Copper is the invisible backbone of the modern world. It is required in every single wire, transformer, electronic device, battery, EV, windmill, solar panel, motor, air conditioner, and much more.

On top of this pre-existing demand, the green transition is boosting copper demand drastically. A traditional car uses 23kg of copper, while an EV needs around 100kg[1]. The same holds true for renewable power, batteries, and the new electric transmission required for the electrification of everything.

This translates into the demand for copper doubling by 2035.

it will be extremely difficult to deliver that scale of supply over the time frame. (…) With all this, there is still not enough copper, even in the High Ambition Scenario. Under this scenario, the maximum annual shortfall would be in the mid-2030s, at 1.6 MMt in 2035. Then the pressures ease because of the increase in recycling and the slowing of growth, particularly in energy transition demand.

S&P Global: The Future of Copper

So betting on copper is a bet on economic growth, the green transition, and a more efficient modern world.

Best Copper Stocks

As a central part of every electric system, copper is never going to be replaced by another metal any time soon.

So let’s look at the best copper stocks.

These are designed as introductions, and if something catches your eye, you will want to do additional research!

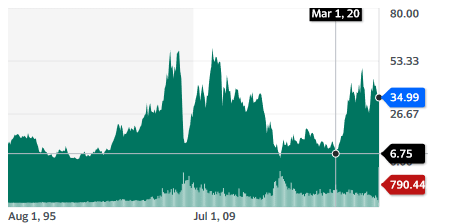

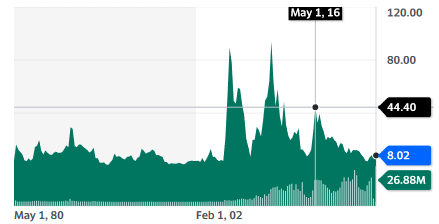

1. Freeport-McMoRan Inc. (FCX)

Freeport was created in a 1988 IPO after the discovery of the Grasberg gold & copper deposit in Indonesia, still its most important asset to this day. The company also has multiple mines in the Americas (USA, Peru, Chile) and 25+ years’ worth of copper reserves.

In 2022, FCX produced 4.2 Blbs of copper and 1.8 Moz of gold. The company should be able to maintain this level of production at least until 2025.

Freeport has a policy to pay back 50% of free cash flow to shareholders with buybacks and dividends. The company has a total of $10.6B in debt, and $8.1B in cash, with debt maturity after 2028.

The multi-decade reserves (44% in the US) and very manageable debt make Freeport a good copper stock for prudent investors. Its diversified locations also reduce geopolitical risk.

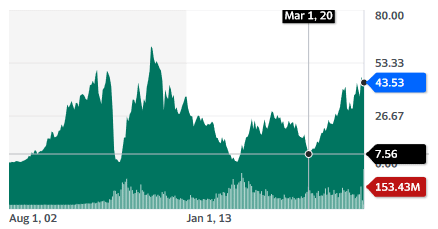

2. Teck Resources Limited (TECK)

Teck is a large mining company focused on steelmaking coal and base metals, mostly zinc and copper. Teck has been working on splitting the company into two parts so the “green” copper segment will not be weighted down by the “ESG-unfriendly” coal segment.

Things got complicated when mega-miner Glencore tried a takeover to later spin off its own coal business together with Teck’s. This led to the splitting plans being withdrawn. Another separation plan is still in the making.

These distractions do not change the fact that Teck is planning to double its copper output (Currently 600k tons per year) by 2027-2029 and then double it again in the long term.

Teck is for investors willing to stomach the short-term confusion about splitting coal and copper operations and looking for strong production growth.

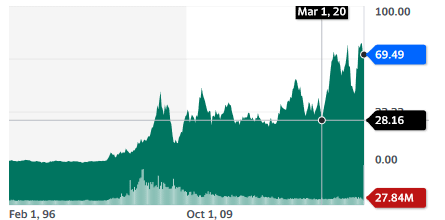

3. Southern Copper Corporation (SCCO)

The company operates in Peru and Mexico, with 11% of the shares in free float and 89% owned by GrupoMexico Mineria.

The company has among the lowest production costs in the copper industry, along with Glencore and Freeport.

It expects to produce 939kt of copper in 2023 and has 44.8 million tons in reserves, the highest copper reserve of any listed company. 77% of the company’s revenues are from copper, with the rest from molybdenum (10%) and a few other base metals.

Southern Copper plans to increase production by 210 kt of copper by 2026 and to 545 kt by 2032.

The company has been strengthening its balance sheet, with cash & equivalent now at $5.1B for a total debt of $6.2B.

This is a pure play in copper with outstanding reserves. This makes the stock interesting for investors looking for as much copper exposure as possible, produced for as long as possible. The jurisdiction risks are nevertheless real, compensating for the very low geological risk.

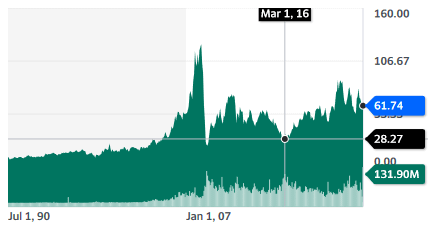

4. Rio Tinto Group (RIO)

The mining giant is, for now, mostly getting revenues from its iron mines in Australia. It is nevertheless active in copper and looking to expand its presence in this market. Rio Tinto has also recently entered the lithium market with the Ricon Project in Argentina. It is also producing diamonds and green aluminum with hydropower energy.

Crucial to these plans is the copper-gold Oyu Tolgoi mine in Mongolia. It is being expanded to double the current production and should be the 4th largest copper mine in the world by 2030, in the first quartile of the cost curve.

