The Federal Open Market Committee minutes from March state that the staff’s projection “included a mild recession starting later this year, with a recovery over the subsequent two years”. Participants “generally expected real GDP to grow this year at a pace well below its long-run trend rate.” In addition, the Conference Board forecasts “that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023”.

With a high probability of recession and a high return on short-term cash, I am at my maximum allocation to cash equivalents of 35% and lowest allocation to stocks of 35%. At some point during the next one to three years, I expect to increase my allocation to stocks to 65% as the outlook for the economy brightens. Increasing allocations to stocks too quickly can result in “catching the falling knife” while the market has further to fall, and being too slow can miss a substantial upside.

Some of the biggest investing mistakes that I have made have been during recessions. This article reflects my current strategy. I selected forty-one of the nearly five hundred funds that I track that had some of the highest two-year returns following the end of the Dotcom and Great Financial Crisis bear markets. I have broken these out into risk categories of Moderate, Aggressive, and Very Aggressive based largely on MFO Risk classifications. My intent is to gradually increase allocations to stocks as fixed income ladders mature and the economy improves.

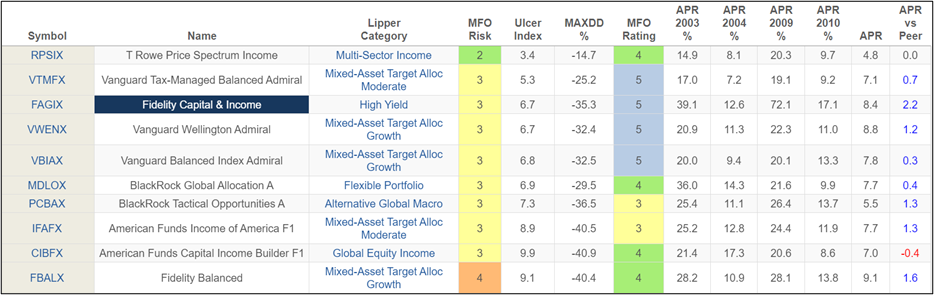

Moderate Funds

Table #1 contains mostly mixed-asset funds, which will benefit in a falling rate environment. I included the T Rowe Price Spectrum Income (RPSIX) and Fidelity Balanced (FBALX) in this Moderate risk category. The funds generally had maximum drawdowns of 25% to 40% and offer more downside protection than an all-equity fund. I intend to exchange more conservative mixed-asset funds for funds like these as I gain confidence that the economy and markets can see the light of recovery.

Table #1: Moderate Fund Performance Twenty Years

BlackRock Global Allocation Fund (MDLOX) looks interesting and is available through Fidelity without a load or transaction fees. Fidelity Capital & Income Fund (FAGIX) does well following a recession as it tends to invest in lower-quality debt, which is in demand as the economy recovers. FAGIX may be an option for investors that don’t want to own high-yield bond funds directly. I like the Vanguard Tax-Managed Balanced Fund (VTMFX) because it invests half in mid- and large-capitalization stocks while minimizing taxable dividends and the other half in federally tax-exempt municipal bonds.

