Fixed mortgage rates are once again on the rise, with rates under 5% quickly becoming a distant memory.

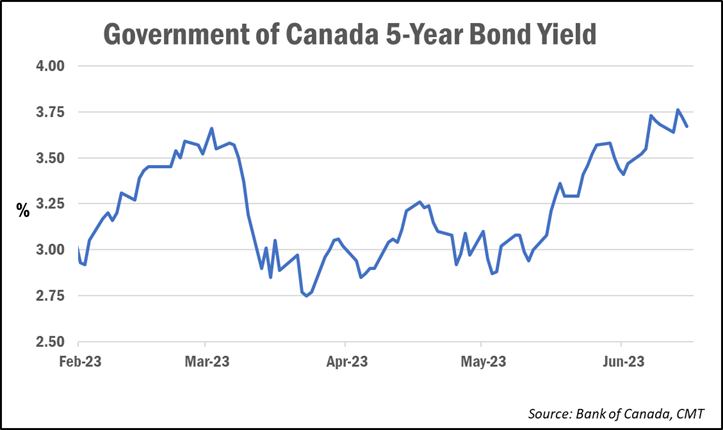

Many lenders, including a number of the Big 6 banks, started hiking rates earlier this week following fresh highs in the Government of Canada bond yield, which typically leads fixed mortgage rates.

On Monday, the 5-year bond yield closed at 3.76%. It then reached an intraday high of 3.84% on Tuesday, approaching highs last seen in November.

Fixed-rate hikes have been widespread among brokerages, monoline lenders and the big banks, with all terms being impacted.

The lowest nationally available deep-discount fixed mortgage rates have surged between 15 and 35 bps since the beginning of the month, according to data from MortgageLogic.news. That jump has largely mirrored the 25-bps rate hike for variable-rate borrowers, which came as a result of the Bank of Canada’s quarter-point rate hike last week.

Posted rates at the Big 6 banks have also been rising. The lowest high-ratio 5-year fixed posted rate, which was available from TD Bank earlier this month, has since jumped by 30 basis points to 5.19%.

“Today’s fixed mortgage rates now reflect the higher-for-longer view,” Integrated Mortgage Planners broker Dave Larock wrote in his latest blog post. “For now, the bond market has capitulated to the BoC.”

Markets are now pricing in at least one additional Bank of Canada rate hike, with the earliest rate cuts now not expected until summer 2024.

It’s a similar scenario south of the border, where additional rate hikes are now expected in spite of yesterday’s rate pause by the Federal Reserve. New projections there show that nine of the 18 Fed officials expect the benchmark rate to rise by another half a percentage point, while three officials believe it needs to move even higher.

“The recent spike in GoC bond yields now has them priced on the assumption that the BoC is likely to hike its policy rates again before the year is out,” Larock explained.

“In turn, that surge introduces the possibility of some near-term give-back (as is often the case after a big move),” he continued. “That should hold fixed mortgage rates steady at their new, higher levels for the time being.”

Rates under 5% are quickly disappearing

The latest hikes have made fixed mortgage rates under 5% a dying breed, with just a handful of posted specials available for 4- and 5-year terms.

“Every rate will probably start with a 5, and some with a 6, by next week,” tweeted Ron Butler of Butler Mortgage.

He recommended that anyone in the market for a mortgage act to get a rate hold right away.

Despite high rates across the board for all terms, Larock said he believes the safest pick, “and who wants to aim for the middle of the fairway,” is a 3-year fixed.

While that may entail paying an above-market in the latter part of the term, he said it’s a trade-off some borrowers will be willing to make given the alternative options.

“The alternatives are even longer terms (which exacerbate that risk) or variable rates and shorter-term fixed rates (which seem to be rising inexorably),” he noted.