Axis Mutual Fund announced the launch of the Axis Nifty IT Index Fund. It is an open-ended Index Fund tracking the Nifty IT TRI Index. Should you invest in this fund?

What is the Nifty 50 IT Index?

The Nifty IT index captures the performance of Indian IT companies. The Nifty IT Index comprises of 10 companies listed on the National Stock Exchange (NSE).

The Nifty IT index is computed using the free float market capitalization method with a base date of Jan 1, 1996, indexed to a base value of 1000 wherein the level of the index reflects the total free float market value of all the stocks in the index relative to a particular base market capitalization value. The base value of the index was revised from 1000 to 100 with effect from May 28, 2004.

Nifty IT Index can be used for a variety of purposes such as benchmarking fund portfolios, and launching of index funds, ETFs, and structured products.

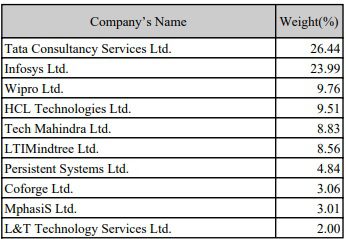

The current constituents of this Index are as below with their % of the allocation.

You noticed that it consists of 10 stocks and 50.43% of exposure in two Indian IT major companies of TCS and Infosys. The remaining 50% is distributed among the 8 stocks. However, if you check the Nifty 50 Index stocks with the stocks of the Nifty IT Index, then 5 companies of this Index are already there in the Nifty 50 Index. Hence, this Index holds around 78% of stocks that are within the Nifty 50 Index.

This creates a huge concentrated risk as the Index constitutes of just 10 stocks, 50% exposure within two stocks, and 78% of Index stocks are already there in the Nifty 50 Index.

Because of this reason, I thought it is valid to compare the Nifty 50 TRI with Nifty IT TRI Indices.

Axis Nifty IT Index Fund – Should you invest?

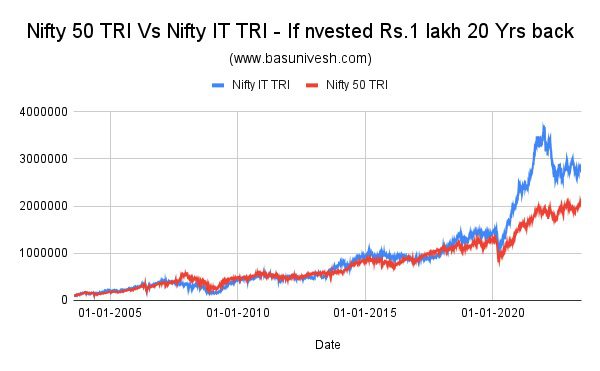

For my experiment purpose, I have taken the last 20 years’ data of both indices. What may be the value of Rs.1 lakh invested 20 years back in both indices?

You noticed that for almost up to the 2020 Covid period, both indices showed similar returns. Sudden outperformance started from 2020 onwards. A wide gap is building post-2020.

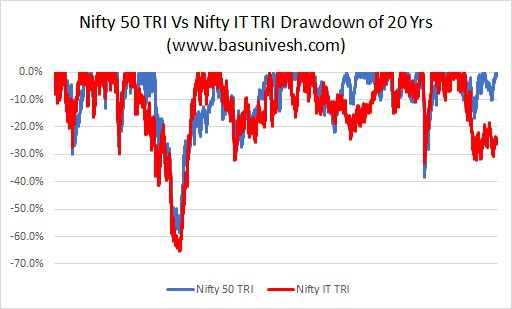

Because of this, the NFO PPT wisely showcases and forces us to believe that the Nifty 50 IT TRI Index is outperforming the Nifty 50 TRI Index since the Covid period. Also showing the drawdown is lower and hence a defense against the market drawdowns.

