For traders who focus on technical analysis, leveraging high-quality software to develop winning strategies is vital. TrendSpider, which bills itself as an all-in-one platform, is a competitive solution in this space.

In addition to the essentials, like charting and backtesting, TrendSpider offers advanced functionality for experienced users. The platform’s high cost and complexity, though, make it unappealing for entry-level traders.

Pros

Wide Range of Investment Coverage

Good Documentation and Education Features

Cons

No Direct Broker Integration

Interface May Be Complicated for New Users

What Does TrendSpider Do?

TrendSpider presents itself as an all-in-one trading solution, offering everything from basic data retrieval to automated trading bots. While the claims of complete trading integration are exaggerated, the platform does offer a surprising number of capabilities, especially once a user is accustomed to the interface.

TrendSpider’s web interface presents a vast amount of information, so users with a large screen or multiple monitors will have the easiest time navigating it. TrendSpider has a mobile app, but it is designed to supplement the web interface by providing basic charts and updated stock watchlists while on the go.

First, we’ll review TrendSpider’s basic functions, including those most essential to technical analysis. Next, we’ll show you how to complete some common trading tasks. Later, we’ll review TrendSpider’s advanced functionality and see what it offers the most experienced traders.

Charting

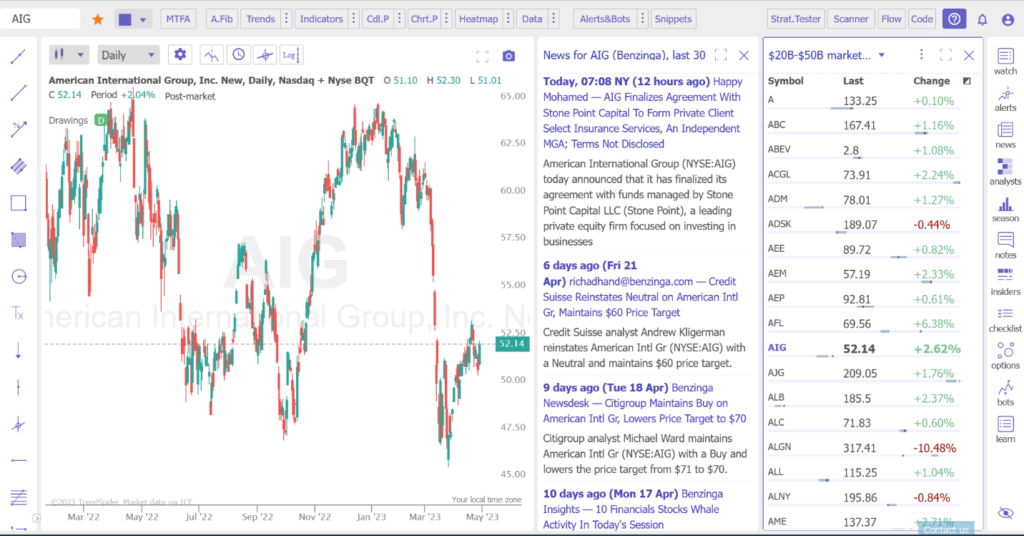

TrendSpider’s main dashboard will likely be familiar to those experienced with trading software. The interface presents a candlestick price chart for the selected position, with supplementary information on the side of the screen.

While TrendSpider allows you to draw lines and arrows in order to chart manually, traders will have a much easier time using TrendSpider’s automated charting tools. Below, we’ve added a simple moving average and automated trend lines to our original chart, all with the click of two buttons.

More advanced charting, like the detection of candlesticks or chart patterns, can be done by exploring the options at the top of the dashboard. Each selection offers deep customization, from selecting the color to searching for unique patterns to detect.

While this depth is useful in theory, in practice, it is difficult to utilize since there is little explanation for the different options. This is especially true for inexperienced technicians, who may be lost when presented with long lists of chart patterns with names like “Rickshaw Man” and “Gravestone Doji”.