The company is also “under immense pressure to develop a US copper project” worth 1/4 of the USA’s total copper reserves.

Rio Tinto also owns Nuton, a technology company that developed a method to extract more copper from ore than before. It could free up to 100 million tons of copper currently trapped in residual tailings. This technology can notably be leveraged to sign deals to acquire a small portion of other copper mines, like recently with McEwen, Arizona Sonoran Copper Company, or Regulus.

The company has a history of maintaining a stable dividend of 40-60% of the underlying earnings.

Rio Tinto is a company for investors looking for general exposure to mining and solid dividend yield, with a strong upside and growth in green transition metals.

5. McEwen Mining Inc. (MUX)

McEwen Mining is a mining company developing precious metal and copper assets.

The company currently operates three gold & silver mines, with the production of 150k-170k gold equivalent ounces (GOE) expected in 2023. It recently raised $82M, which will be enough to bring the Fenix project in Mexico into production at a 26k GOE.

The future flagship of the company is the McEwen Copper subdivision, with the Los Azules Argentinian mine project expected to be the 9th largest in the world, with 36 years of mine life.

McEwen Copper has recently received investment from Rio Tinto’s tech company Nuton and car manufacturer Stellantis (16 brands: Peugeot, Fiat, Chrysler, Citroen, Opel, Maserati, etc.). It is also owned at 13.8% by its founder Rob McEwen, the founder of Goldcorp, who grew the company from $50M to $8B.

The recent capital raise from Nuton and Stellantis for Los Azules put the project value at $550M, more than McEwen Mining’s market cap of $366.6 million. Together, Nuton and Stellantis have invested a total of $210M in Los Azules.

Investors will want to keep an eye on the potential dilution of McEwen mining ownership in McEwen Copper, as the company is likely to have less than $50-100M of free cash flow available every year to finance the $2.4B needed capex to develop Los Azules. Of course, debt and proportional investment by Stellantis and Nuton could provide additional funding as well.

Still, Los Azules is a very valuable asset, and the recent valuation indicates a potential undervaluation of McEwen. Investors willing to wait and to bet on copper price in a 5-10 years horizon will be most interested in this large undeveloped deposit.

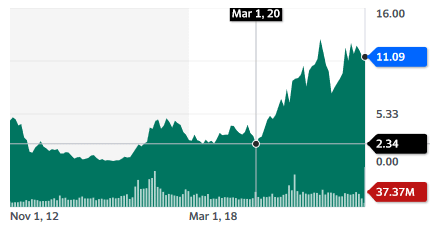

6. Ivanhoe Mines Ltd. (IVN.TO)

Ivanhoe is a leading mining company producing zinc, copper, and precious metals. It operates in South Africa and the Democratic Republic of Congo (DRC).

Ivanhoe produced 333kt of copper in 2022 and plans to ramp up production to 11.4 Mtpa by 2026 and a maximum of 19 Mtpa from 2030 to 2054. The company represents approximately 4% of the total GDP of the DRC.

The jurisdictions where Ivanhoe Mines operates are far from ideal, between a troubled South Africa and a very underdeveloped Congo. What will drive investors to this stock is the promise of extraordinarily large reserves and a potential doubling of production in the 2020s. The stock has gone up almost 5x since its 2020 lows, so some of this growth might be already priced in.

Best Copper ETF

In the mining sector exposed to jurisdictions and geopolitical risk, diversification can be very important. So you might be interested in ETFs targeting the sector as a whole.

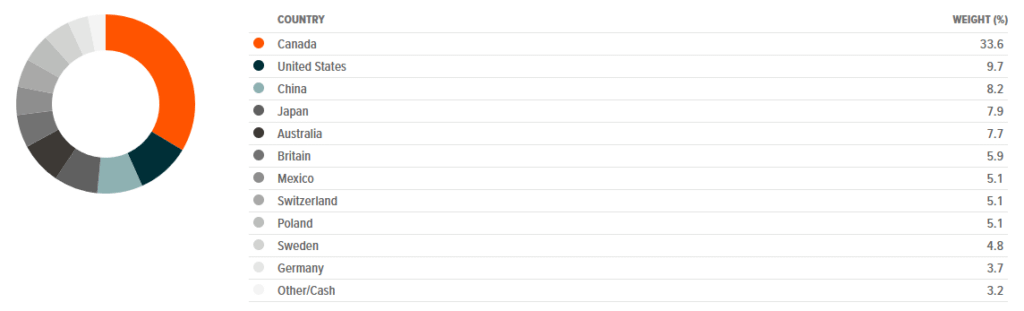

Global X Copper Miners ETF (COPX)

This ETF invests solely in mining companies active in copper. It might nevertheless give some level of exposure to other metals, with its top 5 holdings including Lundin Mining, Teck, and BHP.

While Canada and the USA appear as top holdings (see below), investors will want to check where the mines are actually located, even those with a listing or headquarters in North America.

Best Copper ETNs

COPX is the only exclusively copper-focused ETF, with other mining ETFs potentially including copper but with exposure to other base metals and/or precious metals. Another way to bet on copper is to buy the commodity itself through two available ETNs (Exchange Traded Notes):

Conclusion

Copper is a vital component of the green transition and modern technology, and we are likely to barely have enough of it if green goals are even to be partially reached. Copper miners are likely to do well, even if the sector is known for its extreme volatility and sensibility to recessions.

There is a strong argument for exposure to this key commodity, but investors will want to pay attention to valuation, production costs, and jurisdiction/geopolitical risk.