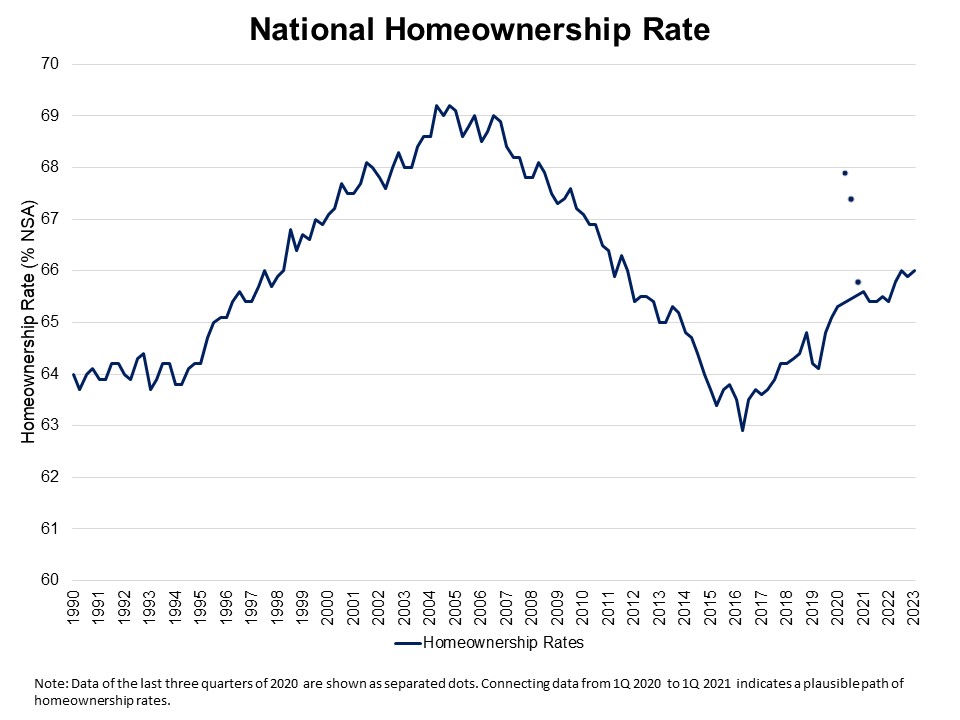

The Census Bureau’s Housing Vacancy Survey (CPS/HVS) reported the U.S. homeownership rate at 66% in the first quarter of 2023, amid persistently tight housing supply. The homeownership rate remained statistically unchanged from the fourth quarter reading (65.9%). It is 0.6 percentage points higher than the rate in the first quarter of 2022. Compared to the peak of 69.2% in 2004, the homeownership rate is 3.2 percentage points lower and remains below the 25-year average rate of 66.4%.

The covid-induced data collection restrictions have ended in all areas as of the last quarter of 2021. However, technical issues involved with data collection changes limit useful comparisons of the data during the pandemic with the prior data series. We have particularly noted the homeownership rate data for the last three quarters of 2020 with separate dots below to denote these technical issues. We encourage readers to consider these data points separately from the remaining data series. Nonetheless, the first three quarters of 2021 likely returned the series to a more apples-to-apples comparison with the prior history of the series.

The national rental vacancy rate rose to 6.4%. The homeowner vacancy rate is still hovering near the lowest rate in the survey’s 66-year history (0.8%), signaling a supply-constrained housing market.

The homeownership rates of adults in all age groups increased over the last year. The homeownership rates among households aged 55-64 registered the largest gains among all age groups, from 75.1% to 76.1%, followed by householders aged 45-54 with 0.7 percentage point increase from 69.4% to 70.1%. Households aged less than 35 experienced a modest 0.5 percentage point increase. The homeownership rates of households aged 35-44 edged up a 0.3 percentage point. Households aged 65 and older saw their homeownership rates rise to 78.8% in the first quarter of 2023 from 78.6% a year ago.

The housing stock-based HVS revealed that the count of total households increased to 129.2 million in the first quarter of 2023 from 127.8 million a year ago. The gains are largely due to strong owner household formation (1.7 million increase), while renter households decreased 236,000.

Related