Have you recently received a lot of money, such as $50k in cash? Maybe you’ve just sold your house or received an inheritance. Or, maybe you have some business profit or have saved up this sum over time.

You probably don’t want to waste this cash and use it unwisely. If you’re looking for some wise ways to use $50k in cash, you’re definitely in the right place.

In this blog post, I’ll walk you through some great options to help you make the most of your money and even grow it.

Is $50k a Lot of Money?

$50,000 is a sizeable amount of cash and you’re wise if you’re trying to think carefully about how to use it. There are tons of ideas, but not all of them are helpful.

What is $50k in money? Depending on how you received your funds, you may have to account for taxes, fees and other deductions. Still, you can accomplish one or several goals with this amount of money, so let’s consider starting with some of those goals.

Think First…Set Some Goals

To make the best decision on which ways to use $50k in cash, take a moment to reflect on your life and goals. Most goals we set for our lives to require finances and investing wisely. Is there something you’d like to do and accomplish within the next few years?

How could this money help you bring your goals to fruition? Approaching the decision from this mindset can prevent frivolous spending, so you don’t regret the choices you make with your funds.

Related: How to Achieve Goals You Set This Year

Where Can I Put My 50k in Cash?

Where you put your money depends on how soon you plan to use it. You shouldn’t keep the cash in your regular checking or savings account for long so it doesn’t get used on expenses that aren’t a priority.

You may want to transfer some of the funds to a high-yield savings account so it can earn interest. Long-term options such as transferring money to a CD or a brokerage account may also be a good idea, but it depends on your plans.

As you decide how liquid (or not liquid) you’d like this money to be, here are some solid ideas to help you make good use of 50k in cash.

1. Pay Off Debt

Paying off debt is always a good option whenever you have extra money or can budget for additional debt payments. According to an Experian study, the average American has $96,371 in consumer debt. This includes everything from credit card balances and student loans to car loans, personal loans, and mortgages. That’s a huge burden!

Consider using some of your cash to pay down high-interest debt. This isn’t the most exciting way to use the money, but you’ll be setting yourself up for success by freeing up more cash flow. Plus, you’ll save on interest you could be paying long-term if you don’t pay down your debt quickly.

2. Boost Your Emergency Fund Savings

Americans need a solid emergency fund more than ever. While financial experts recommend setting 3 to 6 months of expenses aside for emergencies, I understand that this can be challenging for most families.

I teach an online masterclass to help people save a full emergency fund quickly. But one of the best ways to boost your savings is with windfalls, bonuses, or other unexpected cash. If you receive or accumulate 50k in cash, consider using some money to build a full emergency fund.

Related: Emergency Fund Tips: How to Grow Your Account Fast and Where to Start

3. Invest in your IRA

An IRA or individual retirement account is a great way to invest for retirement outside of your 401(k). I’ve personally never had a 401(k) as an option, so I’ve used different types of IRAs instead to save for retirement.

Right now, the maximum annual contribution limit for a traditional or Roth IRA is $6,500. With $50k in cash, you can easily max out your IRA for the year as well as your spouse’s account to boost your retirement savings.

4. Invest With a Brokerage Account

A brokerage account is an investment account that allows you to buy and sell different types of securities such as stocks, bonds, ETFs, and mutual funds. A brokerage account holds your investments and follows an index such as the S&P 500.

The great thing about brokerage accounts is that there is no maximum amount you can contribute each year. There are also no withdrawal fees or penalties to withdraw funds. Meanwhile, retirement accounts like 401(k)s have maximum contribution limits. Several financial institutions offer brokerage accounts such as Charles Schwab and Vanguard.

