Inflation is bad. Right?

Well, not always. As it turns out, inflation isn’t so terrible for everyone. The lucky few will even benefit.

For toy collectors, lovers of sparkly metals, and those who dabble in illegal activities (not recommended), inflation is more like a ray of sunshine than an economic storm.

That being said, costs are rising faster than it takes you to calculate how much extra is on your grocery bill.

Surely there must be prices that have refused to shift?

Up, Down, All-Around

What’s gone up in price (other than everything)?

The biggest price bumps include commodities like eggs, fuel oil, and airline tickets.

And there are a few products that stay stable no matter the economic climate—tomatoes, toys, and televisions.

A certain few are all over the place in terms of price.

The most stable items?

Well, let’s just say you’ll read on with disbelief—

The Thin White Line Between Being in the Red and Being in the Green

If fighting off rising prices left, right, and center has become the norm, get ready for an eye-opener.

Not everything is closing in on you. Some prices haven’t even budged.

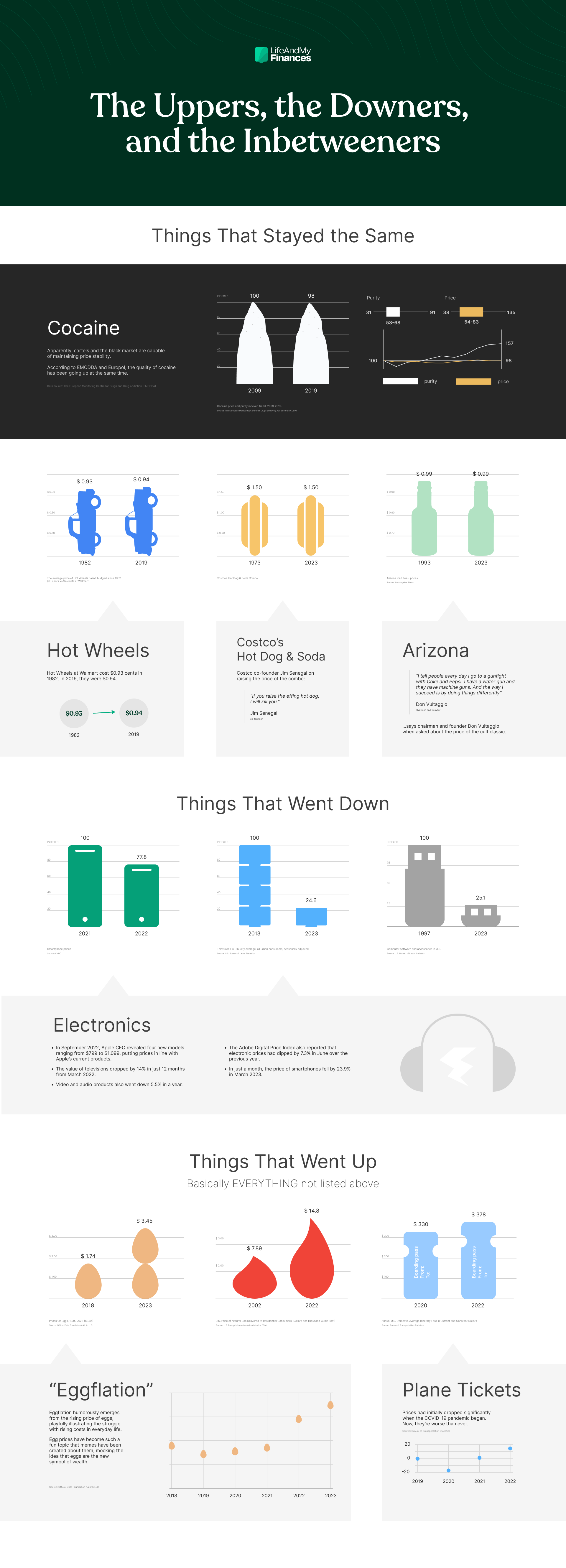

Cocaine

Yes, you read that right.

