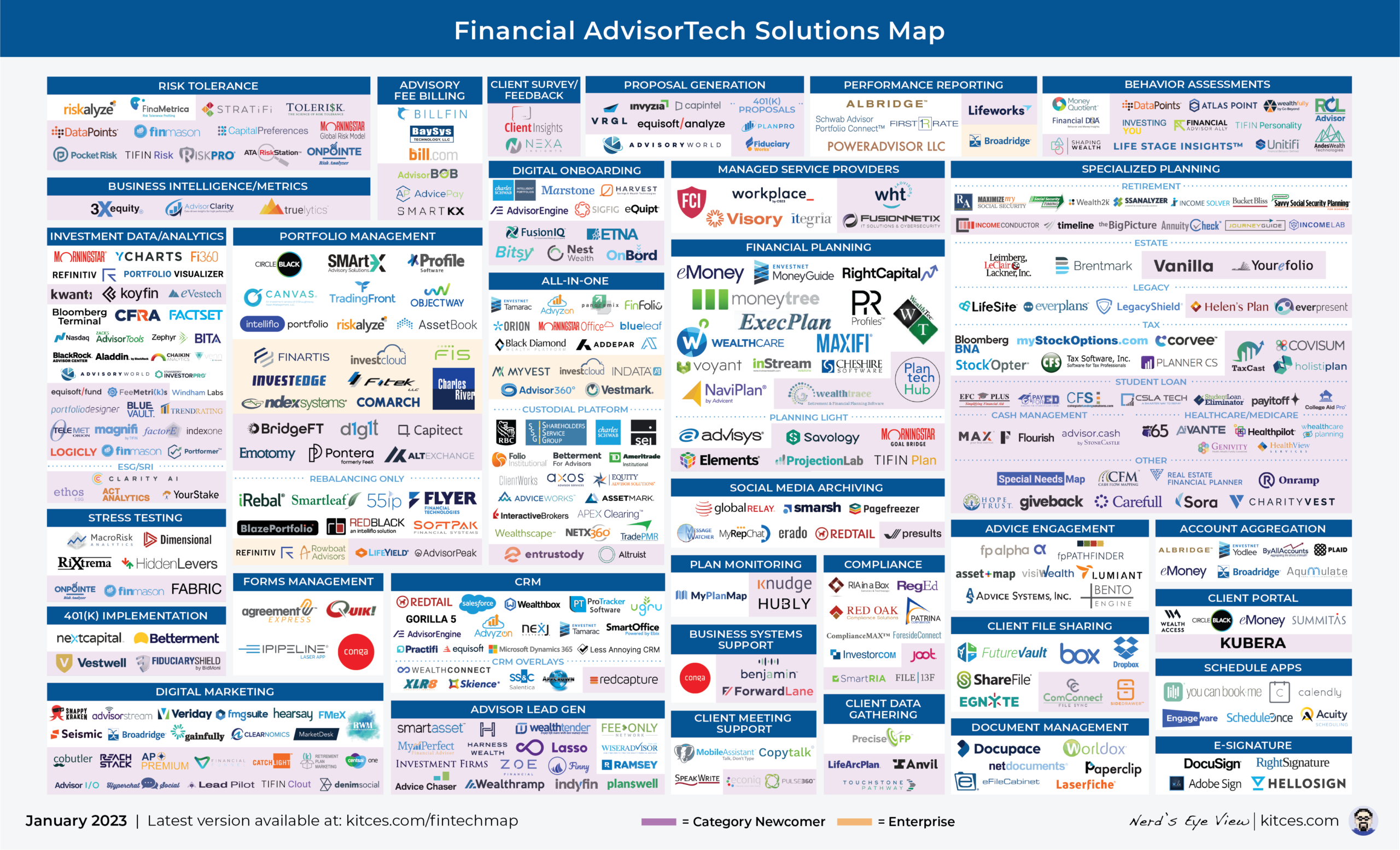

- A look back at the evolution of advisor technology as we come up on the 5-year anniversary of our Financial AdvisorTech Solutions Map, which reflects not only the increasingly crowded landscape with a proliferating number of solutions on the market, but also how shifting technology needs of advisors themselves are eliminating whole categories of advisor technology… and spawning new ones as well.

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!