Following the Reserve Bank’s latest decision to raise the cash rate by 0.25 percentage points, NAB has become the first bank off the blocks to announce that it will pass on Tuesday’s rate hike to mortgage customers, effective May 12.

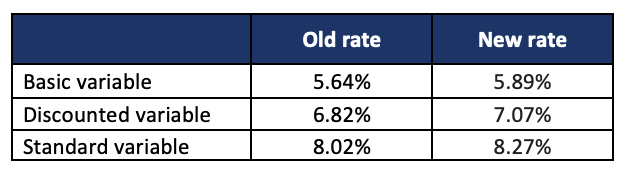

See the table below for NAB’s new customer variable rates for owner-occupiers, from May 12.

Note: Repayments are for an owner-occupier paying principal and interest with a $500,000 debt and 25 years remaining

Sally Tindall, RateCity.com.au research director, the latest RBA hike is “likely to hit home for many borrowers over the next few months as they try to keep their budgets in the black.”

“The majority of borrowers haven’t yet paid for their 10th RBA hike, yet now they’ve got number 11 banked up behind it, just when they thought they might get a chance to catch their breath,” Tindall said.

She urged those on a variable rate to make sure it’s competitive.

“Refinancing or even haggling with your existing lender can inject some much needed breathing space into a tight budget,” Tindall said.

“If after renegotiating your rate, your repayments still don’t stack up, put up your hand and ask for help. Calling your bank and telling them you’re about to miss a repayment might be something you never thought you’d have to do, but the faster you call, the more options you’re likely to have.”

Use the comment section below to tell us how you felt about this.