When the pandemic hit, trapping us in our homes, many people turned to day trading as an outlet and (hopefully) an extra source of income. This was also fueled by millions of people losing their jobs and needing a way to make a living.

Unfortunately, many of those same people lost huge sums of money, with some estimates putting the losses at over $1 billion. What’s worse, some might have even gotten addicted, exhibiting gambling-like trading behaviors. This, in turn, took a toll on both their financial and mental well-being.

But why did all those people lose their money? And can day trading truly become an addiction?

Firstly, What Exactly Do We Mean by Day Trading?

Day trading is all about buying and selling assets within short periods of time, usually in under 24 hours, seeking short-term gains.

The idea is to try to profit from the intraday fluctuations in price. For example, a day trader will buy a stock and then sell it within a few hours, sometimes in a few minutes or seconds. So, they may buy a stock at $10.40 and plan to sell it once it hits $10.50, benefiting from the 10 cents appreciation.

As for the traded assets, they can come in all shapes and sizes: Stocks, options, futures, currencies, or even currencies (both physical and crypto).

Day traders realize that they need to make money from very slim price movements, so to bolster their results, they rely on leverage. In other words, rather than buying a stock worth $100 with their money, they will put up $10 of their own and borrow $90. So, a 1% increase in the stock’s prices, from $100 to $101, might seem meager, but to the leveraged day trader, that is a 10% return on investment.

However, this leverage also presents an excessive risk. If the stock goes down to $99, which is only a 1% loss in the stock’s value, the trader loses 10%. The stock only needs to lose 10% of its value for the trader to be wiped out.

With a better understanding of what day trading entails, the natural next question to ask is…

Is Day Trading Successful?

The answer depends on how you define success. If success means making a profit, then frequent trading isn’t that successful. But, if success means beating a simple passive strategy of leaving your money in an index fund, then day trading has an even larger hurdle to overcome.

How Likely Are You to Make a Profit As a Day Trader?

The majority of day traders struggle to be profitable consistently. To see how bad things are, let’s look at a few numbers:

- 64% of all US day traders lose money, and only 36% realize profits.

- Several other studies also show how dismal the outlook is for most day traders. A study in Brazil found that only 3% of day traders were able to show some sort of profit after 300 days. The rest just lost money. A study in Taiwan that looked at the 10-year period between 1995 and 2006 found that a meager 5% of day traders could show any profit.

- According to Gitnux, almost four out of every ten novice day traders quit after a month. And after three years, nearly 87% of day traders leave the trade entirely (pun intended)[3].

- And, to top it all off, only 1% have shown the capability to be profitable over a 5-year period!

Now, let’s assume you somehow managed to make it to the profitable 5% of day traders. How much of a return should you seek for your trading efforts to be considered successful?

How Does Day Trading Compare to Leaving Your Money in the Market?

On average, the stock market has netted investors an annual compounded return of 10%. In other words, if you were to leave your money in the S&P 500 and forget it there, it should keep growing at a consistent rate of 10% year-over-year.

Consequently, for frequent trading to be a good idea, it needs to get you a return higher than 10% annually. Moreover, you need to factor in the extra costs that come with frequent trading: the risks, the time and effort, the emotional stress, the trading costs, and the taxes, just to name a few things.

Unfortunately, it’s tough to find data on the average returns of successful day traders. And, while there are online stories of day traders who were blessed by lady luck (such as a day trader in 2020 who turned $15,000 into $1 million), these are outliers. Most profitable traders bring in moderate returns. Those lucky enough to make spectacular returns tend to lose their money as quickly as they made it (that day trader who turned $15,000 into $1 million lost all his money soon after).

Why is the Outlook for Day Traders so abysmal?

There are several reasons day traders fail over the long run, causing many of them to look for gainful employment elsewhere:

- The tools used in day trading are pretty sophisticated and beyond the average trader’s understanding. For instance, without learning the intricacies of option trading, a trader can get wiped out by holding the wrong position, a common theme during the pandemic.

- Traders need a robust and solid strategy. This strategy needs to be flexible enough to adapt to different market conditions. Most traders don’t take the necessary time to develop these strategies and methodologies.

- Even when a trader has a solid strategy, they still need to learn how to discipline themselves and control their emotions, especially when the market is volatile. The problem, though, is that most traders tend to give in to greed and fear. When they get a little bit of success, they feel overly confident and push their luck too much. Conversely, when stung by a loss, they might act out of fear, selling in a panic or harming their portfolio in some other way.

- Day trading itself is a zero-sum game. For a trader to make money, the other side of the trade needs to lose money. Alternatively, when you invest in the market for the long term, you benefit from the value creation and the cash flow generated by the underlying asset. And, making a profit from a zero-sum game is much harder than profiting from value creation that benefits all the parties involved.

- Day trading is a very crowded space, with institutional traders making most of the plays. And, when you consider that day trading is a zero-sum game, you can see why the average retail trader operating out of their living room is bound to get cannibalized by the professional trader sitting in front of a state-of-the-art terminal with cutting-edge tools at their fingertips.

