Vanguard is out with its annual deep dive into what its 5 million 401k participants are up to. The firm’s release of How America Saves is chock full of data and charts showing how 401k savings have reached all-time highs at Vanguard; I expect other large plan managers like Fidelity and Schwab to be at or near similar levels.

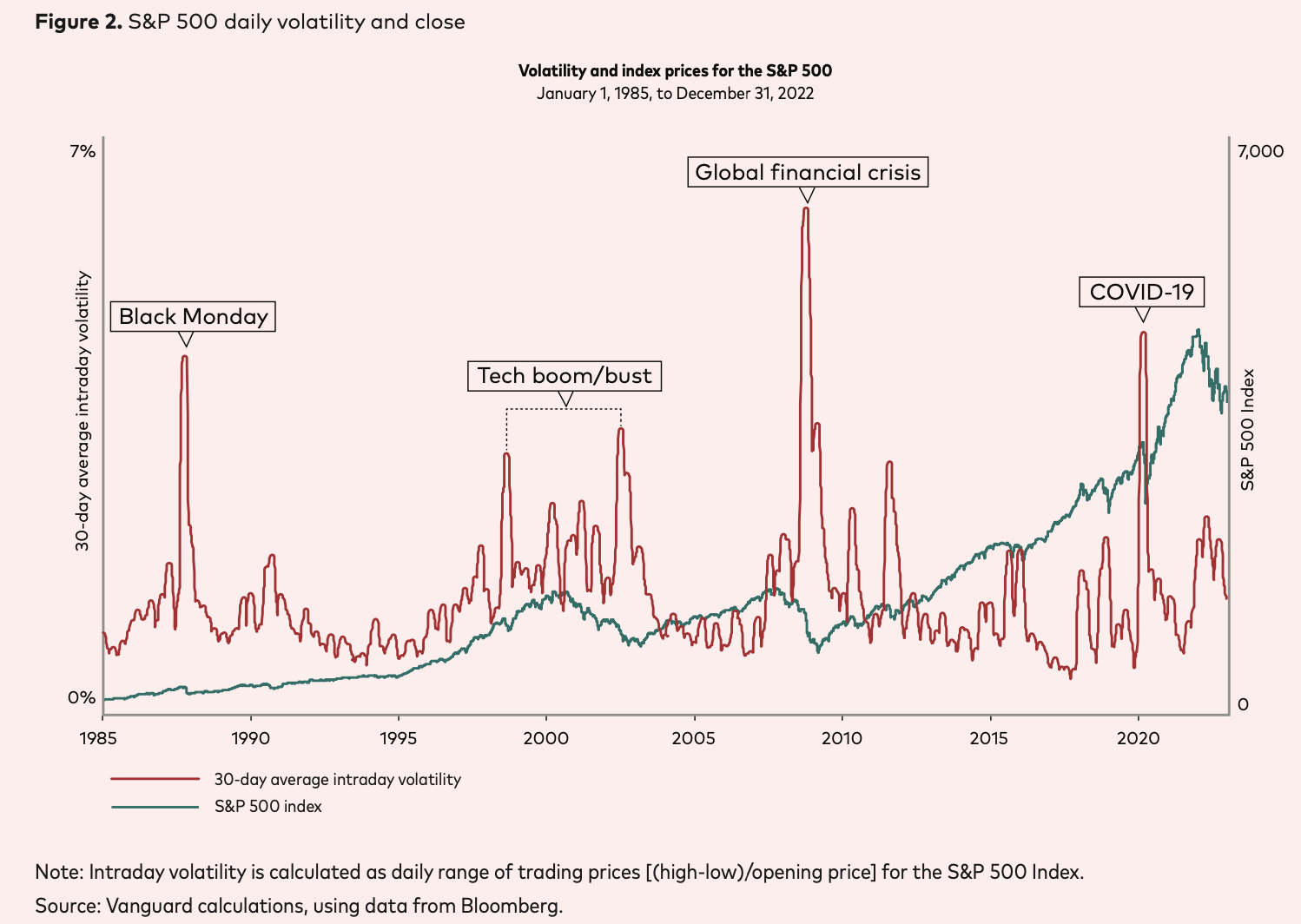

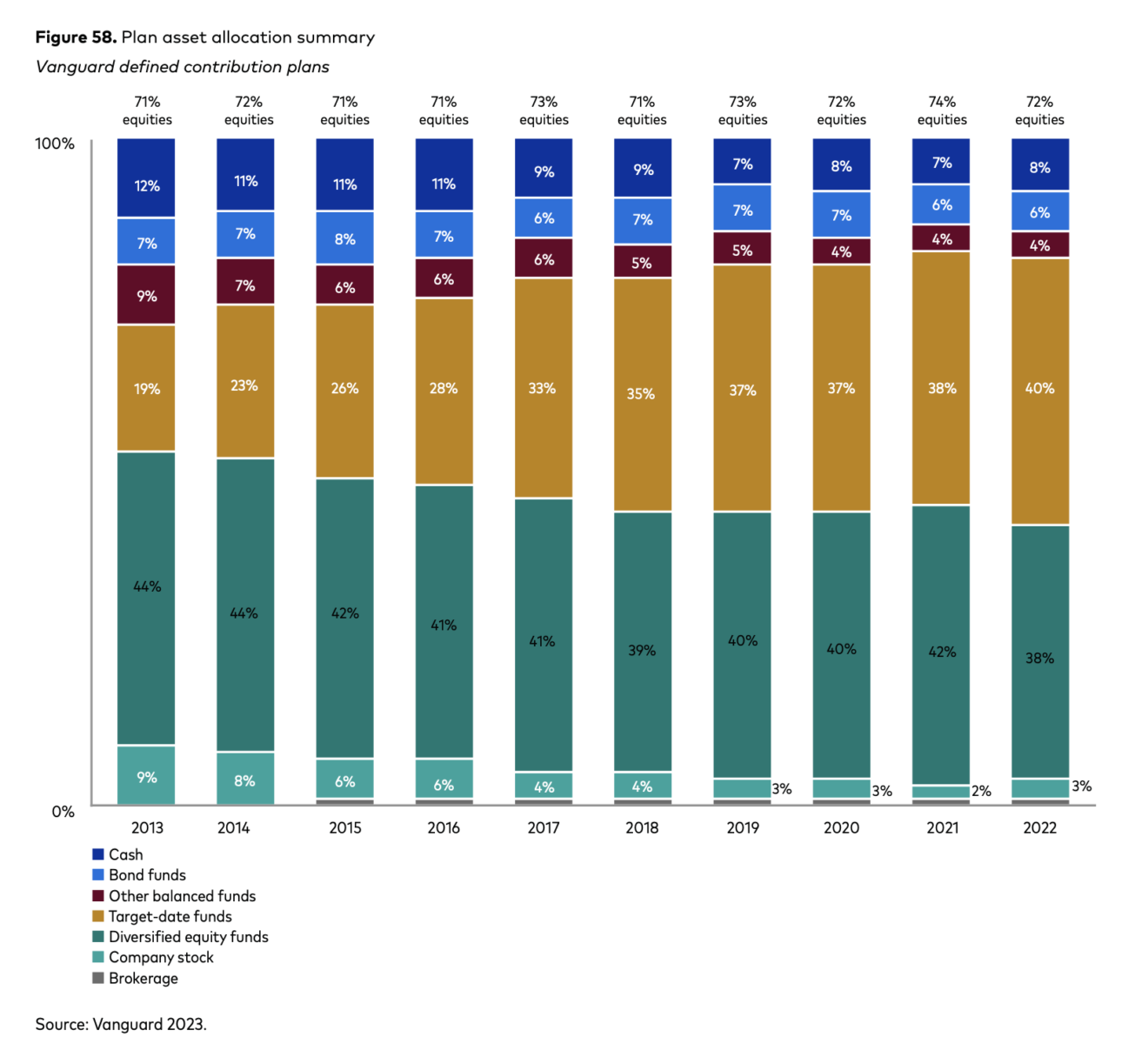

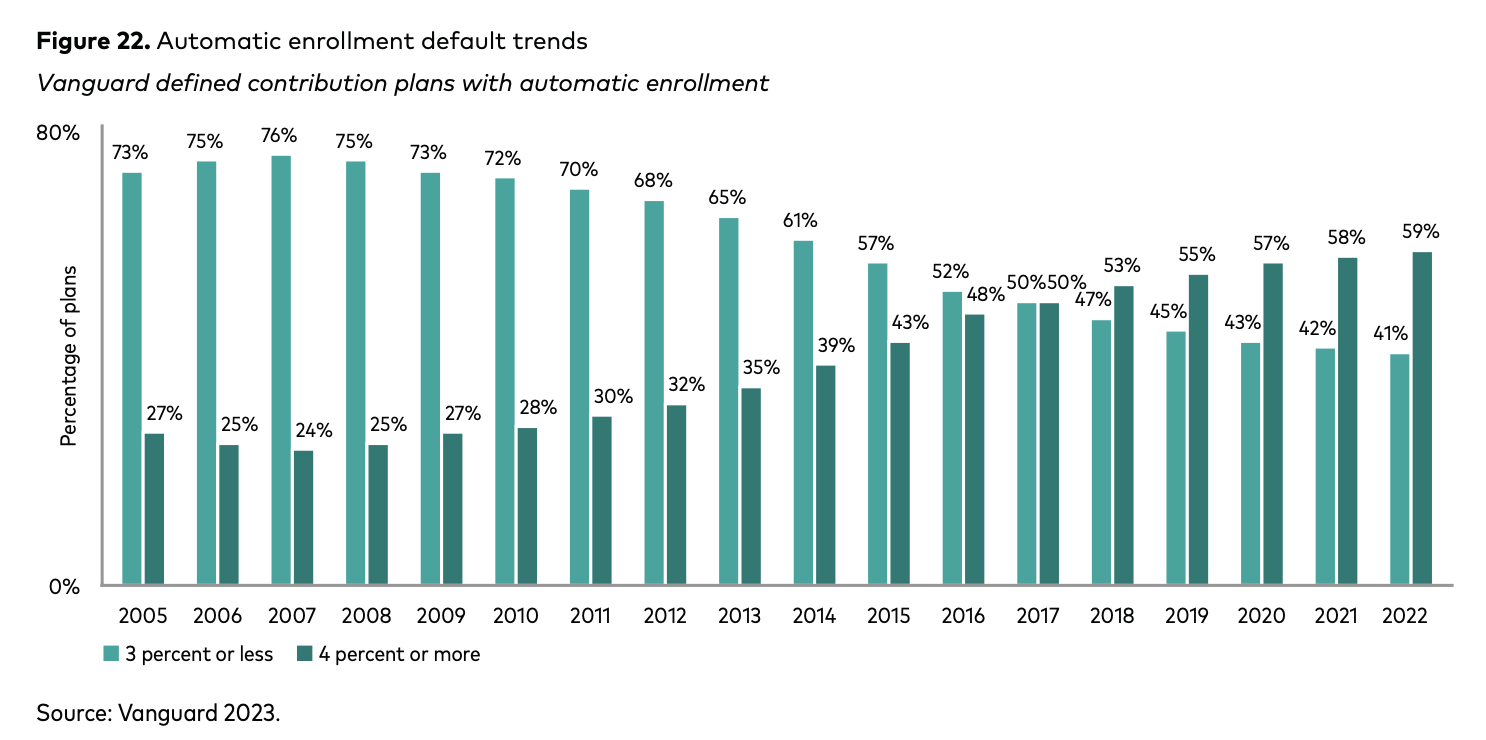

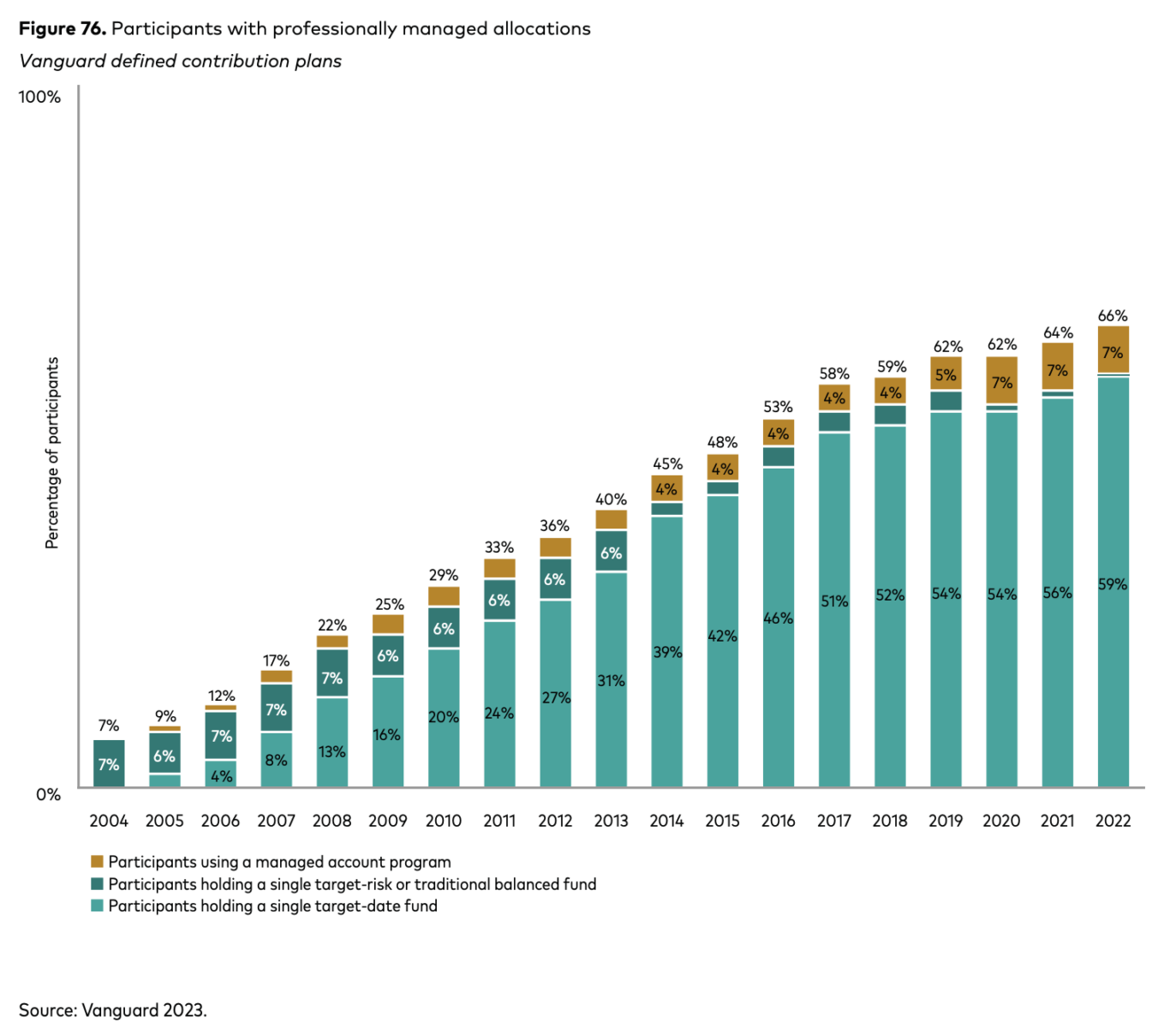

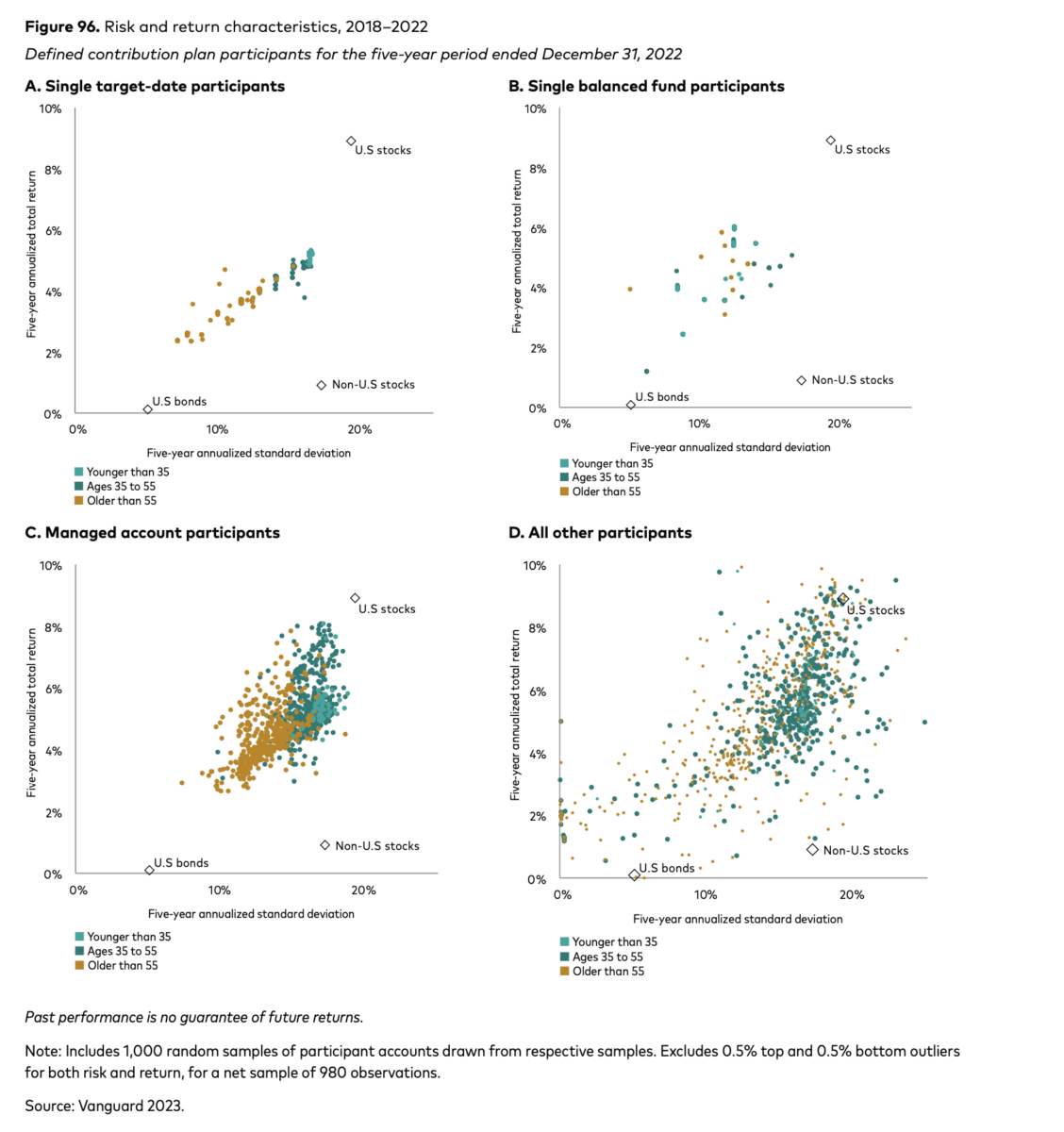

VG credits the impact of automatic enrollment/contribution escalation as leading savers to this milestone. “Record highs in participation, deferral rates, and the use of professionally managed allocations in 2022” added to the totals. The rally off of the June 2022 lows did not hurt either.

Some of the more fascinating data points from the report:

– 2022 featured record-high plan participation rate of 83%, driven in large part by wider adoption of automatic enrollment;

– From 2006 to 2022, automatic enrollment has tripled;

– 41% of all plans offered planning & advice; Larger plans with more than 5,000 employees, 81% offered advice;

– 76% of plans with at least 1,000 participants have adopted this design, bypassing the inertia and procrastination often responsible for inhibiting voluntary enrollment;

– 98% of participants were offered some type of employer contribution; the average employer contribution rate was 11.3%;

