In the 1890s, industrial capitalism had reached the point where the pain inflicted on workers in search of private profits by the industrialists reached a point where the workers could no longer tolerate it and they started to realise that in unity they had strength. This was a period of major industrial disputes and a burgeoning of trade union growth beyond the previously restrictive craft union base. The development of broad-based unions and their move into the political domain to give further voice to the concerns of workers marked a turning point and fostered social democratic political movements and the spread of welfare state capitalism, which lasted until the 1970s. The neoliberal period has seen many of the gains made by workers during that period wound back and now we are witnessing the consequences of that retrenchment – massive real wage cuts, profit gouging and central banks determined for further undermine the well-being of workers as they attempt to push up unemployment, in the name of fighting inflation. An inflation that is persistent only because corporations are using this period to solidify the shift in income distribution towards profits at the expense of wages. It is also apparent that the trade union movement has become co-opted and now collaborate with government and corporate bosses to oversee the deliberate cuts in real wages of their members. this is another turning point in history, where the workers’ own representatives give their support to policies that support those cuts, under the pretense that they have to be responsible. Responsible to whom? We are in a defining period at present in the class struggle and it seems that the labour side has swapped teams.

I have documented in detail how the current period of economic history is quite unprecedented in modern times, in that, a massive redistribution of national income from labour to capital is being deliberately organised by government policy in most countries – mostly through the aegis of central banks increasing interest rates at a time when wages growth is relatively low and well below inflation rates.

That combination is being reinforced by tightening fiscal policy, allegedly being justified by politicians claiming that the enemy is inflation and if they didn’t fall in behind the central banks, the latter would just increase rates even further.

It is quite extraordinary really.

Earlier this week (June 26, 2023), the IMF published an briefing – Europe’s Inflation Outlook Depends on How Corporate Profits Absorb Wage Gains – which demonstrated that:

Rising corporate profits account for almost half the increase in Europe’s inflation over the past two years as companies increased prices by more than spiking costs of imported energy.

While many central bankers have been denying that the data is telling us different.

The governor of the RBA, for example, made a speech at the National Press Club in April 2023 and said:

Rising profits are not the source of the inflation pressures we have ,,, I think what’s been happening is demand is strong enough to allow firms to pass on the higher input costs into prices. So the firms have not suffered a decline in their profits as their costs have gone up.

I analysed the veracity of the Governor’s claim in this blog post – Australia – inflation still falling while the RBA governor keeps inventing ruses to keep hiking rates (May 31, 2023).

Even the IMF is now admitting that wages are not the issue and that profit margins are rising – which means that firms are not just passing on rising unit costs but going further – much further – than that.

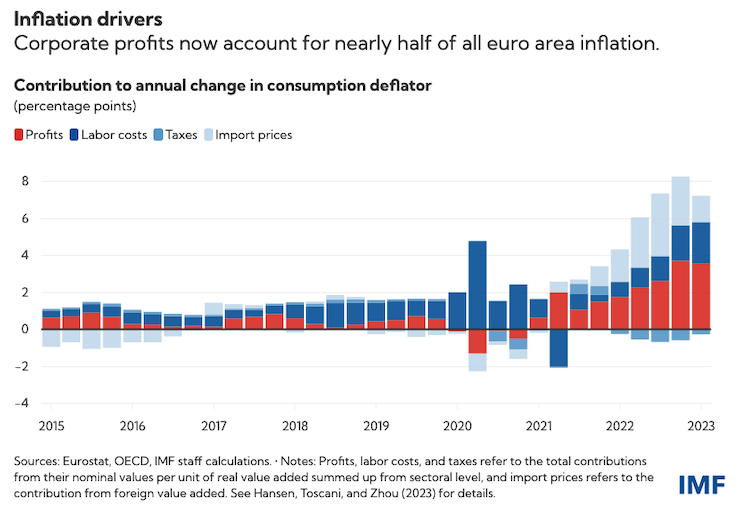

The IMF article provided the following graph, which shows that “the higher inflation so far mainly reflects higher profits and import prices, with profits accounting for 45 percent of price rises since the start of 2022.”

