It’s Wednesday and as usual I consider a few topics in less depth than a single blog post, as a precursor to the music segment. Yesterday’s US inflation data from the Bureau of Labor Statistics (June 13, 2023) – Consumer Price Index Summary – May 2023 – shows a further significant drop in the inflation rate as some of the key supply-side drivers continue to abate. All the data is pointing to the fact that the US Federal Reserve’s logic is deeply flawed and not fit for purpose. Today, I also discuss the stupidity that is about to begin in Europe again, as the European Commission starts to flex its muscles after it announced to the Member States that it is back to austerity by the end of this year. And finally, some beauty from Europe in the music segment.

The US inflation situation

The BLS published their latest monthly CPI yesterday which showed for May 2023 (seasonally adjusted):

- All Items CPI increased by 0.1 per cent over the month (down from 0.4 per cent in April) and 4.1 per cent over the year (down from 5 per cent in April and 6.4 per cent in January).

- The peak monthly rise was 1.2 per cent in June 2022.

The BLS note that:

The index for shelter was the largest contributor to the monthly all items increase, followed by an increase in the index for used cars and trucks. The food index increased 0.2 percent in May after being unchanged in the previous 2 months … The energy index, in contrast, declined 3.6 percent in May as the major energy component indexes fell …

The all items index increased 4.0 percent for the 12 months ending May; this was the smallest 12-month increase since the period ending March 2021.

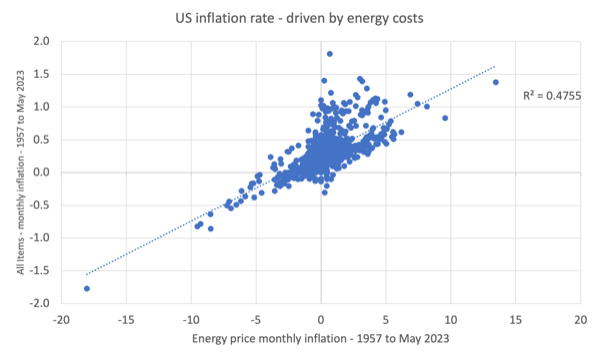

The following graph shows the importance of energy prices to the overall US inflation rate.

The simple regression line (dotted) yields an R2 of 0.48. That means that around 48 per cent of variation in the overall CPI is driven by energy price variation.

It is a little more complicated than that in statistical terms, but, that rough figure is a good guide to how influential energy prices are.

Effectively, the sharp drop in US inflation is down to the sharp drop in energy and petrol prices.

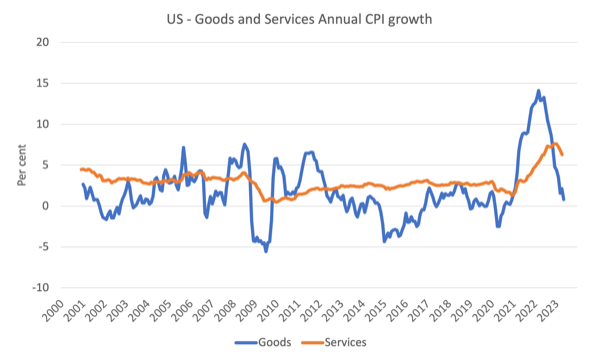

The next graph shows the evolution of annual price rises for the goods sector and for the services sector since 2000 – up to May 2023.

The contention always has been that the inflation has been largely driven and instigated by the supply factors that constrained the ability of the economy to meet demand for goods – the Covid factory and shipping disruptions and the like.

The graph shows clearly that those factors have been in retreat since the second-half of 2022 as the supply chain constraints ease.

The services sector, which is derivative of the supply drivers, lagged behind the goods sector and while still recording higher inflation that the goods sector, now looks to have peaked and is also on the way down.

And the inflation has been falling sharply while the US labour market has been rather stable.

I analysed the latest Bureau of Labor Statistics employment release in this blog post – US labour market – perhaps at a turning point with unemployment rising (June 5, 2023).

While there was a slight slowdown in employment growth there is no sign of a significant recession-type slowdown.

The point is that the lack of correspondence between the labour market dynamics and the inflation dynamics shows the poverty of the logic used by the Federal Reserve Bank to justify their interest rate rises.

The Federal Reserve logic is all about the strength of the labour market (they believe the actual unemployment rate is below the NAIRU) and that drives their zeal to create more unemployment and kill off wages growth, which, in turn, stops inflation in its track.

We also know that household consumption expenditure is not declining very quickly.

