LIC has launched a new single premium traditional life insurance plan. LIC Dhan Vriddhi (Plan no. 869).

Let’s find out about the plan in detail.

LIC Dhan Vriddhi (Plan 869): Important Features

- Single premium plan: You pay the premium just once.

- Non-linked, non-participating: This means you know upfront what will get and when. You can calculate the XIRR from the product upfront.

- Policy Term: 10, 15, and 18 years

- Minimum Entry Age: 8 years (10-year policy term), 3 years (15-year policy term), 90 days (18-year policy term)

- 2 options (variants) based on Sum Assured.

- Option 1: Life Cover = 1.25 X Single Premium

- Option 2: Life Cover = 10 X Single Premium

- Maximum Entry Age: Can range from 32 to 60 years depending on policy term and variant (option 1 or 2) chosen.

- Loan Facility available

Do you know there is a quick and simple way to understand what kind of insurance product you are buying? Participating, non-participating, or a ULIP. And how these products differ. Read this post to find out.

Single Premium plans have a unique problem

The maturity proceeds from a life insurance plan are exempt from income tax only if the life cover is at least 10 times the annual premium or the single premium.

Fair enough. What is the issue?

Let’s say you pay a single premium of Rs 5 lacs under LIC Dhan Vriddhi. I chose Rs 5 lacs because, from this financial year, if the aggregate premium for traditional policies bought after March 31, 2023 exceeds Rs 5 lacs, the maturity proceeds won’t be exempt from tax. This is over and above 10X premium rule.

By the way, all these restrictions are only for survival/maturity benefits. Death benefit is always exempt from income tax.

Coming back, you have 2 options.

- Option 1: Sum Assured of Rs 1.25 X Single Premium: Sum Assured of Rs 6.25 lacs. The maturity proceeds won’t be exempt from tax.

- Option 2: Sum Assured of Rs 10 X Single Premium: Sum Assured of Rs 50 lacs. The maturity proceeds would be exempt from tax (provided you don’t breach Rs 5 lacs in aggregate rule).

Why would anyone choose a lower Sum Assured and let maturity proceeds become taxable?

Well, not so simple.

While the higher life cover (Option 2) ensures that the maturity benefit is tax-free, it also takes a toll on the returns.

Why?

Because a greater portion of your premium/investment must go towards providing you life cover. Traditional products are opaque, and you can’t figure out how your money is being used to provide you life cover. However, those mortality costs are inbuilt into your product returns. In the case of LIC Dhan Vriddhi, this is effected through lower guaranteed Additions for Option 2. We will look at this aspect later in the post.

Everything else being the same,

Option 1 will offer better pre-tax return, but the maturity proceeds will be taxable. Low Life cover (Rs 6.25 lacs)

Option 2 will offer inferior pre-tax return, but the maturity proceeds will be exempt from tax. High life cover (Rs 50 lacs)

Now, if you must invest in LIC Dhan Vriddhi, you must consider the above aspects and decide accordingly.

For instance, if you think you will be in 0% or very low-income tax bracket when you receive payout (and have no need for a large life cover), then you may be OK with Option 1 (1.25 X Single Premium). Because you earn better pre-tax returns (than Option 2), and you won’t have to pay much tax anyways.

The good part is that you will know upfront how much you will get and when. The only uncertainty is about your tax bracket when you receive those payments. If you have a firm idea, then you can decide easily.

LIC Dhan Vriddhi (Plan 869): Death Benefit

Death Benefit = Sum Assured on Death + Accrued Guaranteed Additions

Sum Assured on Death = 1.25 X Single Premium (Option 1) OR 10 X Single Premium (Option 2)

We shall see how Guaranteed Additions are calculated in the next section.

LIC Dhan Vriddhi (Plan 869): Maturity Benefit

Maturity benefit is payable if you survive the policy term.

Maturity benefit = Basic Sum Assured + Accrued Guaranteed Additions

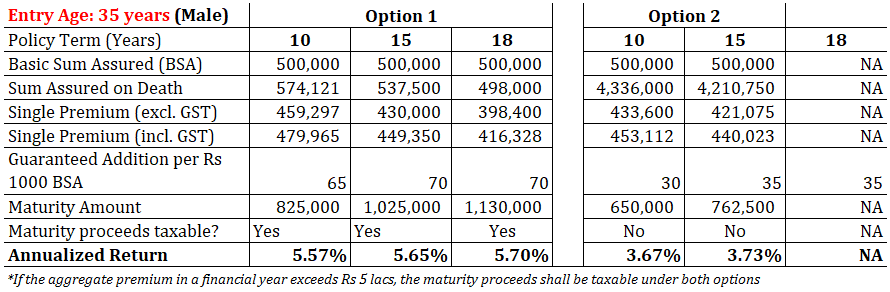

Copying the tabulation from LIC Dhan Vriddhi policy wordings.

