This article was originally published in mint genie. Click here to read it

Imagine the excitement and happiness that comes from buying your first home. For most of us it’s a big step in life and a moment of pure pride.

But it’s also important to remind ourselves that this involves a huge commitment financially.

This means we need to think through our decision both from an emotional and rational perspective.

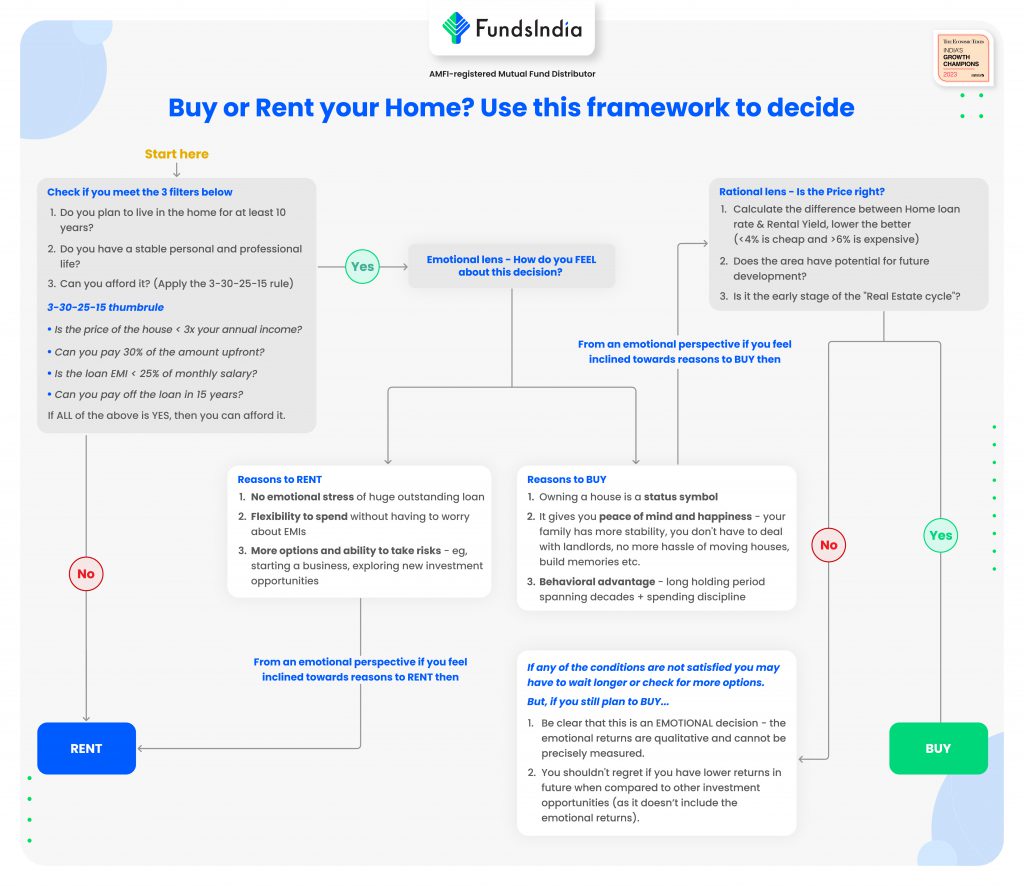

So, how do we decide if it’s better to buy or rent your home?

Here’s a simple framework for navigating this decision and striking the right balance between what you want and what makes sense.

Step 1: The “3 Filter” Test

Filter 1: Do you plan to live in the home for at least 10 years?

If you have a profession which may require you to shift to another place or you want to explore other work opportunities which require you to move out of the current location then it is best for you to RENT your home.

Filter 2: Do you have a stable personal and professional life?

If you have an unstable job/profession or an unstable personal life then buying a home on loan will add to the stress. In this case it is best for you to RENT your home until there is stability.

Filter 3: Can you afford to buy this home?

Apply the 3-30-25-15 thumb rule to check your affordability:

- Is the price of the house < 3x your annual income?

- Can you pay 30% of the amount upfront?

- Is the Loan EMI < 25% of your monthly salary?

- Can you pay off the loan in 15 years?

If all the above is YES then it means you can afford to buy the home

Decision Point:

Did you pass the three filters?

