Consumer credit outstanding growth slowed to a 30-month low of 1.8% in May 2023 (SAAR) according to the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 8.2% and -0.4%, respectively. Credit growth for March and April—each of which were initially reported at 5.7%–were revised down to 4.8% and 5.0%, respectively. Total consumer credit outstanding stands at $4.82 trillion (not seasonally adjusted), with $1.21 trillion in revolving debt and $3.62 trillion in non-revolving debt (NSA).

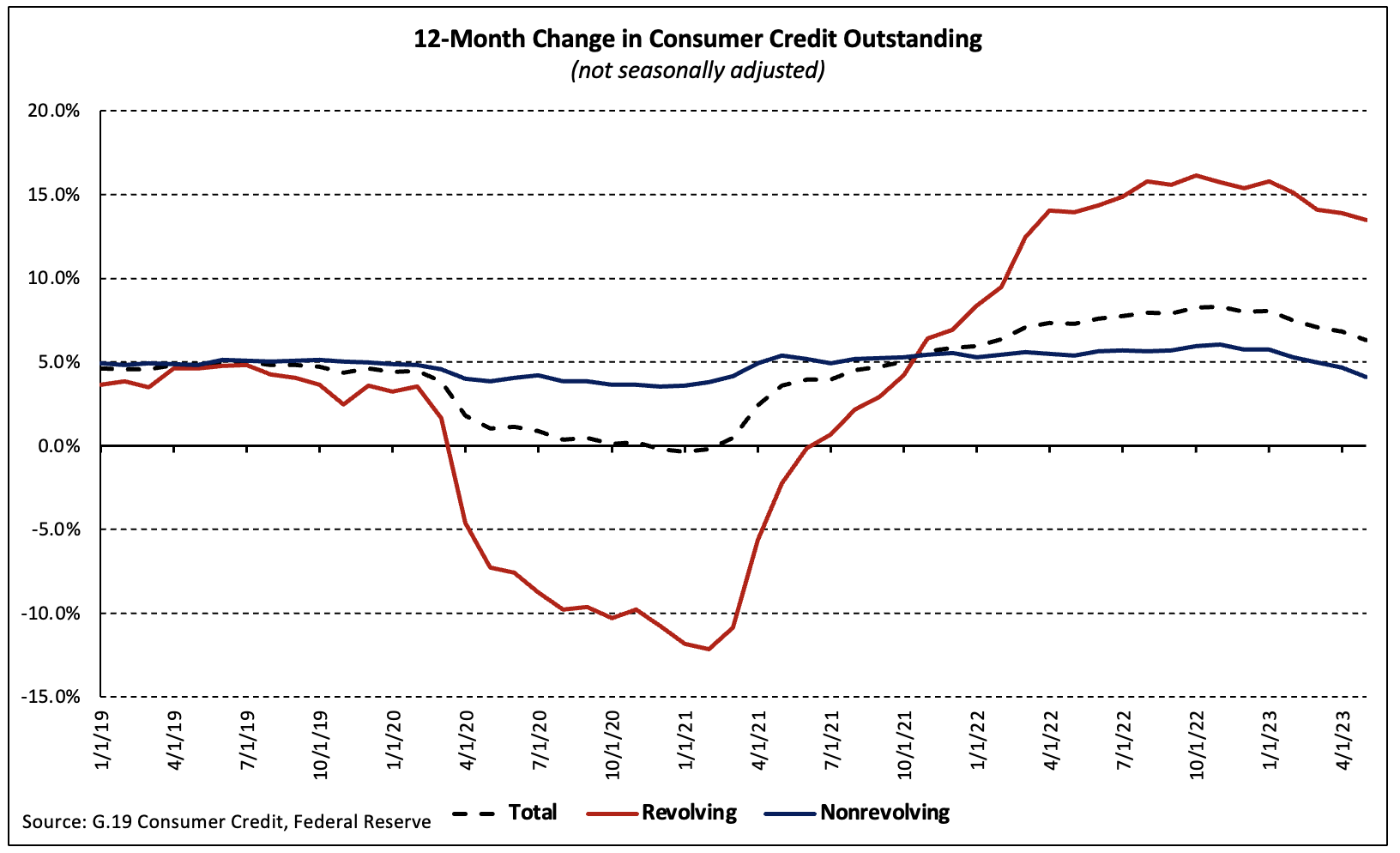

The total balance of consumer credit outstanding grew 6.3% over the 12 months ending May 2023, down from 6.8% in April (NSA). Revolving debt grew 13.5% over the period, more than three times the growth in nonrevolving debt (4.1%). Year-over-year growth of both revolving and nonrevolving credit outstanding has slowed six of the past seven months.

Nonrevolving debt accounted for 75.0% of total consumer debt in May as revolving consumer credit as a share of the total increased to 25.0%—the second-highest reading since early 2020. Over the past 12 months, revolving consumer credit outstanding as a share of the total increased 1.6 percentage points.

Credit card interest rates continued to climb as the average rate climbed from 20.92% in February to 22.16% in May. Over the past 12 months, the average credit card interest rate has skyrocketed 5.51 percentage points–or 33.1%.

Related