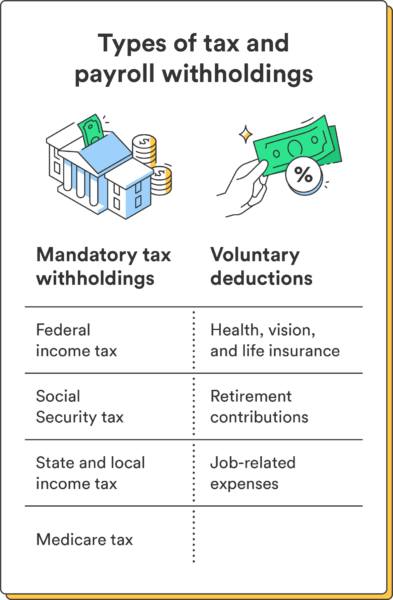

Below is an overview of the types of taxes that could come out of your paycheck, meaning taxes you must pay as an employee. Some taxes, like State Unemployment Tax (SUTA) and Federal Unemployment Tax Act (FUTA), are paid by your employer and not withheld from your paycheck.

| Tax | Employee pays | Employer pays |

| Federal income tax |  |

|

| State tax, local income tax | Depends on location | Depends on location |

| Social Security tax1 | 6.2% (the first $160,200 of earnings in 2023) | 6.2% (the first $160,200 of earnings in 2023) |

| Medicare tax1 | 1.45% | .45% |

| Federal unemployment tax (FUTA) |  |

|

| State unemployment tax (SUTA) |  |

Federal income tax

This is income tax that your employer withholds from your paycheck and sends to the IRS in your name, and how much is withheld mainly depends on the information you provide on your Form W-4, such as your income, marital status, and any dependents you have.

State tax

For applicable states, state income tax is another type of income tax withheld from your pay and sent to your state by your employer. The amount withheld depends on your location, where your job is, and a few other factors based on your Form W-4.

Alaska, Florida, South Dakota, Nevada, Texas, Tennessee, and Wyoming don’t have income taxes.²

Local income or wage tax

Similar to a state tax, your city or county may impose a similar income tax to cover municipal costs like public transportation.

Social Security and Medicare taxes

In addition to federal, state, and local income taxes, employers must generally also withhold Social Security and Medicare taxes from your paychecks. Each has different rates, and the Social Security tax also has a wage base limit (or how much of your wages are subject to being taxed).

For 2023 Social Security taxes, a tax rate of 6.2% is withheld on the first $160,200. For 2023 Medicare taxes, the tax rate is 1.45%.¹