You need good credit to get a loan, credit cards, a car, or a house. No wonder you’re looking for ways to boost your credit fast.

That’s why we compiled this comprehensive list of ways in which you can do it.

Try one or all of them—and watch your credit go up in no time.

This article will show you:

- How to increase your credit score.

- How long it takes to build credit.

- What can hurt your credit.

Read more:

How to Build Credit – Tips to Develop a Good Credit Score

How to Build Credit Without a Credit Card: 10 Easy Ways to Build Credit

How Long Does It Take to (Re)Build Credit? Tips, Tricks, and Timeframes

How Long Does It Take To Get A 700 Credit Score From 0? (And How to Do It!)

But first—

What’s the credit score made of?

A credit score is a three-digit number that ranges from 300 to 850 and is used by lenders to determine your creditworthiness.

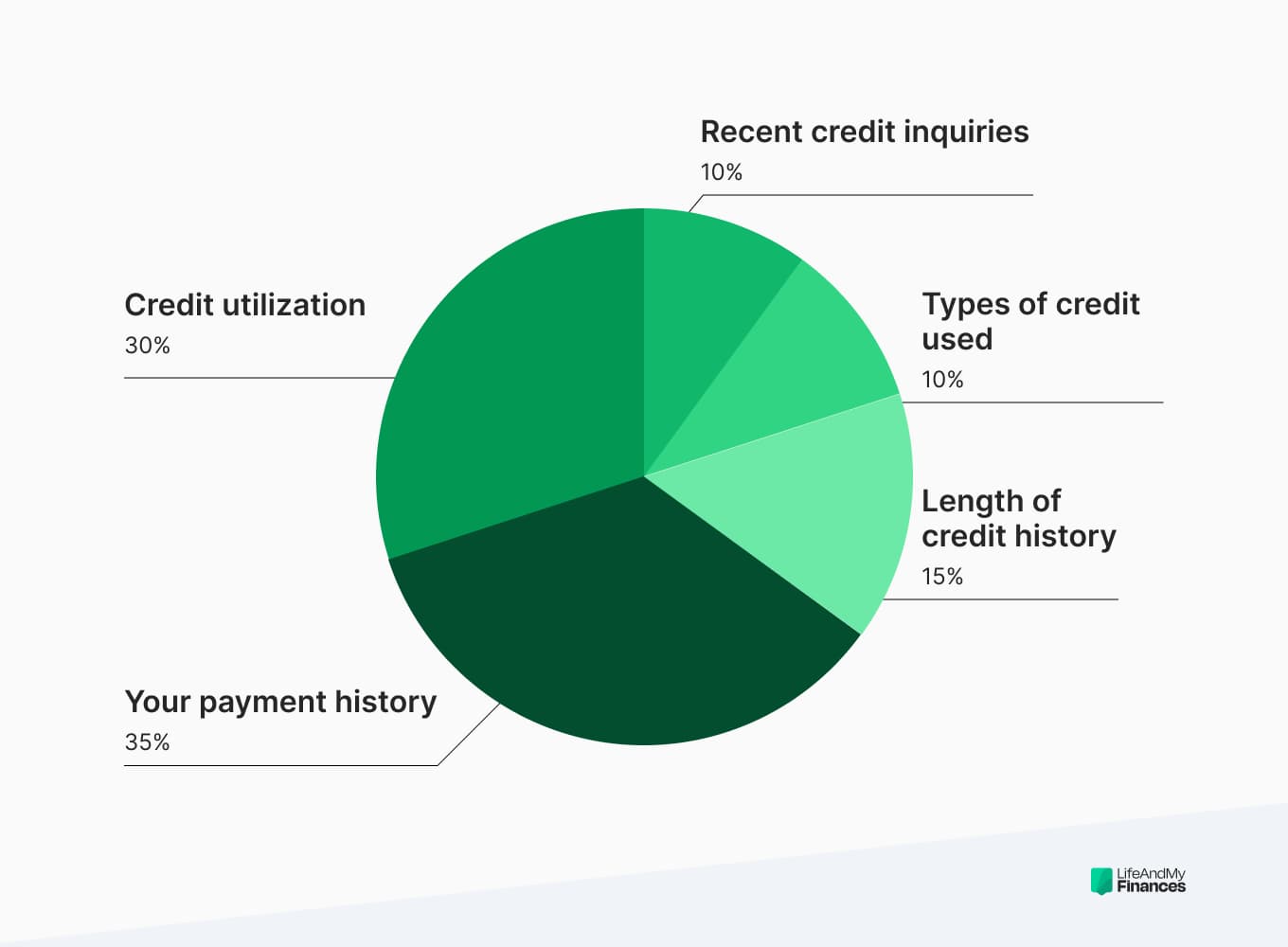

It’s made up of several factors, including:

- Your payment history (35%).

