6. Litigation & Financial Results

Is There a Problem?

I have been watching Illumina for a long time now, but for years its valuation was simply too pricey to make for a compelling investment. This became even more true during the pandemic when every medical and bio stock exploded upward. Illumina’s revenues jumped from $3.2B in 2020 to $4.5B in 2021.

Growth stocks slowed down post-pandemic, and this has not been good for Illumina’s stock price. Shares have dropped 60% from their 2021 peak, erasing all the pandemic gains and then some.

Revenue growth has also slowed, reaching “only” $4.7B TTM (Trailing Twelve Months).

Illumina’s CEO himself called the Q2 2022 performance “disappointing“, due to macroeconomic headwinds. Gross margins dropped slightly to 66% (still impressive), and R&D spending rose massively, from $202M to $327M.

| GAAP | Non-GAAP (a) | |||

|---|---|---|---|---|

| Dollars in millions, except per share amounts | Q2 2002 (b) | Q2 2021 | Q2 2022 (b) | Q2 2021 |

| Revenue | $ 1,162 | $ 1,126 | ||

| Gross margin | 66.0% | 71.2% | 69.4% | 71.8% |

| Research and development (“R&D”) expense | $ 327 | $ 202 | $ 327 | $ 202 |

| Selling, general and administrative (“SG&A”) expense | $ 410 | $ 413 | $ 339 | $ 269 |

| Legal contingencies | $ 609 | $ – | $ – | $ – |

| Operating (loss) profit | $ (579) | $ 187 | $ 141 | $ 338 |

| Operating margin | (49.8)% | 16.6% | 12.2% | 30.0% |

| Net (loss) income | $ (535) | $ 185 | $ 91 | $ 276 |

| Diluted (loss) earnings per share | $ (3.40) | $ 1.26 | $ 0.57 | $ 1.87 |

Source: Illumina Q2 2022

To add to these temporary issues, a charge of $609 million in legal contingencies has been put aside, leaving the company registering a loss for the first time in a decade.

Legal costs as high as half of the quarter revenue could be a big red flag, so let’s look at what happened.

Grail’s Botched M&A

Grail is a biotech company looking to develop an early cancer test using Illumina’s NGS technology. Being able to routinely check for cancer through a blood test (“liquid biopsy”) would be a true revolution, likely saving millions of lives every year.

Grail is currently enrolling participants in a truly massive clinical trial (1 million people), which could lead to the test being commercialized in 2 years.

Grail’s history is rather complex. It was a spin-off from Illumina formed in 2016 as a separate company. It has since raised $2B, including from Jeff Bezos and Bill Gates. Illumina still held 14.5% of the Grail stocks.

Illumina then decided to buy back the whole of Grail, for the hefty sum of $9.7B.

The acquisition was offered half in cash and half in Illumina’s shares. I considered that a good option, and would even have welcomed a larger debt component, as Illumina has very little debt (total liabilities are just a little higher than its $2.9B in current assets).

Still, I have to question what went wrong, considering that Illumina should clearly have kept Grail in-house from the beginning, and financed its development alone.

It is possible that Illumina executives did not fully believe in the project at the time, moved to spread the risk, and were surprised by better-than-expected results.

This was the first mistake, a $7.7B mistake, or 1/4 of Illumina’s current valuation. Clearly, Illumina sees something in Grail’s results that make it want to buy out the other shareholders at almost any cost.

Such an acquisition can also create its own set of issues. Many of Illumina’s clients are developing competing products, and this could create conflicts of interest.

On top of this, the acquisition was challenged by anti-trust regulators on both sides of the Atlantic, mostly because of the risk of conflict of interest with other companies.

In the US, questions are coming from the FTC, which also blocked Illumina’s 2019 tentative to acquire its only real competitor, PacBio.

In the EU, the conflict escalated further, with the threat of a fine equal to 10% of the company’s global turnover.