News and Watchlists

TrendSpider offers an impressive amount of pre-built watchlists, allowing users to search for current price movements among different position segments quickly. Users can also create their own custom watchlists. By pairing this with a real-time news feed through Benzinga, traders can stay up-to-date on the positions that interest them most.

TrendSpider also includes scanner watchlists, which can be used to scan indices for specific patterns or events. For instance, traders can find all the companies in the S&P 500 with earnings in the next 7 days or those with specific volume trends. This can speed up the time it takes to search for different trading opportunities.

Data

TrendSpider offers data access to a fairly broad set of instruments, including stocks, ETFs, crypto, FX, and futures. Note that access to most of this data requires signing exchange agreements, and access to some (like futures) requires paying a separate exchange fee. Notably, bonds are missing from this list, which could make it difficult for traders to analyze strategies that correlate bonds with other instruments.

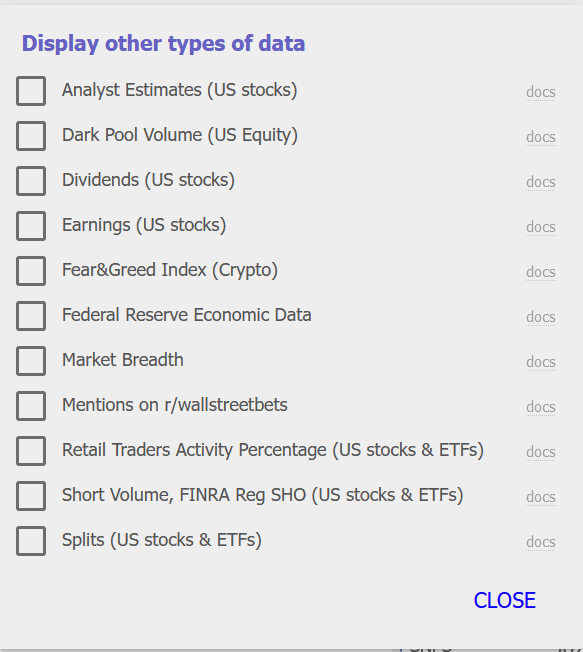

Unlike other trading platforms, TrendSpider also integrates certain alternative data sources. These include information on off-exchange trading volumes, social sentiment, and retail trading activity.

Most of this data can be incorporated into the existing chart for each instrument, although some manifest as a separate chart. There are additional difficulties in incorporating alternative data based on the length of the timeframe. As is typically the case for TrendSpider, what seems simple on the surface hides complexity underneath.

An additional data feature, which is still in beta testing, is the Data Flow feed. This is a real-time flow of certain data sources, such as unusual options activity or insider trading alerts. While this feature might prove useful to some traders, it is debatable whether additions of dubious utility justify the increase in complexity associated with their inclusion.

