LIC recently (On 23rd June 2023) launched a single premium and guaranteed endowment policy called LIC Dhan Vriddhi (Table No. 869). It is a traditional endowment single premium plan with a GUARANTEED tag attached to it. Should you invest?

Let us first try to look into the features and benefits of the LIC Dhan Vriddhi Plan (869).

LIC Dhan Vriddhi Plan (869) Features and Eligibility

- LIC Dhan Vriddhi is a single premium plan.

- Here, you have two options to choose from regarding the sum assured. Option-1 is 1.25 times of the single premium and Option-2 is 10 times the single premium. You have no option to change these options during the policy period. In simple, if the policyholder dies within the term of the Policy Death Benefit paid to the Nominee i.e.

- Option 1 = 1.25 times of Basic Sum Assured + Accrued Guaranteed Bonus

- Option 2 = 10 times of Basic Sum Assured + Accrued Guaranteed Bonus

- The term of the policy is – 10, 15, or 18 years.

- The minimum entry age is 8 years for a 10-year policy term; 3 years for a 15-year policy term; and 90 days for an 18-year policy term.

- The maximum maturity age is 60 years for Option 1, 32 years for Option 2 (18 years policy), 35 years for Option 2 (15 years policy and 40 years for Option 2 (10 years).

- The minimum basic sum assured is Rs.1.25 lakh for the policy and there is no upper limit on the maximum sum assured.

- Two optional riders are available under this plan:

- (a) LIC’s Accidental Death and Disability Benefit Rider, and

- (b) LIC’s New Term Assurance Rider.

- Date of Commencement of Risk: In the case of children whose age is less than 8 years risk commencement starts either from 2 years of taking the policy or 8 years old which is earlier.

- You can surrender at any time (subject to conditions).

- A loan facility is available after 3 months under this policy.

- Cooling-off Period – If a policyholder is not satisfied with the ‘Terms and Conditions” of the policy, he/she may return the policy within 15 days from the date of receipt of the policy.

LIC Dhan Vriddhi Plan (869) – Benefits

# Survival Benefit:

On Life Assured survive up to the policy period, then the policyholder will receive the “Basic Sum Assured” along with accrued Guaranteed Additions will be payable.

The Policyholder/Life Assured shall have the option to receive the Maturity Benefit in lumpsum as specified above and/or in installments (Settlement Option).

The installments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for subject to minimum installment amounts for different modes of payments being as under:

Monthly – Rs.5,000, Quarterly – Rs.15,000, Half-Yearly – Rs.25,000, and Yearly – Rs.50,000.

If the Net Claim Amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Policyholder/Life Assured, the claim proceeds shall be paid in lumpsum only.

For exercising the Settlement Option against Maturity Benefit, the Policyholder/Life Assured shall be required to exercise the option for payment of the net claim amount in installments at least 3 months before the due date of the maturity claim.

However, after a certain period, if someone wishes to discontinue this option, then the future payments arrive at today’s discounted value, and accordingly the remaining amount is payable as a lump sum.

# Death Benefit:

On the death of the Life Assured, during the policy term after the date of commencement of risk but before the maturity date, then the nominee will receive “Sum Assured on Death” along with accrued Guaranteed Additions.

“Sum Assured on Death” for both options are defined as under:

Option 1: 1.25 times of Tabular Premium for the chosen Basic Sum Assured

Option 2: 10 times of Tabular Premium for the chosen Basic Sum Assured

where Tabular Premium shall be based on the age at entry of the life assured, policy term, and the option chosen but before allowing for any rebate. It does not include taxes, extra premiums, and rider premium(s), if any.

However, in case of minor Life Assured, whose age at entry is below 8 years, on death before the commencement of Risk, the death benefit payable shall be a refund of premium(s) paid (excluding taxes and extra premium(s), if any) without interest.

Meaning of commencement of Risk –

In case the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement of policy or from the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier.

For those aged 8 years or more at entry, risk will commence immediately from the Date of issuance of the policy.

What is GUARANTEED in LIC Dhan Vriddhi Plan (869)?

The eye-catching tagline of this product is GUARANTEED. Let us see what is guaranteed.

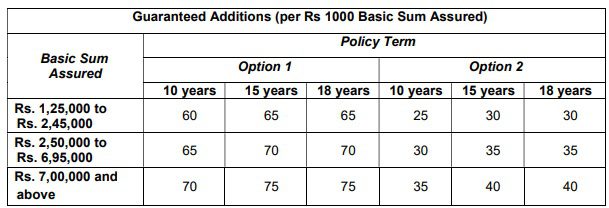

Let me give you an example of how this will work out. Let us assume that you have opted for a basic sum assured policy of Rs.2,00,000 and a term of 18 years. If you have chosen option 1, then every year LIC will add the guaranteed addition of Rs.13,000 to your policy up to the next 18 years.

Surrender Option of LIC Dhan Vriddhi policy

The policy can be surrendered by the Policyholder at any time during the policy term. On surrender of the policy, the Corporation shall pay the Surrender Value equal to the higher of Guaranteed Surrender Value and Special Surrender Value.