Apparently, cartels and the black market are more capable of maintaining price stability than the FED and the free market. Surprising? Yes. Useful? Hopefully not.

According to the EMCDDA and Europol, the quality of cocaine has been going up at the same time.

What industry could say the same thing?

Now let’s put the tangible inflation hedges under the microscope to find out if they can really protect you—

Hot Wheels

Calling all collectors and toy lovers—Hot Wheels is leading the way as one of the most inflation-proof toys in American history.

While prices for everything are shooting up year-by-year, Hot Wheels is breaking the upward trend and has stayed relatively stable for over fifty years.

- The price of a Hot Wheels car has stayed around $1 for over 50 years.

- Back in 1968, initial models sold for between 69 to 89 cents each.

- Hot Wheels at Walmart cost $0.93 cents in 1982. In 2019, they were $0.94.

- Hot Wheels currently sells for about $1.25 each on the Mattel website.

Electronics

Are phones really getting more big-budget, or are you simply more willing to splurge on pricey gadgets than you used to?

Well, according to the Consumer Price Index, it’s your taste that’s getting more expensive, and not the devices themselves.

- The value of televisions dropped by 14% in just 12 months from March 2022.

- Video and audio products also went down 5.5% in a year.

- In just a month, the price of smartphones fell by 23.9% in March 2023.

- The Adobe Digital Price Index also reported that electronic prices had dipped by 7.3% in June over the previous year.

- In September 2022, Apple CEO revealed four new models ranging from $799 to $1,099, putting prices in line with Apple’s current products.

Costco’s Hot Dog & Soda Combo

After being questioned about the price of Costco’s famous hot dog combo, co-founder Jim Senegal reportedly said, “If you raise the effing hot dog, I will kill you.”

Is a bargain hot dog and soda deal worth a death threat? Quite possibly—

- The $1.50 hot dog and soda combo at the Costco food court has stuck to the same price since the 1980s.

- In 2022, Costco CFO Richard Galanti announced that their famous hot dog deal will stick to its price of $1.50, even with all the raging inflation and cost hikes in their other items.

- Almost four decades since its introduction, the combo’s price remains unchanged, proving Galanti’s commitment to his promise.

The Reality of Inflation Hedges

Whenever inflation bursts onto the scene, you won’t escape the topic of rising costs and the headache-inducing price of gas.

If you’re lucky, you might even get stopped by your neighbor dying to tell you all about his “best-kept secret”—inflation hedges.

But are these inflation hedges all they’re cracked up to be?