Still, Illumina pressed on with the merger, “Regulators be damned” as commented in the industry press.

The expected 2024 FDA approval of Grail’s main test and a target of 50 million people tested (and a price tag per test of around $900-$1,000) is probably behind the rush. Even if spread over many years, this would be 10x Illumina’s current turnover.

In the long term, this mess with Grail should not have much impact on Illumina. It has still made for wasted money and negative headlines and it has hammered the stock price.

Option 1 is that the merger actually happens. This might make Illumina both an equipment and a very successful diagnostic company. It would be an expensive acquisition that could have been avoided, but will likely be a profitable one. Maybe a later IPO in 5 years or more could alleviate conflict of interest risk and still earn Illumina a large financial gain.

Option 2 is for the merger to be forced to unwind by EU and US regulators. Then Illumina will still own 14.5% of Grail, Grail will still run its test using Illumina machines, and Grail’s competitors will likely rely as well on Illumina’s best-in-class sequencers.

So overall, I expect this to be a temporary storm. It does not reflect very well on management’s strategic decisions, and this might be the worst aspect of the company.

But it is not as catastrophic as the recent stock price drop makes it appear. Legal costs are already covered now, so it should not affect future profitability.

Valuation

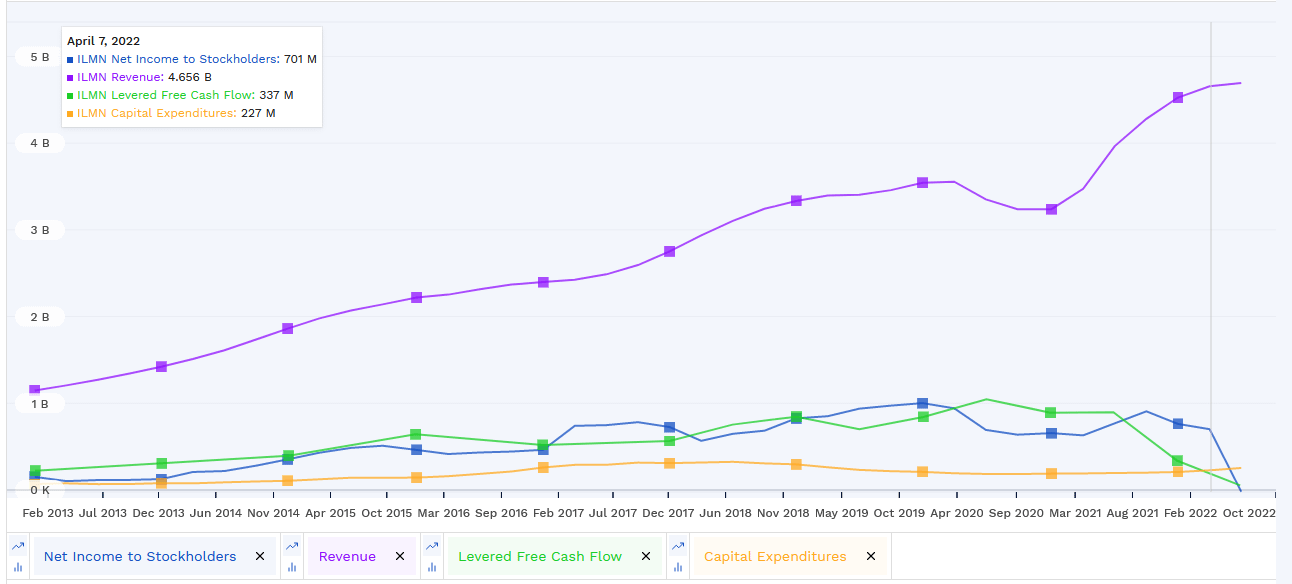

When drawing the last 10 years of Illumina’s performance on a graph, I stumble upon the issue of the last quarter’s loss (from acquisition costs and legal fees) which makes past growth not really readable. So I instead will show the revenue, net income, and cash flow until Q1 2022.

