Quick Stock Overview

Ticker: 9024.T

Source: Yahoo Finance

Key Data

| Industry | Hotel / Railroad / Real Estate |

| Market Capitalization ($M) | 3,530 |

| Price to sales | 1.12 |

| Price to Free Cash Flow | – |

| Dividend yield | 2.81% |

| Sales ($M) | 3,130 |

| Free cash flow/share | – |

| P/E | 4.87 |

1. Executive Summary

Seibu Holdings is a Japanese hotel, railway, leisure activities, and real estate conglomerate. It operates 167km of railway and 83 hotels, most of which are in Japan. It also owns a total of 474 km2 of land, most of which is underutilized and undervalued.

The group suffered during the COVID pandemic, reaching an all-time low in January 2021. It also had to sell some of its hotels in early 2022 to stave off a liquidity crisis. Consequently, the group is trading at a low valuation, assuming little to no growth.

This valuation ignores the fact that Japan is now reopening and coming back to normal. Even the inbound tourist numbers of January 2023, up x83 year-to-year, are still much below the 2019 levels. So Seibu’s results should be coming back to a more normal level, in line with its historical performances.

In addition, the Japanese tourism sector is boosted by the short-term trend of the weak yen and the long-term trend of Japanese culture’s increasing popularity with younger (and even not-so-young anymore) generations.

Seibu’s balance sheet is adequate, even if the group might need to roll over some short-term debt to stay liquid enough in 2023.

In the long run, Seibu’s large land holdings are probably where most of the group’s total value is locked. Even very conservative estimates indicate these lands could be worth as much as the entire current market cap and maybe several times more.

Seibu will be most fitting for investors with a very long-term focus, willing to trade off liquidity for higher long-term returns.

2. Extended Summary: Why Seibu Holdings?

The Great Reopening of Japan

Japan is reopening after 2 years of harsh covid policies, and the yen is weakening rapidly. It is its tourism sector that is the most likely to benefit from these changes. In the long term, tourism is likely to be a growth industry for Japan, carried by its increasing cultural reach and influence.

Seibu Holdings

Seibu is active in hotels, leisure, railroad, and real estate. It offers diversified exposure to the tourism and leisure industry in Japan, including sports venues, hotels, golf, skiing, and others.

Seibu’s Strategy

The Seibu hotel segment is not the center of profit for the group but the entry point in the sales funnel for its leisure, retail, and transport businesses. Customers are then incentivized to come back through premium membership and a point system. It is also sitting on hundreds of square kilometers of valuable land, which it is selling or developing very slowly to maximize its profits.

Financials

Seibu has a relatively weak balance sheet, even if not alarming. It might need to roll over some short-term debt, while the group is getting back in the green throughout 2023. Its valuation is low compared to its peers, even more so when taking into account undervalued assets like its undeveloped real estate assets.

Conclusion

Seibu is best fitted for investors who are willing to wait for the group’s assets to realize their value fully, and for the tourism activity to pick back up to 2019 levels. In the meantime, it will also provide a modest dividend yield.

This report first appeared on Stock Spotlight, our value investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 like-minded investors!

3. The Great Reopening of Japan

A Long-Awaited Return to Normal

A lot of attention has been given to Chinese lockdowns, which were especially harsh, even by Asian standards. But other countries in the region had strict Covid-19 policies as well, including the world’s 3rd largest economy, Japan.

Japan relaxed its COVID restrictions much later than the US or Europe. It reopened for tourism only last October, with restrictions and the scar of the pandemic slowing the reboot of the tourism industry. As new titles covered it in October: “Japan reopens to tourists with shuttered souvenir shops, hotel staff shortage“.

Mask-wearing is still very present, and you need to show vaccination and a negative test to enter the country. But this is finally changing, with a new relaxed border protocol planned for May 8, 2023, that should cancel most entry restrictions. Overall, things are moving in a more liberal direction, even if it will likely slowly take all of 2023 to get back to a more normal situation.