The graph applies to the 20 euro states but I could produce a similar graph for almost any country at present.

The IMF notes that this means that the “Europe’s businesses have so far been shielded more than workers from the adverse cost shock.”

This is in stark contrast to the experience after the first OPEC oil shock in October 1973 where stronger worker organisation contested the real income losses arising from the higher imported oil prices and tried to force the losses on to profits – the so-called wage-price spiral, although it was equally a profit-wage spiral because both parties were seeking to resist the income loss.

That situation is not currently being repeated as the graph shows.

The IMF’s concern (reflecting its ideological position) is that with the supply shock dissipating (energy and other import prices are falling quickly), wages may start catching up.

They posit:

The key questions are how fast wages will rise and whether companies will absorb higher wage costs without further increasing prices.

Well we certainly know what the IMF wants.

The IMF representative gave this speech – Three Uncomfortable Truths For Monetary Policy – at the European Central Bank Forum on Central Banking 2023 held recently at Sintra, Portugal, June 26, 2023.

She said that:

1. “Central banks must continue to fight high inflation now”.

2. “The first uncomfortable truth is that inflation is taking too long to get back to target. This means that central banks, including the ECB, must remain committed to fighting inflation despite risks of weaker economic growth” – in other words, inflation is considered a worse evil than unemployment and the latter has to be used as a policy tool to fight the former.

No sensible accounting of the costs and benefits would ever lead to that conclusion.

Unemployment is devastating for society. Inflation is a nuisance (in the range that we are experiencing at present).

3. The rate hikes run the risk of undermining financial stability and sending banks broke.

On the persistence of inflation, the IMF deputy boss seemed to ignore the IMF research noted above and claimed it was “tight labor markets … and residual pent-up demand” that was the problem.

To which she concluded “financial conditions may not be tight enough” and rehearsed the standard line for her central banker audience that if inflation doesn’t drop quickly then “inflation dynamics” will change (meaning expectations and wages will rise).

So keep hiking until there is no possibility that wages will catch up!

And then “Fiscal policy can help” – which means she is advocating “fiscal tightening” – that is, austerity and rising unemployment.

The speech is full of statements such as “Central banks may need to react more aggressively” – “There could well be a case for preemptive tightening under these conditions if resource pressures appear tight” etc.

So the central banking elites have a clear strategy to damage workers and avoid taking on member of their own class (the profit gougers).

It is hard to imagine how anyone not in that ‘class’ could take the IMF and central bankers’ messages seriously.

Wages are not the problem here.

Yet, monetary and fiscal policy is coordinating to create labour market conditions that undermine the capacity of workers to attempt to catch up and eliminate the real wage losses.

And we can be sure that if the financial instability emerges and banks enter insolvency risk, the assertion that fiscal policy has to tighten will be abandoned immediately as the banksters put their hands out to government for solvency handouts.

The day after the IMF speech was made at Sintra (June 27, 2023), Madame Lagarde’s turn came.

In her speech – Breaking the persistence of inflation – she also avoided the profit gouging issue that the IMF has exposed (among others).

As close as she got was this statement:

… inflation is working its way through the economy in phases, as different economic agents try to pass the costs on to each other.

Those ‘economic agents’ are not workers!

The corporations in her eyes are only “defending their margins and passing on the cost increases to consumers”.

No, they are increasing their margins.

She also reiterated that the ECB would keep hiking interest rates and keep them high “for as long as necessary”.

The reason?

Wages might rise too quickly and by too much even though “we do not currently see a wage-price spiral or a de-anchoring of expectations.”

This threat narrative is all they have.

The ‘maybe’ narrative.

We have to create mass unemployment because otherwise, maybe, wage catch-up will occur!

What are the unions doing in all of this?

I have been thinking about the milieu that ruled in the late C19th and culiminated in the crises that defined the last decade of that century.