- No = RENT YOUR HOME

- Yes = Move to the next Step

Step 2: Emotional Lens – How do you FEEL about this decision?

Emotional Reasons to RENT

- No emotional stress of a huge outstanding home loan

- You have the flexibility to spend well and do not have to worry about EMIs

- You have more investment options and higher ability to take risks.

Eg: starting your own business, exploring new investment opportunities etc.

Emotional Reasons to BUY

- Owning a house is a status symbol and signals to others that you are successful

- It gives you peace of mind and happiness – your family has more stability, you don’t have to deal with landlords, no more hassle of moving houses, you build memories etc.

- Behavioral advantage – inculcates the habit of saving (EMIs), controls spending, and discipline to hold the asset for a long time (spanning decades).

Decision Point:

- If you feel inclined towards reasons to rent = RENT YOUR HOME

- If you feel inclined towards reasons to buy = Move on to the next Step

Step 3: Rational Lens – Is the Price Right?

Now your next step is to find out if the price of the house is right. These three vantage points will help you do that

- Is it cheap or expensive?

In order to determine whether the price of the house is cheap or expensive, you can compare the Home Loan rate and the Rental yield.

Rental Yield is the Annual Rental Income (that you can get if you rent it out) as a Percentage of House Price.

Rental Yield = Annual Rent

When it comes to rental yields, higher the better!

Now, calculate the difference between home loan rate and rental yield.

Lower the difference, the better.

- Home loan rate – Rental yields < 4% = CHEAP

- Home loan rate – Rental yields > 6% = EXPENSIVE

Here is an example of how this works,

Assume the price of the house is Rs 1 crore and the monthly rent is Rs 20,000 (so yearly it is Rs 2.4 lakhs) and your current home loan rate is 9% .

Rental yield = 2.4% (Rs 2.4 lakh

Home loan rate 9% – Rental yield 2.4% = 6.6%

This means the price is expensive right now.

- Is there potential for future development in your chosen area?

A property’s return potential is highly dependent on its location, neighborhood, amenities, connectivity, and future development prospects.

This includes

- Current access to facilities like offices, schools, hospitals, malls and markets, and transportation hubs

- Connectivity to major roads, highways, and public transportation etc.

- Future developments like planned public or private infrastructure projects, metro rail, flyovers, schools, markets, hospitals etc

These factors will help you assess the scope for future development when purchasing real estate.

- Where are you in the real estate cycle?

Understanding the real estate cycle is important to know if the price is right and what to expect as future appreciation. Real estate prices typically experience cycles characterized by a period of upward momentum lasting 7-10 years, followed by a subsequent downturn.

So, ‘WHEN’ you enter the real estate cycle is a key determinant of your long term returns.

In the chart below we can see the last 20 years returns from an investment in real estate,

2002-2011 – 16% annualized returns (up-cycle)

2012-2021 – 4% annualized returns (down-cycle)

As seen above, it is better to buy at the early stages of the real estate cycle

How do we know it is the early stages of the next up-cycle?

Here are some factors to identify this

- Low Past Returns – if the prices have been stagnant (time correction) or declined over the last 7-10 years. Check for early signs of a price pick up.

- Low Supply – Unsold inventory is reducing and there are few or no new real estate project announcements.

- Low Home Loan rates – If home loan rates are low compared to the last 20 year history

- Improving Demand – led by better affordability – higher salaries, lower interest rates and lower house prices

Together, these factors provide an indication of the early stage of an up-cycle.

In short, the price is right if

- The difference between home loan rate and rental yields does not exceed 6% (>6% is expensive)

- The area has potential for future development and price appreciation

- You are investing at the early stage of the real estate cycle

If any of the above conditions are not met, then it means the price is not right.

So, what happens when the price is not right?

You will have to WAIT LONGER to buy the right property or look out for MORE OPTIONS with the RIGHT PRICE.

But, even when the price is not right and you still want to buy a house, what to do?

Remember this,

- Be clear that this is now an EMOTIONAL decision – the emotional returns are qualitative and cannot be precisely measured.

- You shouldn’t regret if you end up with lower returns in future when compared to other investment opportunities (as it doesn’t include the emotional returns).

Once you come to terms with the above two realities, you can go ahead and still buy the home though the price is not favorable

Summing it up… Visually!

An overview of this simple framework can be found in the visual flowchart below.

Other articles you may like