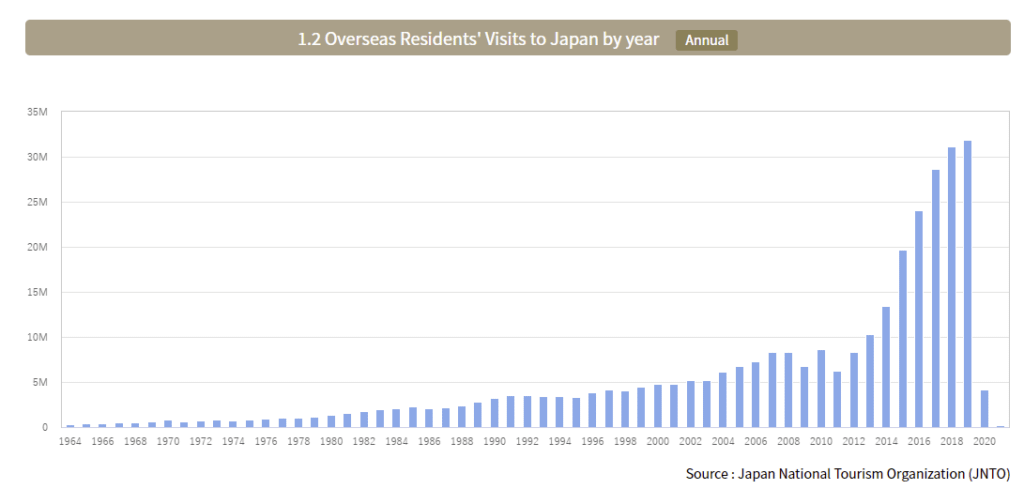

This is a rather big deal. In the last 10 years, Japan has become a tourism powerhouse, more than quadrupling its total of international tourists.

The last numbers for January are very encouraging, with 1,5 million overseas visitors, or an 8,327.9% year-to-year increase. This will still fall short of 2019, with more than 30 million for the year, but this is the first data point indicating that the industry is out of the crisis phase.

Currency’s Brutal Moves Boosting Tourism

Japan’s economy has greatly suffered from COVID, but there has also been a significant impact from the war in Ukraine. Japan is highly dependent on energy imports; especially gas and oil, since it shut down its nuclear powerplant post-Fukushima. So the brewing energy crisis and exploding LNG prices severely affected the country’s trade balance.

The conjunction of the economic crisis, rising energy import costs, and a strong dollar have all contributed to the weakening of the Japanese Yen. The peak was when the country was still locked away from the outside world, but the yen is still yet to recover.

A declining currency has complex effects, but overall, it favorises the tourism sector and most exporters. This is because most of the costs are in local currency (real estate, food suppliers, employees), while the tourists perceive the price in the now more valuable foreign currency.

So that trip to Japan that someone had to wait and postpone for 3 years? It just got 30% cheaper when it comes to food, hotels, parks, attractions, spectacle, transport, services, etc.

Japan as a Cultural Superpower

I also think the attractiveness of Japan is at an all-time high and still growing. The country has slowly evolved into a soft power giant, successfully exporting its cultural products and image abroad.

This is something that might not translate into traditional soft power, like diplomatic influence or an increased role in international institutions. But it definitely has a huge impact on Japan’s image and the country’s attractiveness to tourists.

According to the Duolingo Language Report 2021, Japanese has become the fifth most chosen language in the world, surpassing Italian, and is the fastest-growing language in the United States and the United Kingdom.

With Japanese it’s different. The interest in the language is not so much driven by Japan’s economic appeal as by its cultural capital.

Considering how hard to learn the Japanese language is, it is highly significant to see it ranking above another world-class tourist destination, Italy.

Soft power and cultural influence is something a little hard to quantify, but I think a few landmarks have been achieved in the last few years.

For example:

- Since 2018, mangas are outselling superhero comics in the USA.

- The Super Mario Bros. Movie scored an astonished 96% positive with the public, making it the most popular video game adaption ever (and a low 56% from professional critics…).

- Other IP from Japan have become a lot more mainstream, with Netflix at the forefront to turn them into larger franchises:

- Japanese culture is popular way beyond manga and videogames, even if “otakus” (manga and anime diehard fans) are by far the loudest group:

- Japanese food, from sushi, teriyaki, and miso soup to ramen, is beloved worldwide.

- Japan has an unequaled reputation for being an extremely safe, cultured, and clean country. And the image of Japanese football fans cleaning the stadium after the World Cup matches can only help.

- The government is actively promoting Japan abroad using these solid bases, notably through the “Cool Japan” program.

- Japanese rich history and culture are popular, from geothermal hot baths, tea ceremonies, and Zen philosophy to the samurai esthetic.

This influence will only grow with time, as new generations raised on Nintendo consoles, reading manga, and hanging out with friends eating sushi will be more likely to put Japan on their tourism checklist.