Workers as early as 1848 and guided by the spread of Marx’s work, cottoned on that capitalism was not a system to advance their interests, unless those interests coincided with those of the bosses – which is almost an impossibility.

By the 1870s trouble was brewing and the ‘revolutions’ gave way to the growth of trade unions in the 1870s.

Workers sought solidarity across sectors rather than being confined to craft organisations.

The socialists, intent on political influence, also gave succour to these burgeoning union structures.

The big – London dockyard strike, 1889 – which by the way was aided immeasurably by financial support from Australian workers – was a fabulous success and led to the creation of the – Dock, Wharf, Riverside and General Labourers’ Union – which more or less marked the start of organised labour in Britain.

The workers not only wanted better working conditions and pay but they saw the union movement as a general organising structure to expose poverty and other social issues.

While it took many more years for the unions to provide counterveiling power to the employers, who during the 1890s organised quickly into national federations to attack these new working class organisations, the fact is that the creation of trade unions gave the workers some power to pursue their objectives within a antagonistic class structure.

Similar trends occurred in Australia in the 1890s, specifically in the creation of the mining, shipping, and shearing unions.

The 1890 maritime strike in Australia and New Zealand was supported by the coal miners and the shearers, although it ran aground as a result of a massive recession in that period.

The counter-attack of the employers in that period was concerted and the unions endured significant losses in their attempts to improve working conditions of their members.

The solution?

Take the industrial matters into the political sphere!

At that point, the unions sought a political voice and that led to the founding of ‘Labour’ Parties – and spread into broader social democratic movements.

The creation of these worker parties led to a range of legislative initiatives that allowed workers to make considerable gains and redress the skewed power relations in the workplace.

For example, in Australia, compulsory arbitration became law and formal wage setting tribunals were established.

And so it went.

I thought about all that in the context of what the unions are currently doing.

I do a lot of work for some unions in Australia and they are among the most militant.

But overall the union movement, significantly smaller than when neoliberalism began, has become passive and almost compliant with the current attacks on workers.

I am writing this from Melbourne, Victoria and here is an example of what I am talking about.

In 2022, the Australian Education Union, which represents secondary school teachers sought a 7 per cent pay rise to compensate for the inflation rate at the time.

Under threats from the Victorian Labor Government (yes the government of the workers!), the AEU settled for a meagre 2 per cent rise per annum for four years, with some minor relief being provided in hours per week.

That deal will deliver massive real wage cuts to our teachers.

The teachers themselves were deeply opposed to the concession.

In many schools, the overwhelming majority of teachers voted against accepting the government offer.

This is in the context of the increasing demands on teachers in our schools, especially with Covid still ravaging classrooms.

There was no mention of Covid in the agreement.

Why did the AEU accept such a disastrous deal?

Their leadership tried to spin the story that inflation will be lower than expected.

The reality is that it has been higher and was always going to be so.

The leadership also denied the teachers the right to strike.

Since then many school teachers have quit this once great union in protest for the way their leaders have sold them out.

Further, recently, the boss of the Australian Council of Trade Unions (ACTU), the peak body in Australia, was passive in her approach to the 2023 minimum wage case.

She claimed that:

We will be expecting that the government will support a decent minimum wage rise and that they absolutely have to consider maintaining real wages … but we’ve got to be mindful, you know, where do we strike this?”

We know that things are at a delicate point in terms of where the economy might go, so we’ll be very mindful of that …

The profit gouging is not at a ‘delicate point’.

It is full steam ahead.

And this passive compliance by the head of the peak body of unions is symptomatic of the problem.

She knows that real wages are being significantly cut while profit margins are rising.

Conclusion

The point is that many unions have become part of the elite structures that suppress workers and advance the interests of capital

In the 1890s, the worker organisations would be out of strike right now demanding real wage growth in the face of the profit gouging.

The 2023 union leadership seems to fall over itself to accept shocking pay offers from employers – both private and public – and then spin the agreements as if the workers have gained something.

Capital is the winner, the workers are the losers.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.