Related: How to Start Investing in Stocks With No Regrets

50k Invested For 10 Years

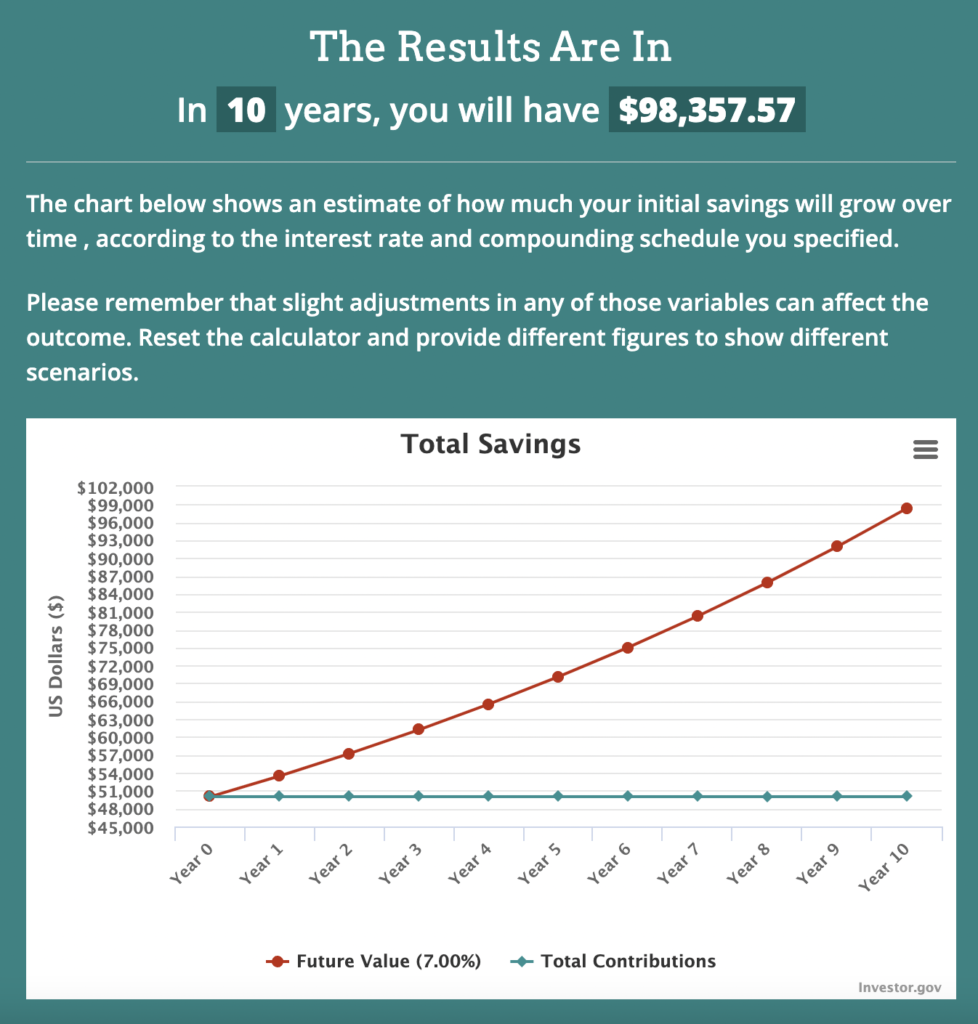

Want to see how much your $50k investment could be worth in 10 years? I love using this free compound interest calculator from Investor.gov. Over the past 10 years, the stock market had a positive return rate of 9.5%. But I plugged a more conservative return rate of 7% into the calculator.

As you can see, if you invested $50,000 and didn’t contribute anything additional for 10 years, you’d still have almost $100,000 with an average 7% rate of return.

5. Invest in Real Estate

Depending on the real estate market in your area, $50,000 can go a long way if you want to invest in property. This amount is enough to put 20% down on a $50,000 home. Or, you can buy a fixer-upper and use the money to make home upgrades.

Some real estate investor even purchase properties out of town or out of state if the prices are better. You’ll likely need to do a lot of research and educate yourself before investing in real estate. However, this can still be a way to build wealth or even start a real estate investing business.

Best Way to Invest $50k in Property

There are several ways to invest $50k in property. You can use it for a down payment, invest in home upgrades, or even buy a fixer-upper in cash.

You can also consider investing in commercial property through crowdfunded real estate projects.