This attractivity is not limited to Westerners. In 2019, Japan was the most visited destination by Chinese tourists. With the rest of Asia getting richer, Japan can capitalize on attracting more tourists, brought by a reputation for high-quality infrastructure, services, food, etc.

4. Seibu Holdings

A Long History

When looking at potential beneficiaries of returning tourism to Japan, I had a few criteria:

- Large asset base, reducing the risk of a specific region or activity turning out to be less popular than expected.

- Diversified, in order to cash in on multiple spending from the same tourists with multiple categories of the group assets and to offer synergy between different activities, like having common HR, software, centralized purchasing department for food, furniture, etc…

- Cheap, as I wanted the rebound of tourism not to be priced in yet.

As there are not that many large tourism groups with a narrow focus on Japan, the choice was rather simple. And as you will see in the next chapter, the company’s current value does not price in the probability of a rebound in revenues and income.

Seibu started as a railroad company in 1912. The company would start its hotel activity in the post-war period by acquiring the Karuizawa summer home of the Asaka-no-miya family, members of the imperial family. It would then get involved in real estate development in the 1970s.

The company would suffer during the Japanese economic crash, culminating in a corporate scandal in 2004 and its delisting from the Tokyo Stock Exchange.

The group would restructure, mostly centered on hospitality and transport, and repair its reputation, and was re-listed in 2014.

A Multifaceted Hospitality Business

The holding is managed with 6 different business lines:

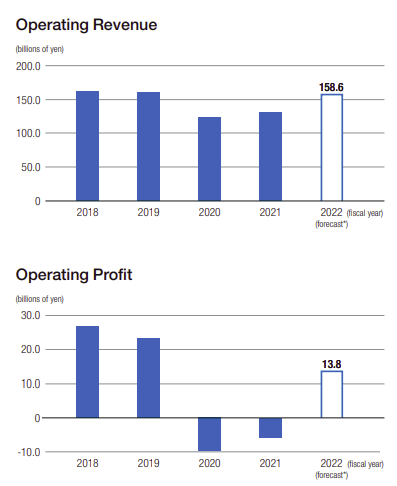

Transport: Train lines and buses. There are 5.5 million residents in the vicinity of Seibu lines and 1.4 million passengers daily on its 176 km of railways. It should generate 158 billion yen in 2022 ($1.2B), on the way back to 2019 levels (¥160B).

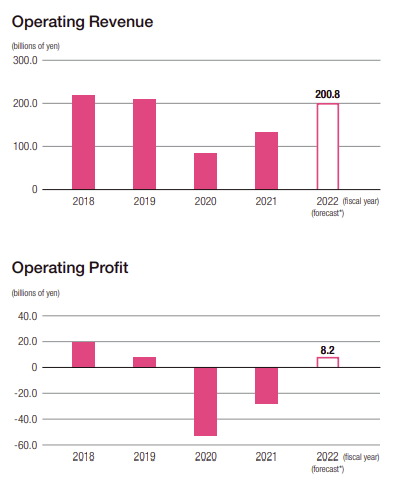

Stay & Travel: 50 hotels in Japan, including attached hot springs, spas, golf courses, and ski slopes. It also includes another 33 hotels overseas, in Hawaii, China, Taiwan, the UK, and Australia. This amounts to a total of 24,366 hotel rooms. The long-term target of Seibu Holdings is to increase this number to 250 over time. The segment was expected to return to a modest operating profit in 2022.

Shop & Eat: This segment groups together hotel restaurants, shops in train stations, a traveling restaurant train, and the Karuizawa Mall of 240 shops.

Amusement: This segment includes multiple facilities:

- A highly competitive baseball team (the Saitama Seibu Lions), the Belluna Dome stadium (31,552 seats), Yokohama Arena (10,560 seats), and a concert hall. And 2 large ice rings and ice shows.

- 5 aquariums, 2 amusement parks + aquarium, and 3 pools, including the largest in the Tokyo Metropolitan area.

- An amphibious bus, a tourism boat on Lake Biwa, and 2 ropeways/gondola lifts.

The amusement category’s offers can also be combined with hotel stays or be part of wedding ceremonies or other events.

Sports: 28 golf courses, 10 ski resorts, as well as tennis courts, bowling alleys, and fitness clubs.

“Comfortable life“: A very diverse segment, mostly centered on real estate: individual homes, vacation homes, and 2 high-end condo & urban development. But also offices, insurance, pet care, daycare, a school, housekeeping services, and even cemeteries!

