It’s Wednesday, and we have a few observations on recent events including a music feature. But the main issue in the last 24 hours is the decision by the Reserve Bank of Australia (RBA) to add an 11th interest rate increase at a time when inflation is falling significantly. As I noted last week, the narrative is now shifting among these characters – it is all about inflation not falling ‘fast enough’ and they still claim a wages explosion is likely unless they get inflation down more quickly. It now appears to me that the RBA has lost the plot completely. I have written regularly about this in the last 12 months, but today I have been exploring new data which shows that rising interest rates create a vicious circle of higher inflation which then precipitate further higher interest rates. My recommendation is that the Federal treasurer should use his powers under the RBA Act 1959 and overrule the RBA governor and his board and freeze interest rates. We have to stop this RBA madness somehow!

Retail Sales falling in real terms

Today (May 3, 2023), the Australian Bureau of Statistics (ABS) released the latest – Retail Trade, Australia – data for March 2023.

In the media release accompanying the new data – March retail sales rise 0.4% – the ABS note:

… that while retail sales recorded a third straight rise in March, a pull-back in spending on discretionary goods has seen monthly turnover remain at a similar level to six months ago.

In fact, the monthly growth for the entire series (since ABS began publishing it in April 1982) averages 0.4 per cent.

The March 2023 growth rate was 0.4 per cent – so nothing extraordinary or overblown.

The annual growth in March was 5.4 per cent down from 7.5 per cent in January 2023 and 6.4 per cent in February 2023.

But once you take the inflationary impacts out of the sales data, then the situation signals that volumes are declining.

The monthly data based on ‘current price estimates’ are a combination of volume and price effects, which means in an inflationary environment, the turnover could rise without any extra volume being sold.

The ABS also publish a quarterly figure which take out the price effects and give us a better measure of volume demand.

We don’t get that data until later this month.

But the December-quarter data shows that volume rose by only 1 per cent over 2022 and really flattened out in the last quarter of that year.

It was largely driven by a rebound in spending in the Cafes, Restaurants, and Takeaway services sector after the Covid restrictions.

So taken together, the monthly and quarterly data indicates that the households are spending more on consumption but actually buying less goods and services.

Real demand is thus lower and falling fast.

The retail trade turnover growth is all down to the inflation effects – which themselves are falling quite quickly as well.

Which reflects on the judgement of the RBA – which claimed when it ‘paused’ the rate hikes in February – that it would be watching the latest data before making a decision in April.

RBA loses the plot

In the – Statement by Philip Lowe, Governor: Monetary Policy Decision (May 2, 2023) – the RBA said:

The Board held interest rates steady last month to provide additional time to assess the state of the economy and the outlook.

Well the latest data shows:

1. Retail trade in volume is falling.

2. The labour market is steady with no wages explosion imminent – – see my analysis in this post – Australian labour market – relatively steady and defies the RBA reckoning (April 13, 2023).

3. The actual inflation rate is falling significantly – see my analysis in this post – Australian inflation rate has peaked and falling fast – but not fast enough for the interest rate boosters (April 26, 2023).

Further, the RBA admits that the full impact of the interest rate rises have not yet been realised given that a large number of mortgage holders are still on the fixed-rate deals they negotiated at the outset, which will start to expire in the coming months.

So even by the RBA’s own faulty logic – that the inflation rate will fall if interest rates suppress spending – there does not seem to be a case for yesterday’s rise.

But the RBA is clearly shifting its narrative and is now justifying the unjustifiable in this way:

… if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment. Medium-term inflation expectations remain well anchored, and it is important that this remains the case. Today’s further adjustment in interest rates will help in this regard.

Everyone who has any knowledge knows that the inflationary pressures have been largely driven by supply-side factors.

I am certainly not alone in that assessment.

The factors are understood – pandemic, War in Ukraine, OPEC+, floods, bushfires ….

None of which are sensitive to the RBA interest rate changes.

And all are starting to abate at various rates – factories are supplying again, goods are arriving at destinations againg in time, the world is working around the Ukraine constraints on food and timber supplies, energy prices are falling fast, agriculture is adjusting to the flood damage and more.

So we all know that these factors are in decline, which is why the inflation rate is falling relatively quickly.

Now, why would anyone who knew that start now to increase their expectations of higher inflation in the next few years?

Given expectations “remain well anchored” during the period when inflation accelerated to near double digits and beyond in some cases, why would people suddenly reverse that behaviour and start revising their expectations upwards to such an extent that inflation becomes entrenched?

It simply is nonsense and hubris for the RBA to justify its decision using this angle.

