Consumer demand for credit has eased, while mortgage arrears have continued to increase, as the impact of interest rate hikes becomes more pronounced, latest Equifax data showed.

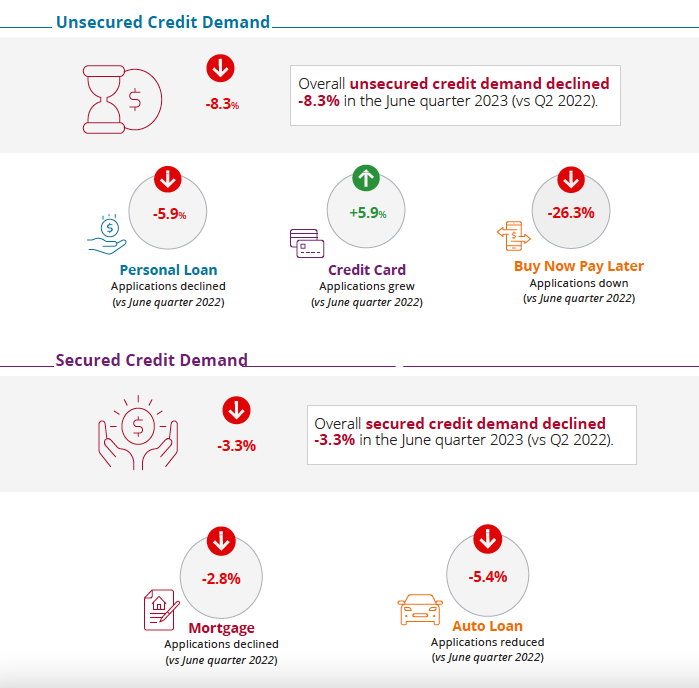

The Equifax Quarterly Consumer Credit Insights for July 2023 showed an -8.3% reduction in demand for credit cards, personal loans, and buy-now-pay-later in the June quarter.

In Q2 2023, credit card applications were up +5.9% versus the same period in the past year while personal loan applications and demand for BNPL both declined -5.9% and -26%, respectively.

“The slowdown in demand for unsecured credit suggests that consumers are spending less in the face of compounding economic pressures,” said Kevin James (pictured above), general manager of advisory and solutions at Equifax.

“While demand for personal loans declined year-on-year, the average limit per account, and the average credit score of applicants, has increased. This could indicate that consumers who previously weren’t feeling financial strain have begun to consolidate their debts, so they can better manage their credit payments.”

Secured credit demand, derived from mortgages and auto loans, fell -3.3% in the June quarter compared to the same period last year. Mortgage demand was relatively stable, slipping -2.8% in Q2 2023, while auto loans tumbled -5.4%.

“The effects of multiple interest rate rises are becoming more evident,” James said. “We are seeing accelerated growth in mortgages in early arrears, with a 33% uptick in mortgage accounts that are 30-89 days past due, compared to 22% last quarter.”

Auto loan arrears, meanwhile, hit a five-year high in the June quarter.

“The significant increase in auto loan arrears suggests consumers are struggling to repay auto loans as they grapple with the high cost of living – a trend that we are also seeing in international markets, including the US and Canada,” James said.

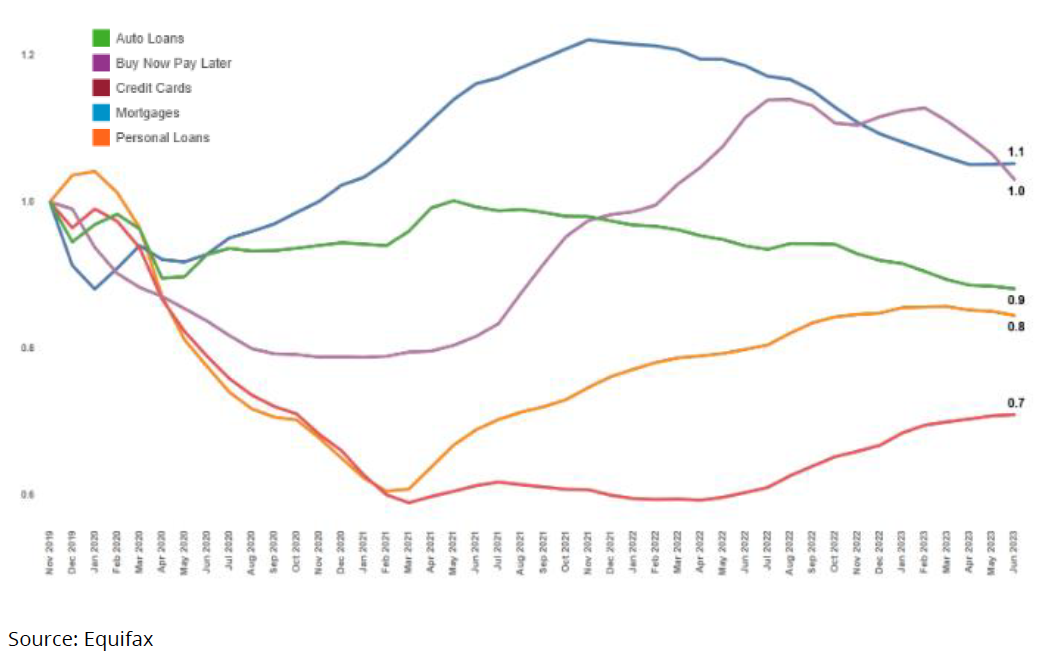

Consumer credit applications – by type (indexed to November 2019)