It’s the end of the month—time to ration your bread and butter, avoid social events, and guard your bank account like a tiger mom.

But what if you could have some extra zeros in your account before payday?

With a monthly budget template, you can put your finances under the microscope, cut back on unnecessary expenses, and save those extra dollars.

And lucky for you, there’s a budget template for every need and preference. So let’s dive in and turn your financial frown upside down.

This article will show you:

- Why having a budget template is important.

- Our complete guide to monthly budget templates.

- How budgeting can help you take control of your finances.

Read more:

Why Do You Need a Monthly Budget Template?

A monthly budget template is a tool that helps you track your income and expenses for a specific time.

It typically includes categories, like housing, food, and transport, and lets you check your expected and actual expenses.

It’s like having a map when you’re lost in the woods. Without it, you can wander aimlessly, get lost, and end up hungry and broke.

But with a monthly budget template, you can plan your spending, avoid overspending, and have enough left over for a midnight snack.

And don’t just take our word for it—a recent survey found that about 90% think everyone should have a budget, and around 85% say they already use one.

The best budgeting advice is to pick a strategy and start today. It doesn’t have to be perfect right away—try a budget out for a few months, and if it doesn’t work out, try something different. I also recommend finding a buddy when first starting to give you a motivational boost.

Jeremy GrantFounder of Knocked-up Money

Time to find the best monthly budget template for you—

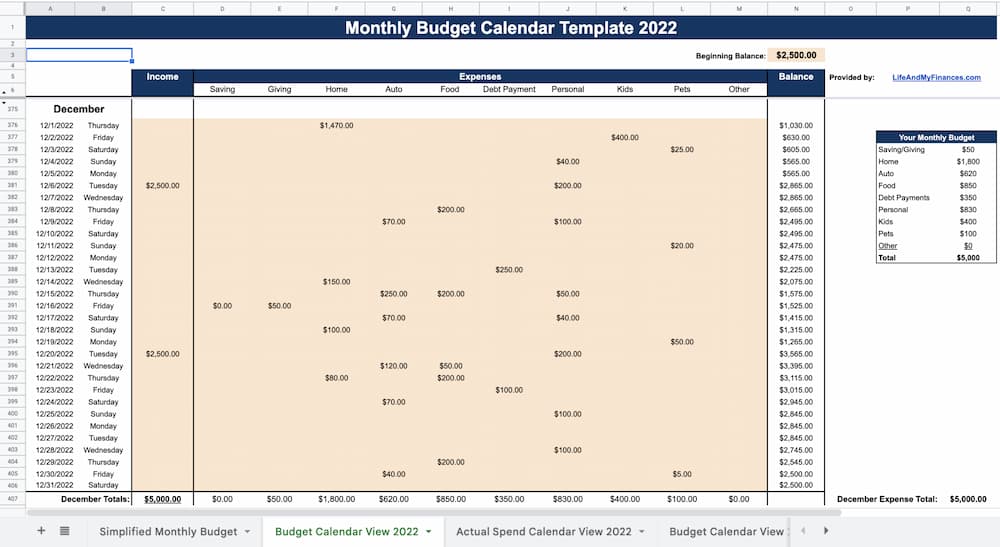

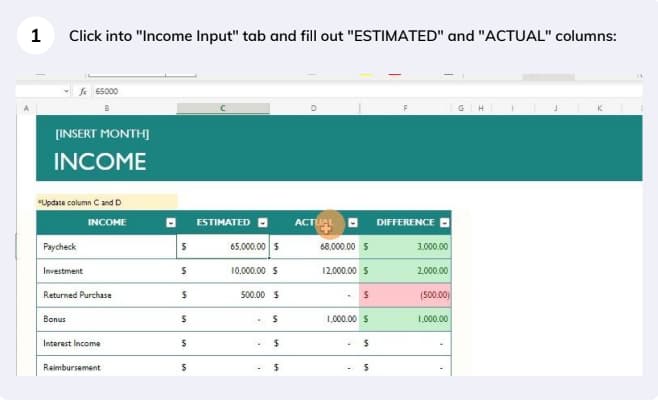

1. Printable Monthly Budget Template: Life and My Finances

Budgeting doesn’t have to be complicated—you can take control of your finances and afford that vacation if you do it right.

Our easy-to-use monthly budget template lets you keep tabs on your spending goals and track any expenses.

Our budget sheet includes estimates, actual monthly spending, and charts to see how you’re doing.

And if you like to stay on top of your finances every day, our calendar view lets you keep track on a daily basis.

You can also get your hands on the fully automated monthly sheet. It does all the work for you, so it’s easier than the printable version—and it comes at a bargain of less than $5.

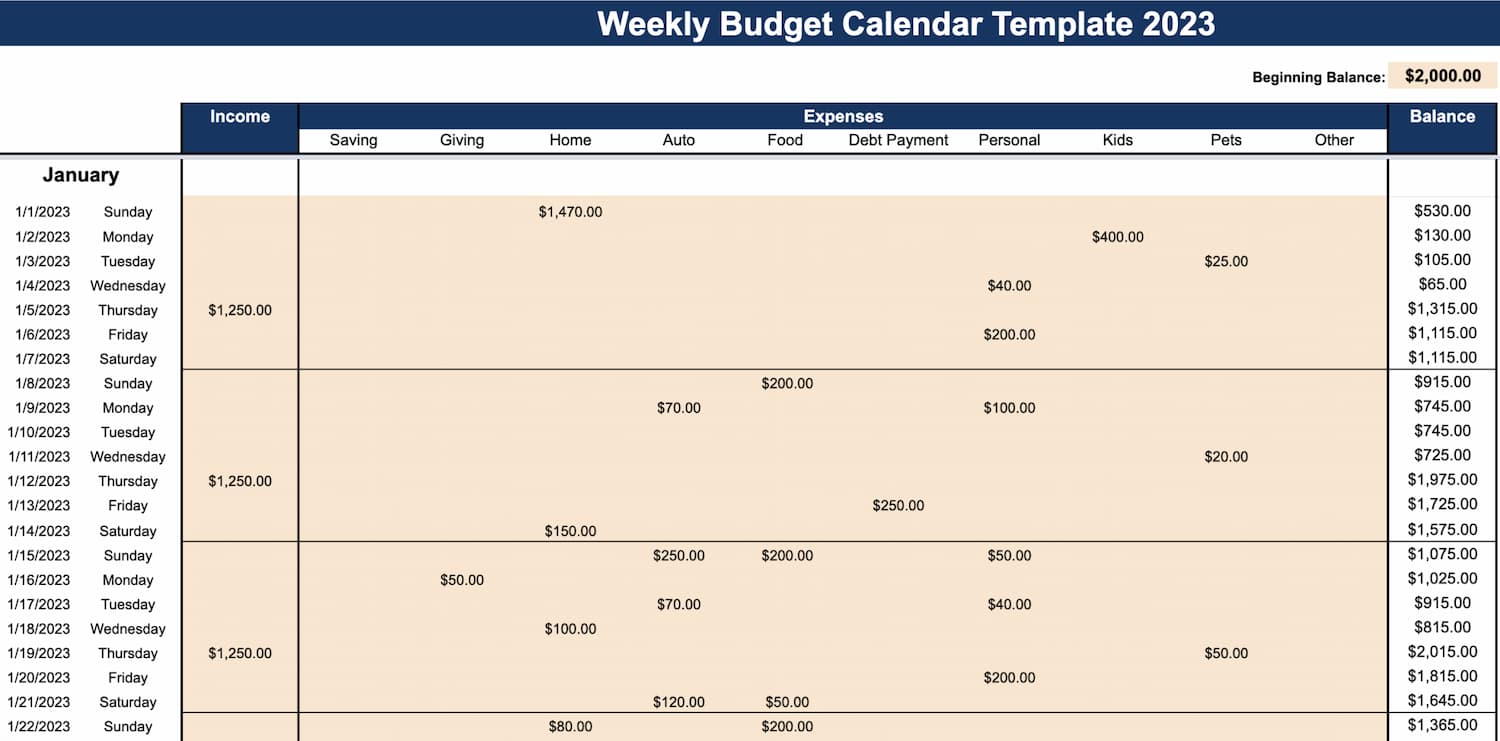

2. Weekly Budget Template: Life and My Finances

Looking for a simple and effective way to manage your weekly budget?

We’ve equipped our free weekly budget template with everything you need to make sense of your day-by-day finances.

This tool is great for those who get paid weekly as it helps you think about the long term and what your budget should look like.

For that special touch, you can personalize everything to fit your needs. And you can even grade yourself on how you’re doing with your spending.

You can also get the fully-automated weekly budget from Etsy for less than $5. It’ll save you a bunch of time doing all the calculations and take away the stress from saving.

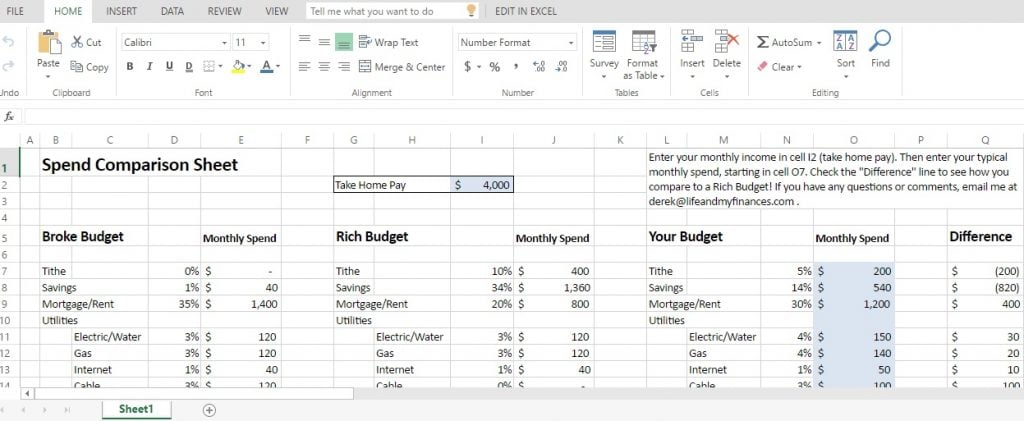

3. Spending Comparison Spreadsheet: Life and My Finances

Our spending comparison sheet lets you see exactly how much you spend each month.