5. Seibu’s Strategy

What Matters in These Assets?

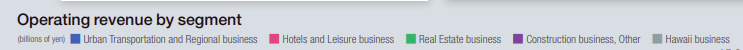

The best way to get a better understanding of such a complex holding structure is to look at 2019 numbers.

Most of the ¥590B in revenues came from construction & real estate (37%), followed by hotels & leisure (35%) and transport (27%).

When looking at operating profit, transport came first (46%), followed by construction & real estate (42%) and hotels & leisure (12%).

The real estate group includes income from both developed and undeveloped properties.

It is not very clear from the company’s presentations if some of the hotels “under management” by the real estate segment do not see some of their profit transferred to that department. It is thus possible that hotel profitability is slightly underestimated.

The total land surface owned is 474 square kilometers (183 square miles). A small portion is regularly sold or developed. This represents a large untapped potential in Seibu’s valuation, but it’s difficult to value precisely. The average land price in Tokyo district was ¥1.1M/m2. That would bring the 474 km2 to an absurd value of ¥520T.

Of course, this was average, including downtown Tokyo and I think considering a much lower value for this land would make more sense. Maybe as low as 1-5 trillion yen. But this would still be a large margin above a market cap of ¥467B.

So land is definitely a hidden asset of Seibu, even if highly illiquid and hard to value precisely.

The Role of Hotels in Seibu Holdings

So while hotels represent a large part of revenue, profit is more driven by transport and real estate. I would not, however, see the hotel & leisure segment as necessarily less interesting, due to the volatility of its profits.

This played negatively during the pandemic but is also the one most likely o benefit from 3 years of pent-up demand.

Most notably, Chinese households famously accumulated collectively $2.6 trillion in additional savings in 2022. So far, they are mostly spending on restaurants, movie tickets, travel, and luxury goods. We can expect Japanese consumers and Asian consumers, in general, to be in the same situation of planning long-postponed holidays and trying to enjoy life.

While the hotel activity will likely boom, I expect the leisure part will do even better. This extra budget might be spent on better hotel rooms or longer stay, but much more likely will be spent on experiences. And this should boost all of Seibu’s segments, not only golf and aquaparks, but also restaurants, malls, and train tickets.

A Complete Leisure and Tourism Ecosystem

Hotels are mostly the entry point of the sales funnel, and as such, do not need to be the profit center.

It is then channeled into other spending through the Seibu membership, Prince Club. The membership guarantees the best rates, discounts on leisure activities, and cheaper railway day passes.

In addition, every yen spent in the Seibu ecosystem gives the customer more points. This is a great feature to have, with Asian consumers being famous for being fanatics about point collecting.

The points are also valid for 5 years, a good timeframe for recurring consumers to look at how to use the points from one stay to the next. It also helps guarantee a base number of Japanese customers already collecting points from the regular commute, day leisure activity, or purchase at Seibu’s malls.

Risks

The Seibu group has solid chances of growing revenues from Japan reopening. There are, nevertheless, a few risks that could endanger this recovery.

Commercial Real Estate

Working from home is probably not going away, at least not fully. This will make office space less in demand. Vacancy rates have surged in the residential and office spaces, likely entirely driven by offices.

So we should expect some of the real estate profit to decline slightly in the next few years, even if offices are just a small portion of a real estate portfolio dominated by residential and retail space.

It could also slow down land development, and office project might be canceled.

Geopolitics

The relationship between China and Japan is not always the best and could degrade a lot further in case of rising tensions around Taiwan and the South China Sea. This could hurt the flow of Chinese tourists to Japan, neutralizing the post-covid boom effects.

Liquidity

Liquidity is always an issue when dealing with asset-heavy companies like real estate, hotels, and railways. It does not fully matter if assets are way above liabilities if cash to fund daily operations runs out. The option is then to sell some illiquid assets or raise more debt.

And this is exactly what happened to Seibu Holdings with COVID. In early 2022, it sold $1.3B worth of hotels – a third of its total portfolio – to the Singapore sovereign wealth fund GIC. Or a third of the total portfolio. If measured in Yen, this deal turned out better than expected, as it took place just before the massive devaluation of the yen.

Seibu is expected to keep managing the hotels, but will only operate them instead of owning the physical structure. This should not hurt the group’s synergy and cross-profit, while it provided it with a much-needed infusion of cash to go over the COVID crisis and restart expansion.

