TrendSpider and TradingView are two of the most popular trading tools on the market for a reason. While the two platforms have their differences, each offers excellent functionality to support technical analysis. In this article, we’ll evaluate what each tool can offer traders and help you decide which platform is right for you.

Head-to-Head Comparison

To see how TrendSpider and TradingView size up with each other, we’ll first compare their competing features and then look at the price points they offer. Then, we’ll give a quick summary of each platform’s pros and cons before diving into a more in-depth comparison.

| Automated Chart Patterns | Yes, the main focus of the platform | Yes, although somewhat limited |

| Free Trial | 7 days | 30 days |

| Community | Official Discord | Built-in community platform, including live streams, education, and trade ideas |

| News | Real-time through Benzinga | “News Flow” aggregates many sources |

| Backtesting | Yes, with an automated pattern search | Backtesting done with Pine Script language |

| Data | Market data, plus alternative data | Standard market data |

| Custom Indicators | Yes, created with JavaScript | Yes, created with Pine Script |

| Broker Integration | No | Yes |

| Heatmaps | Yes, for specific price action on charts | Yes, for markets as a whole |

| Markets | U.S. stocks & futures, crypto, forex | U.S. stocks & futures, int’l stocks & futures, crypto, forex |

| Screener | Built-in community platform, including live streams, education, and trade ideas | Yes, with fundamental factors |

| Read review | Read review | |

| Visit Website | Visit Website |

Pricing

While TrendSpider has some features that TradingView lacks, those features come at a price. TrendSpider is more expensive than TradingView at each competing tier. You’ll have to decide whether those features are important to you.

| Price (Monthly) | |

|---|---|

| TrendSpider Essential | $39 |

| TrendSpider Elite | $79 |

| TrendSpider Elite Plus | $179 |

| Price (Monthly) | |

|---|---|

| TradingView Basic | Free |

| TradingView Pro | $14.95 |

| TradingView Pro+ | $29.95 |

| TradingView Premium | $59.95 |

Pros & Cons

While both platforms offer plenty of features for technical traders, these features do not come without certain drawbacks. Here are the major pros and cons of each tool.

TrendSpider Pros & Cons

- Advanced automated chart pattern recognition.

- The no-code custom strategy and backtesting.

- Excellent technical screener with pattern recognition built in.

- Alternative data sources.

- No broker integration.

- Complex user interface.

- The big learning curve for new traders.

- No international markets.

TradingView Pros & Cons

- Community platform featuring plenty of learning materials.

- Screening that includes fundamental information.

- Direct broker integration.

- Support for many international markets.

- Backtesting requires proprietary language.

- Only basic market data sources.

- Tools may be too simple for experienced traders.

Now that we’ve seen a broad overview of how the two platforms stack up let’s evaluate the specific similarities and differences between TrendSpider and TradingView.

TrendSpider vs. TradingView: Similarities

As we saw in the comparison, TrendSpider and TradingView each offer some unique features to draw traders to their respective platforms. Still, they target the same audience, and they have a lot in common.

Charting

Excellent charting functionality is essential for any platform designed to help with technical analysis. Both TradingView and TrendSpider offer fantastic charting systems to help you study patterns, generate ideas, and time trades properly.

While each platform differs slightly in the specifics, they both offer candlestick charts, advanced drawing tools, and a wealth of indicators based on price or volume action. Whether you use Fibonacci retracements, trendlines, or support & resistance analysis in your trading, both TrendSpider and TradingView will have what you need.

In addition, both TrendSpider and TradingView have some form of automated pattern-seeking, which can help save you time when looking for trading opportunities. TradingView’s automated pattern-seeking seems limited to just a few very popular chart patterns. TrendSpider’s technology is more sophisticated, including the ability to identify over 200 different candlestick patterns.

Each platform offers flexibility for chart layouts, which is perfect for customizing your setup to fit your unique trading style. Besides being able to set up multiple charts side-by-side, both TrendSpider and TradingView allow you to view multiple timeframes within the same chart, which can help contextualize possible patterns within different time scales.

Trading View chart

TrendSpider chart

Screening

Analyzing thousands of charts individually to search for the best trade would be impractical. Thankfully, these two platforms include screening functionality to quickly narrow down possible opportunities.