It also tried the wages angle:

Wages growth has picked up in response to the tight labour market and high inflation. At the aggregate level, wages growth is still consistent with the inflation target, provided that productivity growth picks up.

Real wages are being systematically cut at present – which means there are no inflationary pressures emanating from the labour market.

But more importantly, if the RBA gets its way and pushes the unemployment rate up a percentage point or more – see my blog post for why it thinks this – RBA appeal to NAIRU authority is a fraud (February 23, 2023) – then productivity will slump.

Productivity is a pro-cyclical variable and rises with economic growth, largely because fixed labour is spread over large output (hoarding declines).

So, the RBA’s own logic is inconsistent.

But they are deliberately attempting to push the unemployment rate up.

They noted:

Given the expected below-trend growth in the economy, the unemployment rate is forecast to increase gradually to be around 4½ per cent in mid-2025.

I did a quick simulation based on holding the participation rate constant and projecting the working age population out to June 2025.

If the RBA gets its way, then an addition 178.8 thousand workers will be deliberately pushed out of work.

But the simulation is conservative given the mad decision by the federal government to expand migration by 400,000 this year.

In an economy that is forecast to achieve well below trend growth then the unemployment rise will be much worse than 178 thousand.

That issue is aside from the fact we now have a major housing shortage and increasing numbers of lower income Australians are now living in tents or cars or under bridges.

Which brings me to some other data I was looking at today.

This relates to the circularity of what is happening at present.

Previous state and federal governments imbued with fiscal surplus obsessions and a belief that major infrastructure has to be provided by the ‘market’ (greedy rapacious property developers in this case) have dramatically underinvested in social housing.

We are something like 800,000 units short of demand at present – which reflects how long this disregard has been going on.

And so low-income families have been progressively pushed into the private rental market at terms that suited the landlords rather than the tenant.

As the housing deficit has worsened, rents have started to rise and there is now scant affordable properties available – so tents and cars become ‘homes’ for many.

We are talking – of course – about one of the wealthiest nations in the world – which tells you that distribution of income and wealth should never be ignored in making assessments of the state of the nation.

Tenancy is rising as a proportion of total households because house buying is now too expensive for many low-income families.

About a third of households are forced into the rental market – particularly younger people.

They have less discretionary income and much lower (or zero) saving buffers.

But the problem is now being exacerbated by the RBA’s intransigence.

As mortgage rates rise, landlords are using their ‘market power’ to push up rents significantly to protect their real margins and probably gouge some higher mark ups.

The tax system which gives landlords massive tax breaks for investing in multiple properties does not help either.

The Consumer Price Index measures rental inflation – and together with ‘new dwelling purchases by owner-occupiers’ account for about one-sixth of the total CPI basket.

That means that shifts in these components are significant drivers of the overall CPI movements and the inflation rate.

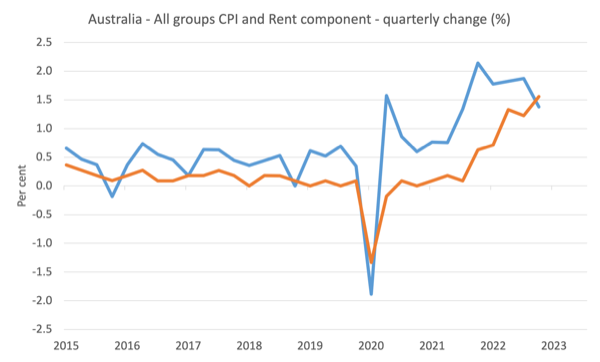

But we are now seeing the rent CPI component increasing faster than the overall inflation rate.

In the March-quarter 2023, the rent inflation was 1.56 per cent (from December) and the overall inflation rate was 1.38 per cent.

In annual terms, the overall inflation rate in the March-quarter 2022 was 5.1 per cent rising to 7.0 per cent in the March-quarter 2023 (noting the December-quarter 2022 was 7.8 per cent).

Over the same period, the rental inflation component was 0.9 per cent in the March-quarter 2022 and is now 4.9 per cent in the March-quareter 2023 (noting it was 3.9 per cent in the December-quarter 2022).

The following graph presents this situation in pictorial form.

1. Rental inflation lags the overall CPI movement.

2. As inflation peaked in the December-quarter 2022, the rental component kept accelerating.

Why?

In part, because the landlords are using their market power to pass on the higher interest rate costs to tenants.

So we enter a ridiculous circularity.

The RBA hikes interest rates.

Rental inflation accelerates even though the other factors driving the overall CPI inflation trajectory are in decline.

