When GXS Bank launched late last year, there was little incentive to sign up because the deposits were limited to only $5,000. However, now that GXS has raised the deposit cap to $75,000, is it worth switching over?

The short answer is – yes – especially if you’re looking for a savings account that has the following features:

- offers an attractive 3.48% p.a. interest rate on your cash

- no need to maintain a minimum balance

- no lock-in period

- no hoops to jump through for higher interest i.e. no salary crediting / GIRO / bill payments / credit card spend needed

- no tiered interest

Note how the interest is applied from your very first dollar to the last, instead of the usual tiered interest levels that we’ve seen the local banks go for.

With the above features, those of you who are tired of having to jump through hoops to earn your bonus interest can check out GXS for a fuss-free alternative.

Who is GXS?

GXS is the new kid on the block – a digital bank owned by Grab and Singtel – and received their license from the Monetary Authority of Singapore (MAS) in December 2020. It launched its savings account late last year, but because GXS had a $50 million regulatory cap on retail deposits imposed by MAS during the lender’ first two years of operation to safeguard consumers’ interests, it had to limit to only selected Grab / Singtel customers and a maximum of $5,000 per user.

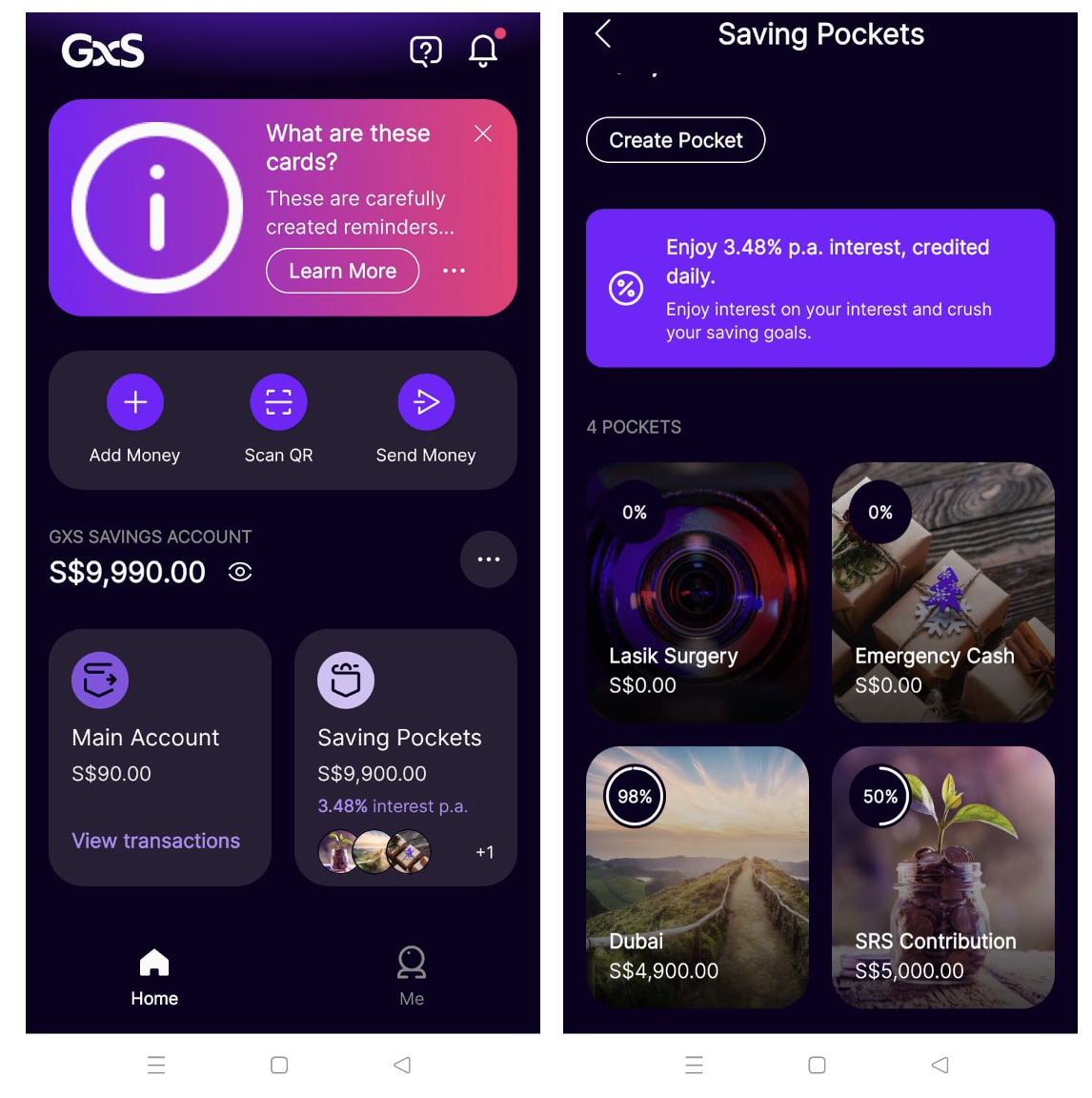

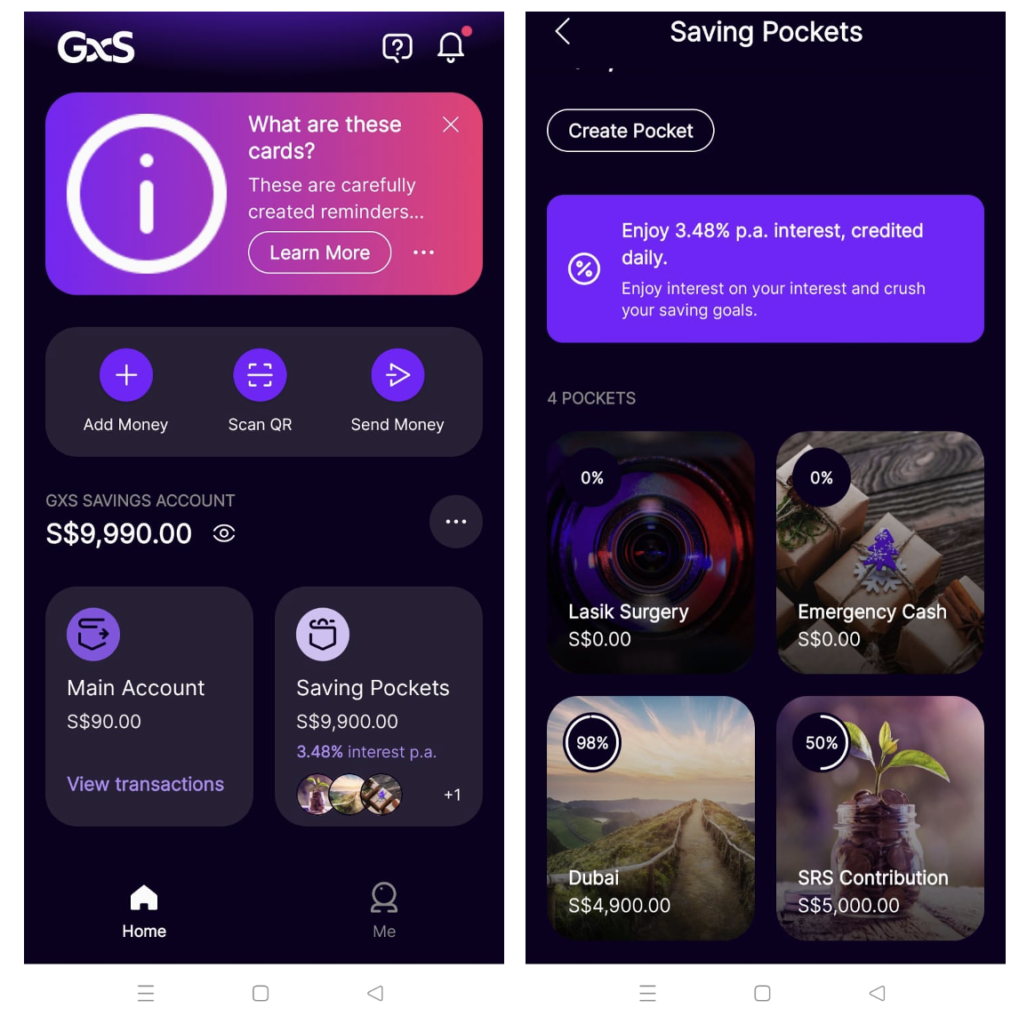

The GXS’ savings account currently offers an interest rate of 3.48% a year on “Savings Pockets” (a feature that reminds me of Hugo’s Money Pots). While I imagine this could be reduced in time to come – especially if the Fed starts ceasing its interest rate hikes – , it still doesn’t stop us from milking the good rates while it lasts.

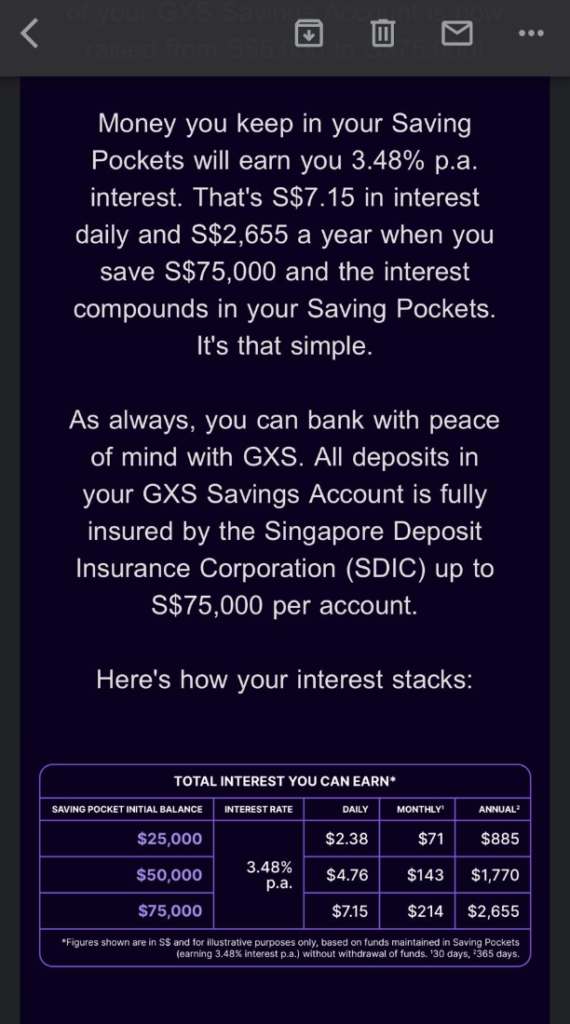

What’s more, another game-changer is that GXS credits your interest on a daily basis, as compared to every month. This lets us benefit from an even higher (and faster) rate of compounding since you’re earning interest on interest – plus, you can feel shiok every day when you log in and see “free money” being credited into your account

In the coming months, GXS has said they will also be launching a debit card with rewards and cashback to entice customers to spend via their savings account. Those who spend with GXS on Grab and Singtel (includes Singtel Dash) will also get bonus points, although the details on GXS reward program is still scarce at this point.

How to get access?

If you’re wondering how to sign up, all you need to do is to download the GXS app and register. Slots are on a first-come-first-served basis, and there is no referral code for now.

Note that you’ll have to be at least 16 years old to be eligible, and signing up is a mere matter of minutes (you’ll need your mobile number, SingPass and email).

You can then fund your account either via PayNow (each person can only have 2 bank accounts for PayNow – 1 linked to your NRIC/FIN and another linked to your mobile number) or by direct bank transfer. I opted for the latter, and received the money within the same minute.

