Setting up your home interior can be a great project, or you may just need to replace pieces of furniture that have worn out. But what if you have less-than-stellar credit? Furniture is expensive, and most of us don’t have that kind of cash lying around.

Even with weak credit, you may be able to find bad credit furniture financing options from popular retailers or from a third-party financing agency.

Bad Credit Furniture Financing Options

What credit score do you need for furniture financing? The answer depends on the source of your financing, though many options exist for financing without a credit check.

Before you decide to sleep on that second-hand futon, you might want to consider one of the following options to secure financing for the furniture you need:

1. Ashley Homestore

Does Ashley Furniture approve bad credit? In some cases, yes. Ashley Homestore provides multiple financing options, including some with no credit check. This may make Ashley one of the best furniture stores with financing for bad credit.

- Wide variety of financing options.

- Furniture financing with no credit check.

- Credit cards offer 0% APR during the promotional period.

- Ashley Homestore reports payments to multiple credit bureaus.

These features make Ashley a solid choice for anyone looking for bad credit furniture financing.

- High APR after the promotional period ends (or if you miss a payment).

- The in-house credit card offers no rewards.

- The credit card can only be used for Ashley Homestore.

- Some financing options require a hard credit inquiry, which can lower your credit score.

Shoppers should take the time to learn more about Ashley’s options for financing furniture with bad credit to ensure they select the option that fits their needs.

2. FlexShopper Lease-to-Own

FlexShopper is not unique to the furniture industry. The company offers multiple options for leasing consumer products and electronics, though they also offer methods for leasing furniture with bad credit.

“Lease-to-own” means you’ll pay a monthly fee to use the furniture, though after a predetermined number of months (or payments), you’ll own the item outright.

- Rapid decisions on leasing options.

- A wide range of consumer products.

- Products come from popular retailers.

These features mean you can lease items from popular retailers (including Ashley Furniture) rather than go through traditional furniture loans.

- Leasing can often cost more over time than buying the item outright.

- Leasing will require a credit check, which may lower your score.

- Limited options for payment terms.

Despite these drawbacks, some consumers may enjoy the selection FlexShopper offers, as well as the website’s transparent pricing model.

3. Wayfair

Is Wayfair for bad credit? Perhaps not exclusively, but the furniture giant offers ways to buy furniture with bad credit through multiple financing options offered through a network of third-party agencies. And unlike other financing options on the market, applying for Wayfair’s financing will not affect your credit score.

- Simple application process and fast approval.

- No credit check until you select a payment offer.

- Financing is unique to the company rather than a credit card.

Wayfair does offer a credit card that can also be used to buy furniture with bad credit, though it’s not clear what credit score you need to qualify for the card.

- No option to select your third-party financing provider.

- Your credit score is affected once you select a financing offer.

- Interest rates are determined by the third-party provider.

Wayfair offers a simpler financing approach than the diverse options of Ashley Furniture, but shoppers may discover that they have fewer options when dealing with Wayfair’s financing network.