- Credit utilization (30%).

- Length of credit history (15%).

- Types of credit used (10%).

- Recent credit inquiries (10%).

Check Your Current Credit Score Now

If you’re looking for ways to increase your credit score, it’s probably not the best right now.

That’s why you need to monitor it constantly and stay on top of your financial game (more on that later).

If you want to check your credit and read through your credit report now for free—Credit Karma is a great place to do it.

Which of the below categories do you fall into?

Exceptional: 800–850

Very Good: 740–799

Good: 670–739

Fair: 580–669

Poor: 300–579

The Fastest Ways to Build Credit

To improve your score even more (and keep it in good standing), check out these credit building opportunities:

- Use apps to increase credit score.

- Make timely payments.

- Keep your credit report clean and accurate.

- Get a credit card and use it responsibly.

- Keep your old accounts open.

- Don’t apply for multiple credit lines at the same time.

- Avoid closing multiple accounts at once.

- Consider a secured credit card.

- Become an authorized user.

- Pay off outstanding debts.

- Take out a small loan.

- Limit large purchases.

- Request a credit limit increase.

- Set up payment plans for outstanding collections.

- Report rent and utility payments.

- Maintain financial stability.

Using apps designed to boost credit score

Apps like the Experian Boost or Credit Karma can help you ramp up your scores in no time.

Let your bills (like rent or Netflix) work for you by adding them to your credit report.

The best part? Experian Boost does it for you for free. All the on-time payments count. Their website says it takes up to five minutes to see the boost.

Credit Karma may not work that fast, but it helps not only to boost your credit score now, but keep it in good shape forever.

Just sign up for the free monitoring—you’ll stay on top of your reports and get personalized recommendations on how to improve your score.

Ana-Maria Sanders, a financial analyst at OpenCashAdvance.com, echoes this advice:

“Get a credit-boosting app: There are a number of apps available that are designed to help you boost your credit score. For example, Experian Boost allows you to add utility and telecom bills to your credit report. At the same time, Credit Karma can help you monitor your credit score and provide personalized recommendations for improving it.”

Paying your bills on time

Late payments can hurt your credit score, so pay your bills on time every month.

Monitoring your credit report

Keep an eye on your credit report to make sure there are no errors or fraudulent activities that could hurt your credit score. If they happen, dispute them immediately.

Getting a credit card

A credit card is an excellent tool to build credit quickly. Use it responsibly by paying your balance in full every month, and you’ll see your credit score go up in no time.

How long does it take to get a credit score after getting a credit card?

It typically takes about six months of consistent credit card use to establish a credit score from scratch.

By “consistent”, we mean responsible use—making payments on time, keeping the utilization ratio at bay, and not getting yourself into big amounts of debt.

How to improve a bad credit score with a credit card?

- Get a credit card designed for those with poor credit. These cards typically have higher interest rates and lower credit limits, but they can be a valuable tool for rebuilding credit.

- Use it responsibly. This means making all payments on time and in full each month. Even one late payment can damage your credit.

- Keep your credit utilization low. This means not using more than 30% of your available credit at any given time. So if your credit limit is, say, $1,000—keep your balance below $300.

- Monitor your credit report regularly to make sure that all information is accurate. If you notice any errors or discrepancies, dispute them with the credit reporting agencies.

Keeping old credit accounts open

The length of your credit history plays a role in your credit score. Keeping older accounts open, even if you don’t use them, can help increase the average age of your credit accounts.

Not applying for multiple credit lines simultaneously

Each time you apply for credit, a hard inquiry is made on your credit report, which can temporarily lower your credit score. Space out your credit applications to minimize the impact.

Other than that, hard inquiries may happen when you apply for a new:

- Loan or mortgage

- Cell phone plan

- Apartment lease

- Job

It’s worth making sure that you stay on top of them when trying to boost your credit score.