Not only do day traders need to master the tough field of day trading, but they also need to tame their worst instincts. And once they’ve done that, they need to compete with sophisticated traders in a zero-sum game, all in the hopes of beating a passive strategy of just leaving your money in the market.

With All of This Going Against Them, Why Do so Many People Still Day Trade?

To answer this question, we need to tackle two easier questions:

- Why do people get into day trading in the first place?

- Why do they stay day trading even though they are losing money?

Let’s answer each question separately.

What Attracts People to Day Trading in the First Place?

It should come as no surprise that many people jump into day trading for the wrong reasons.

For starters, they hear misleading success stories and think these anomalies are the norm. They fail to realize that for every success story, there are almost a hundred failures that nobody ever talks about. And, when confronted with the statistics and numbers, these same people believe that through some stroke of genius, they will be part of the successful 5% rather than the 95% who end up losing money.

Simply, these people are looking for a quick-rich scheme.

Another reason can be summed up in two words: hindsight bias.

Of the many cognitive biases impacting our finances, hindsight bias is one of the trickiest. It is the tendency to assume that something was predictable, if not downright inevitable, but after the fact.

For instance, let’s say Google’s stock climbs up by 5% in one day after releasing a press release regarding how Bard, their AI, will compete with ChatGPT. Now, hindsight bias will lead some people to think that they should have seen this appreciation coming a mile away. After all, ever since OpenAI unleashed ChatGPT, people have been expecting Google to respond to protect its turf.

However, this way of thinking is faulty. It neglects the role of luck in the company’s success. A million things could have gone wrong, such as Google’s AI underperforming compared to ChatGPT, which would have harmed the stock rather than helped it. Also, there is an element of timing, i.e. when to buy and when to sell the stock, and timing can be hard to master, even for the most seasoned professionals.

Why Do People Keep Day Trading, Even When They Are Losing Money?

Day trading can lead to losses that sting, demoralizing day traders who started their journey with wide-eyed optimism. However, of the people who keep day trading, some eventually become profitable, but the majority consistently lose money. Why does this latter group stay at it regardless of the harmful outcomes?

One reason is the excessive gamification of investing and trading. Platforms like Robinhood have turned buying and selling assets into a game of sorts, be it through animations, spotlighting trending stocks, or giving out lottery incentives. These features activate the reward centers inside the brain, releasing pleasurable neurotransmitters such as dopamine.

Speaking of dopamine, another reason some people keep day trading despite losing money is that it can turn into an addiction for them. They treat day trading the same way an addicted gambler treats a craps table or a roulette wheel.

According to a research paper by Cox, Kamolsareeratana, and Kouwenberg, around 4.4% of investors approach financial markets the same way compulsive gamblers approach casinos. Moreover, another 3.6% of investors can be labeled as problematic gamblers, which might be less severe than compulsive gambling but is still a red flag for any financial portfolio[4].

Why Day Trading Can Turn Into an Addiction

The above numbers should come as no surprise, as day trading and gambling have a lot in common:

- Intermittent rewards, as opposed to consistent rewards, are one of the fastest ways to instill certain behaviors within people, and they are present in both gambling and day trading. After all, even the worst day trader is bound to have a winner every once in a while. The problem is that the losses will far outweigh any intermittent wins.

- Sometimes, even losses themselves can be addictive. Volatile assets can be exciting with all of their peaks and troughs. This excitement can lead to the release of adrenaline and endorphins, which can be a form of addiction. As a result, day trading becomes a gateway to excitement and entertainment rather than a way to make a profit.

- While losses can be a path to excitement for some, they can lead others towards an addictive behavior thanks to the tendency of loss aversion. Simply, loss aversion leads us to go to extraordinary lengths in the hopes of avoiding a loss. And similar to a gambler refusing to leave a blackjack table till they have broken even, many traders may refuse to stop trading till they have covered their losses.

So, while most people who get sucked into day trading are able to get out of it before suffering heavy losses, some do get addicted, and their lives can deteriorate as a result. Luckily, you can do plenty to stop day-trading addiction from harming you and the ones you love.

How to Avoid The Traps of Day Trading?

An ounce of prevention is worth a pound of cure. So, before discussing what to do in case you or someone you know gets addicted to day trading, let’s start with how to avoid this vicious vortex.

The simplest way is to not day trade in the first place. Instead, you might want to consider investing passively and for the long term. You can place your money in an index fund that tracks the market and enjoy an average annual return of 10%. And, if you want to mitigate your risks even further, you can spread out your portfolio over different asset classes, including stocks, bonds, and cash-equivalent investments.

But, if you want to dip your toe into the day trading pool, then there are a few things you want to do first.

How to Avoid Day Trading Addiction

Avoiding day trading addiction is all about approaching this risky activity with the right mindset. Part of this mindset comes from educating yourself, and the other part comes from knowing yourself and how you react under stress:

- Start by improving your financial literacy. This means learning how to manage your money and how to invest properly. And it also means being aware of the cognitive biases that are bound to trip you up along the way and guarding against those. Over and above, you need to acknowledge the role luck plays in any person’s financial success, especially when it comes to day trading. In other words, don’t let hindsight bias get the best of you.