All you need to do is enter your monthly take-home pay and current payment amounts for each category.

The sheet is also a fun way to see how you’re spending vs. your rich counterparts. It gives you the chance to compare and make smart spending decisions like the rich do (you might even see your own dollars stacking up).

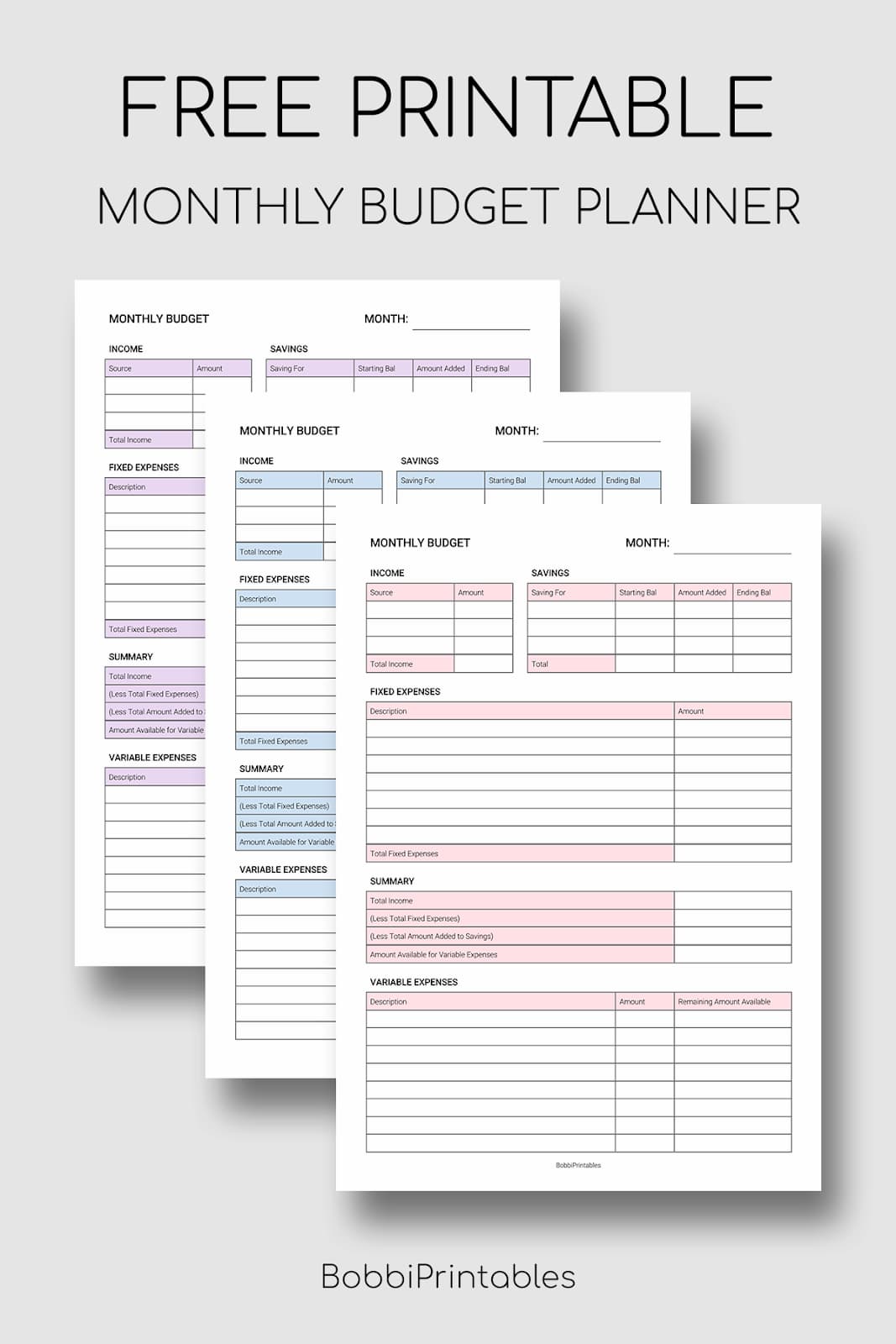

4. Simple Monthly Budget Template: Bobbi Printables

With this budget planner template, you can easily keep track of your income, savings, and expenses.

No more guessing or confusion—you’ll have a clear picture of where your money is coming from and where it’s going.

And don’t worry about paper size—the free Bobbi Printables template is designed to be A4, but you can adjust your printer settings to fit your preferred paper size.

This monthly budget planner is also available as an editable spreadsheet template. So whether you’re a paper-and-pen kind of person or a tech-savvy spreadsheet master, you’re good to go.

5. Bi-weekly Budget Template: Jren Digital

If you receive your pay bi-weekly, we’ve got just the thing for you.

The Jren Digital spreadsheet costs less than $7 and is designed for biweekly paydays, so you can track your cash flow and avoid overspending before payday.

The template comes with automated bi-weekly paycheck dates and a smart bill calendar—saving you a ton of time by entering your income and bills just once.

There’s also a handy expense tracker, so you can see how much you have left to spend as you log your expenses.

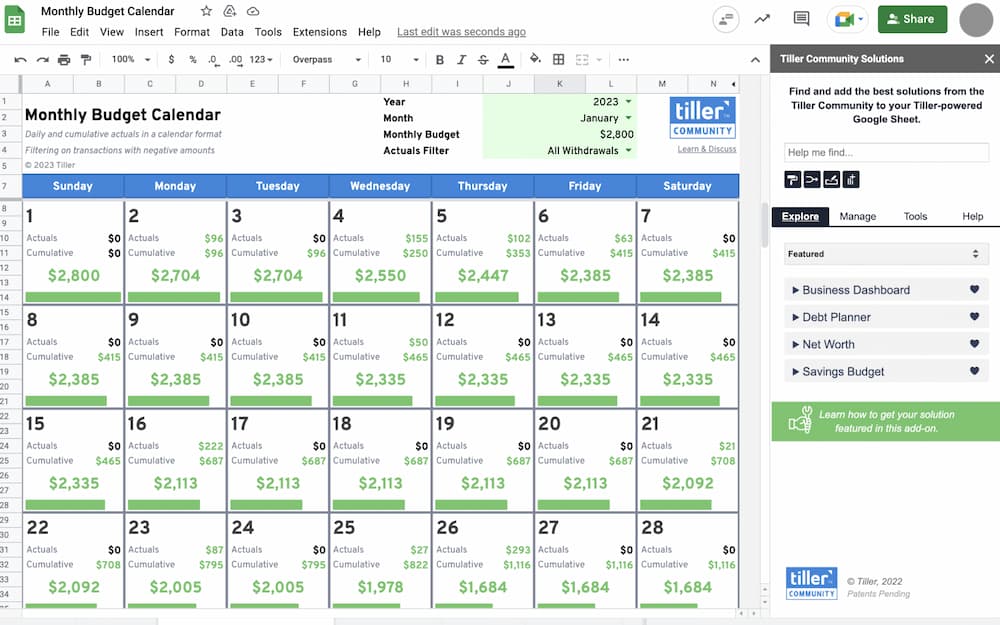

6. Monthly Budget Planner: Tiller

The Tiller monthly budget calendar is a minimalist spending tracker for Google Sheets.

They offer a simple monthly calendar view, so you can set your spending target, track your spending, and see how much you have left to play with at the end of the month.

Using it is as easy as 1-2-3: Just pick the year and month you want to track, enter your monthly spending target, and choose how you want to gather your daily expenses.

While the spreadsheet is free to use, it’s designed for spreadsheets automated by Tiller, where you need to pay a $79 subscription fee for the services.

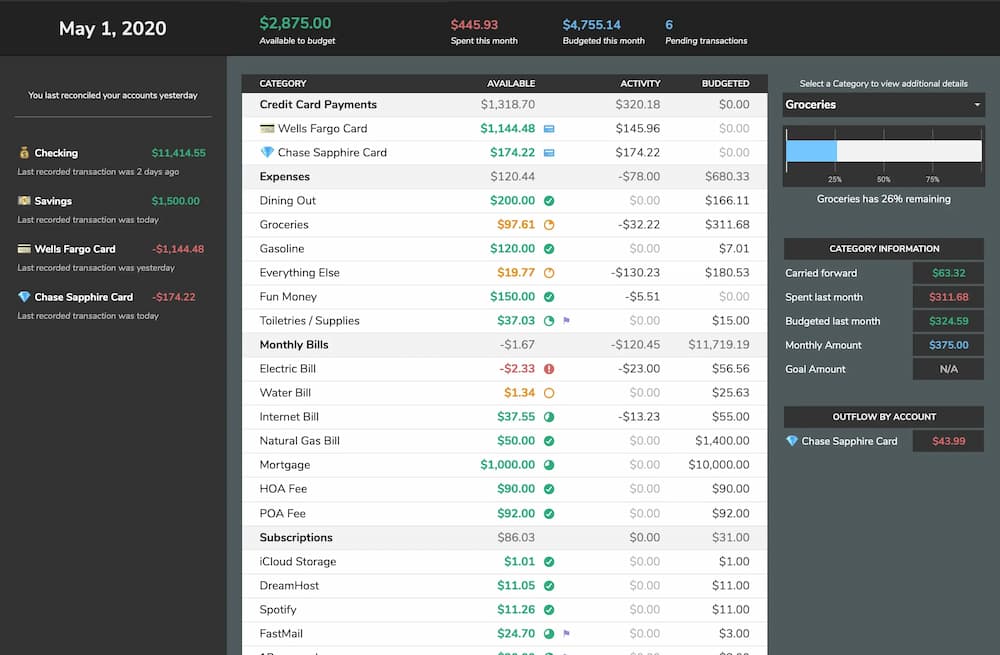

7. Google Sheets Budget Template: Aspire Budgeting

Are you tired of manually tracking your finances?