Backtesting

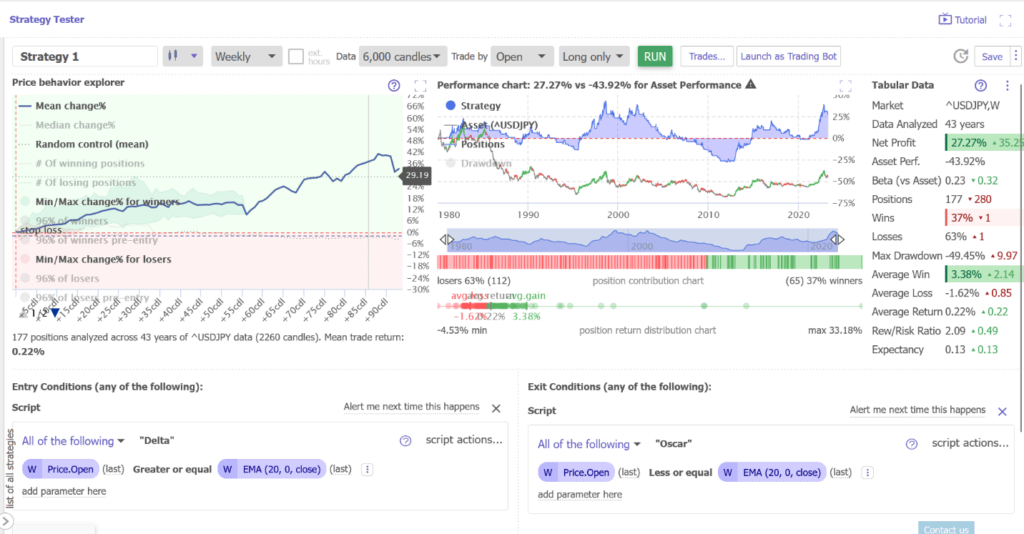

TrendSpider offers a no-code backtesting feature that allows traders to see the historical performance of strategies of interest. While all backtesting is subject to limitations of liquidity and price impact, TrendSpider’s Strategy Tester allows the creation of fairly sophisticated trading strategies without the need to touch the underlying code.

For instance, here is the result of a strategy that involves going long USD-JPY when the last price is greater than the exponential moving average indicator and selling when the price falls below that indicator (with a 2% fallback stop-loss).

While the data presented might take a while for newer traders to digest, the ability to have historical data integrated into a no-code tool makes TrendSpider a very powerful tool for traders with little coding experience.

Scanning

TrendSpider includes a robust scanning suite to discover trading opportunities based on specific criteria. We saw a compartmentalized version of TrendSpider’s scanning capabilities when looking at watchlists, but an independent scanning tool can also be utilized.

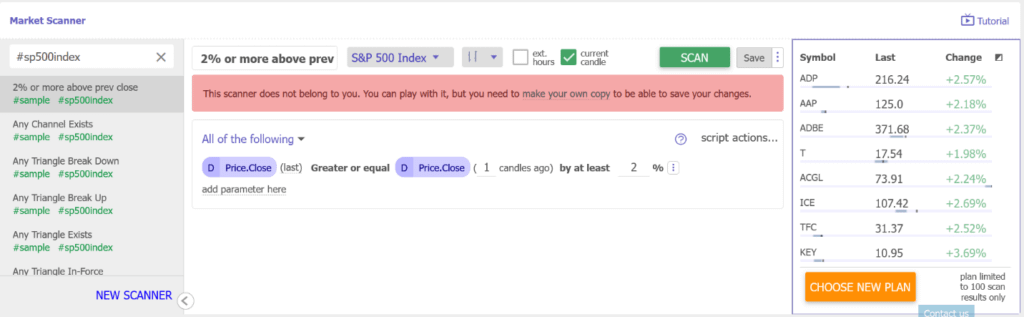

Below, we see the results of a scan that finds stocks in the S&P 500 that finished 2% or more above their previous close. As you’ll see, a scrollable list of all suitable stocks appears on the right-hand side, allowing us to easily dive further into one of the positions by clicking it and pulling up its respective chart.

Note that TrendSpider’s plans differ in the number of results allowed by each scan. In the screenshot above, we are limited to just the first 100 of the suitable stocks unless we choose to upgrade. Moreover, we cannot make edits to the scan we ran, as it was a sample scan provided to us.

Now that we have a broad overview of the basic capabilities of the platform, we can dive in to understand how to use it effectively. In the next section, we’ll further explore the way TrendSpider works by creating our own custom scan and finding patterns in the resulting chart.

How to Use TrendSpider to Scan for Stocks

One way to leverage TrendSpider’s focus on serving technical traders is to use the platform’s built-in pattern scanners to filter positions for attractive opportunities quickly. To understand what this looks like in practice, we’ll go through a step-by-step example that highlights some of the platform’s offerings.

Step 1: Set Up the Scanner

To pull up TrendSpider’s market scanner, navigate to the main dashboard of the interface. In the top right, click Scanner. This will add the market scanner tab right below whatever chart is currently active.

