To save money, there are various account types to choose from, each with its advantages and drawbacks.

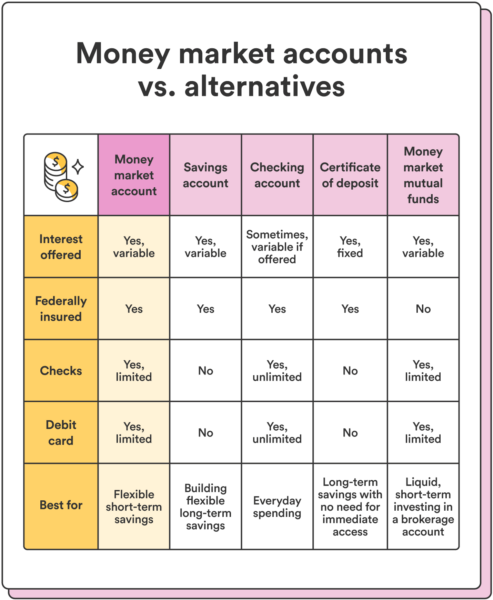

Here’s a closer look at how money market accounts compare to other common types of savings accounts, like traditional savings and checking accounts, certificates of deposit (CDs), and money market funds.

Money market account vs. saving accounts

Money market accounts and traditional savings accounts are common types of deposit accounts banks and credit unions offer. One of the key differences between them comes down to interest rates.

MMAs generally offer slightly higher interest rates than traditional savings accounts (although this varies depending on the current state of the economy since MMA interest rates rise and fall with inflation). However, they also tend to require higher a minimum balance. In contrast, traditional savings accounts often have lower minimum balance requirements, if any.

Some MMAs may also charge monthly fees if your balance falls below the minimum requirement. If you’re hoping to earn more in interest without paying the higher minimum balance of an MMA, you might consider a high-yield savings account instead. HYSA’s are another great way to earn far more in interest than traditional savings accounts for a much lower minimum balance.

Money market account vs. checking accounts

While most money market accounts come with check-writing privileges (and sometimes even a debit card) like a regular checking account, they aren’t designed for you to use for day-to-day spending. MMAs typically restrict the number of transactions you can make per month, whereas checking accounts generally offer unlimited transactions.

While the federal mandate limiting MMA withdrawals to six per month was lifted in 2020, many banks still impose this limit. 1 This is where the main difference between MMAs and checking accounts lies. While checking accounts are designed for everyday spending, MMAs aim to be savings accounts with limited access to your funds.

Money market account vs. CDs

A certificate of deposit (CD) is a savings account that pays a fixed interest rate over a set term, with a penalty for withdrawing the funds before the term ends.

CDs are long-term savings vehicles with set terms and penalties for early withdrawals. This means money in a CD is less liquid (that is, less readily available) than money in an MMA.

CDs also typically require a higher minimum deposit than MMAs, but in exchange for that higher deposit, you may be able to earn a higher interest rate. CDs also offer a fixed rate of return for the term, whereas MMAs generally have variable rates that can change over time.

Chime tip: If you’re looking for a long-term savings option and don’t need immediate access to your funds, a CD may be a smart choice. However, consider an MMA if you want a more flexible savings option with a competitive interest rate.

Money market account vs. money market mutual funds

Money market accounts and money market mutual funds (MMFs) are two different financial products that often get confused with each other. Unlike MMAs, money market funds aren’t offered at banks and credit unions. Instead, they’re offered by mutual fund companies and investment brokerage firms.

While an MMA is a federally insured interest-bearing account, money market funds are mutual funds that invest in short-term debt securities. Unlike MMAs, they aren’t FDIC-insured and are not deposit accounts but investment vehicles that allow you to earn a return on your cash.

MMFs are slightly higher-risk investments because they aren’t FDIC-insured and subject to fluctuations in the market. While still considered a relatively safe investment, they carry some risk since returns aren’t guaranteed.