Aspire Budgeting offers well-designed spreadsheets and automatic transaction importing.

The template lets you easily track your finances in Google Sheets for just $79 a year.

They check all your accounts for new transactions, so your budget is always up to date. And you can categorize transactions on your schedule, so you can focus on the things that really matter (like taking those extra long lunch breaks).

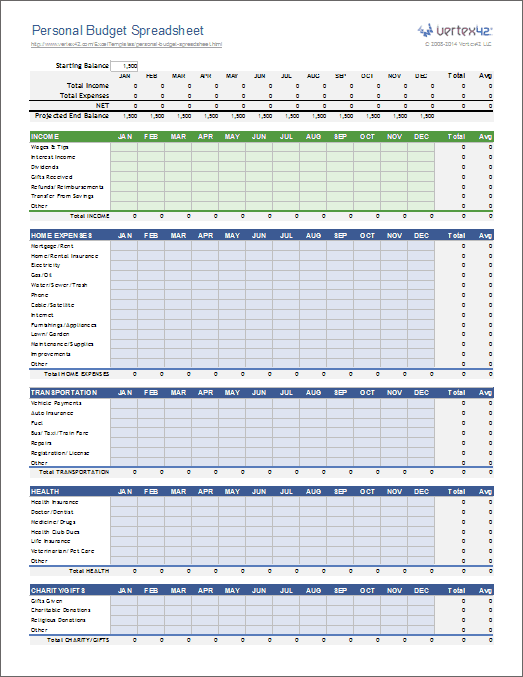

8. Excel Personal Budget Template: Vertex 42

The Vertex 42 Excel budget template lets you easily track your income and expenses using their range of categories.

And if you’re saving for that trip to Florida next year, you can also use the spreadsheet as a yearly budget planner.

And no worries if you don’t have Excel—you can also use the template on Google Sheets and OpenOffice, which are totally free.

9. Easy Budget Template: Mint

Managing finances can be a headache at the best of times.

Luckily, Mint offers this easy-to-use budget template to give you a simple and organized way to track your finances.

The template offers categories for your income and expenses, so you can easily track how much money is coming in and out.

But one of the best features is that they already set the framework for you, which is a huge time-saver. And you can set up a budget in their free budgeting app.

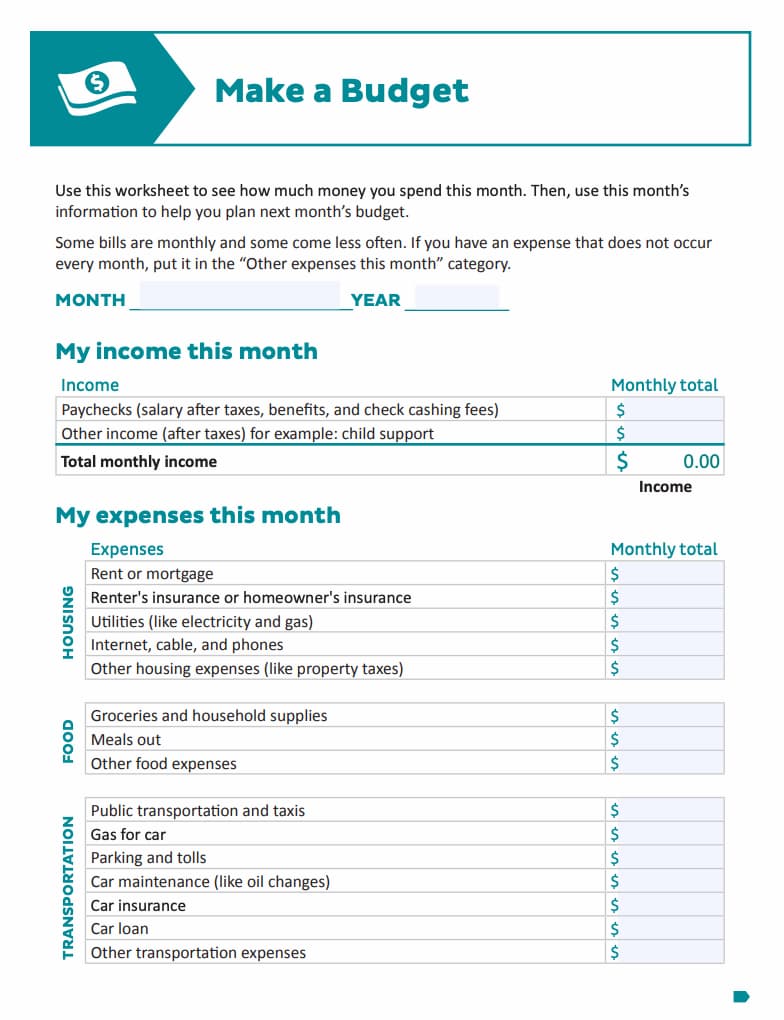

10. Personal Budget Template: Consumer.gov

This Consumer.gov personal budget template not only lets you view your spending for the current month but also makes a plan for next month (talk about killing two birds with one stone).

Just remember that not all expenses occur every month—so for all those pesky bills and expenses that come around less often, you can simply jot them down in the “Other expenses this month” category.

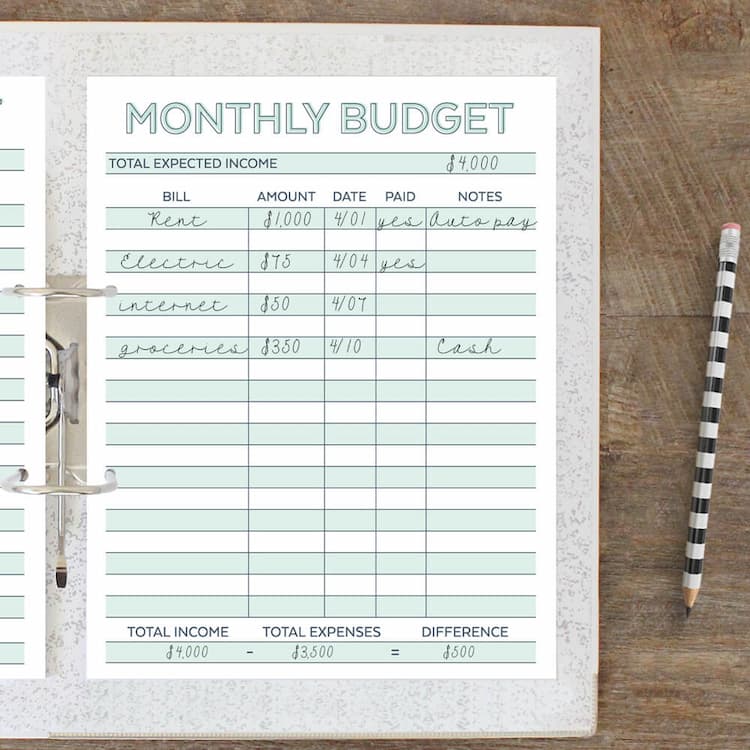

11. Beginner Budget Template: Savor and Savvy

As a beginner, it’s tough to get into the habit of budgeting.

The free Savor and Savvy beginner budget template is easy to use for anyone, though—from first-time budgeters to seasoned savers (and even newlyweds joining checkbooks).

Using the worksheet is a piece of cake—just jot down your expected income, expenses, and the dates they’re due.

There’s even space for helpful notes, so you can set yourself reminders and never forget about that dreaded heating bill again.

12. Cute Budget Template: Printable Crush

Budgeting is great for your bank. Tracking your dollars using an aesthetically pleasing template is even better (it’ll look cute stuck on your fridge).

Printable Crush offers a range of colorful, printable budget sheets that are perfect for those struggling to stay on top of their finances.

And they aren’t just a pretty face—they also include spaces to track your expenses and keep an eye on any debt.

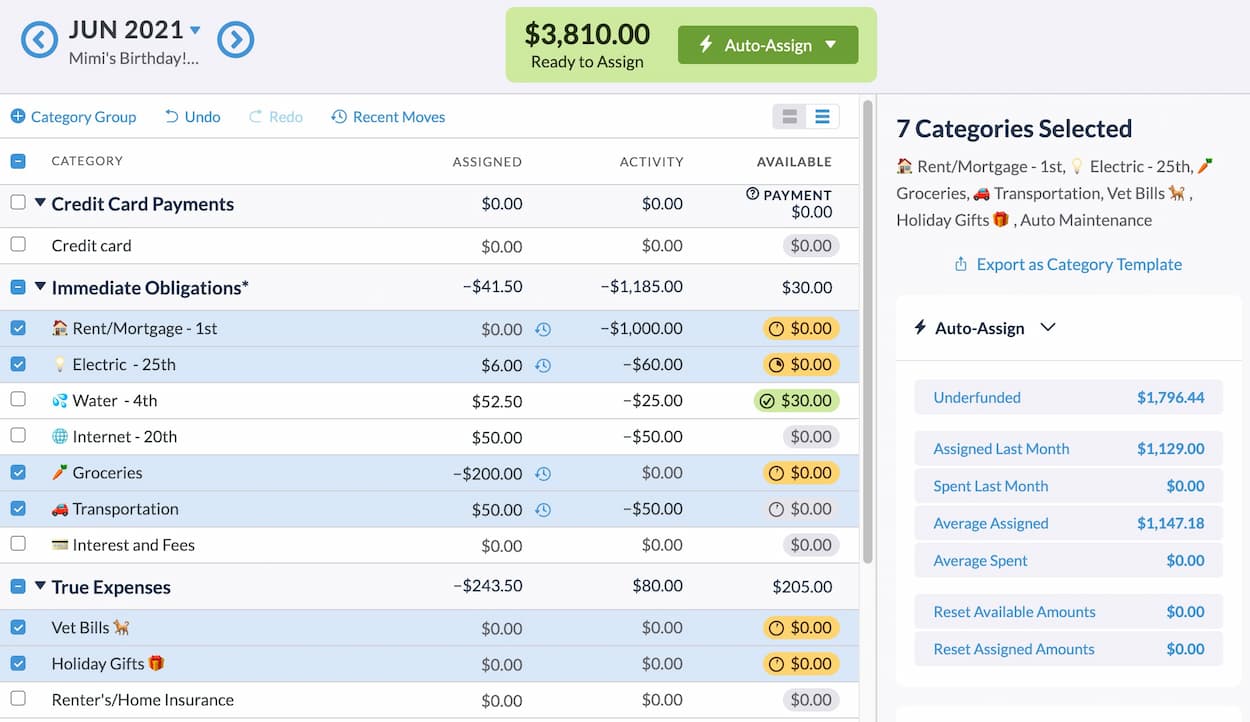

13. Online Budget Planner: YNAB

Time to put your increasingly concerning screen time to good use.