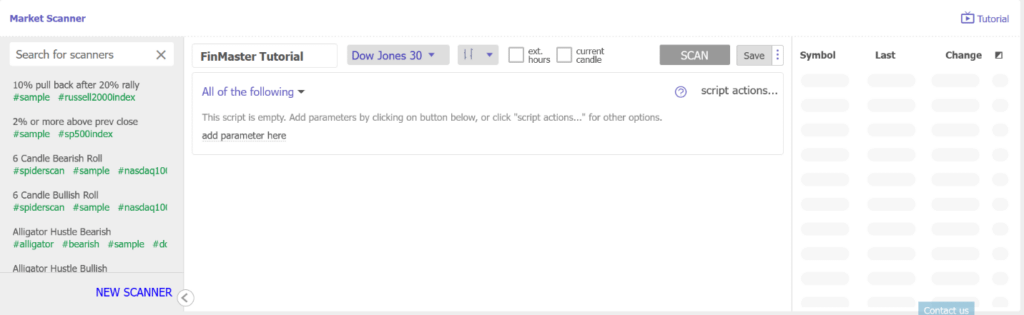

You’ll see a place to name our new strategy right next to the scanner search bar. Let’s name our strategy “FinMasters Tutorial.

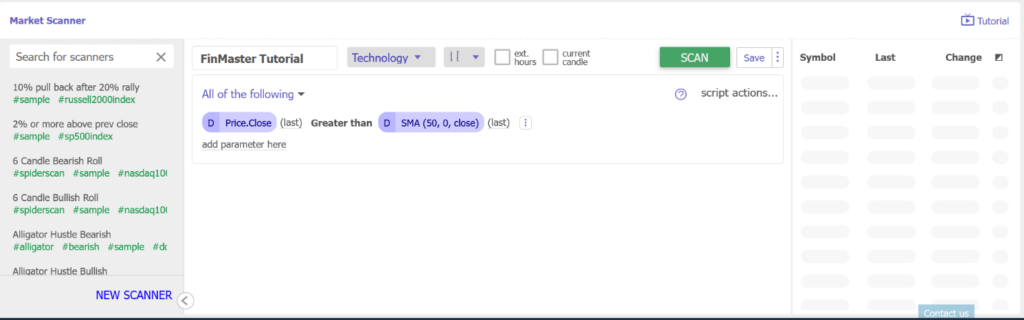

Now, we can go about adding parameters to our scanner. One simple scan is to filter on the condition that the daily closing price is greater than the daily simple moving average indicator, which could indicate positive momentum in the stock. Supposing we are only interested in tech companies, perhaps because we are looking for high-beta opportunities, we can filter specifically on the Technology sector.

Our setup will look like the following.

Step 2: Run the Scanner, Select a Stock

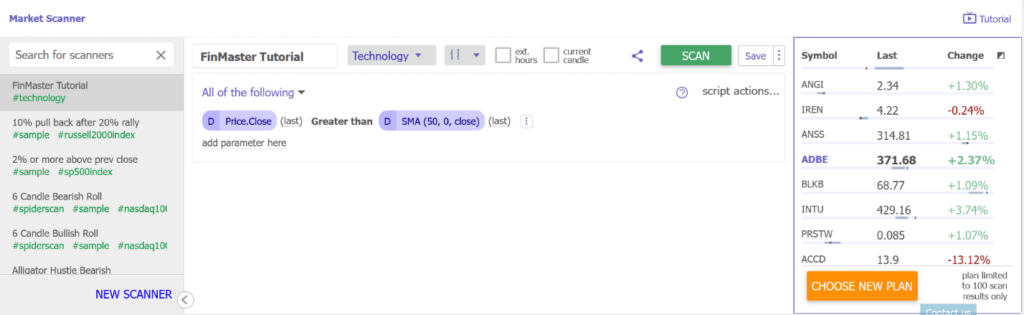

Now that we’re ready, we click Scan to generate a list of stocks that meet our criteria. Note that the total number of positions scanned could be limited by the plan we have.