6. Financials

The Pandemic Impact

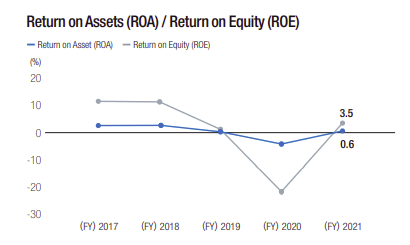

2021 was a rough year for Seibu, although not as bad as 2020 when Japan came to a standstill. It barely managed to get back to positive net profit, mostly out of land sales.

Similarly, returns on equity and assets were back to positive territory in 2021, but much below their historical levels of 10-12% ROE and 2-4% ROA.

Positive 2022 Forecasts

By looking at each segment, we can have a more detailed picture of the recovery. Seibu Holdings offer excellent quality financial reporting, something often rare with a Japanese corporation.

Overall, profits are back, but still at least half of what they were pre-pandemic. This is a fact to keep in mind when discussing Seibu’s valuation compared to its current earnings and cash flows.

Transport

Hotel & Leisure

Balance Sheet & Cash Flow

At the end of 2022, Seibu had ¥89B in current assets, versus ¥284B in current liabilities (of which ¥89B in current borrowing).

Total assets stand at ¥1.58T, versus total liabilities of ¥1.1T.

This seems worrying at first glance but is a concern only if Seibu is unable to refinance its debt. This will mostly depend on Seibu’s long-term credibility and ability to return to profit.

Operating activities provided a positive net cash flow of ¥30.5B. In the last quarter, repayment of debt did cost ¥60B.

Overall, Seibu’s financial situation could be described as rather tense but not alarming. The company should be able to secure more short-term funding if the need arises, especially with Japan’s reopening, greatly reducing the risk on such loans.

Valuation

The company is trading at a P/E of 4.8 and a price-to-sales ratio of 1.12. Overall, Seibu is cheap, and its valuation does not price any improvement from further re-opening and tourism growth.

It can be said that the not-so-perfect balance sheet justifies a discount. But this is a far cry from international hotels group valuation, for example, InterContinental Hotels Group PLC (IHG) trading at a P/E of 32 and a price-to-sales ratio of 2.9.

It seems fair to say that Seibu’s valuation is low for its assets, brand, or financials.

A doubling of these ratios would still keep valuing Seibu at a typical Japanese discount, and back to the lower range of its historical average of a P/E between 11.5 to 21.5.

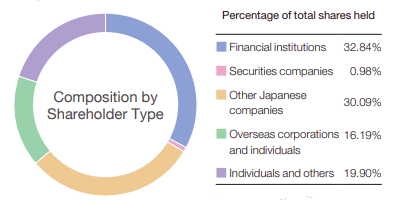

The same disaffection from investors can be observed in Seibu’s shareholder structure, with only 16% of the shareholders being not Japanese.

A revaluation of Seibu is a distinct possibility but might take at the very least a few months, potentially several years. So investors in this stock will have to be very patient. And probably be satisfied in the meantime with the current dividend of 2.8%.

7. Conclusion

Seibu is a simple investing idea relying on a specific event, the re-opening of Japan after the covid pandemic. While this is somewhat of a given, the scale and timing of this reopening, as well as its consequences for the tourism sector, are hard to predict fully. Another event of uncertain duration, the weakening of the Yen, could also contribute to a Seibu Holdings turnaround.

What is more certain is that Seibu Holdings is likely to have passed the critical danger zone of low liquidity in the middle of the pandemic. Returning profitability and pent-up demand should bring the company back into positive cash flow territory and overcome most short-term risks.

From a long-term perspective, Japan’s tourism sector is poised for long-term growth, supported by the nation’s cultural clout and high-quality tourism industry. With its diversified offer of tourism services, leisure attractions, infrastructure, and retail, Seibu is well-positioned to capitalize on this growth.

Its real estate property in the Tokyo region is also likely to provide a steady income in the next decade, likely to the level of the current total market cap or maybe even more.

From that perspective, Seibu’s whole assets are unlikely ever to be sold at a firesale valuation, as another better capitalized real estate group or fund would want to buy these assets and outbid other interested parties. As shown by the recent sale of several hotels, the current valuation is as low as it gets for potential acquirers.

In the end, Seibu is probably best for a very inactive type of investor, willing to wait for anywhere between 3 to 15 years for the group to grow and its asset’s full value to come into play and be accounted for accordingly by the markets.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in Seibu Holdings or plans to initiate any positions within 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this article.