Planned Liquidation and Dissolution

Due to the planned discontinuation of CYT-0851 development, and the previously announced discontinuation of Cyteir’s discovery pipeline, the Company’s Board of Directors intends to approve a Plan of Liquidation and Dissolution (“Plan of Dissolution”) that would, subject to shareholder approval, include the distribution of remaining cash to shareholders following an orderly wind down of the Company’s operations, including the proceeds, if any, from the sale of its assets. Prior to winding down operations, the Company intends to complete regulatory and patient obligations from the ongoing clinical trial. The Company will engage independent advisors, who are experienced in the dissolution and liquidation of companies, to assist in the Company’s dissolution and liquidation. The Company also intends to call a special meeting of its shareholders in the second half of 2023 to seek approval of the Plan of Dissolution and will file proxy materials relating to the special meeting with the Securities and Exchange Commission (the “SEC”). If the Company’s shareholders approve the Plan of Dissolution, the Company would then file a certificate of dissolution, delist its shares of common stock from The Nasdaq Global Select Market, satisfy or resolve its remaining liabilities, obligations and costs associated with the dissolution and liquidation, make reasonable provisions for unknown claims and liabilities, attempt to convert all of its remaining assets into cash or cash equivalents, including through a potential sale of CYT-0851, and return remaining cash to its shareholders. The Company will provide an estimate of any such amount that may be distributed to shareholders in the proxy materials to be filed with the SEC. However, the amount of cash actually distributable to shareholders may vary substantially from any estimate provided by the Company based on a number of factors.

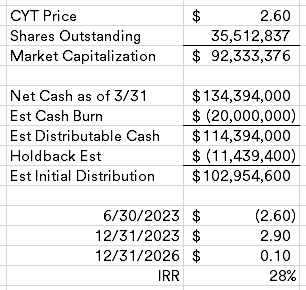

Here’s my quick, likely wrong, swag at a liquidation scenario:

I’m estimating $20MM of cash burn, which might be too high, especially during a period where money market funds are returning 5%, helping to offset some G&A. I’m assuming a year end initial distribution of 90% of the cash, and then just 30% of the holdback amount in 3 years when the liquidating trust winds down.

Disclosure: I own shares of CYT