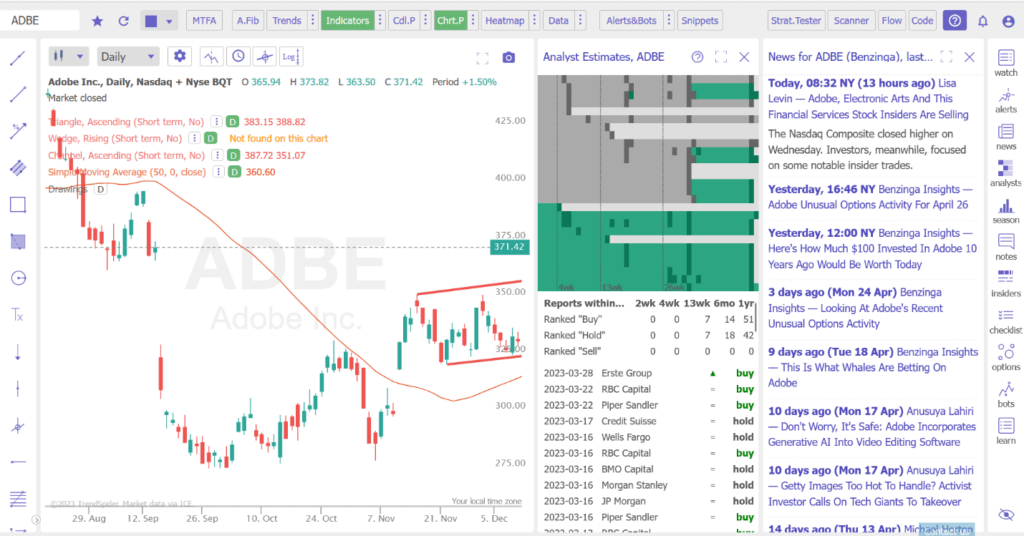

Scrolling through the list on the right-hand side, you might find positions of interest as potential trading opportunities. Since the scanner is a broad tool, we’ll need to dive deeper into any specific stock to decide whether the position is actionable. On the list, Adobe (ADBE) might catch our eye. It is a large, reputable tech firm with a strong previous close. Let’s click the stock to pull up the chart.

We can save our scanner for later use by clicking Save.

Step 3: Evaluate the Chart with Patterns and Indicators

To give ourselves more room to work with the chart, we can click Scanner again on the top right to remove it from our dashboard.

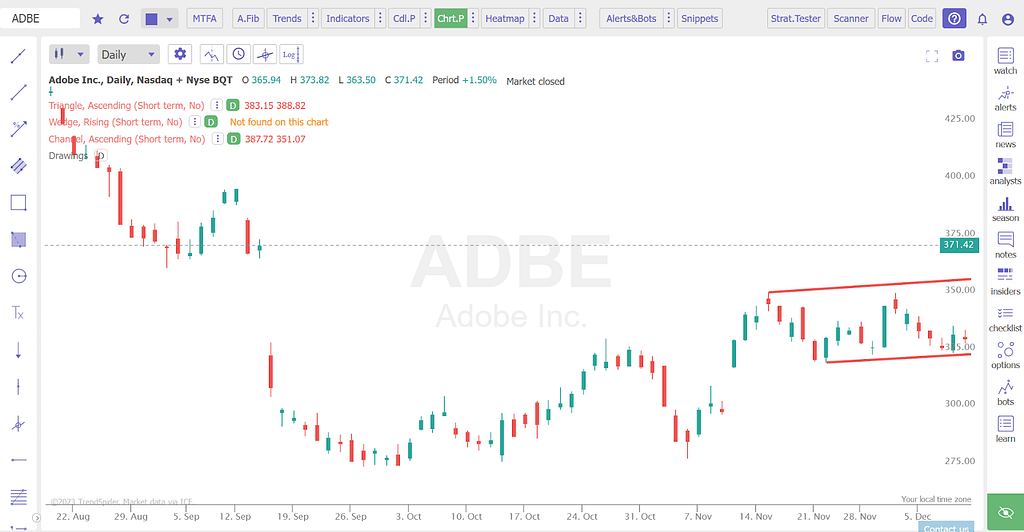

Looking at Adobe’s chart, there might not be any obvious patterns to the naked eye. Let’s use TrendSpider’s automated pattern recognition to see if there’s anything we missed.

