Silver has a long history of being used as currency and has long been considered valuable for its own sake, whether as coins or as jewelry.

Silver has also emerged as an indispensable raw material in today’s economy. Its electrical conductivity makes it indispensable in computer chips and solar panels. 11% of the world’s silver is used for photovoltaic purposes and 33% for electrical applications.

It also has antiseptic properties making it useful for some medical treatments.

Silver combines industrial and monetary demand, creating value in both positive and negative economic scenarios.

It is also a metal that is getting quite rare, with consumption outstripping production for many years. In 2022, markets were undersupplied for 237 million ounces of silver or 19% of the demand of 1.24 billion ounces[1].

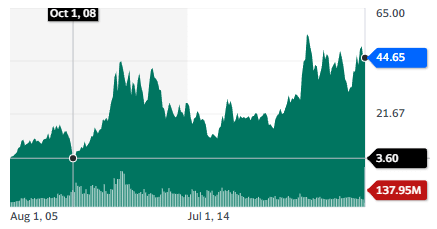

Silver prices are currently on the rise but are still well below the 2 previous spikes of 2011 and 1980 (especially if taking inflation into account).

Best Silver Stocks

Most of today’s silver production is a byproduct of mining for other metals like copper or gold. This makes pure silver players rather rare.

Still, some companies are producing a lot of silver, making most of their revenues from silver or developing new deposits.

So let’s look at the best silver stocks.

These are designed as introductions, and if something catches your eye, you will want to do additional research!

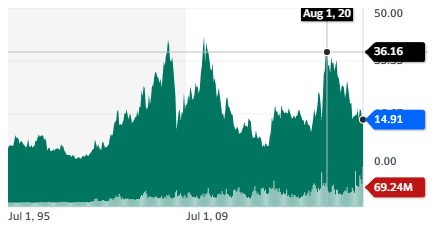

1. Pan American Silver Corp. (PAAS)

PAAS is a gold and silver mining company with operations in Latin America, positioning itself as “The World’s Premier Silver Company.” The production is geographically diversified, reducing the risk from any single jurisdiction.

It produced 18.5 Moz (million ounces) in 2022 and has reserves (proven + probable) of 514.9 Moz, or 27.8 years of current production levels.

The company’s AISC (All In Sustainable Cost) of silver was $16.56, below the recent $20-$26/oz price range.

PAAS acquired 4 mines from Yamana Gold in March 2023 in a $4.8B cash and stock deal. The transaction also had Yamana selling its Canadian mines to Agnico Eagle. This should add to gold and silver production, as well as add 164 Moz of silver to the reserves.

The company might add another 20 Moz of annual production if it managed to regain a mining permit for its Escobal mine in Guatemala, suspended since 2017.

The company has a low level of debt, with $283M to be paid back in 2027 and $500M in 2031.

PAAS is a company fit for investors looking for exposure to silver and relative safety, thanks to large reserves and multiple mines in many different countries. They are also acquiring the optionality of the Escobal mine reopening, as well as several projects still in the exploration stage.

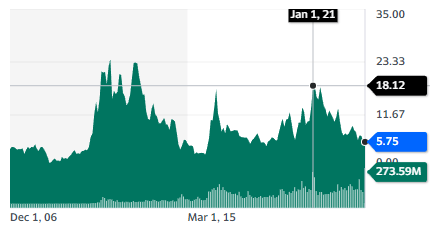

2. First Majestic Silver Corp. (AG)

First Majestic Silver Corp owns silver assets in Mexico and Nevada but currently only produces silver in its 3 Mexican mines. It derives 51% of its revenues from silver and 49% from gold.

The company has grown production steadily, from below 10 Moz of silver ounce equivalent in 2012 to a 2023 guidance for 33-37 Moz of silver ounce equivalent.

The company has a policy aimed at distributing 1% of revenues as dividends, with the rest of the cash flow put toward production expansion.

In March 2023, the company suspended operations at Jerrit Canyon in Nevada due to growing costs that brought its AISC above the current price of silver. In Q1 2023, the company’s average AISC rose to $20.90/ox, very close to silver spot prices, bringing the company’s profitability into question.

It has also been involved with a $500M tax dispute with Mexico since 2021.

First Majestic Silver Corp is a high-cost producer that has had somewhat of a hard time since 2021. That is reflected in the share price. It’s a risky investment that offers the possibility of a turnaround, depending on the outcome of the tax dispute. It would also reap more benefits from an increase in silver prices than other producers.

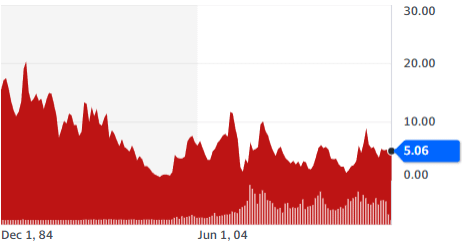

3. Hecla Mining Company (HL)

Hecla is the oldest and largest US silver producer, responsible for 1/3 of the country’s silver production, and the 3rd largest silver producer in the world. It produces 45% of its silver in the USA and the rest in Canada.