The data is thus not kind to the Federal Reserve logic.

The employment release also demonstrated that real wage cuts continue (while moderating), which really takes wages out of the picture when assessing the dynamics of the CPI at present.

Inflation is falling fairly quickly because the main drivers, which are not particularly interest rate sensitive, are in decline.

One rule for some (most), another rule for others (a few)

I have been analysing the commentary provided by the RBA governor Philip Lowe on how is he justifying the ridiculously excessive interest rate increases in Australia for some time now.

He ducks and dives as one story line fails to match the reality but a fairly constant claim is that unless workers take real wage cuts, the RBA will hike rates by even more than now because the wages growth will threaten the inflation target.

Sometimes he puts this in the context of real wages growth – this is his productivity story line where he correctly notes that increasing real living standards in any nation require such growth.

But more recently he has used the productivity line to claim that without productivity growth, real wages have to fall – a subtle shift.

The shift is from productivity growth providing the non-inflationary room for nominal wages to grow faster than the inflation rate, to, productivity growth is required for nominal wages to growth as fast as the inflation rate.

The former contention is correct, the latter is not justified by anything other than the RBA governor thinks that it is reasonable in an inflationary episode for businesses to increase their profit margins.

The governor has been claiming wages growth will compromise the fight against inflation and even claimed last week, in the light of the latest increase in the minimum wage that giving the lowest paid workers are wage rise was one factor that led to the RBA’s decision to further increase interest rates.

Well, I wonder when he is going to comment on the latest data on executive pay.

Today (June 14, 2023), the – Governance Institute of Australia, released their latest report – 2023 Board & Executive Remuneration Report.

The Governance Institute was formerly known as the Chartered Secretaries, Australia organisation, and focuses on “promoting sound practice in governance and risk management”, which includes monitoring CEO remuneration.

While workers’ pay is being cut severely in real purchasing power terms at present, and the RBA governor wants even harsher wage outcomes – or else he will wield his big stick further – the bosses are partying.

The Governance Institute report surveys many Boards of companies, not-for-profits and public organisations.

It found that:

1. “significant remuneration increases across ASX 200 companies with 42% of ASX board directors and 71% of ASX senior executives receiving a pay rise in the last 12 months.”

2. “The remuneration of company secretaries was one such growth area with an average remuneration bump of 11%. Specifically, for ASX 200 companies, this increase was higher at 13%, and 24% when looking at company secretaries of large, listed companies.”

3. “Risk managers also received an average remuneration increase for the last year with a 15% increase.”

4. “Higher bonuses (the potential maximum bonuses that can be offered) were also provided to these professions with risk managers from ASX 200 companies able to receive up to 45% of their fixed salary in bonuses. Likewise, General Counsel & Company Secretaires received an overall average increase of 49%.”

Try rationalising that with the RBA governor’s insistence that workers had to tighten their belts and take the real wage cuts.

And try rationalising that with the demands from the large employer groups and corporations that the Fair Work Commission not increase the wages for the lowest paid by more than 3 per cent in nominal terms, which, of course, represents a massive real wage cut.

There is no rationalisation possible.

This is one law for some (most of us) and another for others (the top-end-of-town).

One media commentary (from a usually business-biased newspaper) wrote today (Source):

… tone-deaf corporate boards that are awarding those base salary increases to their senior executives are risking a community backlash and potentially some blowback from shareholders.

The corporate largesse for executives is even more offensive when businesses have been fighting calls to pay their workers more to match inflation. Wage and salary earners are being told to toe the line and take the pain to avoid a wages spiral that would fuel and entrench inflation.

The Governance Institute study demonstrates that senior executives, already sufficiently well remunerated to be immune from the cost of living pressures felt by many wage earners, are being over-compensated for inflation.

We are living in obscene times for sure.

I urge all readers to write to the Australian companies that pay out these booming rewards to their CEOs and other executives and tell them that you are organising through your social networks widespread boycotts of their products.

Until we really get organised as consumers, this sort of disgusting largesse will continue.

I am doing some more research on the issue to get a list of the worst offenders.

Music – Ola Gjeilo

This is what I have been listening to while working this morning.

I first heard this album – Winter Songs – on a long flight from Japan. The album was released by Decca in 2017.

It is from Norwegian composer – Ola Gjeilo – who works with various string ensembles and choirs to produce a very modern classical sound.

On this track – The Rose II – he combines with the – 12 ensemble – with cellist Max Ruisi.

Very mellow way to study inflation data.

And if choral is your thing, then the Royal Holloway treatment of the song is a treat:

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.