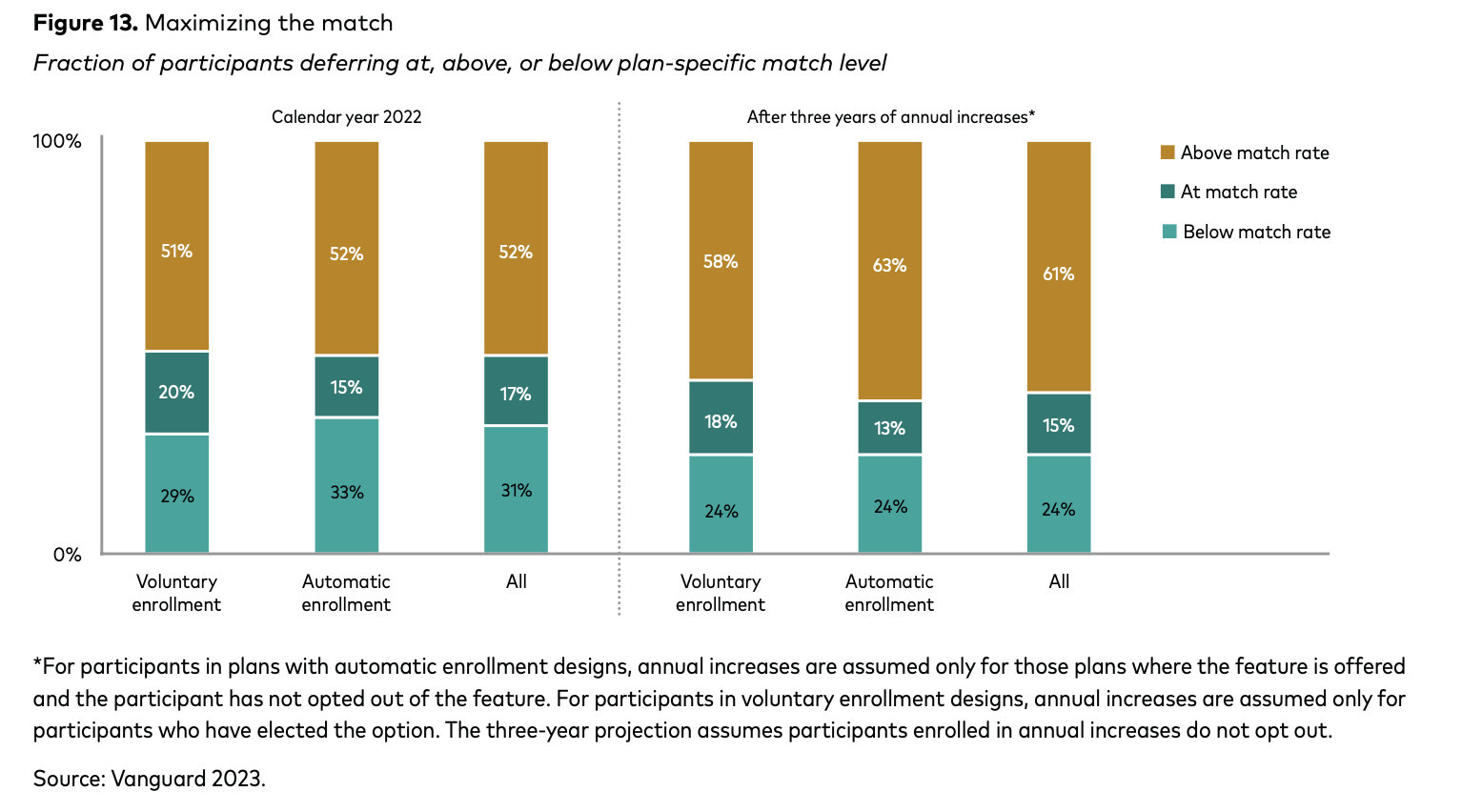

– 20% of participants need a boost of just 1% to 3% to hit their target saving rate;

The entire research report is well worth your time to dive into…

More charts after the jump…

Source:

How America Saves 2023 (PDF)

