Quick Stock Overview

Ticker: MELI

Source: Yahoo Finance

Key Data

| Industry | E-commerce / Fintech |

| Market Capitalization ($M) | $55,945 |

| Price to sales | 5.9 |

| Price to Free Cash Flow | 35.9 |

| Dividend yield | – |

| Sales ($M) | 998 |

| Free cash flow/share | $31.38 |

| Equity per share | $32.43 |

| P/E | 207 |

| ROIC | 9.1% |

| ROE | 16.6% |

1. Executive Summary

E-commerce has taken over the world… at least the Western world and China. Other regions are just getting started. Even with the pandemic giving remote buying a significant boost, some areas of the world are only now reaching a point where e-commerce is starting to overtake brick-and-mortar retail.

One such region is Latin America. It is home to 656 million people, double the US population. It is also quickly developing and modernizing.

One company you might have never heard of is dominating Latin America’s e-commerce market: Mercado Libre.

It follows the simple but powerful model of imitating Amazon, while also adapting to the peculiarity of its home market. As a result, it has managed to absolutely outmatch Amazon and its other regional competitors in its home market.

The stock has now cooled off since the pandemic highs. If it was “just” the Amazon of Latin America, it would be an attractive investment, but not more than that. But it is also leading the fintech revolution in a region where half of the population has no bank account.

So Mercado Libre is best described as early Amazon + early Paypal merged into one company, with the potential to grow into THE tech company of the region and become the first LATAM super app.

In this report, we will take a deeper look at what has made the company successful and at its growth potential.

This report first appeared on Stock Spotlight, our investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 rational investors!

2. Extended Summary: Why MELI?

The Regional Giant

Mercado Libre has come to completely dominate e-commerce in the LATAM region, which offers one of the world’s greatest growth opportunities for e-commerce.

It has managed to keep out foreign giants like Amazon and eBay, as well as out-compete local alternatives, using a mix of imitation and a talent for solving the problems specific to South America, notably logistics and payment.

Logistics is now a solid moat, and payment has turned into a second profit center with even more growth on the horizon than e-commerce.

Mercado Libre Future Potential

The e-commerce segment is still growing fast and has the potential to do so for the next 10-20 years. The fintech section is highly profitable and growing at 50-60% per year, and is likely to become the source of the majority of net income for the company.

The Mercado Libre ecosystem is the best candidate for creating the first LATAM super app, imitating the success of companies like Alibaba and Tencent in China.

Financials

The company’s growth metrics are impressive, and it is strongly profitable and free cash flow positive. Debt is reasonable. Valuation is relatively high compared to free cash flow and sales, but still at a level that makes sense when taking into account the growth of the fintech segment.

3. The Regional Giant

A Difficult Start

If you would have had to guess where the Amazon of Latin America would be founded, you could have given a few reasonable guesses. Maybe Mexico for its proximity to the USA. Or Brazil, by far the largest country in the region.

You would probably not have expected it to come from is the perpetually dysfunctional Argentina. Since Mercado Libre was founded in 1999, Argentina has defaulted on its debt in 2001 and went through several debt restructurings in 2005, 2010, and 2015. It defaulted again in 2020 and might be headed for another round of hyperinflation.

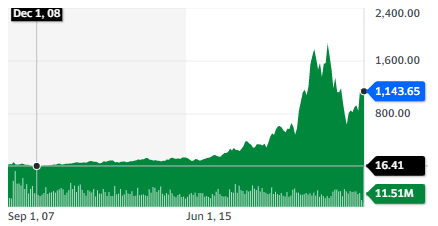

So really, this is not the sort of economy where you would be expecting x100 returns, which Mercado Libre has already created.

Mercado Libre now has 667 million LATAM visitors per month, compared to Amazon at 169 million and 493 million for ALL its competitors together. Mercado Libre is so dominant that it controls more than half of the e-commerce traffic to platforms in the whole of the LATAM region.

In fact, if you look at the most visited e-commerce websites in LATAM, Merdaco Libre national sites are the top 1, 2, 4, and top 10. It is not only dominating the region as a whole but the market of each of the individual countries as well.

I think the Argentinian origins are a big reason why the stock went off the radar of most investors. Argentinian stocks and horrific investing losses usually walk hand in hand, so most people would not even look at it.

I also think that this is the reason why Mercado Libre has out-competed everyone else. A company whose operations can casually handle currency collapse, poor infrastructure, and impoverished consumers can handle anything. In comparison, even Amazon’s notoriously efficient operations will feel lazy and bloated.

This idea of staying lean and savvy actually made the company survive its earliest war with a much better-funded competitor in DeRemate, and is still fixed in the company’s DNA.