TrendSpider’s screening is impressive for the way it allows traders to mix and match technical indicators to find the ideal setup. The visual interface lets you combine factors to easily identify unique opportunities – like, for instance, a specific bullish chart pattern occurring on a stock with high volume and an upcoming earnings release. This screening can be done on entire stock indices, specific crypto exchanges, or even on a custom watchlist of assets.

While TradingView’s screening features do not offer the expansive technical functionality of TrendSpider’s, TradingView makes up for it by including better fundamental information. For instance, TradingView allows users to filter by balance sheet factors like the debt/equity ratio or by income statement factors like EBITDA.

The ability to integrate fundamental and technical information will be desirable to traders who work with both data sets. If you use fundamental analysis to decide what to buy and sell and technical analysis to decide when you will buy and sell, this will be an important feature.

Verdict: While TradingView might offer better screening for traders who consider both technical and fundamental factors in their decision making, users will find great value in the screening and scanning functionality on both platforms.

Alerts

Great trading opportunities don’t always occur when you’re sitting at your desk. Thankfully, both TradingView and TrendSpider offer alerts to inform traders when specific situations occur, wherever the trader might be.

Each platform allows users to activate real-time alerts based on price action, technical indicators, or custom strategies. The most common way to deliver these alerts is via SMS or email, but each platform also has support for webhooks, which opens up exciting automation opportunities for advanced traders.

Webhooks allow a trader to ping specific links when an event occurs. By connecting these links to a broker that accepts trading via webhooks, advanced users can turn TrendSpider or TradingView into automated trading tools. While most users will feel more comfortable entering trades manually if you find a winning strategy, both TrendSpider and TradingView can help you turn it into an automated profit machine.

Backtesting

At the end of the day, even the most logically sound trading strategy needs to be tested in the market to determine its value. To that end, both TrendSpider and TradingView offer access to one of the most vital tools in a trader’s belt: historical backtesting.

TrendSpider’s backtesting is ideal for traders who want to get up and running quickly since it lets users define a custom trading strategy with no coding required. Despite this simplicity, traders can generate and test sophisticated trading strategies with TrendSpider, all expressed using a series of logical conditions.

In TradingView, using backtesting requires learning the Pine Script language, which is used to define custom strategies. While Pine Script is a fairly easy language to learn, this does create more of a barrier to backtesting than TrendSpider’s no-code tools. Still, once a strategy is set up, the process is simple and robust. TradingView allows you to backtest strategies in several different ways, including a mode called “Deep Backtesting”, which utilizes all historical data for a specific symbol.

TrendSpider vs. TradingView: Differences

While TrendSpider and TradingView share many important features, traders should be aware of their differences before settling on one of the two platforms. Let’s briefly review what sets each tool apart.

Pricing

Pricing is the most obvious difference between TrendSpider and TradingView, and it’s important enough to merit real consideration.

Both TrendSpider and TradingView offer three paid tiers:

- For TradingView, these are priced at $14.95, $29.95, and $59.95 when paid monthly.

- For TrendSpider, the tiers are priced at $39, $79, and $179 when paid monthly.

In other words, at each membership level, TrendSpider is more than double the price of TradingView.

TradingView also has more generous free offerings. TradingView’s free trial for any of its tiers is 30 days, while TrendSpider offers just 7. TradingView has a free tier that users can sign up for right away, although it comes with severely limited features.

Verdict: While traders will have to decide for themselves if TrendSpider’s features justify such a price difference, newer traders may find the high price a significant expense compared to their total capital base, especially if they are not likely to use TrendSpider’s more advanced features.

Broker Integration

One of the most significant advantages that TradingView has over TrendSpider is direct broker integration. TradingView allows the integration of many popular brokers, including Interactive Brokers, TradeStation, and Alpaca.

Having direct broker integration means that TradingView can serve as an all-in-one trading solution, including both analysis and execution. For traders who frequently execute intraday transactions, the speed involved in having an integrated broker could be a significant benefit.

Verdict: As we mentioned before, though, both TradingView and TrendSpider do support webhooks to automate trading. Surprisingly, TradingView does not support automated trading directly through the broker integration itself, so the system used to perform automated trading on either platform will actually end up looking quite similar.

Community Features

One of TradingView’s major draws is its social platform, which is built right into the tool. TradingView has an active community that frequently shares trade ideas, learning materials, and strategy scripts. In addition, there are trader live streams you can watch in real time, which can help newer traders learn from experienced veterans.