Make sure you move your money out of your Main Account and into your Savings Pockets in order to get the 3.48% p.a. interest!

Is it worth switching to GXS?

I can hardly think of folks who would not benefit from GXS right now.

Since most of us already have more than 1 bank savings account, there’s really nothing stopping you from signing up for another one – unless you find it too troublesome to manage your cash in multiple different places.

Otherwise, 3.48% p.a. credited daily is a real game-changer. Here’s how it stacks up against the other options I would otherwise consider for putting my cash in right now:

- vs. other digital banks: GXS 3.48% p.a. is higher than Trust Bank’s 2% (non-union members) and 2.5% (union members) p.a. interest rate

- vs. fixed deposits: at 3.48% with zero lock-up period, this beats all the other fixed deposits right now (whose rates range from 2.9% – 3.88% with minimum sums and lock-in periods)

- vs. MAS T-bills: the latest tranche came in at 3.99% p.a. for 6 months. If you missed that, or you’re not a fan of locking your money up for 6 months, then GXS’ would be a more preferable option

- vs. cash management accounts: the rates are comparable or slightly lower, but the difference is that your deposits at GXS are insured by SDIC (while cash management accounts are NOT insured by SDIC). Cash management products like MoneyOwl’s Wise Saver (4%) or POEMS (>4%) are still a valid consideration for folks with cash to spare, so I include them here even though it isn’t an apple-to-apple comparison or an equivalent product.

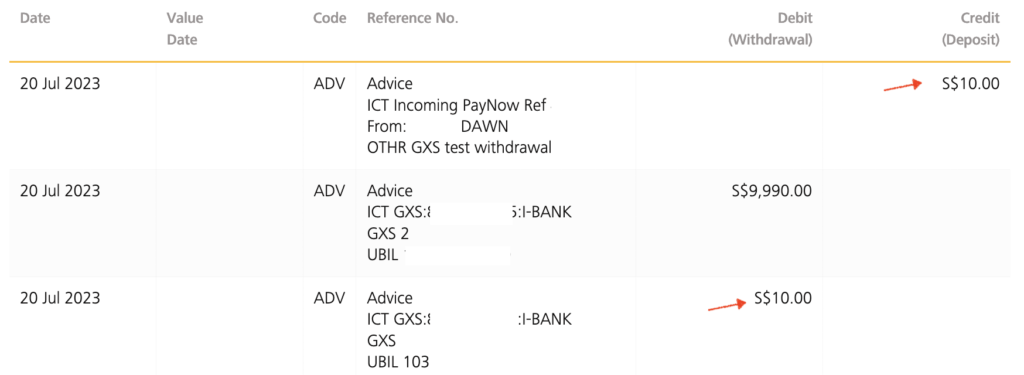

As a skeptic, I tested out by transferring $10 first to make sure the amount went through correctly, before transferring the whole intended sum. I also tested out the withdrawal function, because the last thing any of us would want (while pursuing high interest) is to have our money stuck, isn't it!

What should I use GXS for?

With the attractive 3.48% p.a. interest right now and the lack of hoops to jump through, I would say GXS is among the best choice for fresh graduates and young working adults right now – especially for folks who struggle to hit the minimum spend requirement on their cards.

In terms of funds, you can also park your short-term emergency funds here (e.g. 3-6 months) for liquidity without sacrificing interest, or even your investment war-chest while waiting for opportunities in the stock or options market.

Don’t forget, GXS Savings Pockets feature also makes it a perfect fit for you to put your short-term savings here, such as funds that you’re saving up for an upcoming purchase e.g. wedding, home renovation, a new furniture, etc.

But before you rush to open a GXS account for your elderly parents, do note that GXS is still a relatively new bank after all, and since transactions are mostly online, you may not want to be extra diligent for scams and malware that could gain access to your phone and liquidate your funds. In this sense, the local banks have stricter scam controls in place.

Will YOU be putting your money into GXS?

The battle is on – let’s see how the local banks respond from here!