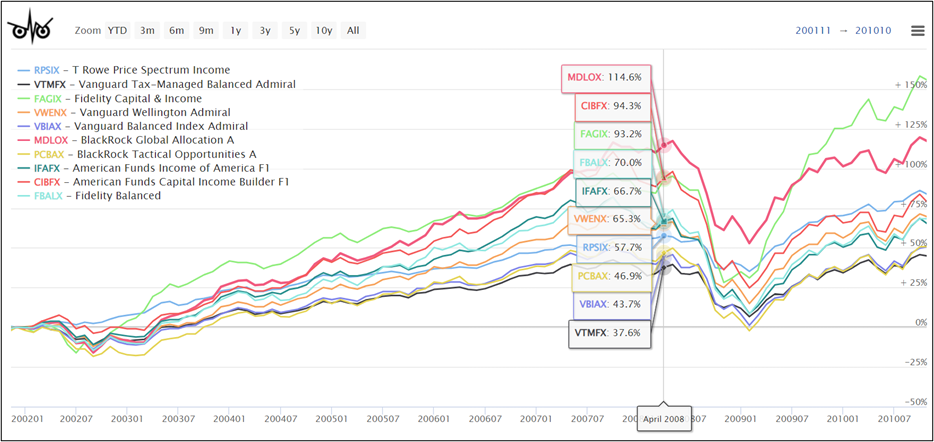

Figure #1: Moderate Fund Performance 2002 to 2010

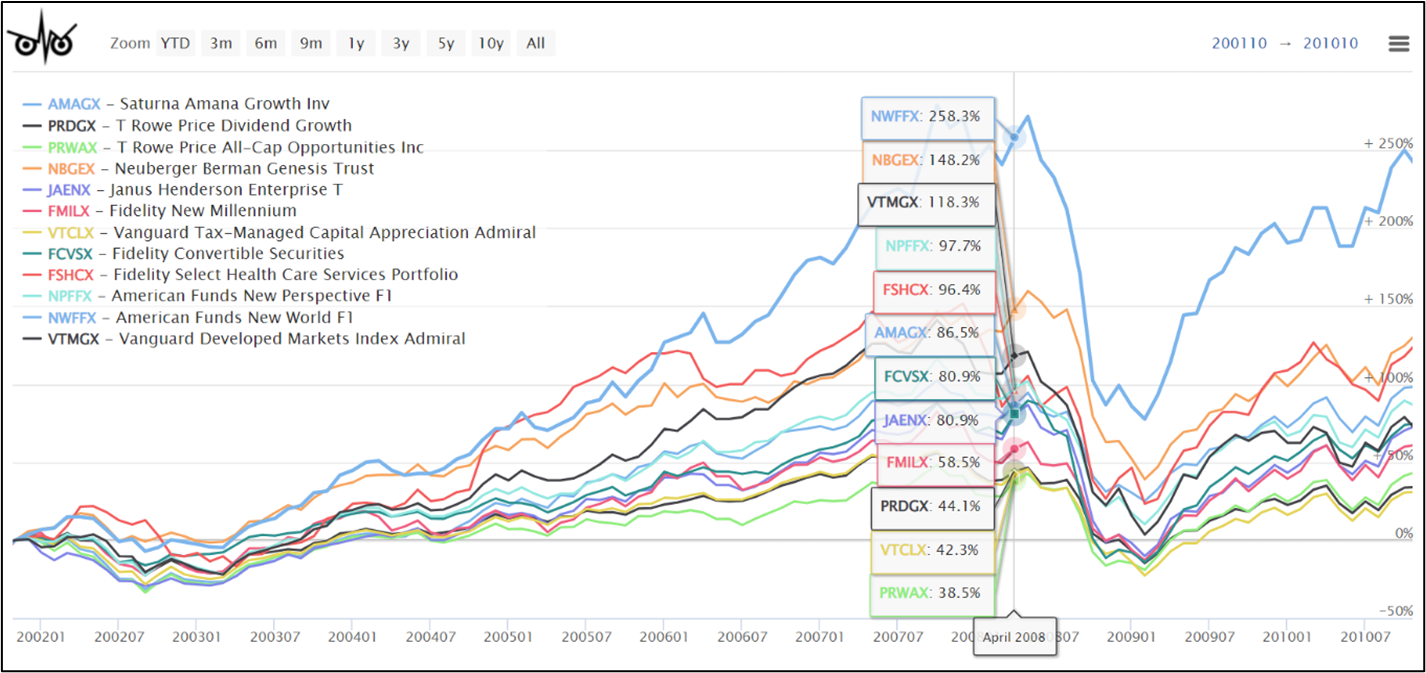

Aggressive Funds

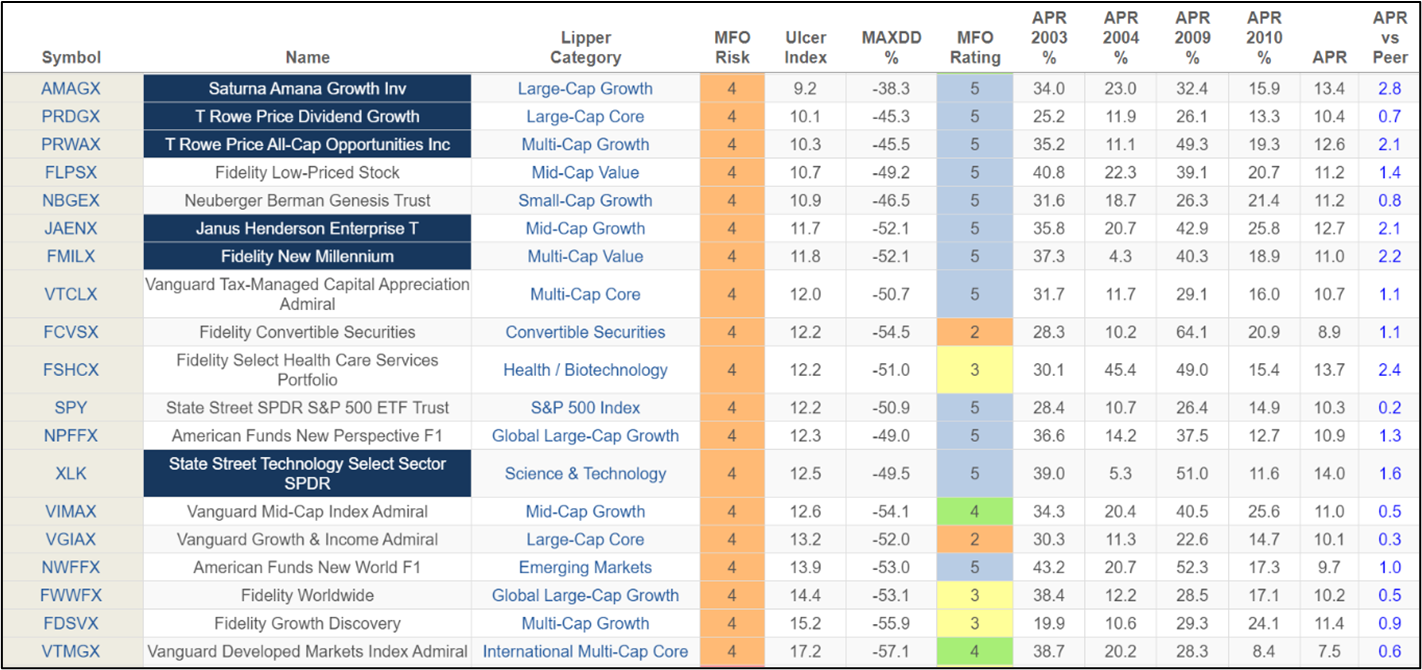

Table #2 contains aggressive funds (MFO Risk =4), which are mostly domestic equity funds with varying market capitalizations. There may also be opportunities in some sector funds, global and international funds, and convertible securities. I expect emerging markets and small cap funds to perform well relative to domestic markets over the next decade.

Table #2: Aggressive Fund Performance Twenty Years

Source: Author Using MFO Premium database and screener. Blue-banded funds have earned the MFO Great Owl designation for top-tier, risk-adjusted returns over all trailing evaluation periods.

The fund that stands out is American Funds New World (NWFFX), which is an emerging market fund that tends to underweight China with only a 12% allocation. Another fund that I like is the Great Owl Fidelity Actively Managed New Millennium Fund (FMILX and FMIL). I am also inclined toward global and international equity funds because valuations are lower than domestic equity. Growth funds like Saturna Amana Growth (AMAGX), T Rowe Price All-Cap Opportunities (PRWAX), and Fidelity Growth Discovery (FDSVX) will probably do well during the early expansion stage.

