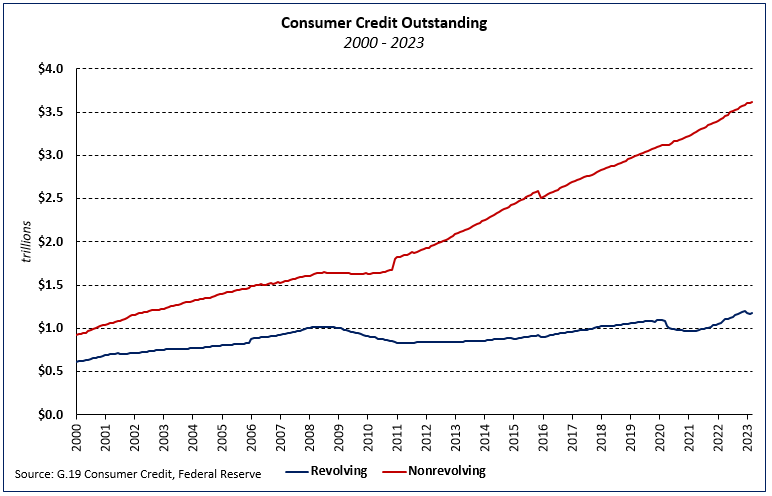

According to the Federal Reserve’s latest G.19 Consumer Credit report, the growth of total consumer credit outstanding slowed from 7.4% to 5.4% (seasonally adjusted annual rate) in the first quarter of 2023. Nonrevolving (excluding real estate debt) and revolving debt grew 3.1% and 12.3%, respectively, over the quarter. On an unadjusted basis, the level of nonevolving credit outstanding at the end of Q1 2023 was $3.6 trillion while the level of revolving debt—primarily credit card debt—was $1.2 trillion.

Revolving and nonrevolving debt accounted for 24.6% and 75.4% of total consumer debt, respectively. Revolving consumer credit outstanding as a share of the total decreased 0.6 percentage point over the quarter but remains 1.6 ppt above the Q1 2023 level.

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding. The most recent release shows that the balance of student loans was $1.8 trillion (not seasonally adjusted) at the end of the first quarter while the amount of auto loan debt outstanding stood at $1.4 trillion (NSA).

Together, these loans made up 88.8% of nonrevolving credit balances (NSA)—the smallest share since Q2 2011 and 2.1 ppts lower than the share in Q1 2022.

Related