Investing can be a complex and sometimes challenging endeavor. While it offers opportunities for wealth creation, it’s essential to navigate the market with caution and avoid common pitfalls. In this blog post, we will explore common investment mistakes that many investors make and provide practical tips on how to steer clear of them.

1. Letting Fear or Greed Guide Your Decisions:

Investing can be intimidating, especially during uncertain times. However, succumbing to fear or greed and avoiding the markets entirely or making impulsive decisions can hinder your long-term financial growth. Instead, focus on understanding market trends, conducting thorough research, and maintaining a disciplined investment strategy.

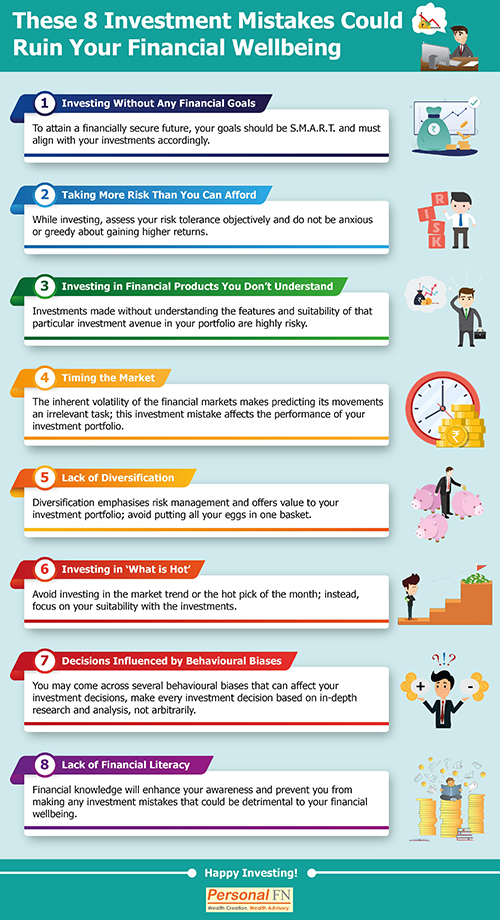

2. Neglecting Clear Investment Goals:

Investing without a clear set of goals or objectives is akin to sailing without a destination. Define your investment goals, whether it’s saving for retirement, funding your child’s education, or achieving financial independence. Assign specific investments to each goal and regularly assess their progress using reliable calculators.

3. Reliance on Questionable Influences:

Relying solely on hearsay, stock tips from acquaintances, or market pundits can be detrimental to your investment decisions. Assess the credibility and expertise of the sources before making any choices. Instead, focus on independent research, diverse opinions, and reputable investment platforms to guide your investment strategy.

4. Succumbing to Market Timing:

Attempting to time the market and predict short-term fluctuations is a common mistake. Even seasoned professionals struggle with market timing consistently. Instead, adopt a long-term investment mindset, make informed decisions based on company fundamentals, and stay committed to your investment strategy through market ups and downs.

5. Lack of Proper Asset Allocation:

Ignoring the importance of asset allocation is a mistake that can expose your portfolio to unnecessary risk. Diversify your investments across different asset classes, industries, and regions to mitigate risk and optimize returns. Understand your risk tolerance and design a well-balanced portfolio accordingly.

6. Overlooking the Power of Rebalancing:

Neglecting to periodically rebalance your portfolio can lead to an unintended shift in your asset allocation. Regularly review and adjust your investments to maintain the desired asset mix and align with your investment goals. Rebalancing also allows you to capture gains and control losses effectively.

7. Being Swayed by Short-Term Noise:

Reacting to short-term market fluctuations and news can cloud your judgment and lead to irrational investment decisions. Filter out the noise and focus on long-term fundamentals. Conduct thorough research, analyze company performance, and remain disciplined in your investment strategy.

8. Overconfidence or Underconfidence:

Finding the right balance between overconfidence and underconfidence is crucial. Overconfidence can lead to excessive risk-taking and unrealistic expectations, while underconfidence may result in missed opportunities. Stay humble, continually learn, seek diverse opinions, and make rational decisions based on thorough analysis.

9. Neglecting the Power of Compounding:

Underestimating the power of compounding is a common mistake among investors. Reinvesting earnings and allowing them to compound over time can significantly enhance your long-term returns. Capitalize on the compounding effect by reinvesting dividends or capital gains and harnessing the potential for exponential growth.

10. Letting Taxes Drive Investment Decisions:

While tax considerations are important, solely basing investment decisions on tax implications can be detrimental. Prioritize investment fundamentals, growth prospects, and risk-return assessments. Evaluate tax implications as part of your overall investment strategy but avoid making it the primary driving factor.

Summary of Common Investment Mistakes

- Investors often make mistakes, and these mistakes can be valuable learning experiences.

- Fear and emotional reactions can hinder investment decisions, whether it’s fear of investing during market downturns or fear of investing at all-time highs.

- Setting clear investment goals and aligning investments with those goals is crucial for making informed decisions.

- Avoid relying too heavily on outside influences and instead focus on one’s own research and analysis.

- Overconfidence and underconfidence can lead to poor decision making. Recognize the limits of one’s knowledge and seek diverse opinions.

- Timing the market is challenging and often unnecessary. Long-term investing and following a disciplined strategy can yield better results.

- Asset allocation, diversification, and risk management are essential for managing portfolio risk and maximizing returns.

- Research and analyze investments before making decisions, avoiding impulsive choices based on trends or rumors.

- Regularly track and monitor investments to stay informed and make informed adjustments to the portfolio.

- Avoid being influenced by short-term noise and focus on long-term fundamentals.

- Rebalancing the portfolio periodically is important to maintain the desired asset allocation and reduce risk.

- Patience is key in investing. Premature selling can result in missed opportunities for long-term growth.

- Be mindful of investment fees and expenses. Consider direct plans, index funds, and understand the impact of taxes on returns.

- Avoid making investment decisions primarily based on tax considerations. Evaluate investments based on their overall potential, not just tax benefits.

Conclusion:

Investing is a journey that requires careful planning, discipline, and a willingness to learn from mistakes. By avoiding these common investment mistakes and adopting a well-informed approach, you can enhance your investment outcomes and work towards achieving your financial goals. Remember to set clear objectives, conduct thorough research, diversify your portfolio, stay disciplined, and focus on the long-term. With a strategic and prudent investment approach, you can navigate the markets successfully and build long-term wealth.