Hecla produced 14.1Moz of silver and 176Koz of gold in 2022. The company plans to reach 17 Moz of silver in 2023 and up to 20 Moz in 2025. A large part of its revenues also comes from gold and other metals (zinc and lead).

The Company’s proven and probable reserves were 240Moz of silver and 2.5Moz of gold (17 years for silver reserves and 14.2 years for gold).

The AISC for silver in 2022 was $11.25/oz (after taking into account sales of other metals mined together with the silver).

Thanks to its location, Hecla offers a much safer profile than most miners from a jurisdiction point of view. Its relatively low cost of production and good reserves make it more attractive to investors looking for a way to get exposure to silver and gold with lower political risks.

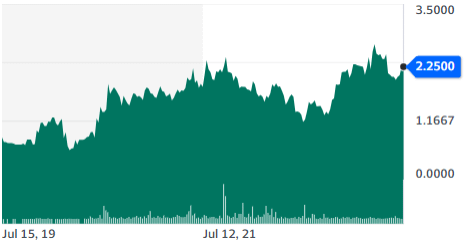

4. Adriatic Metals PLC (ADMLF)

Adriatic Metals is an ambitious silver-zinc development project located in Bosnia & Herzegovina. It was acquired in 2017 and fully permitted in 2022. Production should start in Q3 2023.

Between cash on hand and raised debt, the $254M project is fully funded. The mine has an expected minimum of 10-year lifespan, with the possibility of an extension.

The project targets resources that have been left untapped during decades of communist rule and the subsequent wars following the breakup of Yugoslavia.

As a result, the AISC is projected to be at the extremely low level of $7.3/silver equivalent ounce, giving Adriatic Metals one of the lowest production costs of all global silver projects in development.

As is often the case in mining, this project offers great potential economic rewards in exchange for very real geopolitical risks. While Bosnia is a good jurisdiction from a tax perspective, the region remains volatile, and tensions with its Serbian ethnic minority stay a serious concern, especially in the context of similar flaring tensions between Serbia and Kosovo.

5. Wheaton Precious Metals Corp. (WPM)

Wheaton is a royalty company, not a miner. A royalty company helps miners finance new mines in exchange for a future percentage of the production or a percentage of the mine’s future revenues. They operate like a bank or a venture capitalist but specifically in the mining sector.

In general, this business model tends to benefit from high commodity prices, even when miners might not benefit so much due to rising prices for both gold and silver (revenues) and energy (costs).

Wheaton focuses on high-quality assets, with 93% of its assets in the lowest half of the production costs curve and 30 years of mine reserve on average. Almost all of the mines it has dealt with are in the Americas, with a total of 19 operating mines and 13 development projects.

Company assets generated 620,000 gold equivalent ounces (GEOs) in 2022 and are expected to reach 850,000 GEOs by 2032.

Among royalties “streamers,” Wheaton is the only one to have almost as much revenue from silver as from gold and very few other metals or commodities.

Wheaton has grown its dividends from $0.20/share in 2015 to $0.60/share in 2022, or “~$435/oz to shareholders in the form of dividends”.

ETFs (Exchange Traded Funds)

If you prefer to have exposure to the sector as a whole, there are several silver-focused ETFs available.

1. Global X Silver Miners ETF (SIL)

This ETF is focused on silver miners (most also produce at least some other metals). Its top 4 holdings are a mining royalty company (Wheaton Precious) (24%), Pan American Silver (13%), Hecla Mining (7%), and a metal refiner, Industrial Penol (6%).

2. ETFMG Prime Junior Silver Miners ETF (SILJ)

This ETF focuses on small-cap silver miners, often at the exploration stage. As a result, even if it actually includes some larger miners like PAAS and Hecla, it is a lot more diversified. This ETF is likely going to have a more risky and volatile profile than SIL, but also more upside in case of rising silver prices.

3. iShares MSCI Global Silver and Metals Miners ETF (SLVP)

This is an ETF focused on the top producers of silver, with its top 4 holdings including PAAS (23%), Hecla (13%), Industrial Penol (8.5%), and First Majestic Silver (5.5%).

4. Sprott Physical Silver Trust (PSLV)

This is an investment trust investing in “unencumbered and fully-allocated London

Good Delivery (“LGD”) silver bars.” Essentially it means physical silver held in vaults and explicitly allocated to Sprott instead of together with a pool of other investors. This is probably the safest way to get easy exposure to silver and bet on price fluctuations of the commodity itself.

Conclusion

Silver is an increasingly vital metal in the modern world, especially for electronics and the green transition (solar panels, EVs, batteries, etc.). It also retains some of its appeal as a material for jewelry and as a monetary metal, especially with the return of high inflation.

The chronic underproduction from miners compared to rising global demand could give strong support to the price of this key commodity.

As with any mining investment, investors will want to pay great attention to jurisdiction risks and production costs.

As silver is often a byproduct or co-produced with other metals, they will need to pay close attention to the geological specifics of the mines they invest in and the risk profile of these other metals.