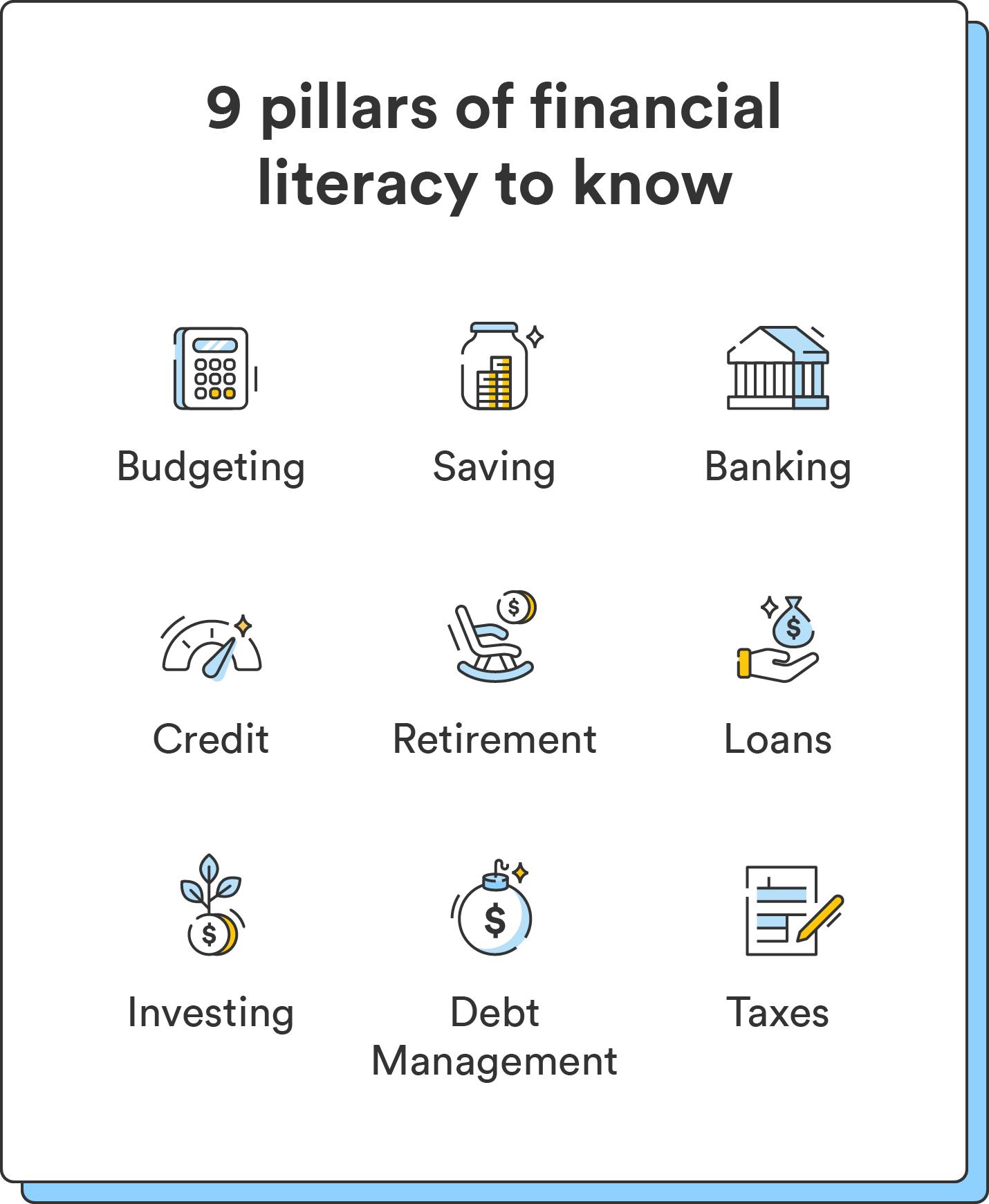

Financial literacy encompasses many different topics. Budgeting, saving, investing, and debt management each play a vital role in your financial well-being. Take a look at the core pillars of financial literacy below.

Budgeting

Budgeting is a cornerstone of financial wellness and involves managing your monthly income and expenses to align with your means and financial goals. Effective budgeting helps you avoid or pay off debt, pay your bills on time, prepare for upcoming expenses, and ensure that you meet your short- and long-term needs.