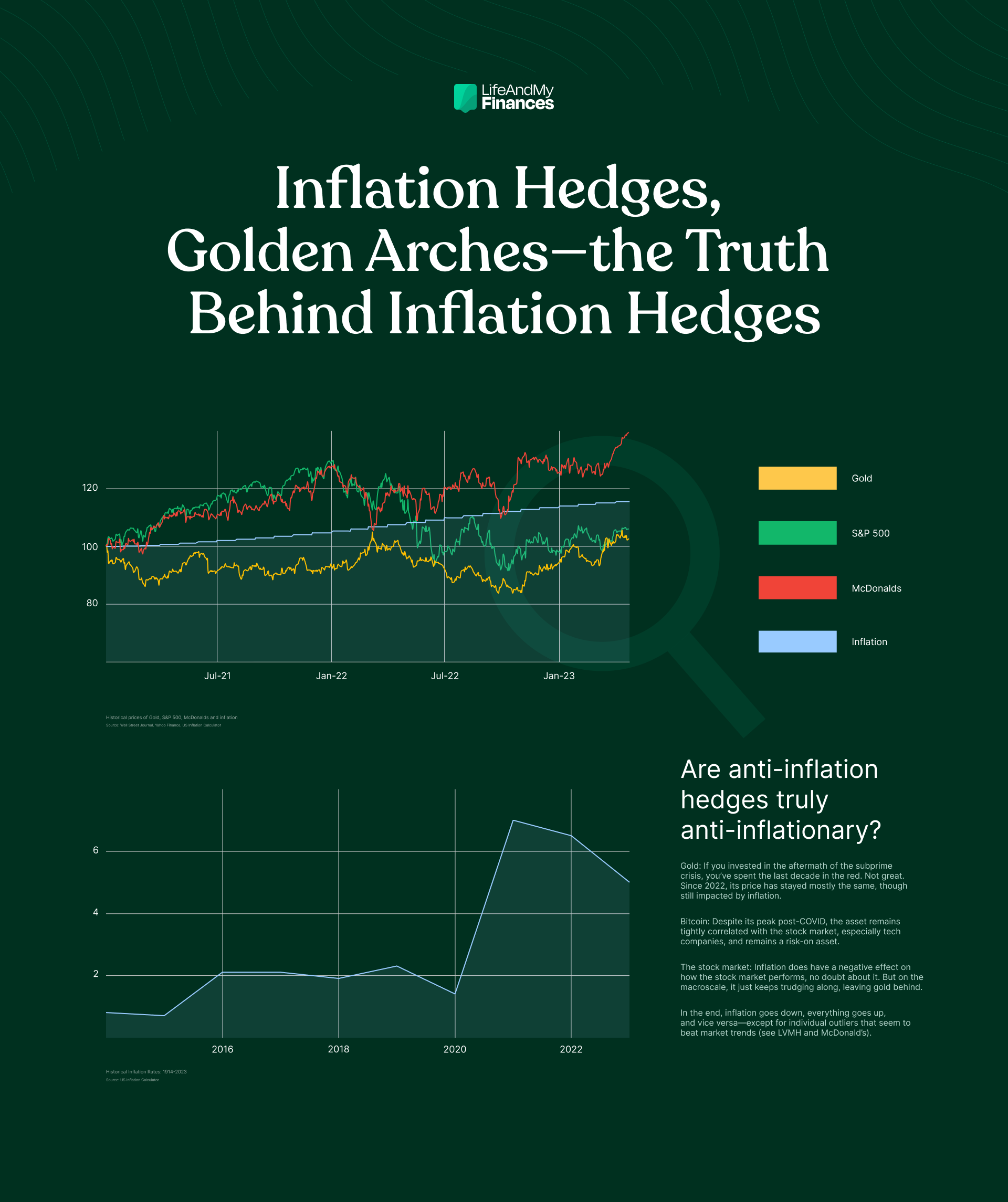

How inflation-proof is gold?

Precious metals are well-known for their inflation-shielding qualities. Where do they get their powers of protection?

Here’s the pitch: Gold is finite. Its supply doesn’t easily respond to changes in demand. It’s also recognized worldwide as a sought-after resource.

Whenever there’s more money than needed in the market—and inflation starts rising—people tend to put their money into gold “to keep it safe.” As demand for gold grows, higher prices follow.

In theory, at least.

Gold’s price was pretty much the same until 2006, but then it started racing up in a world rocked by subprime loans—and it finally hit its highest point in 2012.

The next decade? Honestly, if you bought at the peak, you’ve been in the red for the last ten years.

So the price of gold spikes in times of inflation—but it can also go up when inflation is low.

For example, when the inflation rate dropped from 3% in 2011 to 1.7% in 2012, the price of gold rose from $1,573.16 to $1,668.86—then went back down to $1,409.51 the following year.

In all honesty, gold doesn’t seem like that good of a store of value.

In the microscale, perhaps—but compare its price to the S&P 500 Index:

Want something luxurious that actually gains in value? Look no further than the company behind Moet, Hennessy, and Louis Vuitton:

Can shareholders profit from McDonald’s?

In times of rising costs, it makes sense that people would turn to cheaper eateries to save a few bucks.

But are folks really lining up for burgers when money is tight? And are shareholders profiting from a penny-pinching economy?

McDonald’s prices have gone up too. But even with costs creeping up, the fast food joint is still a less pricey alternative to many other restaurants.