The YNAB online planner lets you account for every dollar, so you can clearly check out your financial plan and make the most out of your money.

And let’s not forget about those non-monthly expenses—like car repairs and pet grooming.

With the YNAB Method, you can break these budget busters down into smaller monthly chunks (and just for $99 a year).

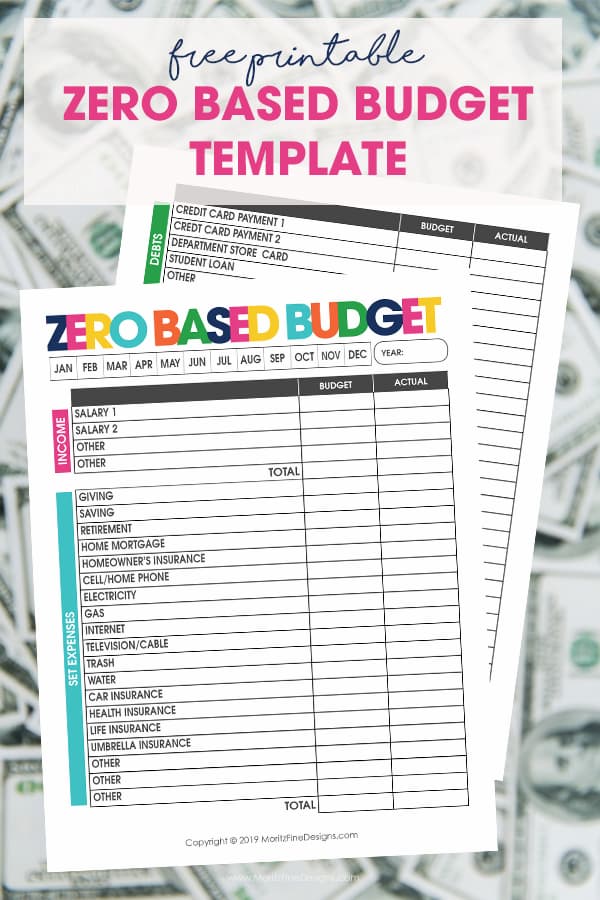

14. Printable Budget Planner: Moritz Fine Designs

If you’re tired of unexpected expenses throwing a wrench into your budget, you could try out the Zero-Based Budget.

With this approach, every expense must be counted for, with your income being put towards debts and expenses until the total balances out to zero.

Sounds intense, but it’s easier than you think.

Just grab the Mortiz Fine Designs free budget template and enter your income information. You can go through any expenses and debt and—eventually—you’ll nail your budget month after month.

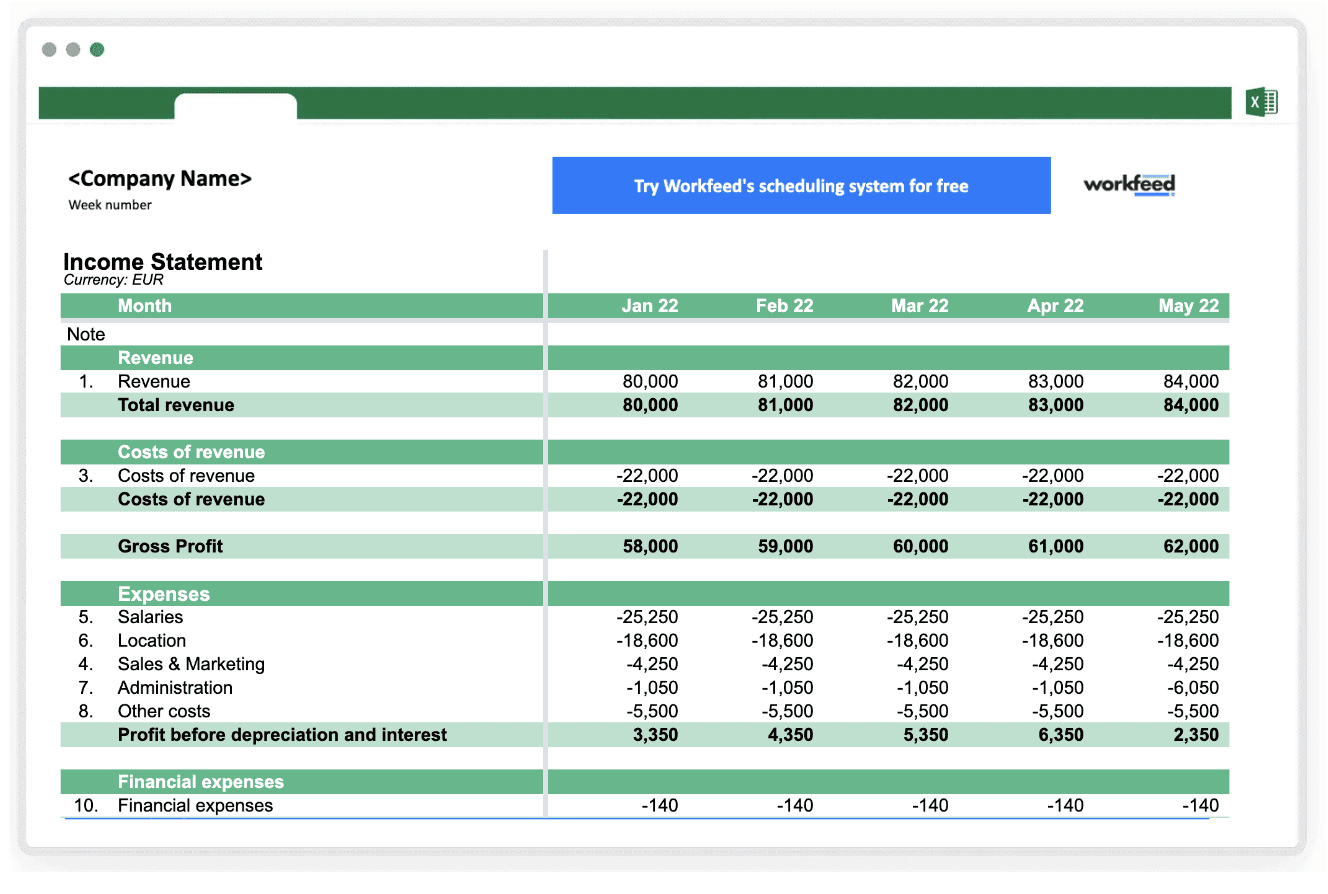

15. Company Budget Template: Workfeed

As a business owner, your goal is to bring in the big bucks. And that’s where a budget plan comes in—it’s like a crystal ball that tells you whether you’re making money.

With the Workfeed business budget template, you can forecast your financials for the next two years without any financial background.

Just follow the steps, and you’ll have a clear overview of your revenue, expenses, cash flow, VAT, assets, and liabilities.