Click the three dots next to Chrt.P. We’ll look for bullish chart patterns to see if there might be positive momentum in the stock. Choose Channel Ascending, Triangle Ascending, and Wedge Rising. Then click apply.

Interestingly, it appears there were some positive patterns that we missed. To reflect our initial scan and understand Adobe’s price change over time, let’s add a simple moving average indicator to the chart. Click the three dots next to Indicators, and if it is not added already, search for Simple Moving Average. Then click Apply.

As we would expect, given our scan, the stock’s recent close was above its simple moving average. It appears the average was declining but has started to reverse around the time bullish chart patterns appeared. While this might indicate an opportunity, TrendSpider offers some additional tools to research our position further.

Step 4: Further Research with News and Analyst Ratings

Sometimes, charts are just not enough to make a trading decision. Luckily, we can utilize TrendSpider’s alternative data sources to conduct additional research.

On the right-hand side of your screen, select both Analysts and News. This should immediately pull up both the Adobe news feed as well as information on recent Wall Street ratings.

It looks like there was no major Adobe news in the past several weeks, although we might want to look into the insider sales that have taken place in case they represent a lack of confidence by management or major investors. Additionally, analyst estimates on Adobe seem fairly positive, with no recommendations to sell.

Ultimately, making a trading decision like this is a personal choice, but this tutorial showed how TrendSpider could be used to intelligently inform those choices, especially once a trader is familiar with the interface. While TrendSpider specializes in supporting technical analysis, the alternative data sources it offers strongly supplement additional research.

While TrendSpider lacks the ability to place trades directly inside the platform, the next section will detail how to replicate this ability with some advanced features.

Advanced Features

Although TrendSpider offers too much depth to fully evaluate in this article, here is a brief overview of the tools that experienced traders will find particularly useful on the platform.

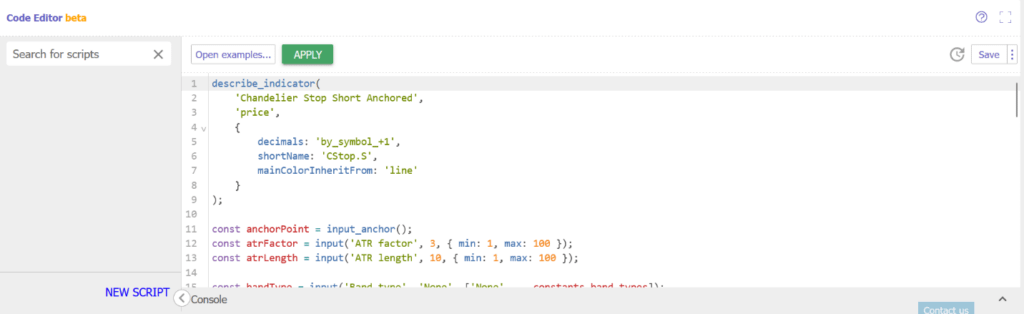

Chart Scripting

With TrendSpider’s code editor, traders can create custom chart patterns and indicators in case the built-in options are insufficient for the needs of advanced users. This tool, combined with the custom backtesting strategies we reviewed earlier, creates powerful options for uniquely tailored analysis and charting techniques.

Trading Bots and Alerts

Trading bots are a method to begin automating live trading for custom strategies. At a basic level, a user could create a bot to send them a text message whenever a strategy has an entry or exit alert. This would allow the user to go to their broker manually and execute the necessary trades.

Once a trader is confident in their strategy, they can modify the bot to send requests to a URL via webhooks automatically. Most major retail brokerages, including TD Ameritrade and Interactive Brokers, allow trades to be executed automatically through these webhooks.