Even though the yearly inflation hit 6.5% in 2022, McDonald’s still had 5% more visitors and earned a profit of $2.59 for each share, which means they enjoyed a growth of 16%.

There’s some food for thought.

Is Bitcoin the future inflation hedge?

You either love it, hate it, or can’t wrap your head around it—but it looks like crypto’s here to stay.

Supporters have claimed Bitcoin is “digital gold”, and predicted its value could climb up to $220,000 in the near future.

While some agree that Bitcoin has the potential to be the next big inflation hedge, others argue that it’s too soon to say—and that the coin’s rocky history doesn’t leave us with much hope.

Let’s take a look at the two arguments:

Arguments For

- Bitcoin is different from regular money because it has a limited supply of 21 million BTC. This means it won’t lose value over time like the money we use every day. So you don’t have to worry about inflation killing the value of what you own.

- There’s a plan to release those 21 million coins on a specific schedule. The number of new Bitcoins being made will go down about every four years.

- In 2012, Bitcoin was trading under $100/coin and peaked at nearly $70,000 in 2021—less than a decade later.

- In 2020, Bitcoin’s price was around $9,000 when the Fed began quantitive easing—in October 2022, Bitcoin sat at about $19,000.

- Bitcoin has shown a price increase of around 85% since the start of 2023, and investments have risen 78% week-on-week globally. Its recovery and rise in value are proof that it can survive and outpace inflation.

Arguments Against

- 2021 was an interesting year for Bitcoin because it mimicked the NASDAQ, which isn’t what you’d expect from a reliable inflation hedge. A true hedge shouldn’t follow the stock market’s patterns—and should be decentralized, like gold.

- Overall, the value of cryptocurrency dropped with rising inflation—in 2022 alone, more than $2 trillion was lost in market value.

- Bitcoin shed nearly 65% of its worth last year, showing it can be volatile as a supposed inflation hedge.

- Bitcoin hasn’t come out unscathed from macroeconomic factors since rising interest rates have affected people’s faith in the market, prompting investors to seek out safer options.

- Ultimately, Bitcoin simply hasn’t been around long enough to be counted on as a true inflation hedge—only time will tell.

Where can you invest to hedge against inflation?

While those invested in McDonald’s are benefiting from a boost in revenue, there’s also the chance to make a buck from companies that aren’t doing so well.

Short selling is a trading strategy where an investor borrows an asset—such as a stock—and immediately sells it in the hope that its price will fall in the future.

The investor will then buy back the same amount of the asset at a lower price, return it to the broker, and keep the difference in price as profit.

For companies like Starbucks—which lost 18% of its value last year—short selling is a tempting strategy. The coffee-house giant recently reported that it has 11.25 million shares sold short, which is 1% of all regular shares available for trading.

But short selling can be risky—you’re betting against the market, which can lead to unlimited losses if the price of the asset rises instead of falling.

Key Takeaways

- Annual inflation currently stands around 5%—with prices of food, transport, and energy shooting up in the past couple of years.

- Other items haven’t budged in decades—such as the famous Hot Wheels cars and the hot dog and soda combo from Costco.

- Surprisingly, the cost of cocaine has even fallen during times of inflation (with better quality in some cases).

- Gold seems to be standing its ground, but doesn’t hold up as a guaranteed inflation hedge—while alternative assets, like Bitcoin, are still up for debate.

- Even during inflation there’s always opportunity. Keep an eye out for smart investment choices (such as short selling) to create an inflation-proof portfolio.