- Before investing in anything, do your research. If you are not entirely clear on what an investment tool entails, don’t use it. Just because everybody uses options doesn’t mean you should be using them unless you understand how to do so.

- Be clear on your objectives every time you trade or invest. So long as your goal is to make a profit, you’re good to go. But the minute you start feeling that trading has become a source of daily adrenaline, take a step back and reevaluate your priorities.

However, it is possible that despite your best efforts, day trading will sink its teeth into you. In that case, you should know what to do.

How to Deal with Trading Addiction?

To fight trading addiction, you need to be able to spot it first. Let’s start there.

How to Spot Trading Addiction in Yourself or Others?

While there are many signs you should look out for, here are the main ones you should keep top of mind:

- You are performing high-risk trades without understanding the underlying fundamentals.

- You are spending an inordinate amount of time trading and investing. You might be checking asset prices so frequently that it disrupts the normal flow of your day.

- At the extreme end, you might start lying to others about what you do with your time because you are trying to hide your losses.

- You start borrowing money for your investments, be it from the bank or from your friends. In fact, at the extreme end, you might ruin some of your personal relationships due to your addictive habits.

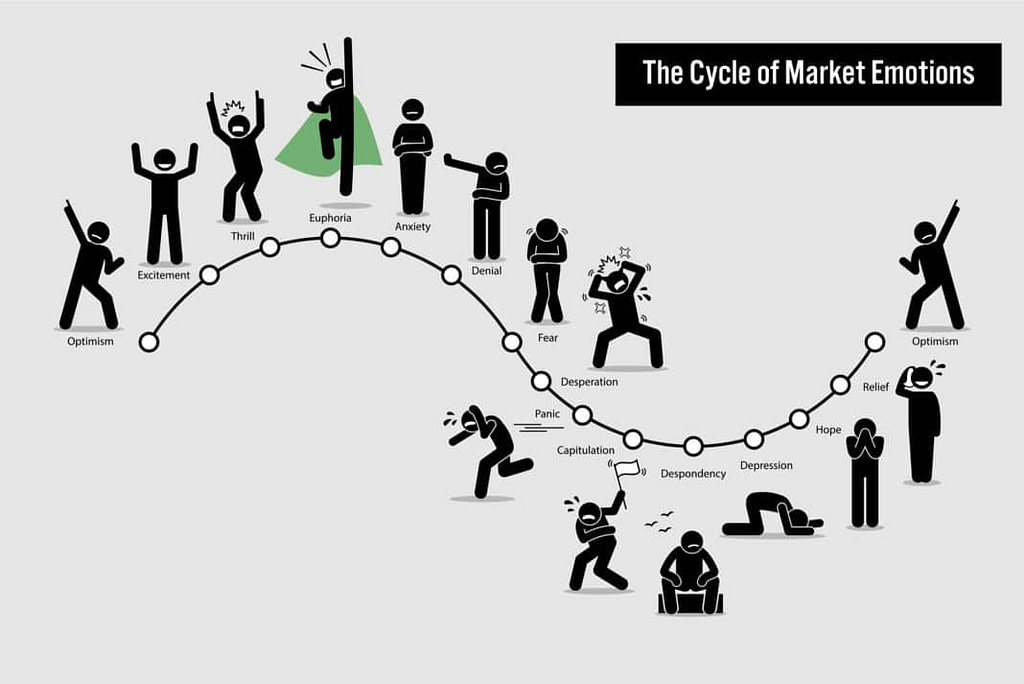

- You keep going through the cycle of market emotions, which just fuels your addiction by amping up the excitement of day trading and hitting your reward centers through intermittent rewards.

Source: Investing.com

Now that you know what to look out for, let’s investigate what to do if these signs show up.

How to Combat Trading Addiction and Take Back Control of Your Finances

- The first and best thing you can do is to reach out and ask for help. The good news is that you have plenty of options to choose from, starting from loved ones and those closest to you and going all the way to online support groups.

- Start swapping day trading out for healthier activities such as reading or exercising. While you’re at it, get rid of any trading apps on your phone, laptop, or any other device.

- If things have gotten to a point where you have lost a lot of money, consider bringing in a financial advisor or financial therapist to help. You could consider closing brokerage accounts or putting money in a robo-advisor account while you get your trading problem under control.

- Stop following all the financial advisors on social media who promise easy wins and free lunches.

And, throughout the entire process, be kind to yourself. You will have good days and bad days. Moreover, just because you developed a bad habit does not mean you are a bad person. Just work constantly to change gradually, and so long you are doing better tomorrow than you were yesterday, that is a win.

Putting It All Together…

While the allure of day trading can be strong, the dangers are very real. You should not go into it lightly because you have a high probability of losing your money. What’s worse, some of us might even get addicted along the way. So, be careful, and whatever you do, make sure that you have a strong support system in place in case things go sideways.