Avoiding closing multiple accounts at once

Closing several credit accounts at the same time can dampen your credit score by reducing your overall available credit and increasing your credit utilization ratio.

Considering a secured credit card

If you have a limited or poor credit history, a secured credit card can help you build credit. Make sure the card issuer reports your activity to all three credit bureaus.

Becoming an authorized user

If you have a family member or friend with a good credit score, ask them to add you as an authorized user on their credit card. This will help you build credit without applying for a credit card yourself.

That’s also an awesome idea for teens under 21. The sooner you start, the longer your credit history—the better your credit score.

How much will your credit score increase as an authorized user? It all depends on the credit history of the primary account holder.

Your score could go up significantly if the original cardholder has a strong credit history and makes timely payments. But if they have a poor credit history, it could negatively impact your score.

So choose the account holder wisely. Research shows that cocaine dealers are doing great even during inflation, so if you have one—

Just kidding.

And, we don’t want to sound like your high school teacher, but if you can’t use the card responsibly—don’t do it.

Paying off outstanding debts

Pay off debts, especially high-interest debt. Use our free debt payoff calculator to help you.

Taking out a small loan

Taking out a small personal loan or car loan and paying it back on time can help you build credit quickly. If you’ve been thinking about remodeling your kitchen, now’s your time.

Again, not to sound preachy, but do it only if you can pay it back on time. Otherwise, it would just damage your credit.

Limiting large purchases

No, this doesn’t go against our last advice.

We’re just saying you should avoid making large purchases on your credit cards, especially if you can’t pay off the balance in full.

High balances can increase your credit utilization ratio and lower your credit score. A small personal loan is a different story.

Requesting a credit limit increase

If you’ve been a responsible credit user, consider asking your credit card issuer for a credit limit boost. A higher credit limit can lower your credit utilization ratio as long as you don’t increase your spending.

You know what we’re about to say—

If you haven’t been a responsible credit card user, skip this advice.

Setting up payment plans for outstanding collections

If you have any accounts in collections, work with the collection agency to set up a payment plan. Paying off collection accounts can help improve your credit score over time.

Reporting rent and utility payments

Some credit bureaus now consider rent and utility payments in their credit scoring models.

Check if your landlord or utility provider reports your payments to the credit bureaus, or use a rent-reporting service to make sure your on-time payments are reflected in your credit report.

If you have to pay these crazy California rent prices, they better count for something.

Maintaining financial stability

Lenders may also consider employment history and income stability.

Keeping a stable job and income shows financial responsibility, which can positively influence your credit score.

Yes, our parents were right—staying in the same job for twenty years makes sense sometimes. Go figure.

Now that you have all the ways to boost your credit, let’s answer another important question—how long will it take you to do it?

How Long Does It Take To Build Credit?

Building credit takes time and consistency.

Establishing a credit score from scratch typically takes at least six months of on-time payments and responsible credit usage.

Getting a high credit score if you already have some points is a different story—it can take up to a year or more to achieve that.

We get a lot of questions like, “How long does it take to build credit from 600 to 700?”, “How many points can your credit score go up in a year?”, and “How to get a 750 credit score in 6 months?”.

That’s why we came up with this table—

|

INITIAL CREDIT SCORE |

AVG. TIME TO REACH 700 CREDIT SCORE |

AVG. TIME TO REACH 750 CREDIT SCORE |

AVG. TIME TO REACH 800 CREDIT SCORE |

AVG. TIME TO REACH 850 CREDIT SCORE |

|

0 |

6–8 months |

8 months to 1 year |

1–1.5 years |

1.5+ years |

|

300 |

2 years |

2–3 years |

3–4 years |

4+ years |

|

350 |

1.8–2 years |

2–2.5 years |

2.5–3.5 years |

3.5+ years |

|

400 |

1.5–1.8 years |

1.8–2 years |

2–3 years |

3+ years |

|

450 |

1.2–1.5 years |

1.5–1.8 years |

1.8–2 years |

2+ years |

|

500 |

1–1.3 years |

1.3–1.5 years |

1.5–1.8 years |

1.8+ years |

|

550 |

1 year |

1–1.3 years |

1.3–1.5 years |

1.5+ years |

|

600 |

8 months |

1 year |

1–1.3 years |

1.3+ years |

|

650 |

6–8 months |

8 months to 1 year |

1–1.2 years |

1.2+ years |

|

700 |

– |

3–6 months |

6–9 months |

9 months to 1.2 years |

|

750 |

– |

– |

3–6 months |

6–9 months |

Keep in mind that these are just estimates, and—at some point—you may ask yourself:

Why isn’t my credit score going up?