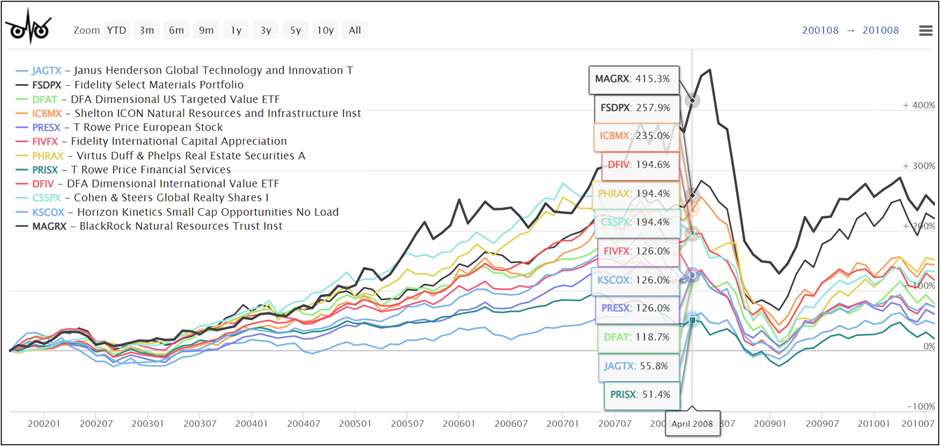

Figure #2: Aggressive Fund Performance 2002 to 2010

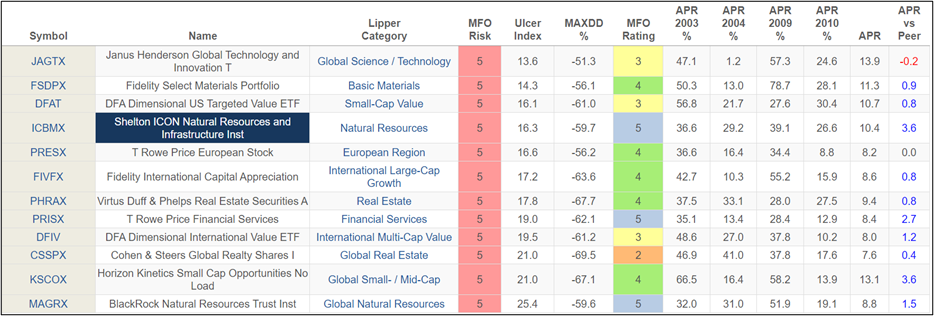

Very Aggressive Funds

The very aggressive funds (MFO Risk =5) consist mostly of sector funds. They tended to have maximum drawdowns of around 60%. Each recession is different, and these funds need to be evaluated carefully to determine where the opportunities lie. Horizon Kinetics Small Cap Opportunities (KSCOX) catches my attention for its long-term performance; however, it is volatile, so allocations should be relatively small.

Table #3: Very Aggressive Fund Performance Twenty Years

Finally, natural resource and materials funds have tended to well as the economy recovers from a recession.

Figure #3: Very Aggressive Fund Performance 2002 to 2010

Closing Thoughts

There are many great funds listed in this article, but the Lipper Category is as important to me as the fund. I will create a new Ranking System for Early Expansion Funds using these Lipper Categories. There are thirty-four Lipper Categories covered in this article. Approximately two hundred of the five hundred funds that I track are in these Lipper Categories. Ninety-five of these funds have an MFO three-year rating of “5” for top quintile risk-adjusted performance, and sixty-one are classified by MFO as “Great Owls” for best risk-adjusted performance.

In addition to a probable recession, there are other risks that may exasperate the economy. The debt ceiling, which will be reached between June and September, is a huge risk even if an agreement is reached before a default occurs. The Russian invasion of Ukraine has the potential to escalate, and the US–China relationship is frayed. It is far from clear that financial stress from banks has been resolved. Stock returns are seasonally low during the summer months, and the adage, “Sell in May and Go Away,” may have relevance this year. I use a multi-strategy, multi-asset approach and am currently tilted to being defensive.

As I described One of a Kind: American Century Avantis All Equity Markets ETF (AVGE), I plan to increase allocations to this fund as opportunities arise. It is an actively managed Global Multi-Cap Core fund of funds that invests in many of the categories listed in this article but without the history to include in this article.

To help mitigate risk, I have a moderately large holding in the flexible portfolio fund, Columbia Thermostat (COTZX/CTFAX) because it has a schedule (Fact Sheet) to allocate more to stocks as the market falls. As I alluded to in To Sell or Not to Sell? (REMIX, PQTAX, GPANX, COTZX), I have been adding to Columbia Thermostat because it is mostly invested in bonds which will benefit when rates fall with upside for increasing allocations to stocks. It did not make this list because the earlier strategy was less successful before changing to a more gradual approach.