You can see the full story here on how DeRemate would not survive funding drying up in 2000 when the dot-com bubble popped, while MercadoLibre thrived on a shoestring budget. Even then, a focus on organic customer acquisition, word-of-mouth marketing, and high retention rates paid off handsomely.

Mercado Libre went public just as the 2008 financial crisis began. While most growth stocks are always at threat of increased rates or a downturn in the world market, Mercado Libre boomed precisely when the rest of the world was in crisis.

Copying in a Unique Way

I mentioned in the introduction how Mercado Libre “just” copied what worked for Amazon and eBay. In terms of the basic structure of the business, and its obsessive focus on acquiring users and keeping them happy, it is true.

But quickly it also hit the brick wall of Latin America’s under-development in the early 2000s. Very few people had credit cards, and cash was king. That’s a serious issue if you are in e-commerce. On top of it, postal services were not efficient, trusted, or reliable. Poor to nonexistent Internet connections were also an issue.

It was common wisdom at the time that e-commerce could not work in such an environment. It was something only doable in more “mature” markets, where infrastructure, habits, and technology were advanced enough.

Unfazed, Mercado Libre created its own payment system in 2003, Mercado Pago (Mercado Pay in Spanish). It partnered with local shops for people to both take delivery and pay in cash for their online purchases. What started as a necessary measure has evolved into a division as important, if not more than the original e-commerce core.

In 2009, the company would also rebuild its technology from scratch to adapt to the rise of mobile following the appearance of the iPhone in 2007. In general, the company culture seems focused on innovating alone, not relying on acquisitions or external providers. That helps it keep close control over associated costs.

Dealing With Geography

I have mentioned that the postal service in Latin America mostly ranges from poor to nonexistent. The road network can be pretty poor as well, and railroads are almost nonexistent. Much of the region’s population lives in mountainous areas, from inner Mexico to the Andes or the Brazilian Highlands. This means high transport costs.

In the early day in the 2000s, it did not matter too much, as anyway, the Internet infrastructure was limited to urban areas. The first users of Mercado Libre had to be living in cities and be affluent enough to have access to Internet.

Later on, to keep growing and use the exploding development of mobile Internet, Mercado Libre needed to reach remote areas with little logistics available.

Stopgap measures helped, like a fleet of motorbikes for deliveries or local providers. But it was not enough. So the company has spent most of the last 10 years building an advanced logistical network, unique in the region. The effort ranged from a fleet of airplanes to logistic centers to the acquisition of logistic software companies. It also shields it from the risk of post services increasing prices and cutting into its margins.

It allowed Mercado Libre to reach same and next-day delivery rates of 55%, and 80% for 48H deliveries, astonishing performance in the region. Mercado Libre now offers a catalog of 397 million listings, with convenience never heard of before (like 82% of deliveries with free shipping). It’s also generating $32.8B in annual GMV (Gross Merchandise Volume).

At Amazon, I know what the big ideas are: low prices, fast delivery and vast, huge selection.

Jeff Bezos

The Mercado Libre logistics network is also leveraged by thousands of local SMEs that otherwise would be stuck in just their region or even city. Mercado Libre even provides them with tools to build their own website, an online ad service, etc.

I will also say that Mercado Libre has more trust with sellers than Amazon, as it does not sell its own products. There is no risk of Mercado Libre suddenly competing directly with a seller once it found a profitable niche. So it is closer to eBay or Alibaba than Amazon in that respect.

4. Mercado Libre Future Potential

E-Commerce & Logistics

The e-commerce business growth profile is going strong with 10% growth year-to-year in unique buyers, unfazed by the end of the pandemic, unlike e-commerce in many other markets.

More interestingly, this is NOT a South American phenomenon. Brazilian e-commerce revenue for Black Friday in 2022 fell by 23%, reflecting the global post-pandemic dynamics. Mercado Libre, however, increased its gross sales on Black Friday in Brazil by 19%. The company explains it by “the great integration of our ecosystem and synergy with the platform’s sellers“. (More on the ecosystem at the end of this chapter).

Aside from the temporary post-pandemic setback, e-commerce progression in LATAM still has a lot of space to grow. 192 million people have shopped online so far, with the number expected to swell to 350 million in 2 years. This would still leave half of the population having never bought anything online.

From these numbers, we should expect MercadoLibre’s e-commerce business to have at least a decade of rapid growth ahead, maybe several decades:

- Growth of the total market as e-commerce gains popularity in the region.

- Growth in overall consumer spending, thanks to economic development and the “re-shoring” and “friend-shoring” of production away from China.

- Growth in market share, as by now, it is clear that e-commerce has a winner-take-all dynamic in every market worldwide.

Unlike other online businesses, including Amazon, the e-commerce section stands on its own and is profitable with growing net revenues.