6. Fundrise

Fundrise is a crowdfunded real estate platform that allows you to diversify your portfolio by teaming up with other investors to fund commercial and residential projects.

Fundrise is a long-term investment and the company does charge a 0.15% investment advisory fee. I also like how the company shares return rates from previous years right on the website for transparency.

7. Invest in Government Bonds

Bonds are a lower-risk investment than stocks because you are loaning someone else money, and they pay it back plus some interest. Government bonds are a debt security that’s issued by the government, which helps support government spending.

These bonds are low risk since they’re backed by the government, and some pay interest quarterly. I probably wouldn’t invest the entire $50,000 in government bonds but this is an option to try out if you think it could work for you.

8. Save For a Home Down Payment

Homes are expensive and $50,000 down payment could be a sizable contribution to help you become a homeowner.

Buying a home also comes with many other expenses, such as closing costs, moving costs, home repairs, and so on. You may want to use some of this money to save for furniture or home upgrades you know you’ll need.

With a home purchase, I always advise people don’t spend more than 30% of their income on home costs each month. Even if you have a $50,000 cash cushion or down payment, it’s important to make sure you can afford the home and live comfortably.

9. Build a Profitable Niche Website

If you’ve always wanted to start a niche website – whether a blog or e-commerce site – you can easily do this for way less than $50,000. Niche sites are great because you can grow your traffic and monetize your site with display advertising, affiliate marketing, sponsored content, and even products.

First, you’ll need to think of a good theme for your website and perform some market research to narrow down your niche and target audience. Then, you will need a self-hosted website. I like Bluehost and Hostgator personally, and they are both affordable options.

With some funds to invest in the project, you can hire

Related: How to Make Money with a Blog or Niche Site

10. Start a Business

Have you been thinking of starting a business? This could be another great way to use $50k in cash. Lack of funding is something that holds a lot of entrepreneurs back from pursuing their venture.

Take some time to carefully plan out your business, perform market research, and plan for startup expenses. You may even want to utilize free resources from the SBA such as business mentorship and grant resources as well.

11. Travel

You may want to travel or book the trip of a lifetime when you have $50k in cash. There’s nothing wrong with this as long as you’re not drowning in debt and have a stable financial situation. I wouldn’t recommend traveling to Australia for a month when you have no emergency fund and $10,000 of credit card debt.

However, you could easily split the money up like this:

- $7,000 to pay off your credit cards and a personal loan

- $10,000 to top off your emergency fund

- $5,000 to $8,000 on a fun family trip

- $10,000 to retirement savings or investments

- The remainder toward general savings or other goals

Related: 9 Ways to Make Money While Traveling

Best Tips and Tricks to Plan a Frugal Last-Minute Vacation

12. Put Money Into a CD

A certificate of deposit of CD is a bank product and savings tool that helps you earn interest on your money. The only catch is that you can’t withdraw your money from the account before the term ends unless you pay a penalty fee.

However, CD terms can range from as little as 3 months to 5 years or more. CD rates are also very high right now, with many banks offering 4% or 5% interest. While I couldn’t recommend putting the entire $50,000 into a CD, you can consider this option for some of the money if you want a low-risk investment.

13. Bonus Ideas: How to Double $50k

Want to double 50k in cash? There are several ways to put your money to work from you and actually grow $50,000 to a bigger amount.

- Invest it. As you can see from my example above, investing in the stock market can likely double your funds in 10 years. And that’s if you let it sit and do nothing.

- Flip a house. If you’re interested in real estate investing and can find quality partners, you may be able to double your money by flipping a property. This will require a ton of work but can be worth it for the right person.

- Start a rental business. Rental businesses are great because you typically can buy your items once and rent them out several times. You will need to invest in things like insurance and other costs, but this is a strategic way to double your investment.

- Invest in other small businesses. Make money from supporting someone else’s success. Even if you don’t have an awesome business idea, you can participate in peer lending and invest in a business that is profitable to get a nice return.

These are just a few creative ways to double $50,000. Which ideas appeal to you or what would you add? Also, how would you best use $50k in cash?

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.