This drawdown clearly shows how much Nifty IT TRI is compared to the Nifty 50 TRI. Hence, by looking at the recent past performance, one can’t judge that Nifty IT Index will always outperform the Nifty 50 Index,

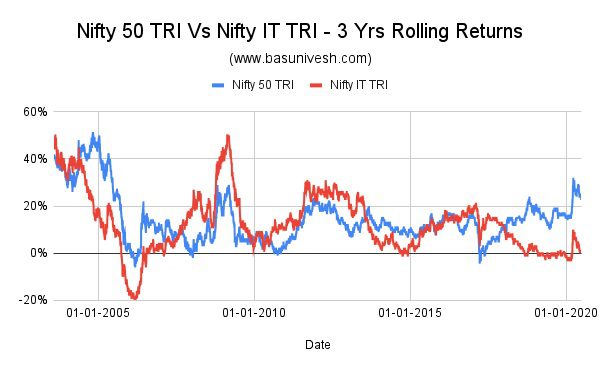

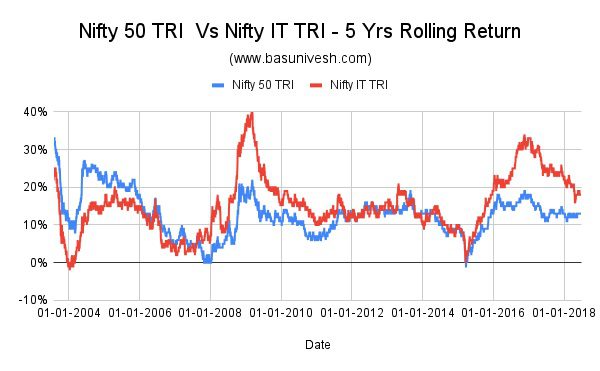

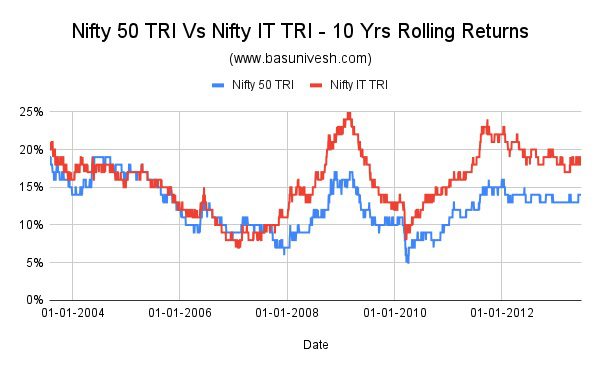

Now let us move on to understand the rolling returns of various periods of these two indices.

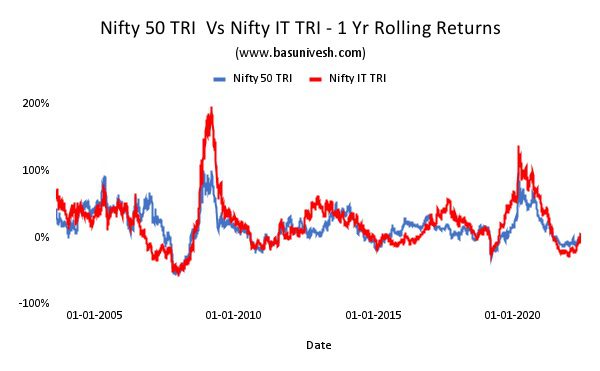

# 1 Yr Rolling Returns

# 3 Yrs Rolling Returns

# 5 Yrs Rolling Returns

# 10 Yrs Rolling Returns

You notice from all of the above charts and compare the lump sum investment chart (considering the drawdown chart), sometimes the Nifty 50 IT index outperformed the Nifty 50 Index. But it is the short period associated with volatility.

Considering all these aspects, investing in Axis Nifty IT Index Fund may create a huge concentrated risk along with underperformance risk with respect to the Nifty 50 Index. Judging the index based on short-term outperformance and assuming the same will repeat in the future is a shortsighted view. A simple Nifty 50 Index is far better than having a separate fund of Nifty IT Index Fund. The reasons are already mentioned above with how much-concentrated risk the index creates.

However, if you are fond of thematic funds and ready to take risks with the hope that Nifty IT Index outperform in the future, then you can invest. But as shown above, such outperformance is for the time being (especially after looking at the past 20 years’ data).