There are countless ways to budget, like:

The method you choose doesn’t matter as long as it works for you. A solid budget will include a fixed and variable expenses list, your monthly income, short-term and long-term savings goals, and future expenses.

53% of those with higher financial literacy reported that they spend less than their income, compared to only 35% of those with lower financial literacy.8

Saving

Saving is a crucial part of financial literacy that allows you to build a safety net for unexpected expenses, achieve your goals, and prepare for the future. It involves setting aside a portion of your income for the future for things like:

- Emergencies

- Major purchases

- Long-term investments

If you don’t regularly save, an unexpected expense can become a much larger setback. Say your car breaks down, and you need $1,500 to fix it. You don’t have any money saved to cover it, but you need your car to get to work – so you take out a high-interest loan or cash advance to cover the cost. While this solves the problem in the short term, you’re now on the hook for paying back that loan with added interest, costing you more in the long run.

50% of adults aged 18 to 29 haven’t saved an emergency fund that covers three months of expenses.²

Building a habit of regularly saving provides peace of mind and financial stability and opens the door to achieving your savings goals. That could be paying for an apartment deposit or a mortgage for your first home, plane tickets for a trip, or anything else you want to save for. Saving is a tool that can unlock opportunities, dreams, and goals for your future.

If you’re wondering how much to save each month, start with 20% of each paycheck. You can also automate your savings by setting up an automatic transfer from your checking account to your savings account.

Banking

Another pillar of financial literacy is banking and bank accounts. You’ll need a bank account for everything from using a debit card, credit card, or ATM to applying for a home loan. They offer convenience and a safe way to store your funds. Here are some common types of bank accounts:

Start by choosing a checking account with a financial institution that meets your needs and goals. You’ll want to compare different banks or credit unions based on fees, interest rates, and ease of use. A checking account also allows you to use tools like direct deposit, which deposits your paycheck straight into your account each month.

You’ll also want to decide on a savings account to store your savings. While checking accounts are used for day-to-day transactions, savings accounts are separate places to store funds you don’t touch often. They allow you to earn interest to grow your money for upcoming purchases. When choosing a savings account, compare each account’s fees, terms, interest rates, and withdrawal limits.

You can download our bank account information printable to keep your account details in one place.

4.5% of U.S. households are unbanked and don’t have a bank account at an insured financial institution.9

Credit

Credit refers to your borrowing history and how well you manage credit and debt. Your credit impacts your ability to be approved for loans, credit cards, and other financial products and secure favorable interest rates. A credit score is also necessary for financial products, like car loans or mortgages.

When you open any type of credit account, your credit history is analyzed by credit bureaus based on five factors:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Applications for new credit (10%)

- Types of credit used (10%)

Based on your account activity, you’re given a credit score associated with your credit report. That impacts whether you qualify for a loan or secure lower interest rates.

To establish credit, you can start by opening a credit card or obtaining a small loan and making consistent, on-time payments. Paying on time can help you develop a history of responsible credit usage and build up your credit score gradually. If you’ve never had credit before or have a poor score, you may need to start with a secured credit card.

While there are many advantages to using credit, remember the impact of poor credit habits on your finances. Not paying your bills on time, maxing out your card, and spending more than you can afford can leave you with high amounts of debt and expensive interest charges that add up fast.

The average credit card holder has $5,474 in debt.10

Debt management

Debt represents money you owe to a lender, who charges you an interest rate to borrow the funds. You’ll likely need to take out some form of debt in your life, whether it’s student loans for college, a home mortgage, or using a credit card for a large purchase. Different types of debt have different benefits and consequences:

- Mortgages and home loans allow for homeownership but carry the risk of foreclosure if you miss payments.

- Student loans provide a path to higher education but can also lead to high levels of student debt without a clear repayment plan.

- Credit cards offer convenience and flexibility but can lead to high-interest debt burdens if not managed responsibly.

To borrow money responsibly, ask yourself whether you can afford the debt and review the terms, including interest rates, repayment terms, and any other fees. If debts are left unpaid, you’ll accrue interest charges on top of the balance you owe, costing you far more in the long run.

When you understand the risks and responsibilities of borrowing money, you can avoid unneeded financial stress, avoid feeling trapped in debt, and use certain types of debt to your advantage (like building your credit score).