Payments (Mercado Pago)

In addition to e-commerce, Mercado Libre has hadits own payment system, Mercado Pago, for 21 years. Its value proposition is easy to understand even by just using Google Translate on the main page (see below).

- No bureaucracy (LATAM banks are notoriously slow, expensive, and generally unpleasant to deal with).

- The ability to use your money instantly from your mobile.

The QR code system essentially replaces the need for cash with a smartphone, which most people have all the time with them anyway. Transfers are free and instantaneous. You also can access an international Mastercard for free.

Some security features, like easy changes to ATM passwords or the ability to pause the card from a phone, are also a strong selling point in countries where personal security is sometimes less than optimal.

Users as young as 13 years old can open accounts, a great way to lock in future users as early as possible.

The same convenience allows shop owners to benefit from Mercado Libre’s large user base and powerful cashless payment systems. The result is rapid growth of the payment ecosystem.

If this growth continues for a few years, MercadoLibre might become THE dominant payment system in LATAM. This is a business with a lot of network effects: If enough people have one, every shop on the continent must accept it. If every shop has it, why bother using something else?

This could become a very powerful moat, as Visa and Mastercard show.

Loans & Investing (Mercado Credito & Fundo)

This is a segment I am personally less enthusiastic about. I understand why Mercado Libre would not like to leave the credit potential of its fintech untapped. There is simply too much money to be made by offering short-term loans at high rates.

And for sure, there is a demand for credit for online purchases. So why not capture that market yourself, and offer an extra service to your users?

While that logic is undeniable, it increases Mercado Libre’s vulnerability to downturns, as credit risk is highly correlated to economic conditions and often hard to predict. So the real profitability or risk for losses is always very hard to evaluate.

The credit portfolio has grown very aggressively, more than doubling since last year. The bulk of the volume is now consumer and credit card loans.

The quality of the loans has been stable, and margins seem great. I am not entirely sure the 10% of provision for bad loans is enough, and we will discuss that further in the chapter on the financials.

On a more positive note, Mercado Libre also offers its user what is essentially a short-term fund deposit, Mercado Fondo. This can provide the company with a lot of operating capital at almost no cost. Please note that the 63% yield offer below is actually deeply negative with Argentina’s inflation currently above 90%. So Mercado Libre is in practice getting paid by its users for accessing free working capital.

On the Way to Becoming a Super-App?

Over the last few years, Mercado Libre has started to form a more coherent move toward making its app a fully-fledged ecosystem. The idea is to copy the Asian model of the superapp.

This model increases engagement by being THE go-to app on someone’s phone. Where you do payments, shop, take a loan, and ideally also chat, socialize, get entertained, etc. For many users, the Internet as a whole become synonymous with the superapp, leveraging the addictive power of the smartphone to a high degree.

Mercadolibre does not have (yet?) a social media or chat aspect, but it started to offer HBOGo and Disney+ to its customer. I think the next step should be to venture into promoting video games, e-sports, or other activities of that kind.

A chat system is also an option. If everyone below a certain age already has the Mercado app installed, it would make sense to make it into the LATAM WeChat.

This is rather early, but there is a good opportunity for Mercado Libre to turn into a true Internet giant, and by far the dominant actor in the Spanish and Portuguese world. In that respect, maybe some extension toward the Iberian Peninsula could be an option as well.

Overall, we should expect the ecosystem effect to become more powerful over time. It will also provide Mercado Libre with a wealth of data that it can to make other moves, like improving lending decisions.

5. Financials

Cash Flow & Balance Sheet

Profitability is good, revenues have been on a solid growth trend for the last 10 years, and free cash flow is now truly flowing. There is not much to comment, the picture is pretty rosy here. And this is at a time when most tech companies in the world are firing 5-10% of their workforce.

Mercado Libre have spend $953M on R&D in the last 12 months, compared to $352M in 2020. I am not sure where the money went, but I would suspect data analysis on credit and the ads segment are the new priority.

Overall, the company’s management has an excellent track record. Founder Marcos Galperin is still the chairman, president, and CEO. As long as this is true, I expect the company not to squander its money on fool’s errands. So I would guess this R&D spending to pay off in the future.