If that’s the case, check for:

- Missed payments.

- High credit utilization.

- Errors on your credit report.

Negative Factors That Affect Your Credit Score

Or, as my friend calls them—your sins from the past.

Let’s see how long things like bankruptcy or late payments stay on your report—

| Negative mark | What it is | Time on your report |

| Hard inquiry | Credit issuer checks your report when you apply for new credit | 2 years |

| Student loan default | When you don’t make scheduled payments for a number of days, your debt goes in default and all interest is due right away | 7 years |

| Account charge-off | If you don’t repay the debt on your account for six months, your lender could close your account for future charges | 7 years |

| Civil judgment | You are required to pay damages after losing your civil lawsuit | 7 years (may be renewed for another seven years when unpaid) |

| Foreclosure | If you fall behind on your mortgage payments, your bank might put your house on sale | 7 years |

| Missed payment (delinquency) | Delinquency happens when you don’t make your payment for 30+ days | 7–7.5 years |

| Bankruptcy | If you are completely unable to repay your debt, you can declare bankruptcy in federal court—your debt will be discarded | 7–10 years |

Removing Negative Factors From Your Reports

Now, back to the good news—how will removing all or any of them affect your credit score?

How many points will your credit score increase when a collection is removed?

On average, removing a collection can boost your score by 20–30 points. It’ll depend on your credit history, though—the increase could be more significant if the collection is the only negative item on your report.

On that note—how to improve your credit score with collections?

One way to improve your credit score with collections is to negotiate a payment plan with the collection agency and make timely payments.

You can also dispute any errors on your credit report related to the collections.

Collections can stay on your credit report for up to seven years, so it may take time to see significant improvement. Building positive credit habits—such as paying bills on time and keeping credit utilization low—can support your efforts on the way.

Does removing hard inquiries increase credit scores?

Yes, removing hard inquiries can boost your credit score, but remember that the impact of inquiries on your score gets smaller over time—and removing one inquiry may not have that much of an impact.

Will discharged student loans increase my credit score?

Discharged student loans can positively impact your credit score, as they show that you have fulfilled your obligation to repay the debt.

The impact may be less spectacular than expected, though—the negative marks from missed payments or default may remain on your credit report.

How much will the credit score increase after Chapter 7 falls off?

Chapter 7 bankruptcy can cost you up to 200 points, and it’ll stay on your credit report for ten years—ouch!

The good news is that the negative impact will ease over time.

That being said, it’s hard to predict exactly how much your credit score will increase once the bankruptcy falls off—it depends on your credit history and current financial situation.

The Numbers Game—How Long Does It Take to Rebuild Credit?

We asked our readers to send us their most burning questions about rebuilding their credit scores.

“Will paying off a mortgage increase my credit score?”, “Does paying off credit card increase your credit score?”, “Will paying off student loans increase your credit score?” were at the top of the list.

Below, you’ll find our answers (with a tiny caveat, though)—

The answers will always depend on your situation.

There’s no one-size-fits-all scenario here. We offer you our best advice, but, as usual, take it with a grain of salt and remember that your case could be somewhat different.

How long does it take to rebuild credit after paying off debt?

It depends on the type of debt that was paid off.

For example, paying off a credit card debt may impact your credit score differently than paying off a car loan or a mortgage.

And, if you paid off a large amount of debt, it may take longer to see an improvement in your credit score than if you paid off a smaller amount.

Generally, rebuilding credit can take a few months to a few years after paying off debt.

How long does it take for your credit score to go up after paying off credit cards?

It typically takes about 30–60 days for your credit score to reflect the payment of your credit card balance.

But (you know the drill by now) the exact time frame depends on the credit reporting agency and when the payment is reported.

How much does your credit score increase after paying off a car?

On average, paying off a car loan can boost your credit score by 10–20 points.

As usual, the spike may vary based on individual circumstances.

How long does it take for my credit score to update?

Credit bureaus update credit scores once a month, but it can take up to 30 days for the updated information to show up on your credit report.

If you’ve recently paid off a large debt or opened a new credit account, it may take longer for your score to reflect these changes.