While TrendSpider does not allow direct integration with brokerages, this method lets users replicate the functionality. Additionally, TrendSpider allows integration with a platform called SignalStack to centralize webhook management among multiple brokers.

Similar to bots, TrendSpider offers dynamic alerts for users to be notified of action for essentially any indicator or trend line. These tools, once you learn to use them, turn TrendSpider into much more than just a charting system and partially justify the platform’s high price.

Frequently Asked Questions

Here are some common questions about TrendSpider and its uses.

Is TrendSpider Better Than TradingView?

Whether or not TrendSpider is better than TradingView depends on the user’s experience level and budget. While the two platforms are comparable in terms of basic functionality, TrendSpider is significantly more expensive than TradingView.

For experienced traders, TrendSpider’s price could be worth it for access to advanced features like automated charting, trading bots, and custom scripting. For newer traders, the robust feature suite and lower price point of TradingView likely make the platform more attractive in comparison. Luckily, both platforms offer a free trial so you can test them out for yourself.

Is TrendSpider Good for Day Trading?

TrendSpider is an effective tool to support day trading, but you cannot trade directly through the platform. This is a big drawback to TrendSpider, and means that the platform is not an all-in-one solution for technical day traders.

In comparison, competitors like TradingView do allow users to place trades via direct broker integration. Ultimately, unless you are trading at a particularly high frequency, the time it takes to enter trades to a separate platform is unlikely to be a significant difference maker in your performance. Still, traders who prefer a solution that bundles trading with analysis should look beyond TrendSpider.

Is TrendSpider Good for Beginners?

No, TrendSpider is not a beginner’s tool. The user interface is somewhat convoluted and the feature set is complex, meaning that new traders will have a significant learning curve as they adjust to the platform. Considering that most beginners will want to focus on the fundamentals of trading, not spend their time learning a specific platform, new traders will likely find better value in simpler, more intuitive trading tools.

With that being said, some beginners want to choose a feature-rich platform to learn, so that they can utilize its full functionality further down the line. For these types of users, TrendSpider could be a good option, especially if these users eventually want to leverage automated tools. To help beginners get started, TrendSpider does offer documentation and educational resources that guide users through the platform.

Can I Use TrendSpider for Free?

While TrendSpider offers a seven-day free trial, you must pay to use the platform after this period. Unlike other trading analysis software, TrendSpider has no free tier, with the cheapest level being $35/month when paid annually. TrendSpider does say that you can email them to request an extension of your free trial if you need more time to make a decision, though.

Plans and Pricing

TrendSpider’s free trial lasts for seven days, although they say users can email support to ask for an extended trial. TrendSpider offers three plans of varying price and quality, which are summarized in the table below.

| Essential | Elite | Elite Plus | |

|---|---|---|---|

| Monthly Price | $39 | $79 | $179 |

| Yearly Price | $384 ($35/month) | $780 ($65/month) | $1,620 ($135/month) |

Below are the features that TrendSpider offers with all plans.

| Essential | Elite | Elite Plus | |

|---|---|---|---|

| Real-Time Data | US stocks & ETFs, Pre-market & after hours, Forex & currencies. |

Digital crypto assets, OTC/pink-sheets (delayed), US Futures (exchange fee). |

CBOE Indices (delayed), Benzinga Pro news, Corporate calendars. |

| Capabilities | Traditional charting, Raindrop™ charts, Over 190 indicators built-in, Unlim. indicators per chart, Up to 16 charts per screen, No advertising – ever, Unlimited watch lists, Trend line detection, Breakout detection. |

Candlestick recognition, Chart pattern recognition, Automatic Fibonacci, Price heat maps, Anchored indicators, Robust drawing tools, Integrated backtesting, Real-time scanning, Smart checklists. |

Multi-symbol view, Multi-timeframe analysis, Dynamic price alerts, Real-time data flow, Volume profile tools, Intraday exotic charts, 100s of other features! |

| Support | TrendSpider University | E-mail support | Live chat support |

Essential

The Essential plan is the most limited of the three. The scanning results, one of TrendSpider’s most useful tools, are limited to just 25. Only two simultaneous workspaces are allowed, which would be difficult to manage given the cluttered nature of the interface. Moreover, there is no access to most of the alternative data that TrendSpider offers, including insider trading or social sentiment.