Download the Complete Infographic

Sources

See All

Apple doesn’t raise prices for new iPhones despite inflation in “shocker” move. (n.d.). Retrieved April 29, 2023, from https://nypost.com/2022/09/07/apple-doesnt-raise-prices-for-new-iphones-despite-inflation-in-shocker-move/

Bitcoin price hits 2023 high after 85% surge. (2023, April 11). The Independent. https://www.independent.co.uk/tech/bitcoin-price-latest-2023-crypto-ethereum-b2317637.html

Brumley, J. (2022, May 2). Why Starbucks Lost 18% of Its Value in April. The Motley Fool. https://www.fool.com/investing/2022/05/02/why-starbucks-lost-18-of-its-value-in-april/

Cocaine retail markets: Multiple indicators suggest continued growth and diversification | www.emcdda.europa.eu. (n.d.). Retrieved April 29, 2023, from https://www.emcdda.europa.eu/publications/eu-drug-markets/cocaine/retail-markets_en

Costco CFO says hot dog combo price might remain $1.50 forever. (2022, September 27). [Text.Article]. FOX Business; FOX 29 News Philadelphia. https://www.fox29.com/news/costco-cfo-reveals-whether-historic-inflation-will-raise-price-of-hot-dog-and-soda-combo

CPI Home: U.S. Bureau of Labor Statistics. (n.d.). Retrieved April 29, 2023, from https://www.bls.gov/cpi/

Current US Inflation Rates: 2000-2023. (2008, July 23). https://www.usinflationcalculator.com/inflation/current-inflation-rates/

Digital Economy Explained | Definitions & Trends | Adobe. (n.d.). Retrieved April 29, 2023, from https://business.adobe.com/uk/why-adobe/digital-economy.html

Fulton, R. J. (2022, October 16). Is Bitcoin a Hedge Against Inflation? The Motley Fool. https://www.fool.com/investing/2022/10/17/is-bitcoin-a-hedge-against-inflation/

Gold Prices—100 Year Historical Chart. (n.d.). Retrieved April 29, 2023, from https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Historical Inflation Rates: 1914-2023. (2008, July 24). https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

https://www.latimes.com/people/lucas-kwan-peterson. (2023, January 31). The Costco hot dog combo has been undercut by Sam’s Club by 12 cents. Which is better? Los Angeles Times. https://www.latimes.com/food/story/2023-01-31/costco-hot-dog-combo-sams-club-taste-test

III, F. A. (2022, December 16). Why Hot Wheels are one of the most inflation-proof toys in American history. NPR. https://www.npr.org/2022/12/16/1143282569/why-hot-wheels-are-one-of-the-most-inflation-proof-toys-in-american-history

Insights, B. (n.d.). How Is The Market Feeling About Starbucks? – Starbucks (NASDAQ:SBUX). Benzinga. Retrieved April 29, 2023, from https://www.benzinga.com/short-sellers/23/03/31240368/how-is-the-market-feeling-about-starbucks

Maheshwari, R. (2023, April 28). Bitcoin Price Prediction: Can Bitcoin Reach $1,000,000 by 2025? Forbes Advisor INDIA. https://www.forbes.com/advisor/in/investing/cryptocurrency/bitcoin-prediction/

McDonald (MCD)—Revenue. (n.d.). Retrieved April 29, 2023, from https://companiesmarketcap.com/mcdonald/revenue/

McDonald’s Return on Investment 2010-2023 | MCD. (n.d.). Retrieved April 29, 2023, from https://www.macrotrends.net/stocks/charts/MCD/mcdonalds/roi

Reinicke, C. (2022, June 15). Bitcoin has lost more than 50% of its value this year. Here’s what you need to know. CNBC. https://www.cnbc.com/2022/06/15/bitcoin-has-lost-more-than-50percent-of-its-value-this-year-what-to-know.html

Reuters. (2023, January 31). McDonald’s Q4 boosted by higher menu prices amid inflation alarms. https://nypost.com/2023/01/31/mcdonalds-q4-boosted-by-higher-menu-prices-amid-inflation-alarms/

Speakman, J. (2023, March 1). Jay Powell May Not Understand Inflation, But is Bitcoin the Answer? BeInCrypto. https://beincrypto.com/bitcoin-hedge-inflation-debasement/

What Bitcoin’s Inflation Hedge Narrative Needs: More Time. (2022, November 10). https://www.coindesk.com/business/2022/11/10/what-bitcoins-inflation-hedge-narrative-needs-more-time/