Galaxy Surfactants Ltd. – A Part of FMCG

GSL (Galaxy Surfactants Ltd.) group, set up in 1980, manufactures, sells, and distributes surfactants and specialty chemicals, which are used as intermediate raw materials in the Home and Personal Care (HPC) products. It is one of the leading players in the world of Surfactants and Specialty Care Ingredients exclusively focused on catering to the Home and Personal Care Industry. The company has 7 State of the Art Plants with 5 Manufacturing Facilities in India, 1 in Egypt and 1 in USA. 9/10 Indian Consumers use Products which have Galaxy’s surfactants or specialty care products atleast once in their Daily Routine. The company manufactures more than 200 products and caters to 1750+ customers across 80+ countries.

Products & Services:

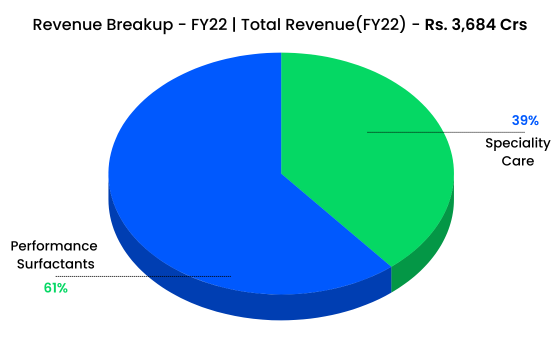

The company business includes two main segments namely Performance Surfactants and Specialty care products.

Performance Surfactants – This segment further divides into Anionic and Non-ionic surfactants with products namely FAES, FAS, ethoxylates, etc. which used as Foam and Dirt removals, emulsifiers and solubilisers in the end user industries like Hair Care (shampoos, conditioners, colorants, styling gels), etc.

Speciality care products – It has multiple divisions namely UV filters, Amphoteric Surfactants, Cationic Surfactants, Preservatives, Preservative Blends, Speciality Ingredients, etc. with products such as Betaines, Sunscreen Agents (OMC, OCN &Others), Transparent Bathing Bar Flakes, Surfactant Blends, Conditioning Agents and others. These products are used in the end industries like Oral care, Home care, Hair care, Cosmetics, etc.

Subsidiaries: As on FY22, the company has five wholly owned subsidiaries.

Key Rationale:

- Strong Position – The GSL group has been engaged in the manufacturing and sale of surfactants and specialty chemicals used as intermediates by the HPC industry for more than four decades. The company is one of the leading players in the global HPC intermediaries’ industry propelled by a long-standing relationship with its clients. The company has a large client base of 1700+ customers across 80+ countries which includes top international and domestics FMCGs. The company’s top 10 clients are Unilever, Dabur, P&G, Himalaya, Henkel, Emami, Loreal, Cavinkare, Colgate Palmolive and Reckitt Benckiser. Clients wise, MNC customers contributes 51% of the revenue followed by Regional players with 11% and Local & Niche players with 38% in FY22.

- Strong Competitive Advantage – The group is integrated across the full value chain of the HPC industry. The company has a strong R&D focused team comprises of 74 professionals who works at a dedicated R&D centre. As of Q3FY23, the group has 88 approved patents and has also applied for another 15, which will continue to support its growing product base (205+) over time. Since the personal care products must adhere to regulatory standards for health and safety purposes, the HPC product manufacturers do not generally change their vendors unless the vendor is unable to adhere to quality standards or supply timelines. The switching costs for HPC companies is also higher for tailored products across end-user categories. This acts as a high entry barrier for the Industry and Galaxy, serving to most of the FMCG giants, is enjoying a strong competitive advantage.

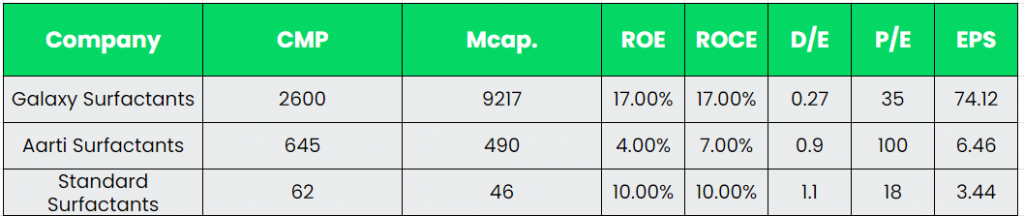

- Q3FY23 – The company reported a revenue growth of 16% YoY in Q3FY23 to Rs.1080 crs. The EBITDA had a growth of 102% YoY to Rs.154 crs in Q3FY23 with an EBITDA margin of 14.2%, an increase of 610 bps from Q3FY22. The Profit after tax reported a massive growth of 133% YoY to Rs.106 crs in Q3FY23 from Rs.46 crs in Q3FY22. Segment wise, Performance surfactants reported a revenue growth of 20% YoY and specialty care products with 11% YoY in Q3FY23.