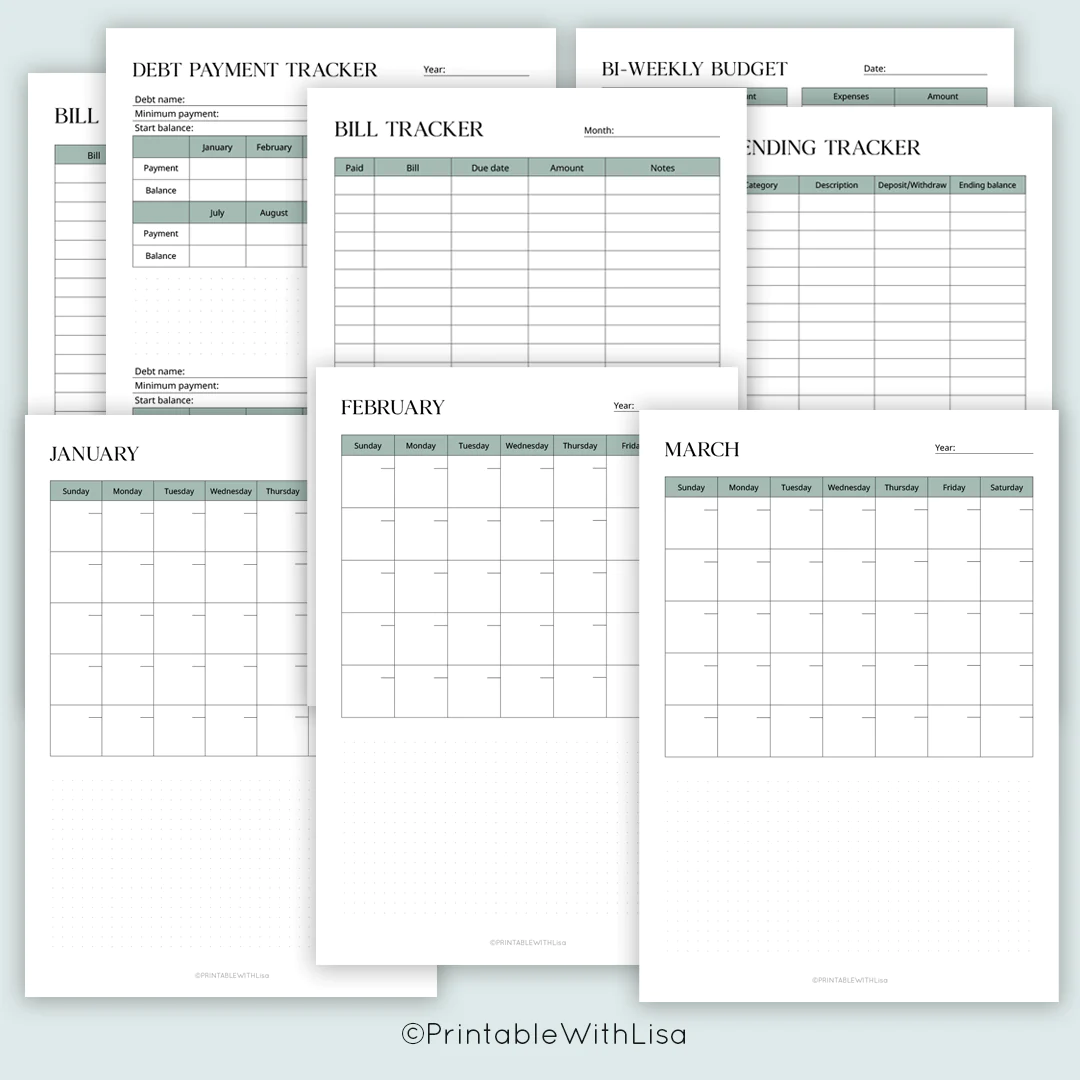

16. Financial Planner Template: Printable With Lisa

If you want the keys to financial freedom, it will take more than just jotting down your expenses.

The Printable With Lisa budget planner comes with weekly, bi-weekly, and monthly versions for less than $15.

You’ll also get your hands on spending trackers, financial goal sheets, and bill and debt trackers.

The planners also come with a yearly overview and a blank twelve-month calendar, so you can get to grips with the bigger picture.

17. Business Budget Template: Vertex 42

Running a business means there’s a lot on your plate.

But having a budget is the key to making important decisions about your company’s growth, salary, assets, and even bankruptcy prevention.

The Vertex 42 business budget spreadsheet comes with an Income Statement Template.

This way, you can keep on track and make sure you don’t lose sight of your financial goals.

You also have the choice of two sample budgets—one for service providers and one for retailers, manufacturers, and publishers.

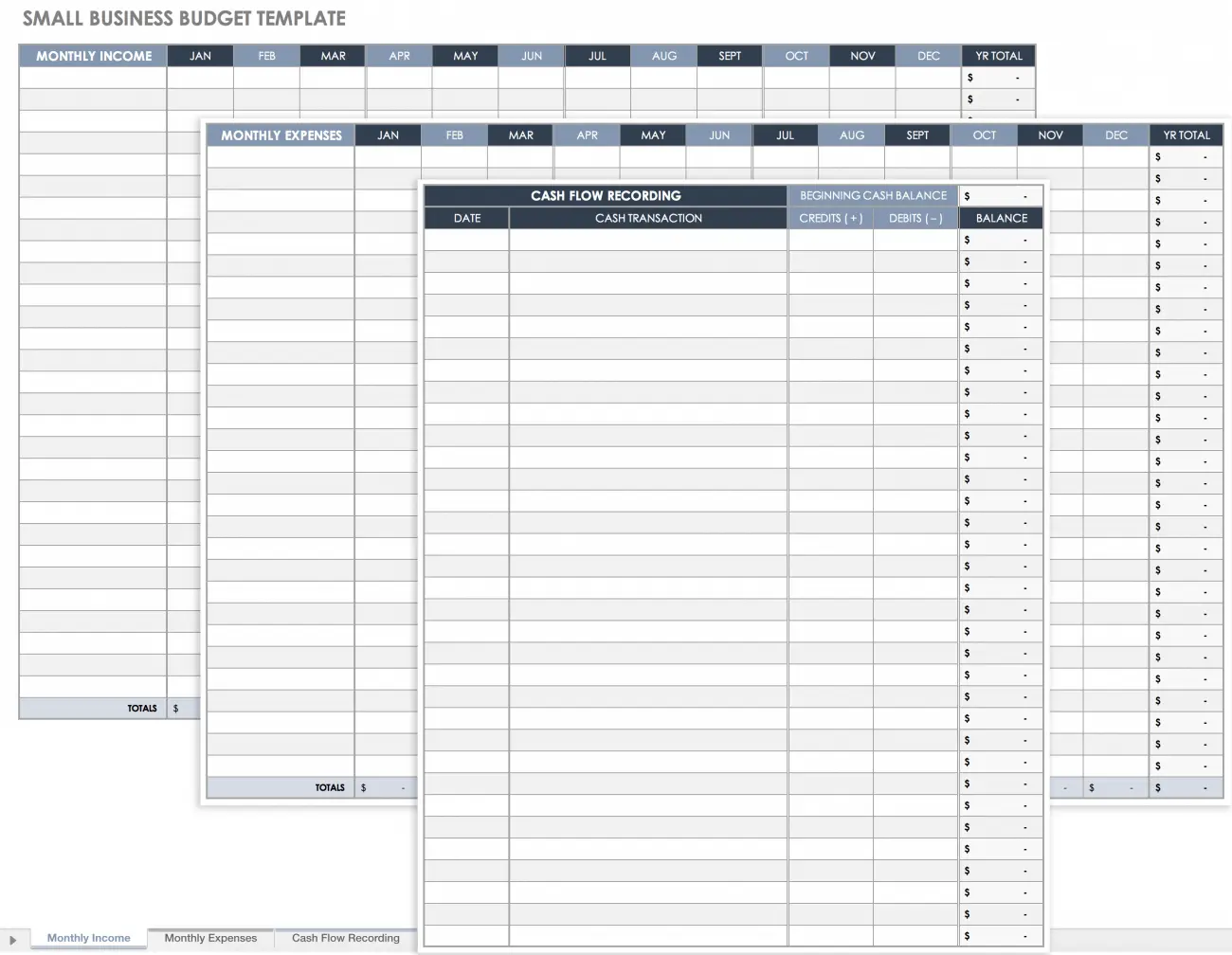

18. Small Business Budget Template: Smartsheet

This small business template includes not one, not two—but three budget planners: one for monthly income, another for tracking monthly expenses, and a third for recording cash flow balances.

By using the Smartsheet template to create and manage your budget, you’ll be able to see how close you are to reaching your financial goals.

With a clear overview of your finances, you can make smart decisions about your small business’s future (maybe expansion is on the horizon).

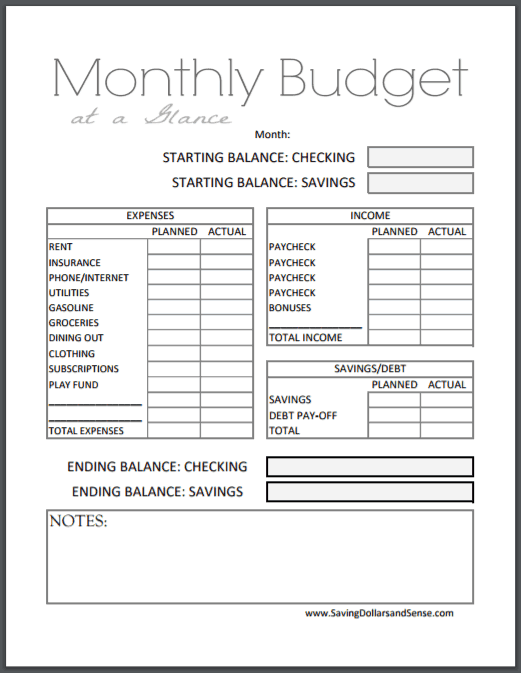

19. Budget Tracker Template

With preset personal budget categories, the free Saving Dollars & Sense printable budget worksheet breaks down your income, expenses, and savings.

It’s the perfect tool to help you stay organized and focused on your financial goals.

But what sets this budget planner apart is its user-friendly layout—say goodbye to confusing spreadsheets and hello to a simple, easy-to-use planner that will help you manage your money with confidence.

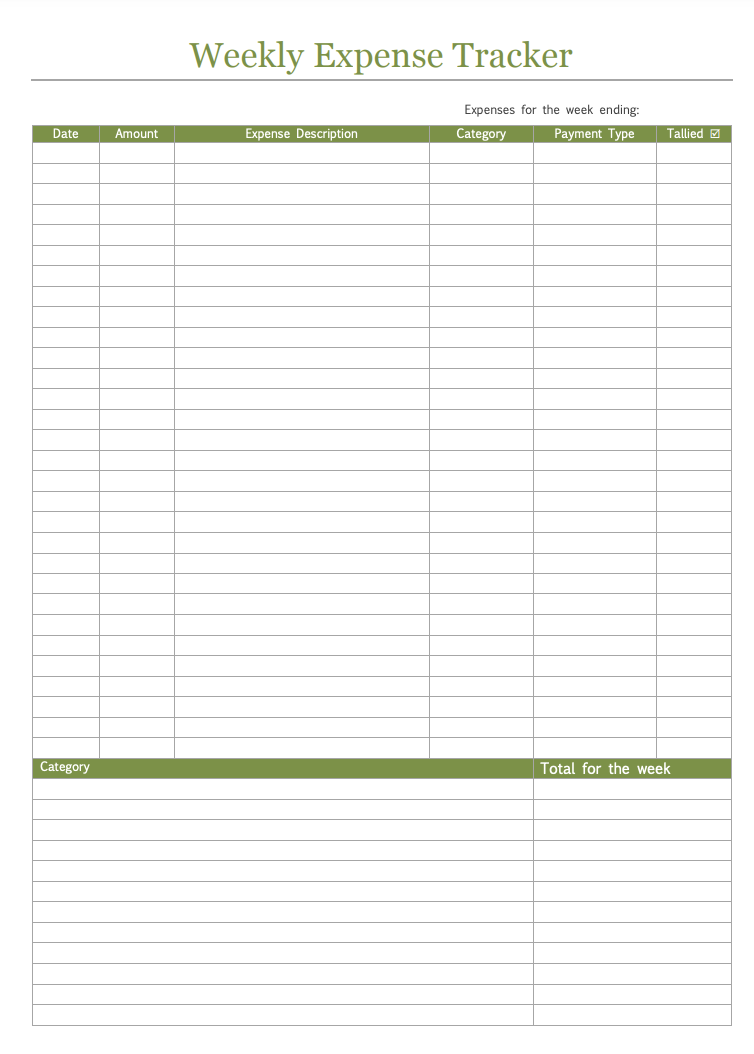

20. Spending Tracker Spreadsheet

Got a little carried away at Target again?

