The Australian property market has seen a decline in property settlement volumes in the financial year ending June, but green shoots are emerging in the second half of the financial year, showing positive signs of recovery.

This was according to PEXA’s 2023 Property Insights Report, which compared property settlement trends over the past four years, focussing on the five mainland states of New South Wales, Queensland, Victoria, Western Australia, and South Australia.

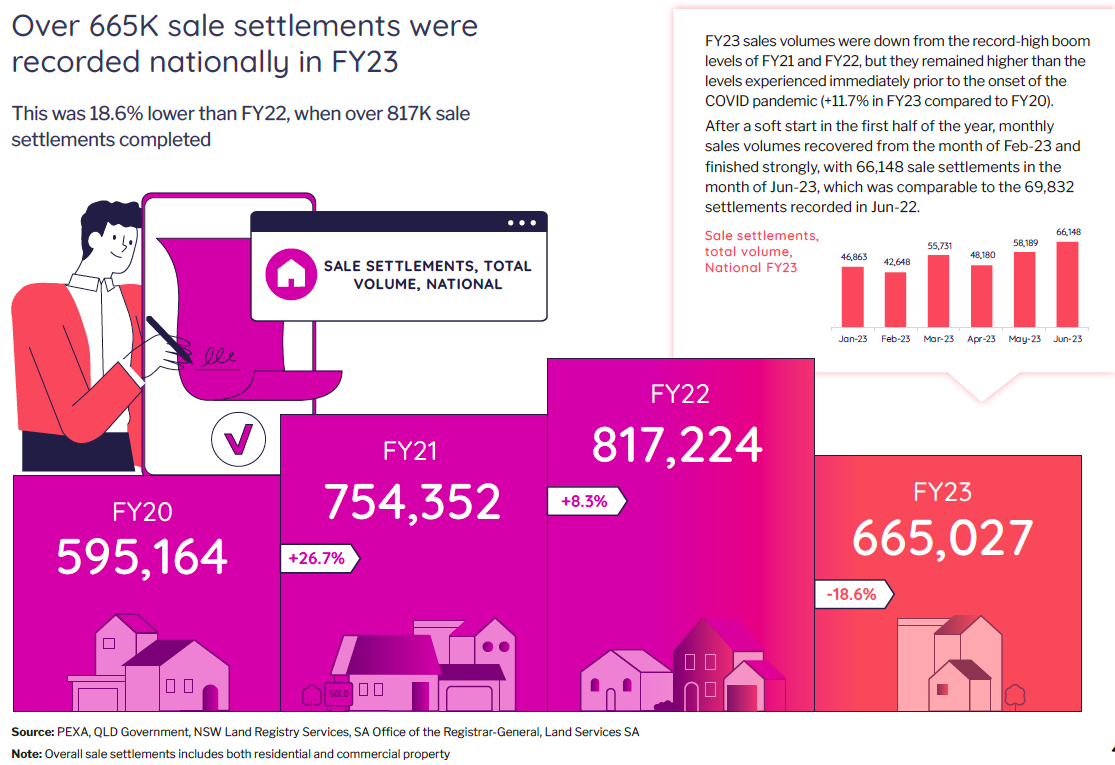

In FY23, more than 665,000 property settlements were recorded nationally, down 18.6% from the 754,352 posted in the previous boom year of FY22, but up 11% than FY20, driven by a soft first half, with all states recording some shrinkage.

Settlement numbers recovered from March onwards, however, with the financial year finishing strongly with more than 66,000 property settlements posted in June – up from 58,000 in May and 48,000 in April – signalling a rebound in settlement volumes.

“As the interest rate cycle approached its peak, we saw significantly fewer sale settlements recorded across the 2023 financial year, compared to FY21 and FY22 although they have still remained higher than levels experienced during the onset of the COVID pandemic,” said Mike Gill (pictured above), PEXA’s head of research.

NSW, Queensland, and Victoria all delivered double-digit declines in residential sale settlements in FY23. Queensland led the nation for the second consecutive year, with more than 176,000 residential sale settlements completed in the latest financial year, ahead of Victoria’s 164,883.

“Despite a soft start to the year, residential sale settlement volumes picked up from March across all mainland states, with June settlement volumes finishing the year strongly – at comparable settlement numbers to the prior boom year. This suggests the market has already bottomed out and is beginning to recover as we enter FY24,” Gill said.

He said there continued to be a strong demand for housing in Australia, with settlement volumes starting to bounce back, despite higher interest rates and other headwinds.

The uptick in settlement volumes varied across price brands in the June quarter. In NSW, property sales across all price bands saw double-digit growth, similar to Queensland, although higher priced properties ($2m-plus) led the recovery. In contrast, lower priced properties (sub $500k) saw the greatest uplift in settlement volumes in Victoria, up 37.2% in the June quarter, largely driven by high development areas of Melbourne.

“There are a number of factors that will continue driving the property market this year, including increased net migration, the trend toward smaller households, low volumes of new listings as sellers wait for the market to improve, and a very tight rental market,” Gill said.

PEXA’s research reported that $603bn was spent on property in Australia in FY23, reflecting the lift in average selling prices over that period. The figure was greater than the amount spent in FY21 and FY20, at $546.2bn and $408.8bn, respectively.

In NSW, more than $181bn was spent on residential property during FY23, down 23.9% than FY22. This was followed by Victoria, with $135.7B (down 19.8% year-on-year) spent on residential property.

Below are some commercial property highlights from the report:

- Across Australia’s three largest states, Victoria recorded the highest number of commercial sale settlements during FY23, with 11,231, ahead of Queensland (10,161) and NSW (9,138).

- Commercial sale settlements fell in all three eastern states in FY23, with NSW posting the largest decline, down -21% year-on-year. The Queensland market performed the strongest over the same period, only falling 9%.

- NSW continued to lead the country for aggregate value, at $30.8 billion (down 22.3% from the peak year of FY22), reflecting the higher average transaction values for commercial property in Sydney.

Use the comment section below to tell us how you felt about this.