The RBA then claims the CPI inflation is not falling fast enough.

The RBA hikes again …

Rinse and repeat.

The casualties of this madness are the low-income families who then are driven to living in tents and cars.

The government should now intervene and use its powers under the RBA Act 1959 and take the decision out of the hands of the RBA governor and his board and freeze interest rates.

They won’t do that but they should.

The penetration of the macroeconomics fiction into the judicial process

On May 1, 2023, the NSW Supreme Court made a major judgement in a high profile fraud case.

The decision – Rex (Crown) v Lauren Cranston – related to a criminal matter of tax fraud, where Ms. Cranston, with her brother and others engaged in an elaborate conspiracy involving phoenix companies to cheat the Australian Tax Office of payroll allocations.

The fraud involved millions and the other fact that attracted the media attention was that the defendent and her brother were the children of a former deputy tax commissioner, who was not implicated in the fraud.

Ms Cranston was the first to be sentenced of the team who have been found guilty of tax fraud and money laundering in the courts.

She received a sentence of 8 years imprisonment for her role in the criminal scam.

But that is not what I am focusing on here.

In his sentencing judgement, Judge Payne cited Section 16A(2) of the Crimes Act, which outlines the considerations that the judiciary has to take into account when assessing the way in which the guilty party will be treated.

After considering several sub-sections of 16A(2), he arrived at “Section 16A(2)(e): Any injury, loss or damage resulting from the offence” and proceded with this logic:

There is no doubt that revenue fraud on the scale here has a corrosive effect on our society. Our system of tax collection relies on taxpayers acting honestly. If the perception became widespread that the payment of millions of dollars in tax was in effect voluntary, and non-payment of tax was effectively risk free, no doubt others would structure their affairs to avoid paying tax. The burden on other taxpayers would be correspondingly increased.

The injury suffered by this offending is a collective financial injury for all taxpayers. The loss to the Commonwealth of over $100 million will need to be made up from additional taxes levied on other taxpayers, by borrowings which must be repaid with interest by taxpayers in the future or by cuts to government spending.

The non-payment of over $100 million in tax occurred in the years immediately prior to the pandemic. During that period, the calls on services supplied by government were as urgent as they have been at any time since the Great Depression. The loss of over $100 million which would otherwise have been available to fund government services is a very significant injury suffered by all Australians.

So in determining the severity of the sentence, the Judge invoked the ‘taxpayer fiction’ and clearly doesn’t understand how the monetary system works or the role of the currency-issuer in that system.

He obviously thought that by defrauding the Australian government, these criminals has compromised the capacity of the government to spend and the damage caused would result in higher taxes, lower spending and/or higher future borrowing in the future.

The fraud did not compromise the ability of the Australian government to fund services during the pandemic. The government has all the dollars it ever needs to meet demands for its services.

The taxes it collects do not fund those services.

The fraud did not reduce the funds “available to fund government services” as argued by the Judge.

They did not result in a “significant injury suffered by all Australians”, which is not to say the fraud was acceptable.

So, one might argue that if the Judge actually understood macroeconomics and wasn’t just rehearsing the flawed propositions derived from mainstream economics, then he may have considered the offense to be less severe than he clearly did.

I am not arguing the offenders should not go to prison – I make no comment on that.

But you can see how the mainstream macroeconomic fictions penetrate decision-making in all sorts of ways throughout our society and regularly result in poor judgement.

If I was an appeal lawyer in this case, I would learn Modern Monetary Theory (MMT) and use that knowledge to contest the severity of the sentence.

Music – Harry Belafonte

This is what I have been listening to while working this morning.

There was no music segment last week, but a notable death occurred in the music industry that I recognise today.

American singer Harold George Bellanfanti Jr. died on April 25, 2023 at the ripe age of 96.

He popularised calypso and Caribbean mento music among middle class audiences.

His parents were Jamaican migrants and he was schooled in Kingston, Jamaica.

I always considered him in a good light as a result of his activism against racism, inequality and civil rights although he cosied up to the war mongers like JFK and LBJ.

It should be said though that he was a major critic of American foreign policy – towards Cuba, the Cold War, Grenada, etc

But I considered anyone that was blacklisted during the McCarthy pogroms to be worthy.

This track was written in 1984 by Dakota Sioux musician – Floyd ‘Red Crow’ Westerman – and Harry Belafonte often sang it during his live performances, although he never released it as a recording.

It is a very fitting partnership between him and Floyd Westerman, as they both fought for the rights of their minorities against white imperialism and colonialism.

It is very sad that Harry Belafonte is gone.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.