John James

Vanguard Group, June 2023

Selected Charts

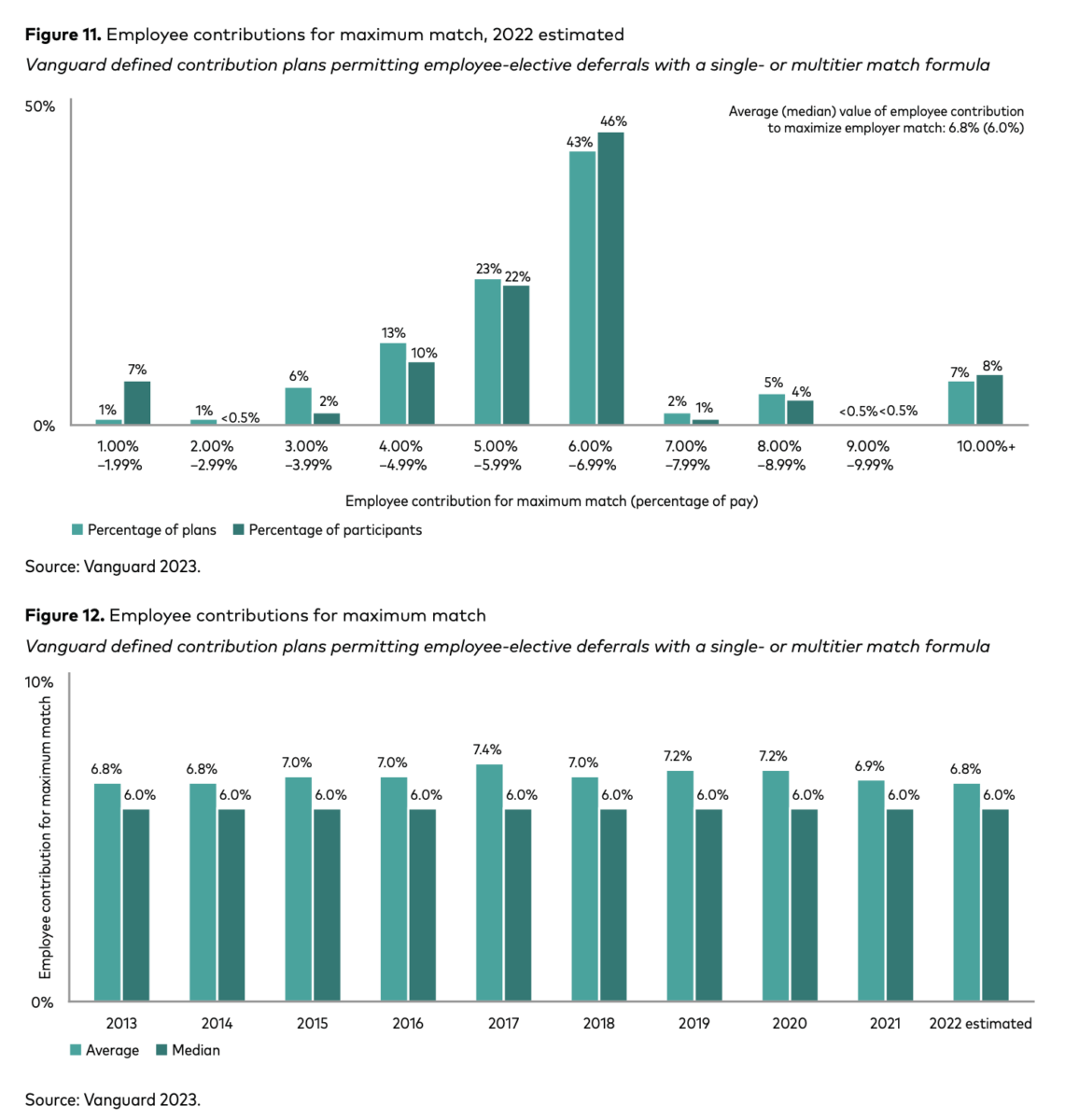

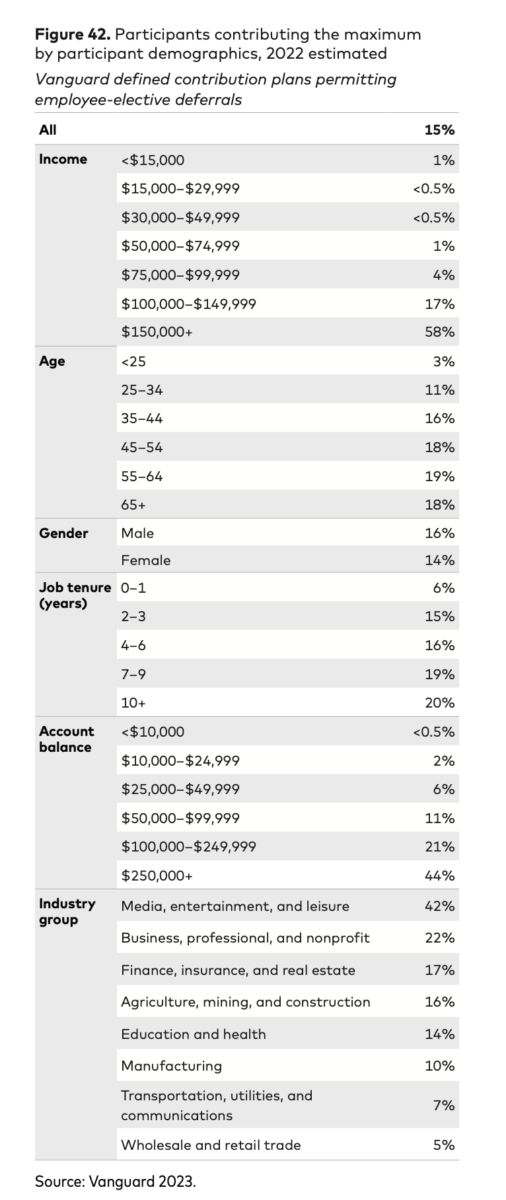

Employees with Maximum Matches