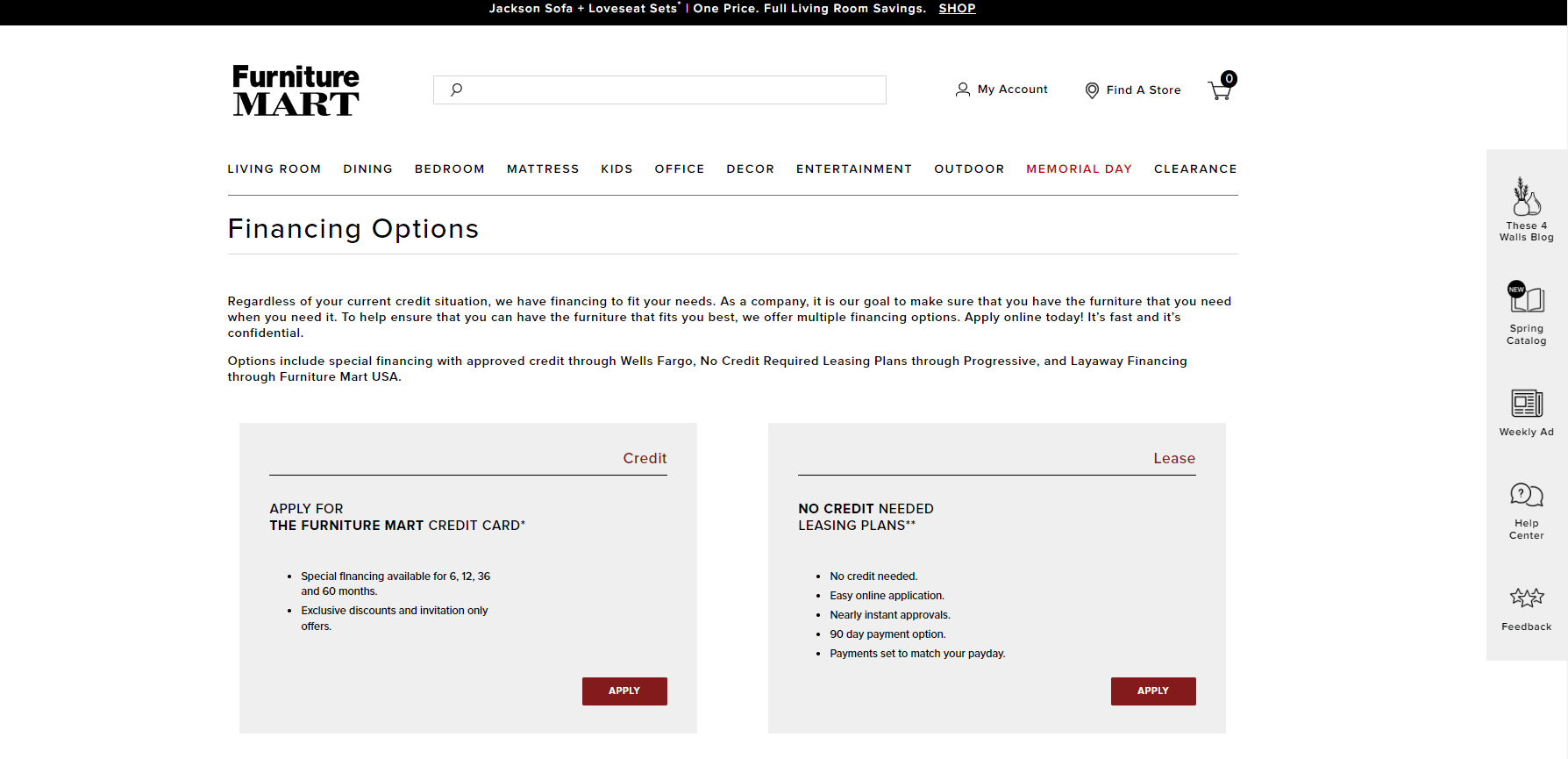

4. Furniture Mart

While Furniture Mart offers credit card options, the company also provides leasing options with no credit check required. These leasing options are administered by Progressive, while Furniture Mart also offers layaway financing through the store directly.

- No-credit-check leasing options.

- Rapid approvals.

- 90-day payment options.

- Flexible payment schedule to align with your payday.

These features make it easier for those interested in leasing furniture with bad credit. If you qualify for the company’s credit card, you can take advantage of seasonal promotions and other discounts.

- Unclear leasing schedule or payment structure.

- Leasing can become more expensive than buying outright.

- The lease-to-own option is not available in Wisconsin and Minnesota.

Shoppers may need to do some digging before they can learn how much a lease-to-own option might cost.

5. Affirm Furniture

Instead of offering credit cards or leasing agreements, Affirm takes a different approach. With Affirm, you’ll shop for your favorite items and brands, then pay over time. This buy now, pay later business model works through an app on your smartphone, which also enables you to set up automated payments.

- Easy to manage through the app.

- Transparent pricing and no hidden fees.

- Automated payment options.

- Affirm can be used for a variety of consumer goods.

- Will not affect your credit score.

This may make Affirm one of the best options for buy now, pay later furniture for bad credit.

- Big-ticket items may generate interest.

- Limited options for choosing a payment schedule.

- Limited customer service options.

