Last week I had the opportunity to sit down for dinner with one of our own, the legendary David Sherman. He is no stranger to regular readers of MFO. His funds, public and private funds through Cohanzick and CrossingBridge and the RiverPark Short Term High Yield Fund, for which he’s the sub-adviser, are uniformly first rate. He’s articulated four investing principles that are embodied in each of his portfolios:

- Return of capital is more important than return on capital.

- We are in it for the long haul, seeking to achieve consistent, solid returns.

- Understanding the business model and associated risks is essential to intelligent investing.

- Being disciplined and pragmatic are indispensable in this ever-changing world.

I commend to you both our coverage of his thoughts on the banking crisis (“The tide is going out,” 2023) and our profiles of RiverPark (now CrossingBridge) Strategic Income and RiverPark Short Term High Yield.

We went to dinner at a local Italian place, La Pecora Bianca, only to find out we could have gone to an even more local(er) Italian. David lives exactly a block away from me on the Upper West Side.

We went to dinner at a local Italian place, La Pecora Bianca, only to find out we could have gone to an even more local(er) Italian. David lives exactly a block away from me on the Upper West Side.

“Where do you get your coffee, David? Why have I never seen you around here?” I asked.

“I don’t do coffee,” he told me. And I understood why when he took me on a whirlwind of his views on markets and business ideas from the 1990s to 2050. David Sherman doesn’t need coffee. He is amped up on markets and life.

It was a most fascinating evening where I learnt a lot from a market veteran. His views often did not align with mine, and to be honest, that’s the kind of dinner I like to go to. It helps me evaluate what I have figured out and what’s missing.

It would be impossible to cover all of it in detail here. However, I think it might be fun to format this article into a rapid-fire set of Q&A to get his perspective on markets (beyond his fund).

Don’t hold him to the responses, but they are instructive nevertheless.

Personal Investment Situation

- Do you manage your personal investments? Kind of.

- Do you have a well thought out personal account (PA)? Nope.

- Why not? Not enough time, given fund responsibilities.

US Stocks

- Views on US Stock Market: Expensive

- What percent of your portfolio are US stocks? Less than 15%

- What did you buy last? Google, when the AI Bard fiasco happened, and State Street, which is the only financial that has nothing to do with the banking crisis.

Snowball interjects: in February 2023, Google debuted its competitor to ChatGPT, a program that is dubbed “AI Bard.” The problem is that Bard sort of blew the answer to one question. Someone asked, “What new discoveries from the James Webb Space Telescope can I tell my 9-year-old about?” Bard promptly (and, I’d guess, cyber-cheerfully) offered a list that included one 19-year-old discovery definitely not related to JWST. Investors promptly sold Alphabet in a two-day panic, dropping its market value by $170 billion. Fuller coverage from The Verge.

- View on Berkshire Hathaway: Complicated.

- Why? It’s better than owning the S&P 500 Index fund. It’s a well-managed “mutual fund.”

- But? Buffett key man risk.

- Do you think Buffett makes actual investing decisions anymore? No, but he can call capital away from the guys who do.

International Stocks

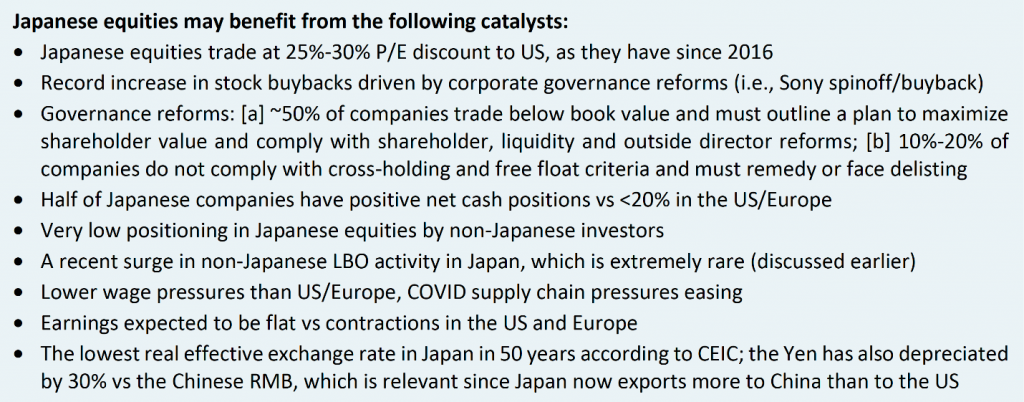

- What do you think about Buffett’s Japan trade? Makes a ton of sense. Japan is my favorite market.

- Name some reasons: Japanese government owns a significant portion of Japanese stocks. There is now a legal mandate to monetize the embedded value for shareholders. Large number of companies trade at net-net.

Snowball interjects: hi, again! “Net-net” refers to a company whose cash on the books is greater than the total value of their stock. Translation: when you pay, say, $10 for one share of a net-net company, you’re getting, say, $12 in cash plus the value of the company’s operations.