Use the free Frugal and Thriving expense worksheet to note any expenses (no cheating).

By recording your expenses, you can then analyze them to get a clear picture of your spending patterns.

But what about tracking expenses on the go?

There’s also a second printable expense tracker, designed to be cut out and folded into wallet-sized convenience so that you can easily keep tabs on your spending as you load up that shopping cart.

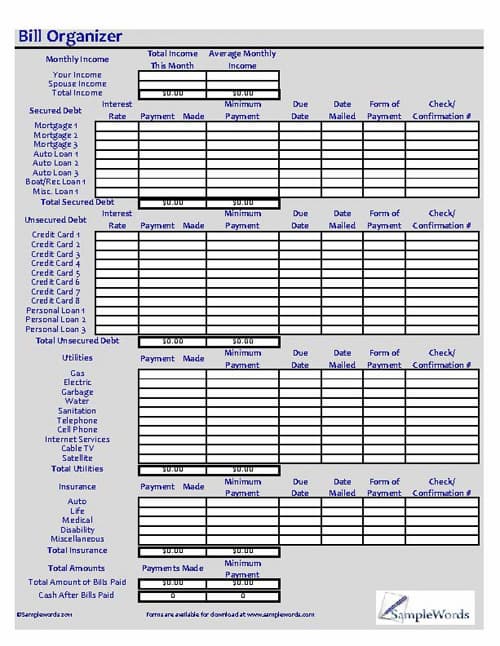

21. Bill Organizer Budget Spreadsheet: Samplewords

The darkest times come when you can’t pay your electricity bill.

Avoid any nasty surprises with this budget organizer, which lets you note any debt payments, including mortgages, credit cards, auto loans, utilities, and insurance.

And don’t stress about all those numbers—this Samplewords budget Excel template automatically calculates the totals of each category, the number of bills paid, and any cash left over.

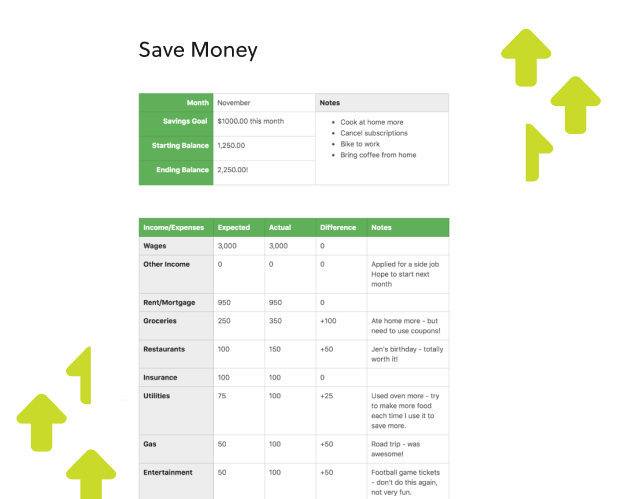

22. Monthly Expenses Template: Evernote

With just a click, you can set up a monthly expense sheet and start putting a microscope on exactly how you spend your money.

The Evernote planner lets you identify areas where you can save more by adding your income and any expenses for rent, groceries, eating out, and more.

You can also fill in what you plan to spend in the “expected” column for each expense.

Then—when your spending is done for the month—fill in the “actual” and “difference” columns to see if you’re staying on track.

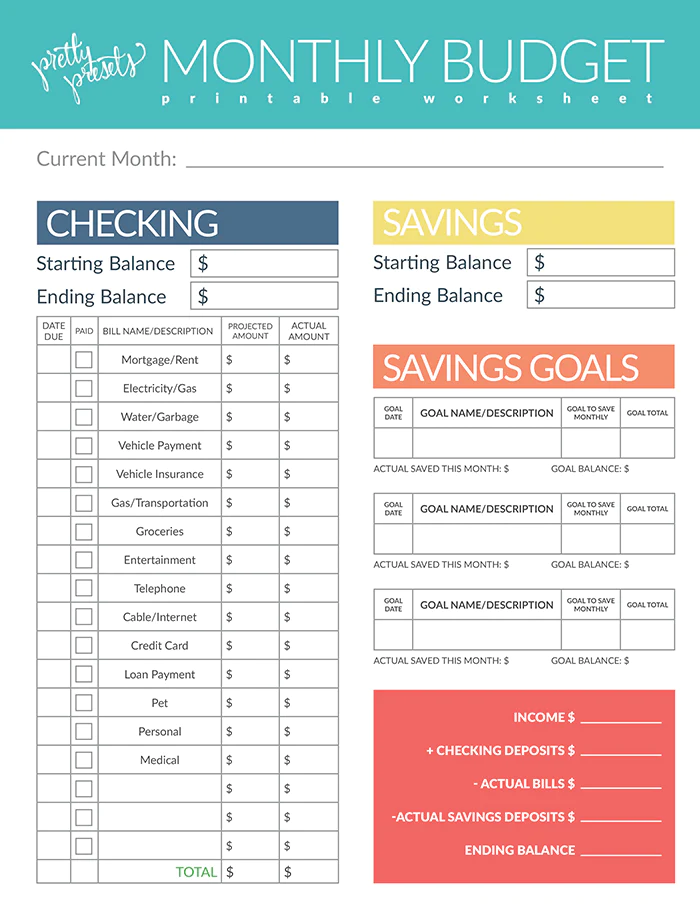

23. Savings Tracker Template: Light Room Presets

You need a new fridge, but that money just keeps disappearing from your bank account (I’m sure those new shoes had nothing to do with it).

Well, with this free Light Room Presets worksheet, you can stay on top of all your expenses and stick to your budget.

There’s a handy section to jot down your savings goals, where you can record your starting and ending balance each month to see if you’re close to your target. You’ll be enjoying the sweet taste of ice-cold water in no time.

And if you’re serious about saving, check out the best savings accounts.

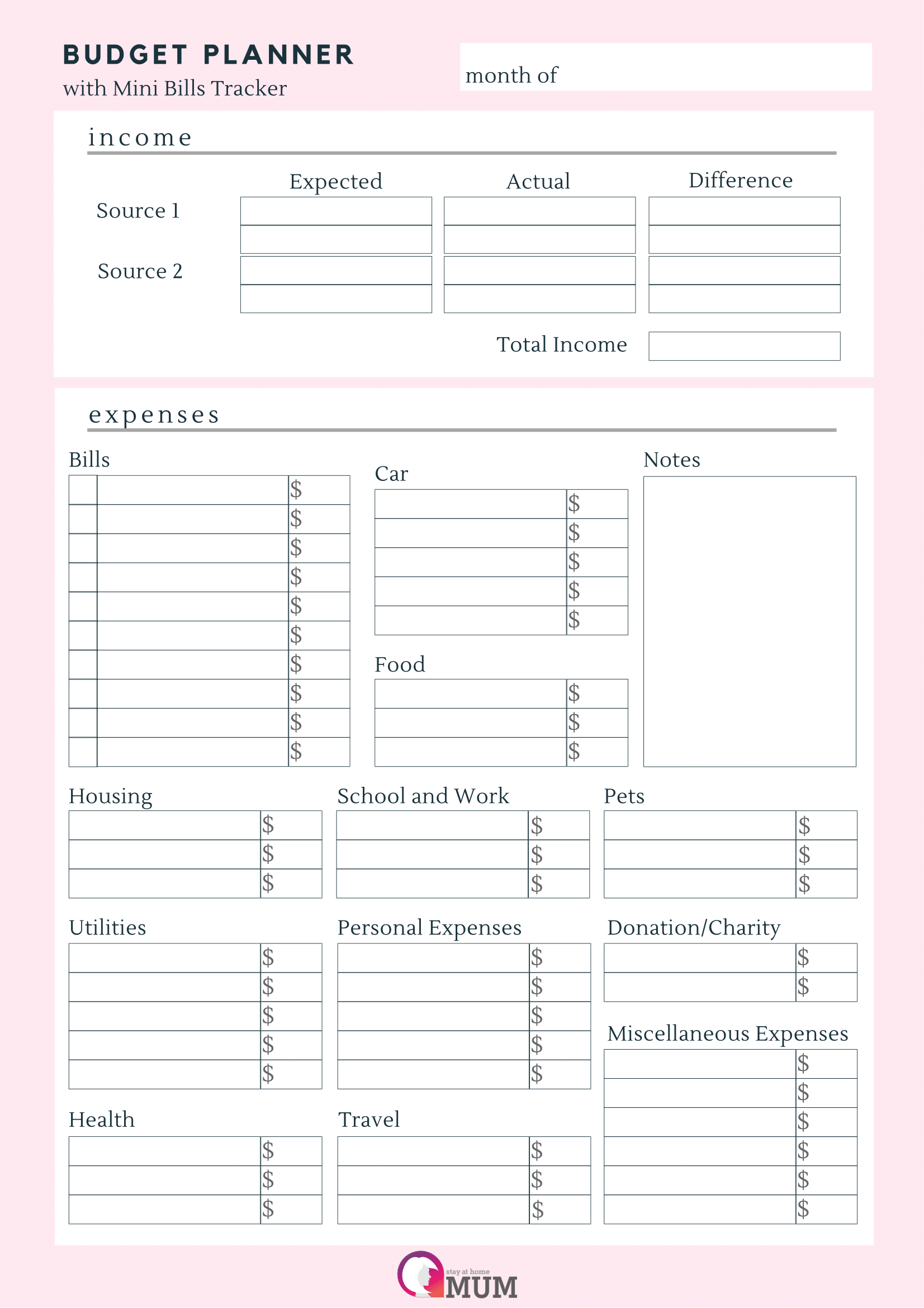

24. Household Budget Template: Stay-at-Home Mum

If you have kids (or a food-loving partner), you’ll know that a household budget can make all the difference to your finances.