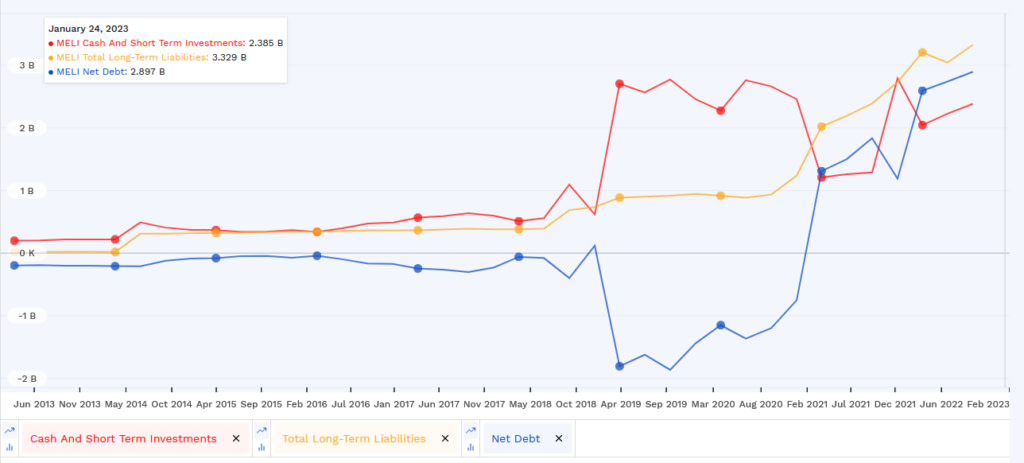

The company has some long-term debt, but nothing dramatic. It also has a rather large cash cushion of $2.4B. As long as the cash available is equal to the total credit portfolio, I think we can be somewhat reassured that even a period of poor performance by the credit department could not endanger Mercado Libre. The same is true for debt, especially considering the $1.6B in free cash flow.

I expressed my worries about Mercado Credito, but even if it turns sour, I do not think it could endanger the company in any significant way. Even a tripling of losses to 30% bad debt would “only” involve $600M, or 1/3 of the free cash flow.

Valuation (E-Commerce)

Valuation is always a tricky thing with growth stocks, as so much of the value depends on predictions of what will happen 5 to 10 years in the future. The price-to-sales ratio of 5.9 is not cheap, nor is the price-to-free cash flow of 35.9. The P/E of 209 is even more out of bounds.

So we could say some of the growth is definitely already priced in. If the business was only the e-commerce part, I would suspect this is a fair price, considering the still large untapped LATAM e-commerce potential and Mercado Libre’s dominant position.

But if Amazon taught investors anything, it is that a dominant position in one market can turn into a dominant position in plenty of other markets. So the investment case relies on large part on the potential for Mercado Libre to take over some of the financial systems of the LATAM region.

Valuation (FinTech & Other)

Fintech

The online payment section grew 50% year-to-year. The point growth (new selling points like local brick-and-mortar shops) grew 78% year-to-year. The QR payment system grew at a triple digit percentage.

Overall, the system of Mercado Pago processed 1.4 billion transactions in Q3 22, up 66% year-to-year.

At $1.2B, the fintech segment (Pago + Credito) represents almost as much net income as the $1.46B of the e-commerce segment. The growth rate of the FinTech segment, at 50%-150% depending on the sub-segment, indicates how large the opportunity is and how untapped this market still is in Latin America.

I think this kind of explosive growth is worth a rather pricey valuation. My only reservation is still the Credito segment. It might be incredibly profitable, but it might also turn Mercado Libre into too much of a bank or a credit supplier for my taste. Still, as long as it stay small enough compare to the overall business, it is fine with me.

Future Opportunity

Some of the service providing by Mercado Libre is for now, just the cherry on the cake, like streaming HBO and Disney+. It is still yet to see what will come out of such opportunities and if they will be profitable.

At the very least, they should reinforce the strength of the ecosystem and help boost the adoption of both e-commerce and fintech solutions.

6. Conclusion

Mercado Libre is a success story that will be studied by entrepreneurs and investors for decades to come. It could be tempting to imagine we “missed the boat” when looking at its 100x return since the depth of 2008 markets. I think this is incorrect.

For sure, some of the growth opportunities have been missed already. In the confines of its geographical region, I think the comparison to Amazon is fair. Amazon’s IPO in 1997 at $0.12/share made a lot of people think there was not much opportunity left when it hit the $12 mark in 2012. It would then go on and reach an all-time high of $175/share in 2021.

Can Mercado Libre do as much as another 10x from here? Maybe, but it does not need to do that to still make a good investment. Even if it “only” makes 2x-4x over the next decade, it would still be a great contributor to any portfolio.

Considering a growth rate of 15%-20% for the e-commerce segment, and 50% or more for the FinTech segment, this is an entirely reasonable growth expectation.

Over time, Mercado Libre is probably going to outperform many stocks, driven by the joint forces of regional economic growth, Internet adoption curve, e-commerce growth, and new products and segment launches.

This is an opportunity captured by the superb execution of an experienced leader and his team that have made the “impossible to do e-commerce in Latin America” an everyday reality for hundreds of millions of people. It would be hard to bet against Mercado Libre expanding its dominance in a region where e-commerce and fintech penetration still has enormous room to grow.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in MELI or plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.