The Guaranteed Surrender Value (GSV) payable under the policy shall be:

- During the First three policy year: 75% of the Single Premium

- Thereafter: 90% of the Single Premium Single premium referred above shall not include taxes, extra premiums and rider premium(s), if any.

In addition, the surrender value of accrued Guaranteed Additions i.e. accrued Guaranteed Additions multiplied by GSV factor applicable to the accrued Guaranteed Additions, shall also be payable. These GSV factors expressed as percentages will depend on the policy term and policy year in which the policy is surrendered and are given below:

How much returns can we expect from LIC Dhan Vriddhi Plan (869)?

As everything in this policy is GUARANTEED, let us take an example and calculate how much returns we can expect by investing in this policy.

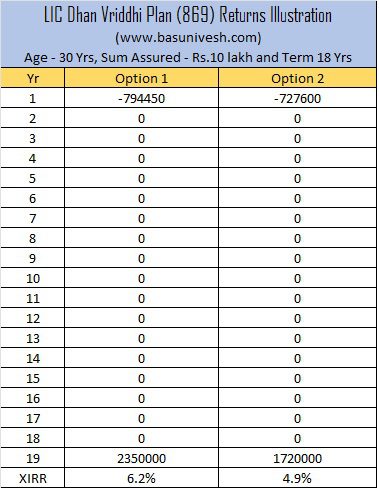

Let us assume that a 30-year-old guy is purchasing this policy of Rs.10,00,000 sum assured. For this, the premium he has to pay is Rs.7,94,450. Assume that he has opted the Option 1. Then, the sum assured at death will be –

Sum Assured on Death is 1.25 times X Single Premium (before GST) = Rs.9,93,062.

If the death happens during the policy period, then his nominee will receive Rs.9,93,062 + Accrued Guaranteed Bonus.

Now let us assume that the person is surviving for the next 18 years, then as per the above-guaranteed bonus table, the policy will get Rs.75 as GA (Guaranteed Addition) per Rs.1,000 sum assured. As the sum assured opted is Rs.10,00,000, the policyholder will get Rs.75,000 as GA to be ADDED TO HIS POLICY (which policyholder will get this maturity or death happens then to the nominee).

Hence, at maturity, the policyholder will receive Rs.75,000*18 Yrs = Rs.13,50,000 as GA + Rs.10,00,000 Sum Assured = Rs.23,50,000.

Now assume that he has opted the Option 2. The premium for this is Rs.7,27,600. Then, the sum assured at death will be –

Sum Assured on Death is 10 times X Single Premium = Rs.72,76,000.

If the death happens during the policy period, then his nominee will receive Rs.72,76,000 + Accrued Guaranteed Bonus.

Now let us assume that the person is surviving for the next 18 years, then he will receive yearly GS as per the above table is Rs.40 per Rs.1,000 Sum Assured. As the sum assured opted is Rs.10,00,000, the policyholder will get Rs.40,000 as GA to be ADDED TO HIS POLICY (which policyholder will get this maturity or death happens then to the nominee).

Hence, at maturity, the policyholder will receive Rs.40,000*18 Yrs = Rs.7,20,000 as GA + Rs.10,00,000 Sum Assured = Rs.17,20,000.

Now let us try to understand the IRR or return on investment from both versions of this policy.

Woow…from Option 1, you are getting around 6.2% returns right? Hold on…there is a catch here. This 6.2% return is not tax-free!!. But the option 2 returns are tax-free.

As per Section 10(10D) of the Income Tax Act, if the policy premium is greater than 10% of the Sum Assured, then the maturity amount is taxable. But in the case of option 1, it is just 1.25 times the premium you paid. Hence, option 1 maturity proceeds are taxable as per your tax slab and option 2 maturity proceeds are tax-free.

Also, the yearly aggregate premium should be less than Rs. 5 lakhs (effective from 1st April 2023) to avail of the tax-free maturity from this policy. Hence, this new rule is applicable for both Option 1 and Option 2. To understand the taxation of insurance policies, then refer to my article “Insurance Policy Tax Benefits – Under New / Old Tax Regime“.

It is now clear from the above tax rules that if opt for Option 1, then the income is taxable which reduces your post-tax returns (If you are under 30% tax slab, then post-tax it is 4,34%). However, if you invested more than Rs.5 lakh, then no matter whatever option you choose, the returns are taxable.

LIC Dhan Vriddhi Plan (869) GUARANTEED Plan – Should you invest?

You noticed that even though GUARANTEED is the big tagline with this product, the returns are pathetic. However, if you are happy with around 4% to 6% (6% possible only if the policyholder chooses Option1 and remains within the basic tax exemption limit at the time of maturity and also the premium paid is less than Rs.5 lakh) returns by investing for 18 years, then obviously you can choose it!!. Because the word GUARANTEED is there and the brand LIC is associated with it

Liquidity is also always a concern in such policies as the GSV rules reduce returns.