- Financial Performance – The total volumes of the company have grown at a CAGR of 6% between FY17-22. The company’s revenue and PAT CAGR stands at 10% and 21% between FY15-22. The company has generated a cumulative Free cashflow (FCF) around Rs.825 crs in the past 6 years (FY15-21) barring FY22 since High receivables and inventory hit a toll at the operating cashflow for FY22. The FCF of the company has grew at a CAGR of 60% from Rs.15 crs in FY15 to Rs.257 crs in FY21.

Industry:

Covering more than 80,000 commercial products, India’s chemical industry is extremely diversified and can be broadly classified into bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilisers. The Indian chemicals industry stood at US$ 178 billion in 2019 and is expected to reach US$ 304 billion by 2025 registering a CAGR of 9.3%. Oleochemicals are chemical compounds derived from natural fats and oils that can be used as raw materials or as supplemental materials in a variety of industries. Oleochemicals can be used as a substitute for petroleum-based products known as petrochemicals. Oleochemicals mostly cater to Personal care and home care segment of FMCG Industry. Indian beauty and personal care (BPC) market is the 8th largest in the world. Fragrances, Makeup and Cosmetics, Men’s Grooming are all expected to grow at CAGR 12-16%. The personal hygiene market is expected to reach $15 Bn by 2023 in India. In India, the Oral Care segment generated revenues of over $1.57 Bn in 2021, and the market is expected to grow at an annual rate of 4% between 2021 and 2026 to reach $2.08 Bn by FY26. Indian Hair Care market is predicted to reach $4.89 Bn by 2025 with a CAGR of 6.6%. In 2021, the Hair Care segment accumulated revenue of $2.55 Bn. The share of hair care market is largest in the cosmetic industry in India, dominated by the hair oil segment.

Growth Drivers:

- Indian beauty and personal care (BPC) market stands at $15 Bn and is growing at 10%, expected to double by 2030 with skin care and cosmetics driving this growth.

- Rural per capita consumption will grow 4.3 times by 2030, compared to 3.5 times in urban areas.

- An increase in demand for personal care and home care products along with rapid urbanisation, higher income levels, and evolving preferences is expected to drive growth in surfactants consumption.

Competitors: Aarti Surfactants, Standard Surfactants, etc.

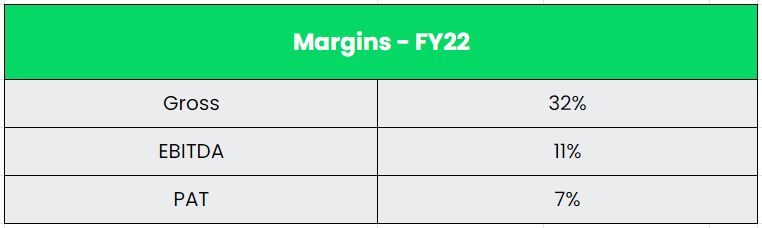

Peer Analysis:

Galaxy Surfactants is the India’s largest Manufacturer of Oleochemical based Surfactants for HPC Industry and no other company is specially catering to that industry on the whole. From the above, it is evident that the company has no direct peers in terms of the end usage and it has strong financials which is lacking for its peers.

Outlook:

The management highlighted that the overall volumes should make a comeback in FY24 as local Egypt volumes are getting better and customers are confident of volumes recovery in Turkey as well. Indian demand continues to be strong and well in line to cross 100 MTPA sales volumes in the domestic market. The capex for FY24 expected to be around Rs.150 Crores, with Rs.120 Crores already spent in the first nine months of FY23. The management aims for a volume growth of 6-8% and it expects EBITDA and PAT to grow higher than the volume growth with a ROCE of around 22%. Current capacity utilization level stands at 65-67% with an optimum utilization at 85%. Europe and China are expected to bounce back with normalisation of inflation/covid situation which will help to improve the speciality care products volume.