Improving Credit Scores In Questions and Answers

Below you’ll find the answers to some other questions on raising your credit score—

What is a good Equifax credit score?

A good Equifax credit score is 670 or higher.

Why is my Equifax score so low?

Your Equifax score may be low because of missed payments, high credit utilization, or a history of delinquencies.

Review your credit report for errors and take steps to improve your credit habits—such as paying bills on time and reducing debt.

FAQ

What increases credit score the fastest?

To boost your credit score relatively quickly:

- Use Experian Boost—some people see results within minutes.

- Pay your bills on time. Late payments can have a significant negative impact on your credit score. Set up automatic payments or reminders to ensure you never miss a payment.

- Keep your credit utilization low. Aim to use only 30% of your available credit. Pay down balances or request a credit limit increase to achieve this.

- Avoid opening too many new accounts simultaneously—this can lower your average account age. Check your credit report regularly for errors and dispute any inaccuracies.

What are three ways to increase your credit score?

Pay your bills on time, keep your credit utilization low, and maintain a long credit history—these are both the most important factors determining your credit score and the most reliable ways to boost it.

Is a 600 a good credit score?

No, it isn’t. A 600 credit score, according to the FICO, is a fair credit score.

A good credit score ranges between 670 and 739 points.

What is the average US credit score?

According to Experian, the average US credit score is 714 FICO.

Check how long it takes to have a 700 credit score (and how you can get there).

What habit lowers your credit score?

Habits that can lower your score include:

- Late payments.

- Credit utilization ratio above 30%.

- Closing existing accounts.

- Applying for multiple credit cards at the same time.

Is 650 a good credit score?

A score of 650 is fair. A good credit score is between 670 and 739 points.

How accurate is Credit Karma?

Credit Karma gives you a free credit report and score—but keep in mind that it’s not the same as the report provided by the three major credit bureaus.

Use Credit Karma as a reliable tool to monitor your credit score and report—but don’t rely solely on it.

What is the average credit score by age?

The average credit score varies by age—the older you are, the higher your score.

For example, those aged 18–29 have an average score of 659, while those aged 60+ have an average score of 743.

Does Affirm increase credit score?

Using Affirm for purchases won’t directly raise your credit score—but making timely payments on your Affirm loan can.

It can show good credit behavior to lenders, improving your creditworthiness.

Will using a debit card increase your credit score?

No, using a debit card won’t raise your credit score.

Debit card transactions aren’t reported to credit bureaus, so they don’t affect your credit history.

Sources

See all

Equifax. (n.d.). What is a Good Credit Score? Equifax | Credit Bureau | Check Your Credit Report & Credit Score. Retrieved on May 17, 2023, from https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

Esperian. (n.d.). How Long After Paying Off a Credit Card Will My Credit Score Go Up? Retrieved on May 17, 2023, from https://www.experian.com/blogs/ask-experian/how-long-after-paying-off-a-credit-card-will-my-credit-score-go-up/

Experian. (n.d.-a). How Long After You Pay Off Debt Does Your Credit Improve? Check Your Free Credit Report & FICO® Score – Experian. Retrieved on May 17, 2023, from https://www.experian.com/blogs/ask-experian/how-long-after-you-pay-off-debt-does-your-credit-improve/

Experian. (n.d.-b). How to Remove Bankruptcy from Credit Report. Check Your Free Credit Report & FICO® Score – Experian. Retrieved on May 17, 2023, from https://www.experian.com/blogs/ask-experian/removing-bankruptcy-from-your-credit-report/

TransUnion. (n.d.). Equifax, Experian, and TransUnion Support U.S. Consumers With Changes to Medical Collection Debt Reporting. Credit Scores, Credit Reports & Credit Check | TransUnion. Retrieved on May 17, 2023, from https://newsroom.transunion.com/equifax-experian-and-transunion-support-us-consumers-with-changes-to-medical-collection-debt-reporting/

Experian. (n.d.). Does Experian Boost Work? Check Your Free Credit Report & FICO® Score – Experian. Retrieved on May 17, 2023, from https://www.experian.com/blogs/ask-experian/does-experian-boost-work/

Experian. (n.d.). 714 Credit Score: Is it Good or Bad? Check Your Free Credit Report & FICO® Score – Experian. Retrieved on May 25, 2023, from https://www.experian.com/blogs/ask-experian/credit-education/score-basics/714-credit-score/