18% of U.S. consumers said their main source of debt is their home mortgage, and 20% said their main source of debt is credit card debt. 11

Loans

Loans can provide a way to finance major expenses, like buying a car or pursuing college, without a large upfront payment. They also provide a structured repayment plan so you can budget effectively to ensure the loan gets paid off. Understanding loans and their impact on your finances can help you make informed financial decisions.

There are different types of loans, like:

There are also costs associated with getting a loan, and you’ll want to evaluate different loan options based on your needs. Researching and comparing loans from different lenders can help you find the most favorable terms, rates, and repayment plans.

While loans can provide access to large expenses, they are a debt that often requires interest payments. Paying more in interest increases your overall cost of borrowing, so understand how much you’ll pay in interest over a loan term to make a sound decision.

Consider the long-term implications of taking out a loan and how much it will cost you over time. Evaluating whether a loan aligns with your goals and is within your means will help you be a financially literate borrower.

Gen X has an average student loan debt of roughly $45,800, the highest across all generations. Gen Z has an average total student loan debt of $20,470.12

Investing

Investing helps you maximize your financial potential and find opportunities to grow your wealth. Investing means buying securities like stocks, bonds, mutual funds, ETFs, and other investments that grow in value over time. And the sooner you start investing, the more time your money has to grow.

Part of understanding this pillar of financial literacy is knowing how to choose the right investments. This depends on several factors:

- Your age and time horizon (how much time you have to keep your funds invested)

- Your risk tolerance

- Your short- and long-term financial goals

One key to deciding what to invest in is the concept of risk and return. All investments carry some risk, and some are less risky than others. Those closer to retirement are likely to choose less risky investments, while those who are decades away may opt for riskier investments with the potential for higher returns.

You can mitigate risk through another key investing principle: diversification. Diversification means spreading your investments across various asset classes and sectors to reduce your overall risk. Diversification helps protect your investment portfolio from market volatility and the poor performance of any single investment.

Your age, income, and financial goals will determine your best investment choices. You don’t need a lot of money to start investing, and you don’t need to be an expert to build a solid portfolio. Online brokerages or robo-advisors are a popular way to start investing that doesn’t require an expensive financial advisor. Many will help you make investment decisions based on your goals and risk tolerance.

Over two thirds of beginner investors feel like they need more resources to make investment decisions that impact their future.13

Retirement

Retirement planning entails setting yourself up financially for your retirement years. Once you grasp other components of financial literacy, like budgeting and saving, building credit, and managing debt, you can start thinking about ways to build your wealth for retirement.

62% of 18 to 29-year-old adults have no retirement savings.14

Understanding your finances can help you start thinking about how much money you may need to retire comfortably. Consider the types of expenses you may have down the line and how much money you’ll need to afford them. You don’t need to know exactly how much money you’ll need to start saving and planning. What matters is that you take steps toward growing your savings specifically for your retirement years.

There are different types of retirement accounts and savings vehicles that can maximize your retirement savings, like:

These come with different tax benefits, terms, and contribution limits, and you’ll need to consider which option best aligns with your unique goals and circumstances.

Thinking through your retirement goals, envisioning the lifestyle you plan to lead, and making a plan to ensure financial security in your later years are all important parts of financial literacy – and the sooner you start, the more time you have to save. Not sure where to start? Our retirement planning printable can help you navigate important action items:

33% of Americans expect to have to keep working after they retire to maintain a comfortable standard of living.15

Taxes

Financial literacy regarding taxes covers knowing how taxes can impact your income and finances. There are different types of taxes, such as:

- Income tax

- Sales tax

- Property tax

- Capital gains tax

Each has its own rules and implications, and being aware of the different rates, deductions, and credits can help you minimize your tax liability.

Staying organized and keeping accurate records is also important for tax management. To file your taxes properly, keep track of your income, expenses, and relevant documents like receipts and financial statements. Knowing how to claim deductions and credits can also help you make more informed decisions when filing your taxes.

Taxes are complex, and you may eventually consider working with a financial advisor to ensure you understand different tax laws and how they apply to your unique situation. Proactively planning and meeting tax obligations can help you maximize your tax benefits.

40% of U.S. households fail to pay their income taxes.16