Finally, and most critically, the Essential plan does not include multi-factor alerts or trading bots. This will limit the main utility of TrendSpider, which is the ability to automate complex trading processes. For most users, the Essential plan is unlikely to be worth the price.

Elite

The Elite plan, which offers up to four workspaces, six trading bots, and multi-factor alerts, opens access to far more of TrendSpider’s platform. Importantly, this tier includes all the alternative data TrendSpider has to offer. The biggest limitation is that scanning results are limited to 100.

Still, this is likely going to be the best plan for most users. It offers access to TrendSpider’s complexity at less than half the price of the Elite Plus plan. Additionally, the Elite tier allows users to access priority support options, which could be critical if an important trading strategy breaks down.

Elite Plus

The Elite Plus plan improves on the Elite plan by offering up to 50 bots, the largest backtesting depth, and unlimited scanner results. TrendSpider offers free 1-on-1 training at this level to help traders understand the platform and use it most effectively.

While this tier clearly improves on the features offered in the Elite plan, it comes at a high price, which is unlikely to be worth it for anyone except professional traders or those running particularly complicated trading strategies.

Is TrendSpider Worth It?

TrendSpider is a complex tool that has both positives and negatives.

For advanced users, the ability to create custom indicators and connect trading bots with webhooks will prove useful (although direct broker integration would be even more useful). Automated pattern-finding in charts and advanced stock screening tools should speed up the time it takes to evaluate opportunities.

At the same time, users pay for this complexity both in the price and in the time it will take to learn the platform. TrendSpider’s interface is lacking, and many of the advanced features are hidden behind several layers of options. While TrendSpider does offer a solid amount of documentation and educational resources, this still creates a barrier for new users to get started.

TrendSpider is expensive, especially compared with TradingView, one of the largest software platforms in the technical analysis space. You can read our review of TradingView here, which highlights its superior price point.

Inexperienced traders are unlikely to find TrendSpider’s price worth the value. For advanced users, spending the time necessary to learn the platform via TrendSpider’s free trial is only likely to be worth it if one of the advanced features could be a particular difference-maker for your trading strategy.

Verdict

While TrendSpider has its drawbacks, including a poor user interface and lack of direct broker integration, the automated pattern recognition when charting and a strong capacity for customization could make it the right tool for advanced traders.

Although its high price and complexity will be off-putting to newer traders, the wealth of accessible data and no-code backtesting options could still provide inexperienced users value. With a free trial and no charge as long as users cancel before the billing period begins, traders looking for a software platform focused on technical analysis would be wise to spend some time exploring TrendSpider.

How We Review Trading Software

We rate all the products we review using a key set of criteria. This allows us to compare products that are not identical fairly.

These are factors we looked at when reviewing trading software.

Price: Is the service offered at a reasonable price considering the features it includes?

Considering that TradingView and other competitors offer comparable functionality at a lower price point, TrendSpider does not perform well from a price perspective. However, it does have multiple offerings, so users can choose the tier that suits them best.

Tools & Features: Does the service offer a set of tools and features that are useful, powerful, and/or set them apart from their competition?

TrendSpider has plenty of powerful features for technical analysis. Basic tools are supplemented with unique functionality, like automated pattern recognition, and advanced tools, like scripting and trading bots, should provide value for experienced users.

Ease of Use: Is the platform easy to use? How long would it take for a new user to figure it out?

TrendSpider is not particularly easy to use. The user interface is complex, and many options are hidden beneath layers of options. Still, the platform offers educational resources and training videos.

Range of Investments Covered: How many kinds of investments does the service cover?

TrendSpider covers a wide range of investments, including FX, futures, stocks, ETFs, and indices. While mutual funds, options, and bonds are not covered, technical analysis is less applicable in these areas anyway.