I think the growth profile of the company is still intact. Revenues are still in the same trend The only thing impacting free cash flow in the curve below is a 50% increase in R&D spending, something that should pay off in an even stronger long-term moat.

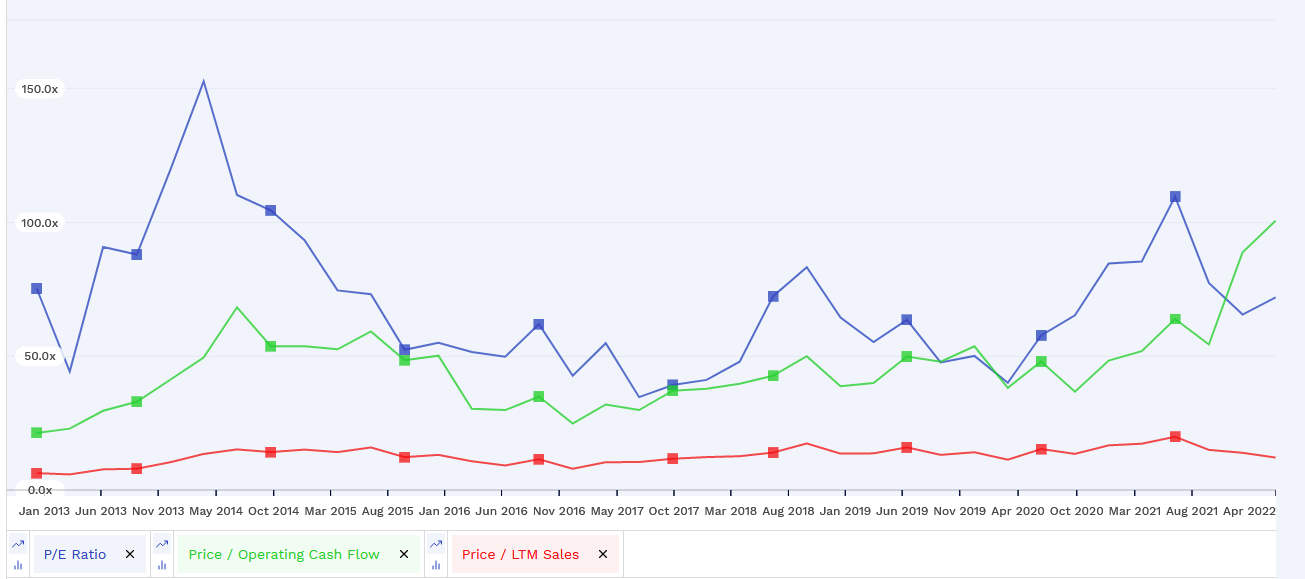

When it comes to valuation ratios, Illumina has been (justifiably in my opinion) valued at a high P/E between 40 and 130. Similarly high, price-to-sales oscillated from 6 to 20, and price-to-operating-cash-flow from 21 to 89.

The current price-to-sales ratio is 6.6. Earnings are negative so there’s no P/E. Same for free cash flow.

The current negative earnings and free cash flow are a direct result of the Grail acquisition costs and potential associated fines. At most, Grail will decrease total free cash flow while it gets ready for commercialization.

So this is mostly a one-time or short-term event that will not change the core moat and quality of Illumina.

With the price-to-sales ratio lower than in a decade, I think the stock is quite reasonably valued and potentially undervalued.

Returns to Shareholders

Illumina prefers share repurchases to dividends as a way to return capital to shareholders.

One on hand, considering the growth profile, this might be a good idea. On the other hand, considering the relatively high valuation of the company, I am not entirely convinced this is the ideal way to do it.

Illumina repurchased $750M worth of shares between February 2020 and now. With how expensive the share prices were at the time, I question the timing and capital allocation skill of Illumina’s management.