Any online social platform will certainly deal with some useless, misleading, or rude content, but TradingView’s community platform does generate surprisingly good ideas and discussions. Still, some traders could find the community features distracting, so TrendSpider’s approach, which keeps its official Discord server separate from the platform, might be preferred.

Advanced Functionality

While TradingView might have TrendSpider beat as far as price and community are concerned, TrendSpider’s advanced functionality could prove to be a real difference maker for experienced traders.

While both platforms include tools to create custom indicators, TrendSpider allows users to go into more depth. To create custom indicators on TrendSpider, users must code in JavaScript rather than the simpler, proprietary Pine Script language that TradingView uses. While JavaScript is more difficult to learn, it is also much more general, allowing users to bypass the possible limitations of indicators made in Pine Script.

Additionally, TrendSpider bills itself as the foremost platform for automated chart pattern recognition. While TradingView does offer automated chart patterns as well, it does not integrate these patterns into screening as TrendSpider does. TrendSpider’s approach makes it possible to scan thousands of assets at once for a specific pattern, helping you find the best opportunities more quickly. TradingView, on the other hand, only allows you to search for patterns on one chart at a time.

Heatmaps

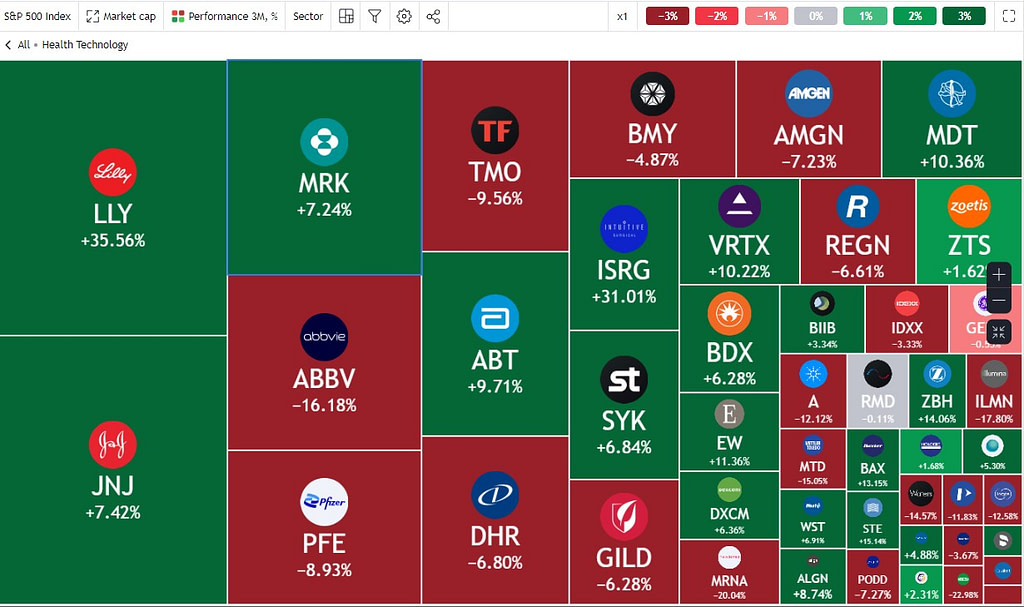

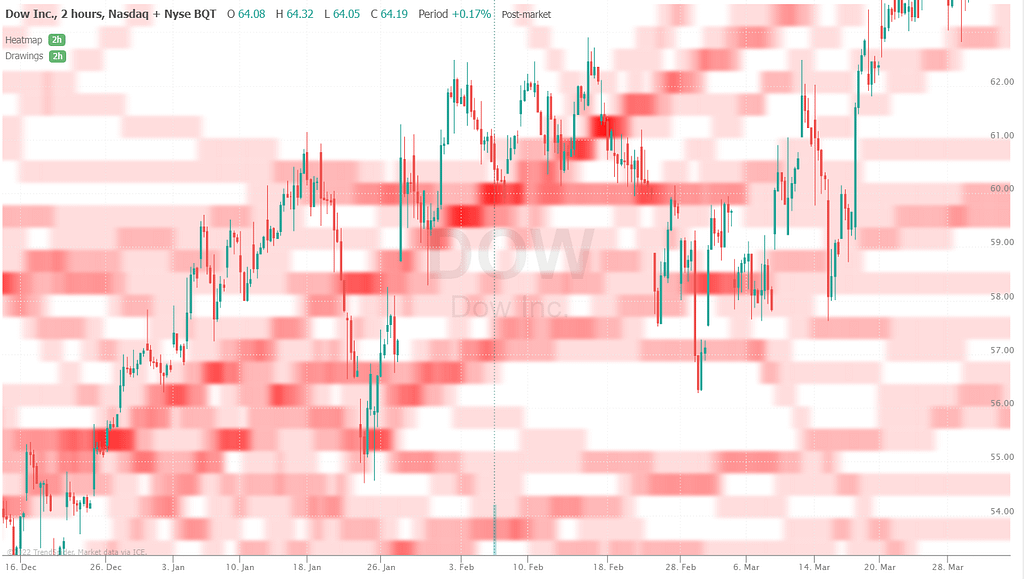

Heatmaps are a tremendously valuable tool for traders, as they can translate numerical data into visual data, letting you spot patterns far quicker than you otherwise might. While both TradingView and TrendSpider offer some form of heatmaps, each platform’s approach to doing so differs widely.

TradingView offers heatmaps of markets as a whole, with the two main focuses being the stock market and the crypto market. Within the stock market heatmap, traders can select the typical American exchanges or other international ones. The heatmap is further broken down by sector, letting you easily spot market movements on the fly, which is especially important if your strategy depends on volatility.

TrendSpider, on the other hand, tailors its heatmaps to focus on specific price action. These heatmaps can be displayed directly on the trading chart and automatically identify factors like market depth, trendlines, and support & resistance levels. For traders who might look at hundreds of charts a day, being able to quickly visually interpret the most important elements of a chart should speed up opportunity analysis significantly.

Markets and Data

The final main difference between the two platforms lies in the range of support for different markets and data. For the most part, TrendSpider and TradingView support the same markets, but TrendSpider edges out TradingView when it comes to alternative data sources. Traders should note that accessing most real-time data through these platforms will require an additional fee.

