Latest FCA data shows a sharp drop in the number of regulated firms in April as the number of authorised firms continues to tumble.

Data for April reveals that the number of authorised firms on the FCA Register fell by 427 compared to the previous month, continuing a recent downward trend.

The number of regulated firms has now fallen by 7% since January 2022 (83,500 firms) to less than 78,000 now.

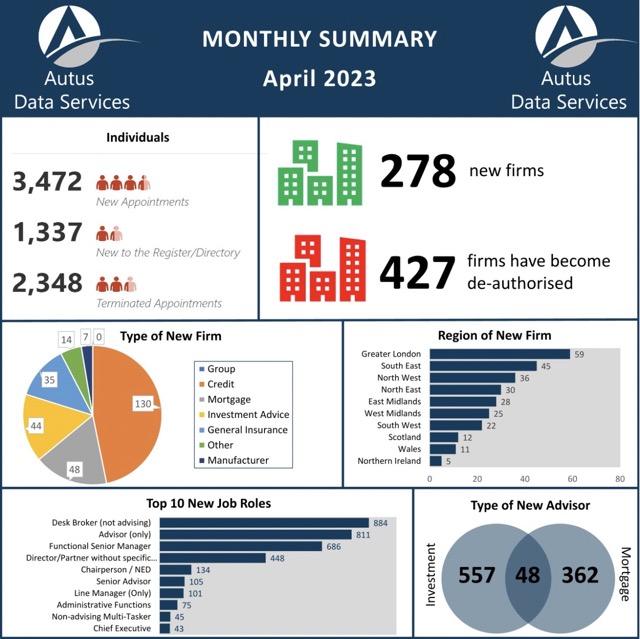

Figures show that 427 firms were ‘deauthorised’ in April with 278 new firms authorised, a net drop of 149.

Data services provider Autus, which analysed figures, said recent times had shown a decline in authorised firms. Its analysis covers all FCA regulated firms, not just intermediary businesses.

Andy Marson, managing director, operations, Autus Data Services, said: “April has seen a further decline in the number of firms authorised by the FCA, continuing a trend that has been ongoing for many months recently. In January 2022 there were over 83,500 firms authorised but that has fallen to less than 78,000 in April 2023, an overall reduction of 7%.”

“Some sectors are contracting more than others, with 13% less firms in the general insurance market and 8% less in the Credit segment while the Mortgage market has remained quite buoyant with a reduction of just 1%”

“In terms of the Investment Advice market, the number of Directly Authorised Holistic Financial Planning firms (who advice investments, protection and mortgages) has reduced by nearly 200 firms (7%) while the number of Appointed Representative firms in this segment has reduced by nearly 600 firms (9%).”

In contrast to the drop in regulated firms, the FCA data also reveals an increase in the number of people working in the industry. Autus says this suggests a trend towards more people working in larger firms.

With a wave of mergers and acquisitions under way, particularly in the wealth management sector, it appears many firms are being taken over or merging as the regulatory burden continues to increase although these firms are, on average, employing more people.

While the number of regulated firms is down, recruitment for regulated firms is healthy with data for April showing 3,472 new appointments and 1,337 new people joining the FCA register. Even so, many people are also leaving the sector too with 2,348 terminated appointments.

Despite the decline over recent years, investment advice continues to see new firms launch with 44 new firms authorised in April. There were also 35 new general insurance firms.

London and the South East saw the highest number of new firms started overall with 59 in Greater London and 45 in the South East (see graphic)

Source: Autus