Still, the company’s unique business model may make it a popular choice among furniture shoppers with low credit scores or limited funds.

6. Klarna

The buy-now, pay-later business model has become quite popular, and Klarna is another strong contender for bad credit furniture financing. Smaller purchases can be funded in an interest-free payment plan, while larger items can be paid off on a monthly plan.

Klarna is available through a downloadable app, though the company also offers a browser extension that makes it easy to shop through your desktop or laptop.

- Convenient payment options.

- Simple user interface.

- Multiple financing options for big-ticket items.

These features make Klarna a welcome option for furniture financing with bad credit, and the app also makes it easy to shop for a range of consumer goods.

- Users incur fees for missed payments.

- Large financing amounts may require a hard credit check.

- Limited access to customer service.

Klarna’s model makes it ideal for small purchases, but financing furniture should be done with care, as it’s possible to experience a hard credit check that can lower your score.

7. Acorn Finance

You may be familiar with Acorn as a financing and budgeting app, but Acorn also provides bad credit furniture financing.

Applicants can receive approval in as little as 60 seconds with no hard credit check that can lower their score. And because Acorn is not affiliated with any particular store, you can use the app to secure bad credit furniture loans for essentially any purchase.

- Financing applications will not affect your credit score.

- Rapid approval.

- Flexible financing option for use in multiple stores.

These features make Acorn one of the most-trusted no-credit-check furniture financing options.

- Limited ability to choose from Acorn’s network of lending partners.

- Actual terms of furniture financing are set by a third-party lending provider.

- Acorn’s lending network may assess fees or penalties.

These drawbacks are hardly insurmountable, though shoppers will need to pay close attention to ensure they know the details of the financing option they’re getting into.

8. Rent-A-Center

When you think of furniture stores with financing for bad credit, you might think of Rent-A-Center. The company has certainly been a mainstay for those looking for rent-to-own furniture options. And while the company has been in business for a while, they’ve streamlined the application process to make it easier than ever to rent furniture.

If you only need furniture temporarily (such as between moves), you can simply rent the items you need with no obligation to buy.

- Multiple leasing and renting options.

- Product repairs are built into the fee.

- Option to own the item in six months.

- No-credit-check options are available.

- Does not affect your credit score.

Rent-A-Center may be a quality option for those looking to lease furniture with little to no credit.

- The costs of leasing can exceed the cost of buying.

- Fees and penalties for missed payments.

- Rent-A-Center does not report payments to credit bureaus.

These features mean you stand a greater chance of hurting your credit than helping your credit. Still, if you’re looking for furniture leasing options, the company offers some features that help them stand out from the competition.

9. Grand Furniture

While several of the above options have been for non-traditional options (leasing, financing apps, etc.), Grand Furniture may be a solid option for those looking for brick-and-mortar furniture stores for bad credit.

The company boasts multiple financing options with no impact on your credit score and up to 60 months of 0% interest financing.

- Low and no down payment options.

- Up to 60 months of interest-free financing.

- No credit check for furniture financing.

Again, these benefits are particularly important for those looking to browse inside physical furniture stores. Financing bad credit customers is possible through the company’s competitive options, and your credit won’t be impacted.

- 0% financing requires additional qualification.

- Grand Furniture does not report to credit bureaus.

- Customers may face fees for late or missed payments.

Additionally, while customers may appreciate a physical store, they’ll also be limited to Grand’s inventory.

Alternatives to Bad Credit Furniture Financing

Now that you know how to finance furniture with bad credit, you may be wondering if it’s a good idea. Generally speaking, you should avoid any sort of financing that costs more than buying the item outright. That’s especially true for furniture, which depreciates over time.

- Buying second-hand furniture until you can save more money.

- Living with roommates to share furniture.

- Creatively repurpose other materials to make end tables, etc.

These solutions can help you furnish your living space without going deeper into debt or using financing options that might harm your credit.

Making the Right Money Moves

Furniture financing can put comfort within easier reach. And as long as you do the math beforehand, you may find furniture loans that work for your budget. But others may want to keep saving and purchase the home furnishings they need when they’re ready and not by taking out additional loans.