Valuation:

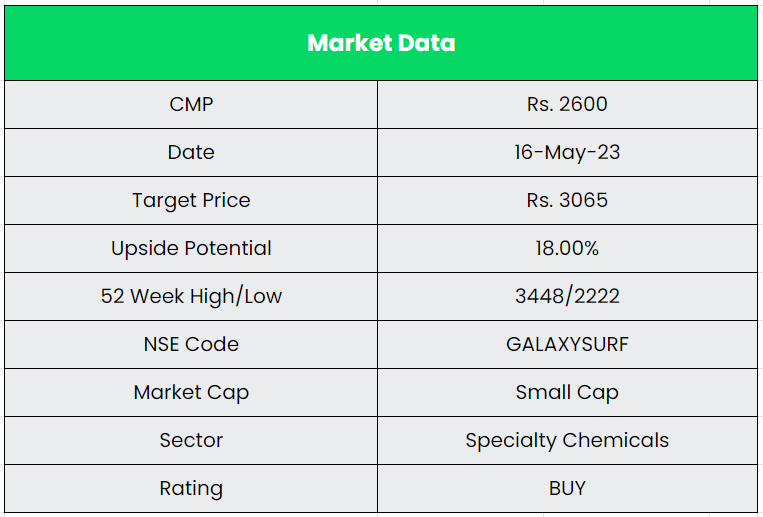

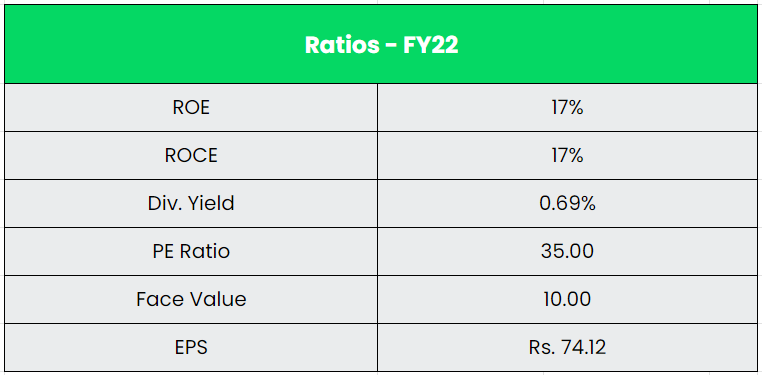

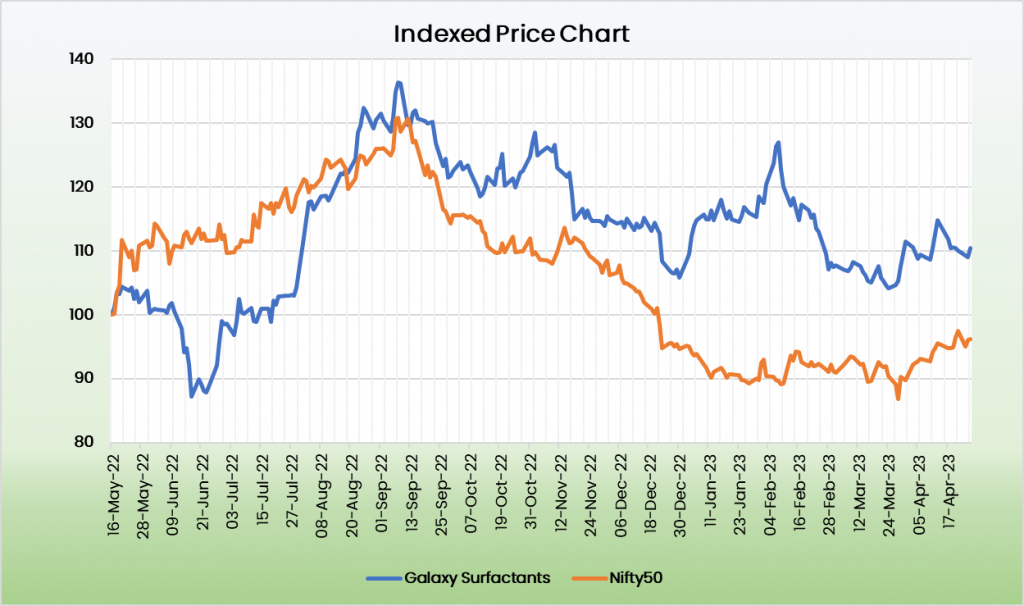

The company’s unique products with a strong client base in a less competitive market paves way for a robust growth. Stable domestic growth and recovery in the export growth will shoot up the revenues going forward. We recommend a BUY rating in the stock with the target price (TP) of Rs.3065, 25x FY25E EPS.

Risks:

- Raw Material Risk – Fatty-alcohol prices have been very volatile historically. Although management was able to control and hedge its costs to a large extent, continued volatility would pose risk to the margins of the company.

- Client Concentration Risk – The company drives its revenue majorly from FMCG industry thus any slowdown in FMCG industry will directly impact the revenue growth of the company.

- Export Risk – Continued weakness in demand in the export market such as China, Europe, etc. will affect the export volumes and thereby affecting the revenue growth of the company.

Other articles you may like