This Stay at Home Mum template comes with spaces for income sources and a tracker for your bills.

And no matter what goes on at home, this template includes brainstormed categories to fit everyone’s needs—this includes utilities, health, school, and expenses for your furry friends.

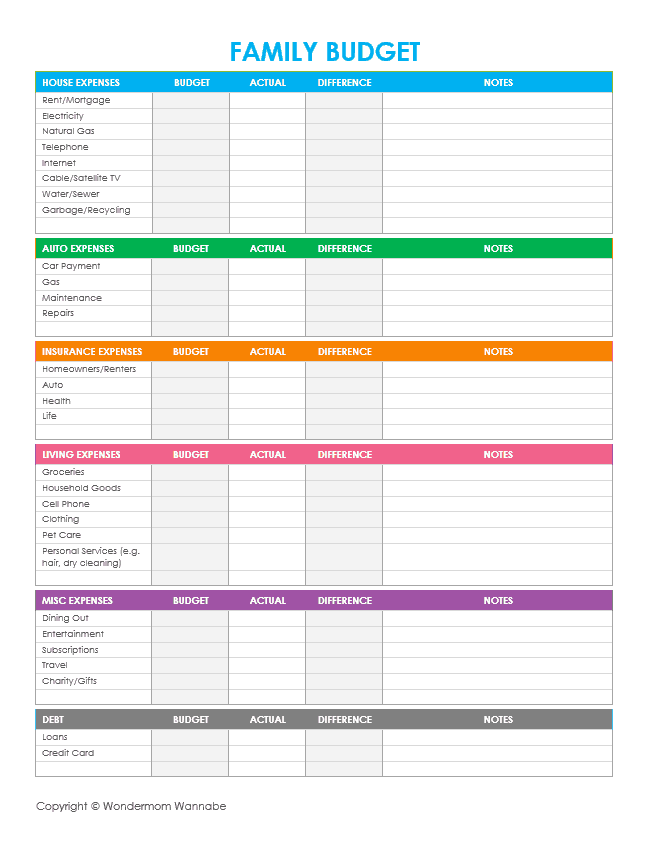

25. Family Budget Template: Wondermom Wannabe

You’ve always wanted to take your kids to Disneyland—but the mounting grocery bills and unexpected car repairs have put the brakes on that.

To help you visualize your goals and track your progress, try using the free Wondermom Wannabe savings goal worksheet.

Simply write down how much you plan on saving each month for each category and your goal for the end of the year. Your kids will be singing Bibbidi-Bobbidi-Boo before you know it.

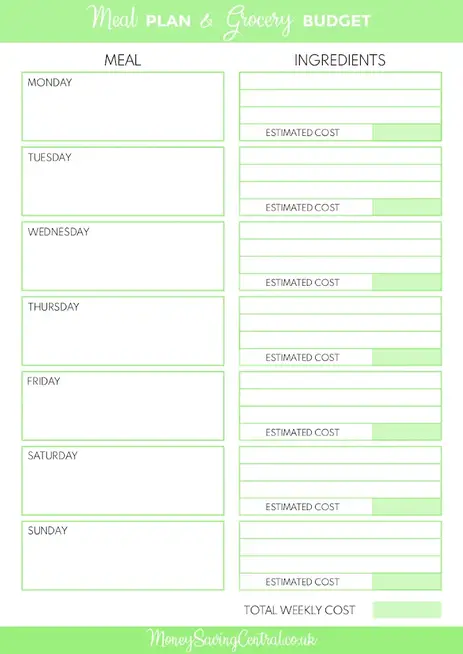

26. Grocery Budget Template

Do you find yourself throwing away leftover food every week? Turns out your kids aren’t the biggest fans of apples like you thought—and that money could have gone towards the monthly bills.

Money Saving Central offers a free printable meal plan and budget so you don’t spend extra on fruit that will only ever make trips to the office and back.

The grocery budget is weekly, so you can use it to plan your meals and work out the estimated costs.

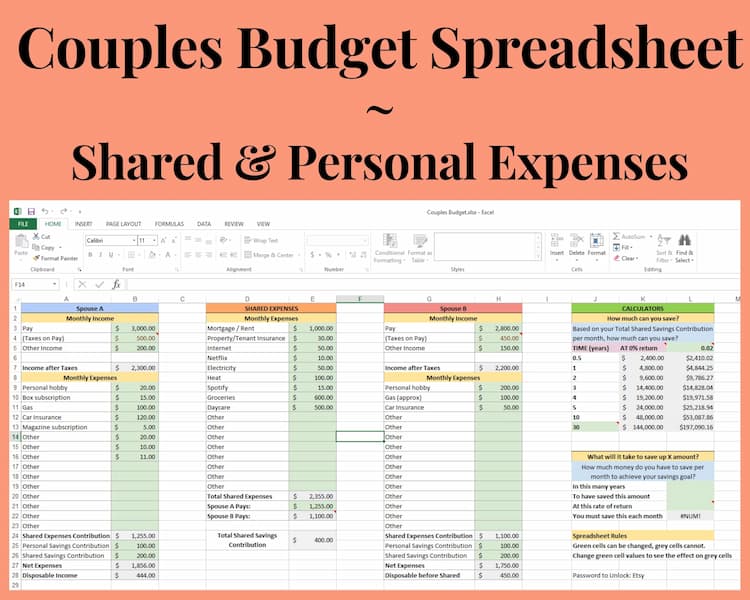

27. Couples Budget Template: Light by Lemon

Say goodbye to financial bickering with this couple’s budget spreadsheet template from Light by Lemon.

It’s pretty simple, with everything you need on one page for less than $4. Plus, the formula cells are locked and colored grey to avoid accidental deletion.

The spreadsheet comes with three main components: the Shared & Personal Monthly Budget, the Potential Savings Calculator, and the Savings Goal Calculator (which helps you determine how much money you need to save each month to reach a certain savings goal).

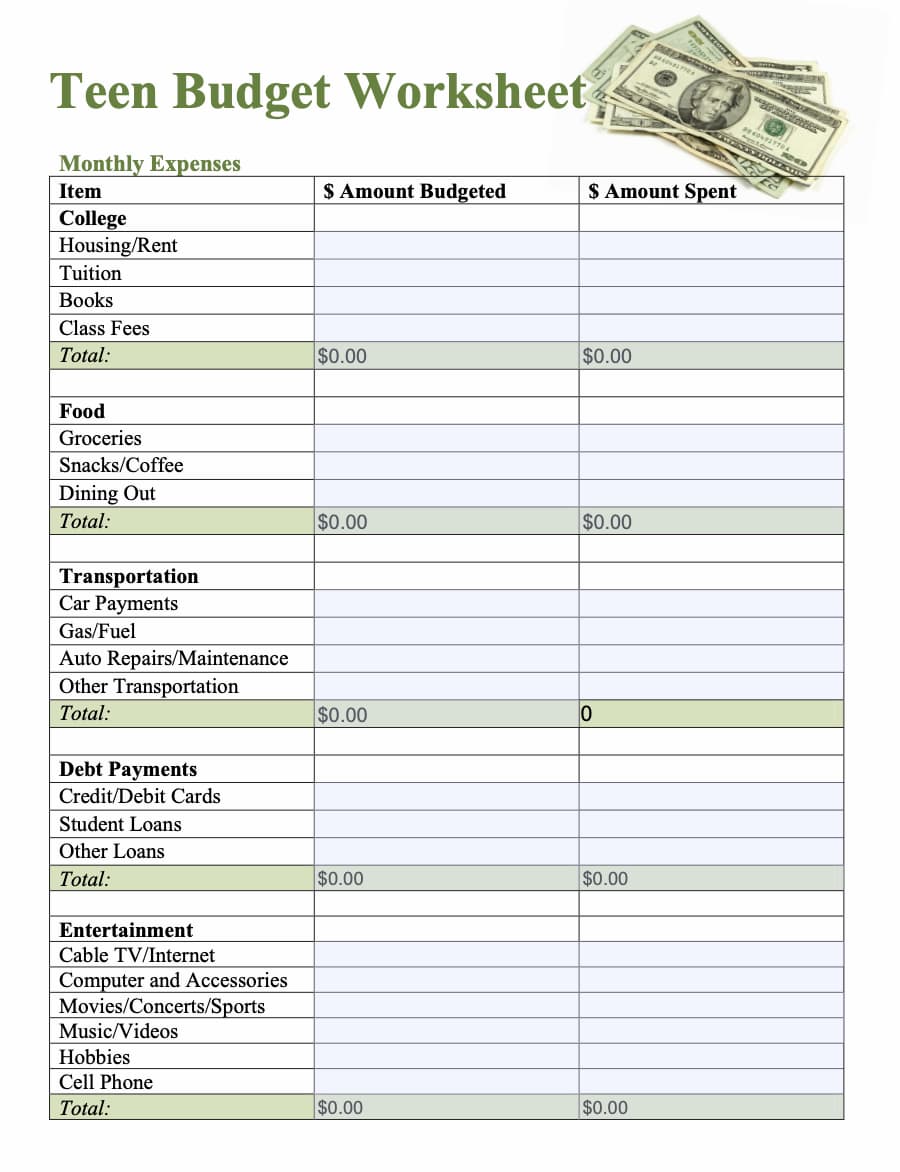

28. Teen Budget Worksheet: Family Education

Want to teach your teen the value of money (and get them off your case for the new iPhone)?