As you can see, Guaranteed Additions are lower for Option 2. Along expected lines. This is to incorporate the impact of Higher mortality cost in case of Option 2.

LIC Dhan Vriddhi (Plan 869): What are the returns like?

Let’s understand this with the help of an illustration.

I checked the premium calculator on LIC website and chose the “Online” Purchase as the medium. You are supposed to enter the “Basic Sum Assured” and not the Single Premium (that you want to invest) as part of the calculation flow.

Note that “Basic Sum Assured” is different from Sum Assured on Death.

I chose the Basic Sum Assured of Rs 5 lacs.

Entry age: 35 years (Male)

Option 1

Policy Term: 15 years (I chose the longer tenure)

The following numbers were automatically calculated.

Single Premium = Rs 430,000 (excl. GST) (Don’t know how this was calculated)

Sum Assured on Death = Rs 5,37,500 (this is 1.25X Single Premium)

Single Premium = Rs 4,49,350 (incl. 4.5% GST)

What will be the maturity amount?

Guaranteed addition per year = (Basic Sum Assured of Rs 5 lacs/1,000) X 70 = Rs 35,000

Guaranteed additions accrued for 18 years of policy term = Rs 35,000 X 15 = Rs 5.25 lacs

Maturity Benefit = Basic Sum Assured + Accrued Guaranteed Additions

= Rs 5 lacs + Rs 5.25 lacs = Rs 10.25 lacs

You invest Rs 4.49 lacs and get Rs 10.25 lacs after 15 years.

That’s an annual return of 5.65% p.a.

Note this is pre-tax return. These maturity proceeds will be taxable (after adjusting for your investment).

Option 2

Policy Term: 15 years

Basic Sum Assured = Rs. 5 lacs

Single Premium = Rs 4,21,075 (excl. GST) (Don’t know how this was calculated)

Sum Assured on Death = Rs 42.1 lacs (this is 10 X Single Premium)

Single Premium = Rs 4,40,023 (incl. 4.5% GST)

Guaranteed addition per year = (Basic Sum Assured of Rs 5 lacs/1,000) X 35 = Rs 17,500

Guaranteed additions accrued for 18 years of policy term = Rs 17,500 X 15 = Rs 2.62 lacs

Maturity Benefit = Basic Sum Assured + Accrued Guaranteed Additions

= Rs 5 lacs + Rs 2.62 lacs = Rs 7.62 lacs

You invest Rs 4.40 lacs and get Rs 7.62 lacs after 15 years.

That’s an annual return of 3.73% p.a.

Even though the returns are exempt from tax, 3.73% p.a. is a very low rate of return for a 15-year maturity product.

Note that the returns will also depend on your age. I calculate returns for 2 entry ages (25 and 35) for Basic Sum Assured of Rs. 5 lacs.

As you can see, the returns are higher for lower age.

What should you do?

I trust your judgement.

Different investors have different expectations from an investment product. Some want safety and return guarantee. Some want liquidity while others are keen on good returns.

With LIC, I wouldn’t worry about my money not coming back. Moreover, since LIC Dhan Vriddhi is a non-participating plan, you also know upfront what you are buying. What you will get and when. You can calculate CAGR/IRR. Zero confusion.

At the same time, you must consider the rate of return and the taxation of maturity proceeds.

Are returns of 3.5%-6% p.a. attractive enough for a product with a long maturity of 10 to 18 years ? Not in my opinion.

In addition, there are usual flexibility issues of traditional plans. If you must exit for some reason before policy maturity, there is a heavy exit cost too.

Do you plan to invest in LIC Dhan Vriddhi? Let me know in the comments section.

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investment in securities market is subject to market risks. Read all the related documents carefully before investing.

Note: This post is for education purpose alone and is NOT investment advice. This is not a recommendation to invest or NOT invest in any product. The products quoted are for illustration only and are not recommendatory. In a product review, my attempt is merely to explain the product structure and highlight pros and cons. My views may be biased, and I may choose not to focus on aspects that you consider important. Hence, you must not base your investment decisions based on my writings. There is no one-size-fits-all solution in investments. What may be a good investment for certain investors may NOT be good for others. And vice versa. Therefore, read and understand the product terms and conditions and consider your risk profile, requirements, and suitability before investing in any investment product.