TrendSpider supports real-time stock, crypto, futures, and forex data, along with delayed index data. The platform stands out for also offering some interesting alternative data sources, which could be valuable for certain trading strategies. For instance, TrendSpider grants users access to data on unusual options order flow, the percentage of retail trading activity in the market, and the total dark pool volume for certain assets.

TradingView also supports real-time stock, crypto, futures, and forex data, as well as real-time index data. Unlike TrendSpider, TradingView also offers access to a significant number of international markets, including Australian, Indian, and Japanese stocks. While the alternative data offered by TrendSpider is attractive, international users should carefully consider the markets to which they need access.

Which One Should You Use?

TrendSpider and TradingView can both be great solutions for traders, but choosing the right one for you will ultimately depend on your personal preferences and your unique trading style. With that in mind, this section will break down which platform could be right for specific users, depending on the features they’re interested in.

Remember, both TrendSpider and TradingView offer free trials, so we advise you to take each tool out for a test run before committing to either one.

- Experienced traders

- Automated pattern recognition and advanced screeners

- No-code backtesting and trading tools

- Alternative data sources

- Newer traders

- Community features

- International markets

- Direct broker integration

TrendSpider is a fantastic tool for experienced traders that need advanced functionality, but its high price is likely to be off-putting for new traders. In addition, TrendSpider’s complexity comes with a cost: the user interface is not particularly intuitive, and the platform can be difficult to learn. For inexperienced traders who are still learning the ins and outs of technical analysis, learning TrendSpider is unlikely to be the best use of their time.

We cannot ignore the excellent pattern recognition tools that TrendSpider provides, particularly in the way they are integrated directly with advanced screeners. While the platform might take time to learn, you should consider the time you might save by having TrendSpider search thousands of assets for specific trading opportunities in the blink of an eye. TrendSpider’s in-depth backtesting tools, which link well to the platform’s no-code trading strategies, are an added draw.

While TradingView can replicate some of these features, its comparative simplicity is one of the main reasons it is a more popular tool overall than TrendSpider. Newer traders will have a much easier time getting up and running on TradingView. Moreover, the community features, including learning material and live streams from veteran traders, dovetail well with TradingView’s focus on the burgeoning technical analyst.

Still, some features of TradingView will be key difference-makers for certain traders. Non-US users, in particular, are likely to prefer TradingView due to the range of international markets the platform supports. In addition, traders who want to execute trades directly from their analysis program will need TradingView’s broker integration.

Ultimately, there is no one answer to which platform is better since traders differ in their needs and want. But with the guidance above, you should be able to choose the tool that will best help you succeed in the markets.