This Family Education monthly budget worksheet is designed to help your teenager organize their expenses and savings.

Simply download the sheet and save it to your desktop. Your teen can then type in their monthly expenses and income, and the sheet will automatically calculate their budget.

And best of all, it’s completely free.

29. College Budget Template: College Life Made Easy

It’s no secret that college isn’t cheap.

Designed specifically for college students, this free College Life Made Easy budget template includes a place to write down your income, savings, and expenses.

And no worries if you’re not majoring in finance—this budget template is easy to use and simple to understand.

Plus, with a clear overview of your cash flow, you’ll be able to make better decisions about your spending and still have enough for the odd party (or five).

30. Event Planner Budget Template: Hopin

If you want to turn event dreams into a reality, look no further than this free Hopin event budget template.

This event budget template takes the guesswork out of budgeting and lets you focus on bringing your unforgettable experience to life.

Once you’ve created your event brief, it’s time to get down to the nitty-gritty of budgeting.

This all-in-one event budget template lets you assign actual spending to all aspects of your event, so you know you’re racking the right expenses.

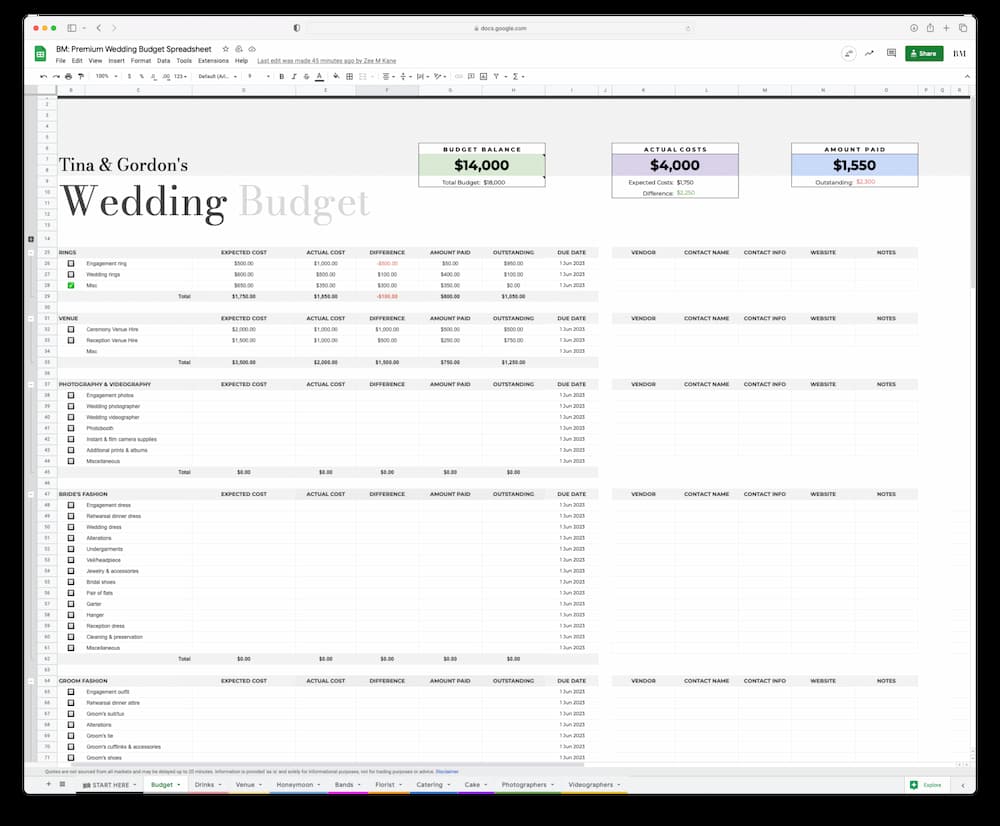

31. Wedding Budget Worksheet: Bridal Musings

Bridal Musings has created two spreadsheets to make your wedding planning a breeze.

First up is the free comprehensive wedding budget spreadsheet that’ll help you estimate costs in the initial stages of planning.

Looking for something even more comprehensive?

There’s also the all-in-one wedding planning spreadsheet for $105 (with regular discounts). This includes everything from guest lists to seating plans and food and drink calculators.

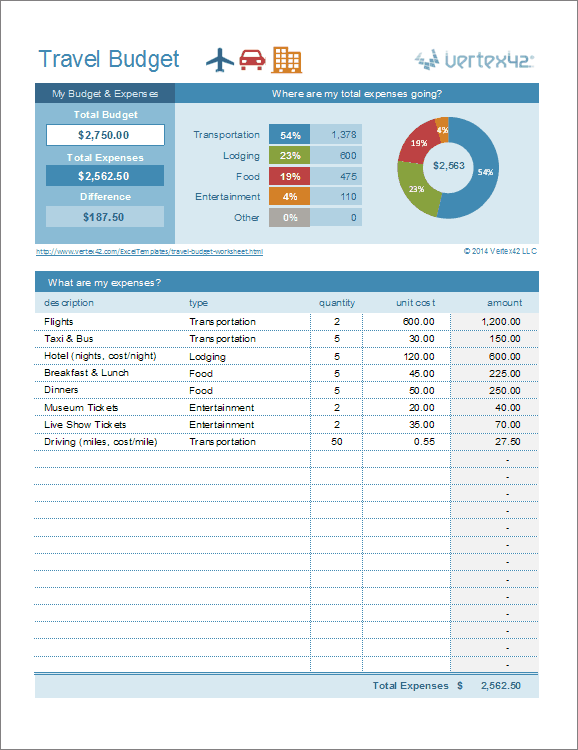

32. Travel Budget Template: Vertex 42

Don’t let finances put a damper on your vacation plans.

By using this Vertex 42 travel budget template, you can list all of your travel expenses and estimate your total costs.

The template is easy to use—simply enter a quantity and unit cost for each item. The top section lets you set a total budget.

As you enter your travel costs, you can quickly see where your money is going and if you’ll have any extra or need to adjust your budget.

Planning your next vacation? Check out our ultimate bucket list items for more travel ideas.

Key Takeaways

- A budget can help you track your spending, save up, and take control of your finances.

- Our monthly budget template promises to simplify the process and help you keep an eye on your money goals.

- And remember—if at first you don’t succeed, try again (it’ll be worth it).

FAQ

What is the 50-30-20 rule?

The 50/30/20 rule is a simple budgeting guideline that can help you manage your money in a balanced way.

The rule says that you should spend 50% of your income should go to necessities such as rent, utilities, and groceries.

The 30% should be allocated to spontaneous spending like dining out or shopping.

The other 20% of your income should be saved or invested in long-term goals such as retirement or building an emergency fund.

This rule can be a helpful starting point for those new to budgeting or who want a quick and easy way to get started. While it may not work for everyone’s unique financial situation, it can be a useful guideline to help you keep tabs on your spending.

Use our free budget calculator to maximize your savings.

How to make a budget spreadsheet?

Create a budget spreadsheet easily with these simple steps:

- Open a blank spreadsheet in Excel or Google Sheets.

- Label the first row with your budget categories (e.g. rent, gas, groceries).

- Label the first column with the months of the year.

- Enter your estimated monthly costs for each category.

- Use formulas to automatically calculate totals and remaining balances.

- Add charts or graphs to visualize your spending habits, then customize the spreadsheet to your preferences.

A well-organized spreadsheet can help you understand your spending habits and improve your finances.

And if you want to save time, here’s our free monthly budget template.

What is the 70 20 10 rule budget spreadsheet?

The 70/20/10 rule budget spreadsheet is a budgeting guideline that can help you allocate your income.

You should aim to allocate 70% of your income towards necessities such as housing, utilities, and groceries.

The 20% should be put towards financial goals such as debt repayment or retirement savings.

And 10% of your income goes towards personal goals such as travel or hobbies.

This budgeting method helps prioritize necessities while allowing room for personal and financial goals. Using a budget spreadsheet can help you track your progress and make adjustments along the way.

Take a look at the top free monthly and weekly budget planners.

How to start a budget for beginners?

Starting a budget for beginners is easy with these simple steps:

- Determine your net income (income after taxes).

- List your monthly expenses (be sure to include everything).

- Categorize your expenses (e.g. housing, food, transportation).

- Calculate how much you spend in each category.

- Compare your expenses to your income to see where you can make cuts.

- Create a budget plan and track your progress.

By creating a budget plan, you can better understand your spending habits and identify areas where you can save money. This is a great way to start building a strong financial foundation for the future.

What’s the best monthly budget planner?

Our monthly budget planner is ideal for both budget newbies and seasoned savers.

The template contains a budget estimate, various categories, and actual monthly spending. Our budget charts also make it easy to track your finances.

If you want even more control, you can also try our weekly budget planner. Our template lets you customize the tool to meet your specific requirements for a personalized touch.

How to create a budget in Excel?

Creating a budget in Excel is easy with these simple steps:

- Open a new workbook and create a new sheet.

- Label your income and expense categories in separate columns.

- Enter monthly estimated amounts for each category.

- Use formulas to calculate totals and remaining balances.

- Create a chart to visualize your spending habits.

- Customize your budget sheet to your liking.

Excel offers many features to help you build a detailed and organized budget that works for you.

Check out our weekly budget template that can be used on both Excel and Google Sheets.

How do you use a budget template?

Firstly, you can choose a template that suits your needs and download it. Start by inputting your income and expenses into the corresponding cells.

Once you’ve done your calculations, check your totals to ensure you’re not overspending. And if you think your goals aren’t realistic, feel free to adjust your spending if necessary to stay within your budget.

Using a budget template helps you keep track of your spending, prioritize your expenses, and avoid overspending. It also lets you see where your money is going and make necessary adjustments to improve your financial health.