Quince Therapeutics (QNCX) ($55MM market cap) is a broken biotech that is trading well below cash and is facing activist pressure from two parties looking to either acquire the company for cash or put the company into liquidation. In the first half of 2022, Quince (known as Cortexyme at the time) bought Novosteo in a reverse merger, then in this past January, the company sold their old drug portfolio back to the previous management of Cortexyme who now run privately held Lighthouse Pharmaceuticals for a 7.5% equity stake in Lighthouse (plus a CVR of up to $150MM based on meeting certain milestones). Alongside the asset sale, Quince also announced a 47% reduction in force and that they would be pursuing an out-licensing strategy for their remaining drug candidate, NOV004, which is designed to accelerate bone fracture healing. The go-forward strategy now is:

On January 30, 2023, the Company provided an update on its development pipeline and business outlook for 2023. The Company intends to prioritize capital resources toward the expansion of its development pipeline through opportunistic in-licensing and acquisition of clinical-stage assets targeting debilitating and rare diseases. The Company plans to out-license its bone-targeting drug platform and precision bone growth molecule NOV004 designed for accelerated fracture repair in patients with bone fractures and osteogenesis imperfecta.

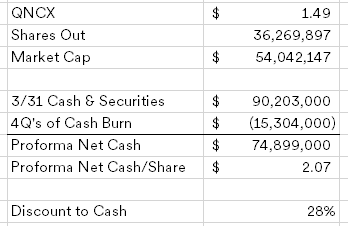

This acquisition strategy appears to be dubious given their track record, the current market mood towards reverse mergers and/or speculative biotech companies. Biotechs in this position should show some humility, liquidate and let the shareholders decide where to redeploy that capital, not management. My super simple back of the envelope math for these broken biotechs is as follows:

This situation has caught the attention of two investors:

- Kevin Tang owns just under 10% of the shares and based on other similar situations, one can assume he’s asked if management would be open to an offer to buy QNCX for some discount of cash plus a CVR for any proceeds the pipeline brings in a sale;

- Echo Lake Capital submitted a non-binding proposal to buy QNCX for $1.60/share, which was formally rejected by the company, who then adopted a poison pill. Echo Lake followed up this week with another letter criticizing management.

While management hasn’t given up here like I would prefer to see, they have cut costs and this is basically a cash shell at this point with no business, not to dissimilar to other ideas in the broken biotech basket. If Tang or Echo Lake manage to force management’s hand, a strategic alternatives or liquidation announcement could be a catalyst to move the stock higher.

Disclosure: I own shares of QNCX