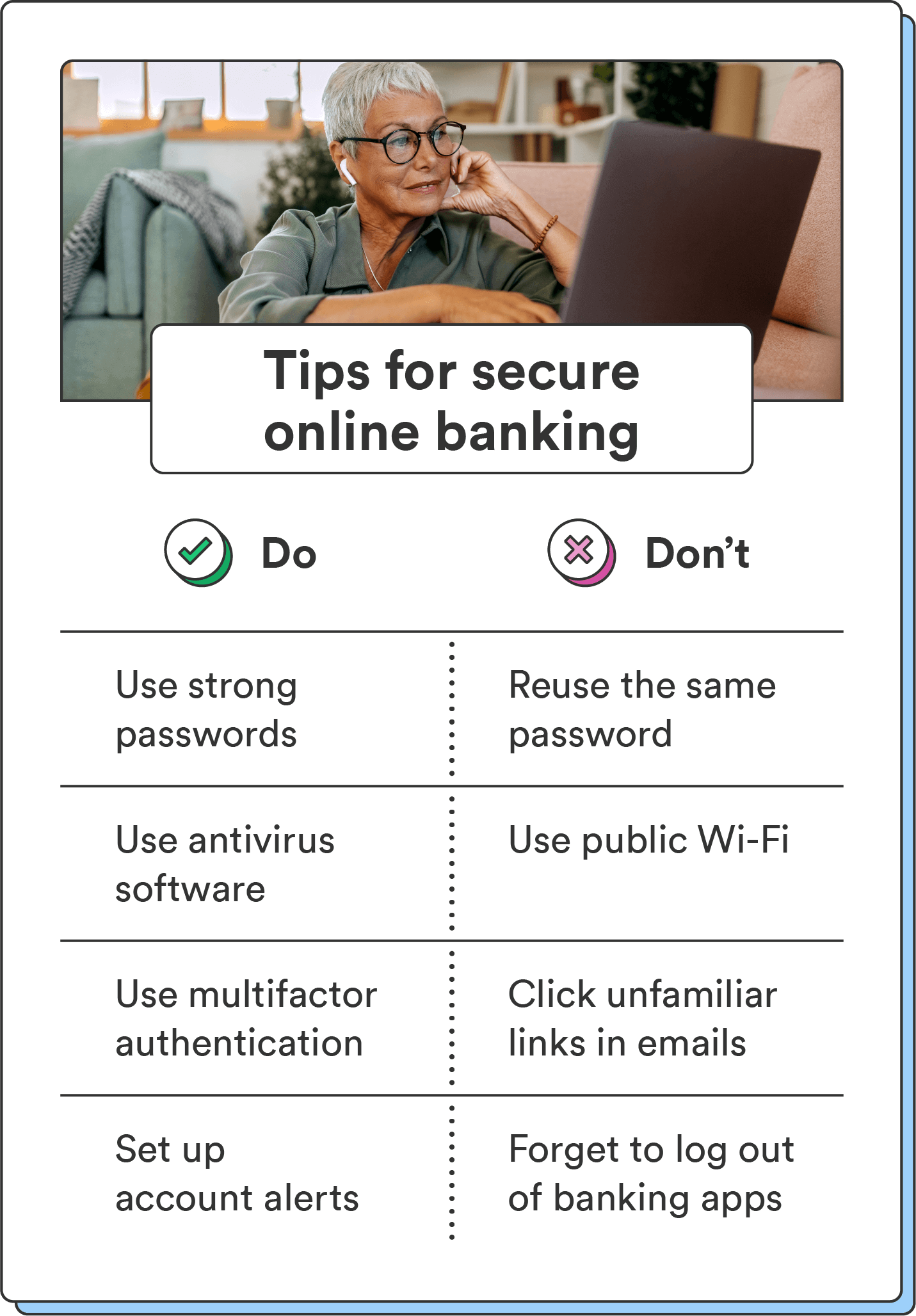

Ensuring a secure experience online isn’t only up to your financial institution. The tips below cover a few easy ways you can ensure your data stays protected.

1. Choose safe passwords

Your password is one of the first lines of defense securing your personal information, and a 12-character password takes 62 trillion times longer to hack than a six-character password.4

Use complex passwords with a variety of letters, numbers, capitalization, and punctuation. Make it at least 12 characters, and include random words or phrases that aren’t tied to personal information (like your birthday or home address). If you have multiple bank accounts, use a unique password for each one. You can use a password manager to store and track your passwords.

2. Use antivirus software

Installing antivirus software across your devices can help safeguard your data. Your phone may already have antivirus protection built-in, but downloading additional software creates an added layer of security.

Look for antivirus software bundled with other security features, like password management, firewalls, and a VPN.

3. Use multi-factor authentication (MFA)

MFA requires an additional form of verification in addition to your login credentials, providing extra security to your accounts. This additional verification could come in the form of a unique code sent to your mobile device or biometric data that requires your fingerprint.

MFA is an easy way to boost your security when banking online. Enable MFA across your accounts, which can usually be done in your account settings.

4. Avoid public Wi-Fi

Public Wi-Fi networks are often unsecured and may be prone to interception from hackers. While there’s less cause for concern when surfing the web in a coffee shop or browsing social media at the airport, accessing your online bank account is a different story.

Avoid logging in to your account when connected to a public Wi-Fi network. Always connect to a secure, password-protected Wi-Fi network instead. If you must access your account on the go, opt for your phone’s cellular data to connect instead of Wi-Fi, if available. You can also use a virtual private network (VPN) to encrypt your Wi-Fi connection and secure your data while you’re away from home.

5. Opt in to bank alerts

Many financial institutions allow you to receive alerts via email or text message when your balance dips below a certain amount or if a large purchase is made. When you opt in to these alerts, you can immediately report any potential fraud, scams, or unauthorized purchases on your account.

If your online financial institution doesn’t offer account alerts (although most of them do), keep a close eye on your account activity by periodically checking your transaction history. This way, you can proactively spot any unfamiliar account activity and report it immediately.