JP Morgan’s Michael Cembalest, “Too Long at the Fair” (May 2023) and the case for Japanese stocks

- View on Indian stocks: They have been a great investment for my family since the 1990s. I sold them a few years ago.

- Why did you get into India, then? I liked the democratic angle compared to other EMs. This is a country where property right matter – which is very important from an investment perspective – and where the populace values education.

He asked me about my views on India, and I said I was invested through private equity.

Private Investments

- Do you do a lot of private equity? No

- Why not? Money is completely out of my control when I do privates. I don’t look at my statements or read commentary. It’s meaningless. Only thing that matters is how much money I get back at the end. India is one place where I would do private equity.

Snowball interjects: Joel Tillinghast, one of the greatest investors in Fidelity Investment’s history, is retiring from active management at the end of 2023. At the end of May 2023, he sat down for a long interview with Adam Fleck and Christine Benz of Morningstar. In it he was pretty caustic about the prospects of those who invested in US private equity.

Snowball interjects: Joel Tillinghast, one of the greatest investors in Fidelity Investment’s history, is retiring from active management at the end of 2023. At the end of May 2023, he sat down for a long interview with Adam Fleck and Christine Benz of Morningstar. In it he was pretty caustic about the prospects of those who invested in US private equity.Private equity has lower reporting and regulatory requirements. It accepts much higher leverage than public companies. It doesn’t have to be continuously valued, which is marvelous for people who don’t want to be marked to market, which is a lot of people as Silicon Valley Bank showed. My personal guess is the ship won’t go much further. One Ivy League endowment, public American Equities, are just 2.25% of the endowment assets. So small caps are a niche asset within this niche asset class. For comparison, the university holds about 10 times as much as that 2.25% in leveraged buyouts, and they also hold about 10 times as much in venture capital. The horse is already out of the barn.

What’s amazed me is how high private equity, and hedge fund, and all the other chic things that the Ivy League endowments go for—how high the fees are. The Ivy League needs a Jack Bogle moment. (Joel Tillinghast: The Art of Investing, 5/30/2023).

That was generous, compared to Jason Zweig’s acidic take of private investments that are publicly available (“No one is checking to see if the details in these [regulatory] filings are even remotely true,”4/7/2023) and the funds that tout them (“Imagine an investment that can deliver high returns with barely any risk, almost completely independent of the stock market. Good luck finding that. But you can easily find funds that make such grandiose claims. They’re common in one of the hottest areas in markets today, private investments,” 4/28/2023).

Real Estate Investment Trusts (REITs)

- View on Real Estate Investment Trusts (REITs): Terrible investments

- Why? They are serial diluters. They keep issuing stocks all day long. No way to make money.

- How do you do real estate? Through private investment.

Snowball interjects: Taylor Swift, likewise. I wonder if they’ve met. Regardless, you might want to check out our article “Taylor the Investor: You Belong With Me.” She’s also into closed-end funds.

Inflation

- Views on inflation: Read David Buckham’s The End of Money (2021). We are scr***d.

Bonds

- TIPS: Not good investments.

- Why? They don’t capture services inflation.

- NY Munis: Better investments, given the tax angle.

- What should I have more of? Munis > TIPS

Strategic vs Opportunistic

Me: You have identified a lot of problems with a lot of conventional assets. Where’s your money in?

David: I am very opportunistic. If I don’t see something obvious and big, I keep my money in cash. I don’t have to invest.

Mutual Fund Observer

- Thoughts on MFO: Great community. Not enough young people in the community. Fix that.

- How? Write more columns for young people. Market. You can’t just write. You have to market what you write.

- What do you want written? Health Savings Account (HSAs). Please tell young people about them. It’s the best tax advantaged vehicle out there. I love them.

David made sure I ordered dessert – an Olive Oil cake with caramelized kumquats. He paid for our meal and insisted we walk off the dinner with a stroll around the Museum of Natural History. He explained to me how he thinks of his funds, his investors, challenges with the fund management industry, and the fund rating systems.

David made sure I ordered dessert – an Olive Oil cake with caramelized kumquats. He paid for our meal and insisted we walk off the dinner with a stroll around the Museum of Natural History. He explained to me how he thinks of his funds, his investors, challenges with the fund management industry, and the fund rating systems.

“You know what people want, right,” asked David. With David, questions posed are a pause which he answers with my silence.

“POSITIVE BETA,” he emphasized. “ALPHA seems less important to them.”

Snowball’s final interjection: “Positive beta” describes an investment that moves in the same general direction as the market. “Alpha” refers to peer-beating returns. You could think of a preference for positive beta as a sort of fear of missing out (FOMO) impulse; you don’t need to be at the front of the pack, but you certainly want to be in the race.

More than once, he made fun of me for sitting on my ass while he has to “work hard for a living” and reminded me to get on with my life now that my kids are grown-up teenagers and no longer need me. I said I’d sit down and write a column about that.